Are ‘Green Bonds’ The “But It’s For The Children” Trojan Horse For MMT?

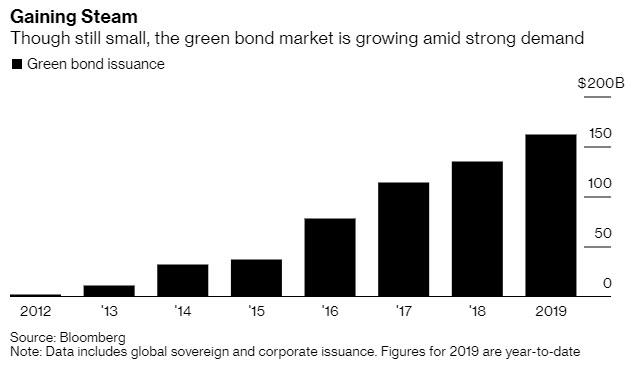

While still small, sustainable financing is growing. There’s been $165 billion of so-called “green”-bond issuance from companies and countries this year – more than double 2016’s total – according to data compiled by Bloomberg.

And, under pressure from ‘the people’ demanding policymakers “do something” to save the world from almost certain climate-driven doom, Bloomberg reports that central banks are putting their money-printing malarkey to work in sustainable financing, opening up a new source of demand for the budding asset class.

Most major central banks have signed on to promote sustainable growth, offering incentives that encourage green financing.

“Central banks are important institutional investors, and the fact that they are participating in this market, it gives the market almost like a seal of reliability and maturity,” said Christian Deseglise, global head of central banks and global sponsor of sustainable finance at HSBC Holdings Plc, the biggest underwriter of the bonds this year.

“It’s not so much about adding demand, because we already have demand,” he said. “It’s the quality of that demand that’s really important.”

The European Central Bank has been buying the debt as part of its asset repurchase program.

Hungary and France’s central banks have each created funds dedicated to ecological investments.

Now Peru is considering buying green bonds, too.

While the Federal Reserve, with nearly $4 trillion on its balance sheet, is notably absent from the Network for Greening the Financial System, regional branches have published research on the topic, and Chairman Jerome Powell maintains that it’s a “longer-run issue.”

However, as Bloomberg notes, pricing and liquidity are still limiting factors. As green bonds become more mainstream, investors are offered little additional incentive to buy them as they price comparably to non-green debt.

“As soon as the green-bond market becomes sizable you’ll see central banks investing more in green bonds,” according to Massimiliano Castelli, head of sovereign strategy at UBS Asset Management.

Of course, as most are aware, “green”-bonds are largely a marketing gimmick, and if central banks really do escalate their buying, then you don’t need a crystal ball to forecast that there will be a rise in companies’ “Greenwashing” their issuance – using green labels to spend on not so green things!

Nevertheless, The San Francisco Fed is quick to explain the ‘benefits’ of these “Green bonds” – and

The Forest Resilience Bond (FRB) is a financial tool that enables private investment in forest enhancements on public land. The FRB promises to accelerate the pace and scale at which critical work to restore the health and functioning of the nation’s forested landscapes is undertaken.

It does so by engaging private capital to cover the upfront cost of activities to improve forest health and by bringing together stakeholders that benefit from this work to share in the cost of reimbursing investors over time. These beneficiaries sign contracts that jointly cover the project cost plus a modest return to investors, meaning that no one stakeholder shoulders the burden of repayment alone. The result is a collaborative finance model that yields clear ecological, social, and financial returns.

While perhaps less obvious, the FRB model also unlocks opportunities for positive social impact in rural communities across the country. In addition to the direct impact of job creation, FRB projects can catalyze infusions of capital into rural areas by sending signals to the market that there is a steady supply of raw material to fuel forest-based industries. Against a backdrop of declining rural prosperity, this article envisions how the FRB could play a role in assisting rural areas – especially those with historically forest-based economies – transition to a more resilient ecological and economic future.

…

What differentiates the Forest Resilience Bond (FRB) from other approaches is not only its use of investor capital to fund restoration quickly and at scale, but the collaborative model of cost sharing between beneficiaries.

This approach engages a range of stakeholders to split the cost of repaying investors and involves them in project development. As such, the FRB model encourages a collaborative systems-level response to forest health challenges that makes use of funds, experience, and expertise from a range of public, private, and civic stakeholders.

Or, put another way, it’s a public-private partnership that levers taxpayer funds to support ‘green’-led initiatives, without the need for voting (because the central banks are unelected!)

So, to summarize, the concept of “green”-bonds is becoming more and more mainstream – who cares if we don’t get any yield, at least we are signaling just how virtuous we are – and as various ‘wealthy’ western nations hit the monetary and fiscal policy wall, the rhetoric around “People’s QE” or a Modern-Monetary-Theory-driven (MMT) redistribution spreads positively among many (especially the socialism-supporting Millennials).

While common-sense destroys the radical concepts behind MMT, we would argue that “green”-bonds are the perfect trojan horse to create a narrative that monetizing debt “that’s good for the world” is something ‘no one’ can argue with… Let’s just hope not, for the sake of our children’s future loss of purchasing power.

“Central banks are already buying green bonds and they should be buying more,” said Ulrich Volz, director of the SOAS Centre for Sustainable Finance in London. “But at the end of the day we need a mainstreaming of responsible investing across all assets.”

Of course, we look forward to the issuers of “green”-bonds explaining how their bonds mature past the world’s apparent sell-by date in 10-12 years depending on which climate-extremist you ask.

Tyler Durden

Thu, 10/31/2019 – 17:45

via ZeroHedge News https://ift.tt/36p36Vw Tyler Durden