Repo Madness: The Rest Of The Story

Submitted by Chris Whalen, The Institutional Risk Analyst

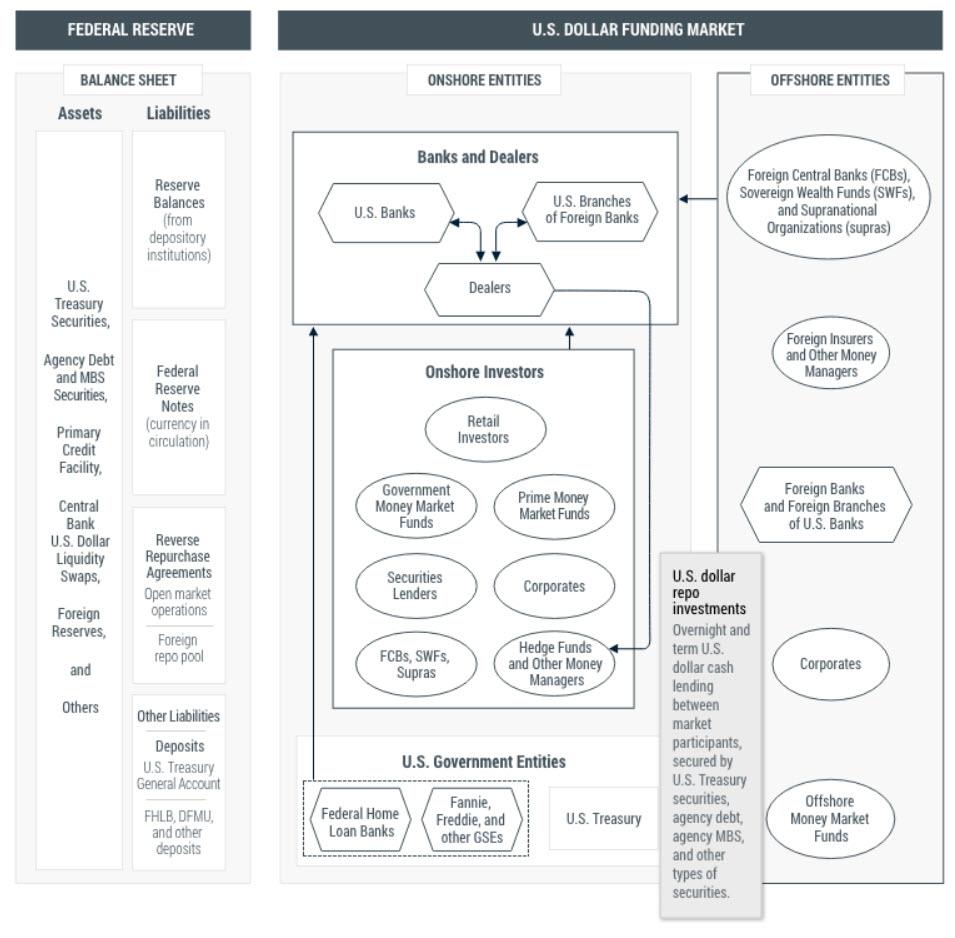

The Federal Open Market Committee cut the target for short-term funds another quarter point last night, raising the question as to whether the central bank can actually defend the 1.75% upper bound of the new policy range. Fact is, demand for short-term funding is pulling rates higher as the year draws to a close.

We got to dine with the risk committee this week, revealing new aspects of the recent repo kerfuffle that deserve mention. Chief among them was the idea of competition and, indeed, even conflict between the retail bank side of the house and the capital markets component inside the Fed’s primary dealers.

It seems that when the Federal Reserve Board was caught napping in mid-September, the bank treasury side of one of the largest US banks basically took a line from the 1990 Martin Scorsese film “Goodfellas” and told the bank’s capital markets side: “Fuck you, pay me.”

Under Regulation W, which implements what we traditionalists know as Section 23A of the Federal Reserve Act, transactions inside the bank holding co do not count against the bank’s statutory allocation for transactions with affiliates. But when market rates spiked, the retail treasury representing a very large insured depository, essentially told the traders to pound sand when it came to price. Reg W requires transactions with affiliates to be at market on an arm’s length basis, even with risk-free collateral supporting the trade.

The lesson here is that regulators do not want the cash-rich retail bank to give carte blanche to the traders, either with respect to the amount of liquidity or the price. The regulatory system worked – but also caused a new problem. A rush of fully motivated capital markets banksters suddenly turned outward and sought funding in the broader market for federal funds.

A squeeze ensued on or around September 16th, needless to say. Risk free collateral went begging for funding. Effective rates to finance Treasury and GNMA collateral spiked to double digits. So then, ask not whether one aspect of federal prudential regulations or another caused the liquidity squeeze seen last December and in June and later in September.

Ask instead why the Fed and other regulators cannot cooperate to tweak the system and fix da plumbing. December is just a month away. The reality, as F.A. Hayek described in his classic 1988 essay “Fatal Conceit: The Errors of Socialism” is that fine tuning the markets is an impossibility. The Fed suffers from the “fatal conceit” that “man is able to shape the world around him according to his wishes.”

Happy Halloween

Softbank Denies WeWork Control??

Meanwhile in the world of finance, a couple of notable events and comments occurred that deserve comment. PIMCO announced that it is reducing allocations to corporate debt, another data point on our worry beads regarding corporate credit in 2020.

Our favorite was the blasé Street reaction to the announcement by Softbank that its 80% stake in the insolvent WeWork did not mean control. Hello?? Further, Masayoshi Son indicated that therefore the company would not be consolidated onto Softbank’s balance sheet. Really? If this transparent evasion of leverage disclosure does not qualify for securities fraud in the US, then we need to buy some new textbooks.

Several managers, ratings firms and former shareholders complained about a “lack of controls” at Softbank in a Wall Street Journal article by Phred Dvorak and Justin Baer, but when one man is in charge is this even up for debate? We have always viewed Softbank as an investor driven Ponzi scheme, but we suspect our readers already knew that.

Of note, we also were reminded over dinner that no less than Deutsche Bank AG (DB) has been the advisor and lender for much of Softbank’s issuance of securities. Would be funny were it not so very sad, especially for the credulous sovereign investors in Softbank. The whole vision thing strikes us as a grotesque speculation verging on outright fraud. On Wednesday, DB reported a third-quarter loss of $955.1 million or about 10% of total revenue, after reporting a profit in the same period a year earlier.

The Softbank strategy goes like this: Give me and lend me enough capital and I will corner the market for innovation or some such version of that theme. We recall that Jim Fisk and Jay Gould attempted a similar operation in the late 1860s. Their machinations resulted in Black Friday September 24, 1869, the first modern financial crisis. Their scheme to corner the gold market – and ensnare President Ulysses Grant in the operation — collapsed in spectacular fashion, leading the US into a credit crisis. Gold, after all, was money in those days.

DOJ/HUD Accord Reached

Hannah Lang of National Mortgage News reports that Department of Housing and Urban Development Secretary Ben Carson announced that HUD and the Department of Justice released a joint a memorandum of understanding, stating that HUD will deal with False Claims Act violations — involving Federal Housing Administration (FHA) lenders — mainly through administrative proceedings. This is a big deal for HUD and the mortgage industry, which has been brutally raped since 2008 to the tune of tens of billions of dollars by a succession of ambitious politicians.

One of the main reasons why Senator Kamala Harris (D-CA), who served as the state’s AG during the 2012 National Mortgage Settlement, won higher office was the billions she extracted from the shareholders of JPMorgan (JPM), Bank America (BAC) et al. And this is why a very angry Jamie Dimon publicly took Chase out of the FHA loan market immediately after, followed by hundreds of other banks.

Today only Wells Fargo & Co (WFC) and Flagstar Bank (FBC) remain as significant bank issuers and servicers of GNMA securities in the FHA/VA/USDA loan market. As former GNMA President Ted Tozer told us last week, without the bond market execution of GNMA-guaranteed securities the FHA/VA/USDA programs are moribund.

We salute Secretary Carson and FHA chief Brian Montgomery for getting this interagency understanding done, but the banks won’t come back to the FHA/VA loan market until 1) the cost of servicing GNMA securities is brought into line with the GSEs Fannie Mae and Freddie Mac and 2) profitability on origination of FHA/VA loans improves a lot more. GNMA MSRs should trade even yield to conventional mortgage servicing assets.

Perhaps the bigger challenge for HUD is convincing the Fed, OCC, FDIC and other prudential regulators to allow large banks to return to the FHA market. So long as the federal regulatory community sees small, low FICO, high LTV loans as being “unsafe and unsound,” the banks are unlikely to return fully to the GNMA market. Small loans are loss leaders. Would you rather service a $280,000 FHA loan for 32bs per year gross or a $3 million prime jumbo loan at 25bps per year?

Tyler Durden

Thu, 10/31/2019 – 18:05

via ZeroHedge News https://ift.tt/2JAz5Z5 Tyler Durden