Is A “Classic End-Of-Cycle Melt-Up” Imminent?

Authored by Mark Orsley, head of macro strategy at Prism FP,

-

Potential for the data deterioration theme to pause in the next quarter

-

Phase 1 US-China deal could pivot Manufacturers from inventory destocking to restocking

-

Key manufacturers talking about this potential on earnings calls

-

-

This underappreciated catalyst could cause a temp bounce in the economic data, lift stocks and curve steepeners even higher – classic end of the cycle melt up

WARNING: This note contains content more positive than the past 10 months and may not be suitable for readers who are expecting a perma bear.

I jest obviously but the theme all year has revolved around the idea of data deterioration. The question from those tired of that notion is always “what would change your view” and the answer is consistently:

1) CB’s adding liquidity

2) China-US trade war progress

3) EU fiscal stimulus

For the first time all year, all three potential catalysts emerging at the same time which risks a Q4 melt up in risk assets and (I hope you are sitting down) an improvement in some of the economic data – mainly the manufacturing sector.

Central Banks pumping liquidity once again

This has been THE driver of the cyclical “up crash” first kicked off around October 8th when Fed Chair Powell noted that the Fed will soon announce steps to add to reserves over time through the purchases of T-bills. Around the same time, as we discussed previously, many Fed officials began setting up the Oct cut which many thought was in question (Rosengren, Evans).

That powerful force of a coming Fed liquidity injection + another Fed cut to sustain the expansion caused a key reversal in the macro landscape where:

-

USD topped out and depreciated lower

-

Cyclical equities/commodities bottomed and started to break out higher

-

Interest rates bottomed and started pricing out future Fed cuts

-

Yield Curves like 2s10s, that had been dormant, began to steepen

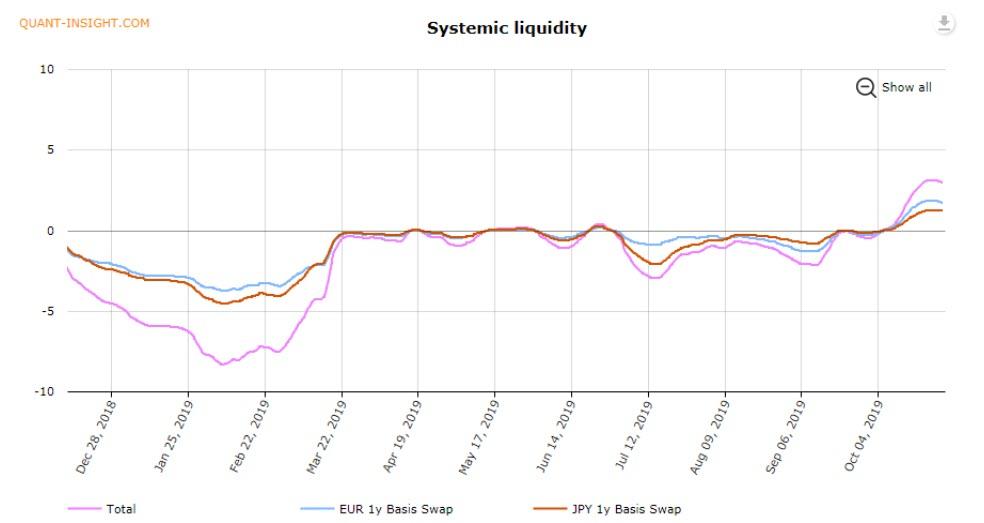

Dollar liquidity got a further boost when Italy for the first time since 2010 issued a $7b USD denominated bond on Oct 9th. That drove the likes of 1yr EU/US basis swaps higher which is atypical into year-end, and a signal that USD liquidity is improving.

Liquidity injection causing a positive cyclical feedback loop

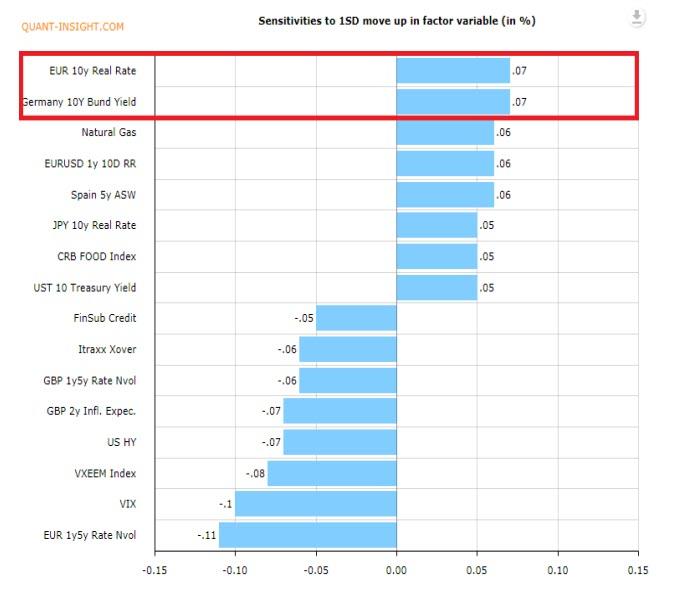

And if you are wondering why yields are rising, basis swap widening is your “tell.” The Fed (and ECB), are adding liquidity and that is driving global yields higher as confirmed in the QI macro PCA model which shows that for both US and China 10yr yields; rising basis swaps (ie: systemic liquidity) are causing nominal yields to rise.

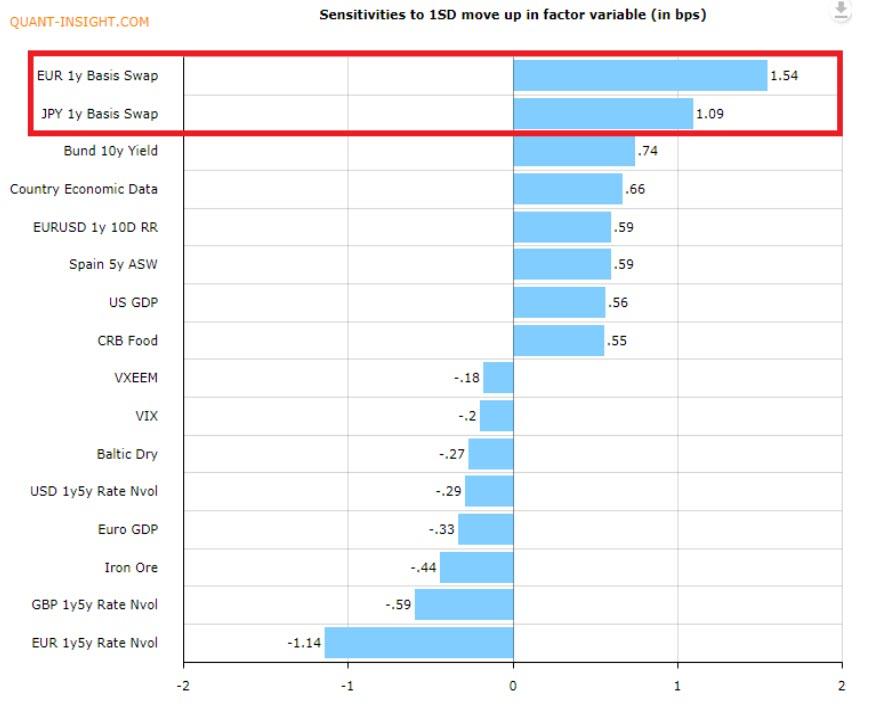

China 10yr yield sensitivities to macro factors indicate basis swaps/systemic liquidity is causing rising yields…

Same story in the US and to show it a different way, the sensitivity to systemic liquidity has been increasingly positive since Oct. 8th…

Then, those rising yields are causing commodities like copper to rise. Copper’s macro sensitivities show rates are the top positive drivers…

And lastly, rising commodities, and the feed through to inflation expectations, is causing the S&P rally and the curve steepening.

So there you have it, the liquidity injection by the Fed’s “don’t call it QE” program is causing a very QE like reaction. Call it a positive cyclical feedback loop.

That’s “the where we have been,” but now let’s look forward. Is there further impetus for this theme to follow through beyond the Fed’s reaction function? YES.

IMPORTANT – Upside growth potential in Q4/Q1

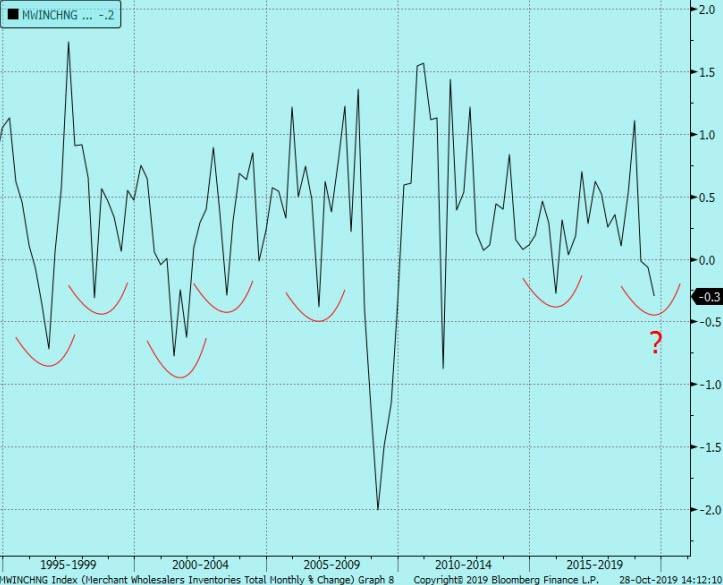

The market rhetoric over the past couple weeks has been stabilizing PMI’s. The Markit Manufacturing PMI for example bounced from a low of 50.3 two months ago to a modest 51.3 now – no big growth surge. However, the main positive in the report was the rise in New Orders and the decline of Inventories. In today’s ISM, we saw New Orders and Inventory both rise. This is the theme I want to highlight today: the potential that destocking in the Manufacturing sector is largely over and the potential for restocking.

As we saw in the Wholesale Inventory data on Monday, the current inventory drawdown is down to levels where you start to see restocking…

What differentiates this note from others is the willingness to do some dirty, bottoms up research like listening to earnings calls. What is MOST notable is that companies are commenting on this inventory dynamic in their earnings calls this quarter which is indication that we have reached a pivot point.

Let’s start with a global chemical company (often thought to be early cycle indicators) offering many different types of chemical products that operates in 30 different countries. They have exposure in North America, Europe, Middle East, and most importantly, China. This is about as good of a read through as you can get for cyclical stocks and on this destocking/restocking theme. What did they say in their earnings call on October 25th?

“We believe that the destocking we reported impacting the first half of the year in polyurethanes is finished most specifically in China.”

“We continue to see customer destocking with such a deep supply chain this business (textiles) has seen more volume pressure than our other businesses. We believe there is little if any destocking left in the chain.”

“Its volume that is hurting the bottom line and I suspect that volume will obviously be coming back as the economy starts to stabilize or even if the economy doesn’t stabilize when you see a lot of the de-inventorying, destocking that is out there taking place.”

”And I think that’s probably the first quarter in the last three quarters or so where we have seen a return to growth in China. So I’m not here to say that China is off to the races and we are going to great guns there but I do think that it has more to do with the idea that we’re done with destocking on a large basis in China.”

“While we’ve experienced real growth within this region demand in China remains well below average and erratic. We believe this will remain unchanged until trade discussions have some form of resolution thereby helping customer confidence and visibility.”

In other words, there is significant upside risk to rebuild inventories if at least some of the uncertainties can be removed, and China growth is better but still not robust.

How about a major global manufacturer of construction machinery…

“In the fourth quarter, we now expect end-user demand to be flat and dealers to make further inventory reductions due to global economic uncertainty.”

“…improved lead times, along with these dealer inventory reductions, will enable us to respond quickly to positive or negative developments in the global economy in 2020.

They are basically saying their dealers are still running down inventory, but if economy picks back up; they are coiled and ready to go.

One more company talking about how they are aggressively reducing inventories is a well-diversified manufacturer of everything from electronics to industrial products to consumer products…

“First, the biggest impact to Q3 margins was the year-on-year decline in organic volume, along with our actions to lower production volumes and reduced inventories to improve cash flow in the quarter.”

You get the idea. Large manufacturers have been running down inventory to build free cash flow. Typical in a slowdown but now will have inventory levels so low, that any improvement in growth prospects will leave them scrambling to rebuild.

Why is this inventory story important?

Critical point -> manufacturing companies have reduced inventories in the face of the China slowdown. Those same companies are indicating that a rate of change improvement in geopolitical risks (Trade Wars and to a lesser extent Brexit) could lead to a restocking. That restocking would give you more than just optimism the market has priced in. That’s real, hard economic growth which the market is not priced for. Dare I say the potential for green shoots.

Since the restocking is reliant on improved geopolitics, let’s address the two biggies.

US-China trade war progress

-

News last week that China passed a law that will protect IP rights of foreign businesses operating in the country

-

The fact they passed this is a very positive signal that China is willing to bend on a major sticking point in the negotiations

-

-

Pledge to open up Financial Services market

-

Reports that the Phase 1 deal is basically completed and to be signed Nov 17 in Chile

-

China requesting the US cancel some of the existing tariffs

Bottom line: a much more positive tone in the talks than we have seen all year. The ball is now in Trump’s court. The size of the reversal in the data will depend on the scope of the tariff roll backs. Most likely outcome is Trump simply does not impose the December tariffs but keeps all the prior tariffs in place until all phases of the deal are completed. That would mean a temporary bounce in the data but the long-term uncertainty will remain. Upside would be a rollback of previous tariffs especially those that hit the consumer.

Ignore the hype in yesterday’s headline regarding a long term deal with Trump. As our China watcher Jessica Sun is pointing out, China would rather make a deal with Trump than Warren, and despite long-term hurdles; China is “forging ahead” to prep for Phase 2.

EU fiscal stimulus

Two thing are driving the rising probabilities of fiscal stimulus currently:

-

Continued degradation in the German economic data – Manufacturing PMI still printing a depressed 41.9

-

Angela Merkel’s CDU party losing another regional election to the right wing AfD – the AfD advocates fiscal spending to boost the working class they tend to represent (similar to Trump in the US, Bolsonaro in Brazil etc.)

Bottom line: What used to be a long shot is now moving to possible. Germany, with their current account surplus, has had room to add stimulus but the German public generally has had disdain with running a current account deficit which made fiscal stimulus impossible. That is changing given the poor economy and rising prospects of the CDU losing power.

What does this do to the data deterioration theme?

It could pause it. Or to say it differently; it could cause a tactical economic bounce inside the larger data slowdown trend.

Note that despite the “beat” that the street set the market up for in today’s NFP, payrolls is growing at a 6m average of 155 down from 230 just one year ago. So growth in general is still soggy with the risk that the labor slowdown eventually bleeds into the consumer (strong consumer is THE most consensus thought – at risk).

Does this change the view on duration and curve shape?

In the front end, the Fed just “floored” Eurodollar pricing when Powell said they are not even thinking about hikes as inflation undershoots and AIT comes into their mindset mid-2020. Therefore, Eurodollars are the optimal hedge for cyclical longs as the Fed will not reverse the cuts. Additionally, the ironic thing about this potential economic bounce is if yields (long end) do rise more; it will push the economy right back into the data deterioration theme.

We are already seeing sectors levered to rates like the housing data start to fade (“misses” in Existing Home Sales, New Home Sales, Housing Starts, FHFA Home Price Index this month) so the point is rising yields will once again work to choke off an economy very sensitive to higher yields (too much debt, can’t have that bubble burst). Therefore, avoid shorting the front end and instead look to buy the dip as long-term indications are for further weakness in the US economy (as seen in forward indicators like CEO surveys). Use ED’s as your hedge against a Phase 1 breakdown.

Therefore, the long end is more exposed to a broader correction if the restocking theme does kick in. That obviously argues for additional curve steepening.

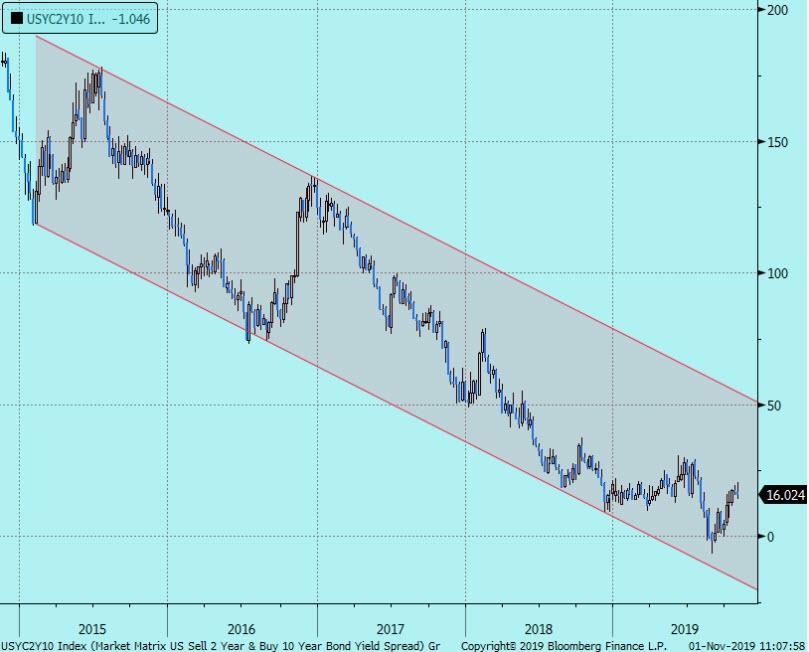

US 2s10s: the inverse head and should pattern that formed in the summer is still in motion. The target is 25bps…

Are we being too short sighted though? Given all the catalysts, a larger move to the upper end of the range should be considered – new target 50bps?

Does this embolden the buy S&P upside/cyclical melt up thesis?

Definitely. Most of the positioning data I can find says the market is ill prepared for a rate of change improvement to the economic data. This “offsides” setup was apparent in the technicals which continue to indicate further price gains ahead.

S&P mini’s have broken out of its neckline of its bullish inverse head and shoulder pattern. Target is 3,185…

And obviously you can consider positions that are levered to China including EM equity indices, Euro Stoxx, and Copper.

To succinctly recap:

-

Inventory levels for the Manufacturing sector have been brought down to a level that makes it susceptible to reverse quickly if there is any surprisingly positive news on trade wars

-

With a Phase 1 deal looking done, that restocking risk is also growing which would be a near term boost for the global economy – Manufacturing PMI’s bounce

-

Additionally, German fiscal is finally looking like a possibility

-

The benefits of lower rates + higher stocks add an additional growth tailwind

-

That all means upside risk in risk assets and to some extent yields (long end)

-

Rising yields into the US election cycle (which will add uncertainty in 2020) will make this only a tactical bounce; the data deterioration theme will likely reemerge especially as the more difficult parts of US-China talks drag on

-

Continue to recommend:

-

S&P upside (ESH0 3300/3400 call spread)

-

Hedged with front end upside (2EG0 98.875/99.375 call spread now screening on top)

-

Sell Fed Fund spreads that have priced out cuts: FFM0/FFU0

-

US 2s10s steepeners

-

Tyler Durden

Fri, 11/01/2019 – 13:45

via ZeroHedge News https://ift.tt/2pxJhei Tyler Durden