October Payrolls Preview: Brace For Impact

After several months of disappointing payrolls prints, October is set for a doozy.

The headline jobs number is expected at 85k, a sharp drop from 136K in September, largely influenced by the strike at GM which might have affected as much as 80k workers; the trend rate has held steady in recent months, though recent prints are notably below the 12-month pace, as one would expect amid mixed labor market indicators: the ADP surveyed mixed expectations, and the previous was revised down; initial jobless claims have been flat while job cut announcements rose; the Markit PMI saw the employment sub-index fall at the steepest rate since 2009 while consumer confidence signals were also mixed, with the differential between jobs “plentiful” and “hard to get” widening, boding well, and consumers’ expectations for income prospects rose even as consumers were less confident about the outlook and the expectation for more jobs in the months ahead fell.

Here is a summary of what to expect, courtesy of RanSquawk

- Non-farm Payrolls: Exp. 85k, Prev. 136k.

- Private Payrolls: Exp. 80k, Prev. 114k.

- Manufacturing Payrolls: Exp. -50k, Prev. -2k.

- Government Payrolls: Prev. 22k.

- Unemployment Rate: Exp. 3.6%, Prev. 3.5%. (FOMC currently projects 3.7% at end-2019, and 4.2% in the long run).

- U6 Unemployment Rate: Prev. 6.9%.

- Labor Force Participation: Prev. 63.2%.

- Avg. Earnings Y/Y: Exp. 3.0%, Prev. 2.9%; M/M: Exp. 0.3%, Prev. 0.4%.

- Avg. Work Week Hours: Exp. 34.4hrs, Prev. 34.4hrs.

The street expects 85k nonfarm payrolls to be added to the US economy in October, while Goldman expects 75K new jobs, which in addition to a 46k drag from the General Motors strike, expects further declines in the services sector. The three-month trend rate currently stands at 157k, a touch above the six-month pace of 154k, though both are lower than the 12-month average of 179k.

GM EFFECT:

The October report will be adversely affected by strikes at GM. There were around 48k GM workers on weekly and bi-weekly wages, who were paid in the week running up to the strike, and will not be included in the October NFP. The impact on GM supply chains is less clear, with some estimating that as many as 200k workers may have been affected, though this has not been reflected in weekly jobless claims data which signaled just short of 12k workers impacted in key GM states (heading into the September NFP, claims were 212.75k in the NFP survey week, and have risen trivially to 215.75k into the October data). Some of the impact might also be seen in future reports, given that there may be more workers yet to make a claim. As a comparison, the GM strike in 1998 reduced payrolls by 132k, but most expect a more benign outcome in this month’s data, with a figure nearer to 50-80k suggested, analysts have opined. Away from GM, upside may come via census hiring, where 28k of temporary workers have been hired, of a targeted 40k.

ADP EMPLOYMENT:

The ADP’s gauge of private payrolls printed 125k (exp. 120k), though the previous was revised to 93k from 135k due to back fitting, rather than an ominous sign for September revisions; Due to methodological differences, the data was not affected by the 50k striking workers at GM. Moody’s economist Zandi said that job growth has “throttled” back over the last year, with the slowdown most pronounced at manufacturers and small companies. Zandi warned that if hiring weakens any further, unemployment will begin to rise.

CHALLENGER JOB CUTS:

Job cuts announced by US employers jumped to 50,275 in October, from 41,557 (down 33.5% Y/Y, however) – the second consecutive month during which cuts were lower Y/Y. Challenger said that job cuts were steady, for the most part, though it did point out increases in certain industries, particularly those experiencing disruptions from new technologies, uncertainty from government regulation or issues with trade. The report also noted that many steel companies announced cuts last month, attributed to a number of reasons, including tariffs on steel, declining demand, and market conditions. In the autos sector, companies have announced 43,025 job cuts this year, 197% higher than the 14,489 announced through the same point last year. Challenger said, however, that hiring plans by US companies were at a record high, and through October, companies announced 1,162,375 hiring plans, 431,781 of which are for the holiday season.

BUSINESS SURVEYS:

We have not had the release of the ISM surveys ahead of the jobs report, whose employment sub-indices give a read on how the labour market is progressing. Markit’s PMI report for October, however, stated that employment numbers fell for a second month, declining at the steepest rate since December 2009, which survey respondents often attribute to more cautious hiring strategies and a lack of new work to replace completed projects. These surveys, however, may also be subject to the GM-effect.

CONSUMER CONFIDENCE:

Within the Conference Board’s gauge of US consumer confidence, the differential between jobs plentiful vs jobs hard to get — which can provide a good signal for the direction of the jobless rate — rose to 35.1 from 33.2, auguring well for the jobs report, with those judging that jobs were “plentiful” rising to 46.9 from 44.8 (jobs “hard to get” rose very slightly to 11.8 from 11.6). However, the report noted that consumers’ outlook for the labour market was less upbeat, with the proportion expecting more jobs in the months ahead decreasing from 17.6 16.9, while those anticipating fewer jobs rose from 15.4 to 17.8. And on their short-term income prospects, consumers expecting an improvement increased from 19.7 to 21.1, while the proportion expecting a decrease holding steady at 6.5.

ARGUING FOR A WEAKER REPORT:

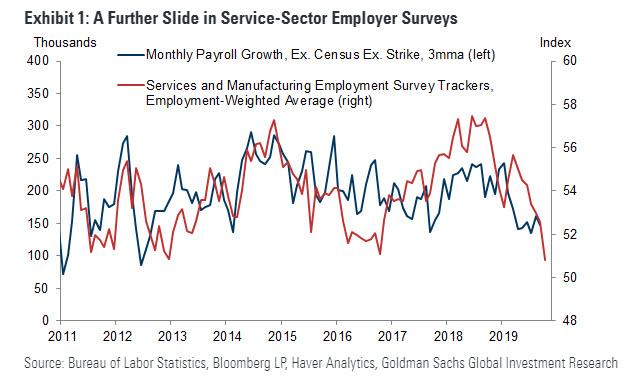

Employer surveys. Business activity surveys were mixed in October (on net stronger for manufacturing but slightly softer for services). And while the employment components generally rose for the manufacturing sector (tracker +2.3 to 53.7), they declined further for the much larger services sector (-1.7 to 51.0). As shown in Exhibit 1, the level of these surveys is consistent with an underlying pace of job growth of around 100-130k per month. Service-sector job growth was 109k in September and averaged 121k over the last six months, while manufacturing payroll employment contracted by 2k in September, below its +3k average over the last six months.

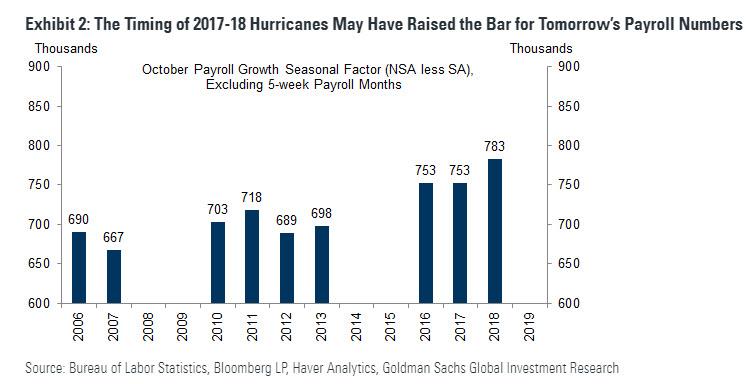

Hurricane Echo. As shown in Exhibit 2, the seasonal factors have evolved in recent years to anticipate incrementally larger October job gains, and we note the possibility that the seasonal adjustment software is fitting to the post-hurricane employment rebounds of October 2017 and 2018. If so, this would imply a higher hurdle for job growth in tomorrow’s report.

GM Strike. As indicated in the BLS strike report, 46k General Motors employees did not work during the October payroll period due to a United Auto Workers strike. The GM strike ended last weekend, meaning that this one-off drop within tomorrow’s nonfarm payroll figures is set to reverse with the November report.

ARGUING FOR A STRONGER REPORT

Labor market slack. With the labor market somewhat beyond full employment, we see the dwindling availability of workers as one factor weighing on job growth this year. In past tight labor markets however, payroll growth tends to reaccelerate in October (for example in 2007 and 1999). Accordingly, we believe some firms likely pulled forward hiring into October, anticipating a shortage of applicants in Q4.

Scope for revisions. Because August and September tend to be weak in the preliminary release—likely reflecting a recurring seasonal bias in early vintages—we note the possibility of upward revisions accompanying tomorrow’s report. Indeed, job growth over the prior two months has been revised up with the October report in 4 of the last 5 years (average revision of +35k).

NEUTRAL FACTORS

Jobless claims. Initial jobless claims were roughly unchanged in the four weeks between the payroll reference periods—averaging 216k—and are consistent with a very low pace of layoffs. Continuing claims rose by 27k from survey week to survey week, the largest sequential increase since June.

ADP. The payroll-processing firm ADP reported a 125k increase in October private employment, 15k above consensus and just below the 132k average pace over the three prior months. While the ADP report was somewhat stronger than our estimates and suggested that the underlying pace of job growth remains decent, we expect additional factors including the General Motors strike to weigh on Friday’s employment numbers.

Job availability. The Conference Board labor market differential—the difference between the percent of respondents saying jobs are plentiful and those saying jobs are hard to get—rebounded by 1.6pt to +35.1 in October, not far from its cycle-high. Other job availability readings were softer: JOLTS job openings declined further to a 17-month low (-123k to 7,051k in August) and the Conference Board’s Help Wanted Online index fell (-1.4pt to 103.0 in September).

UNEMPLOYMENT RATE:

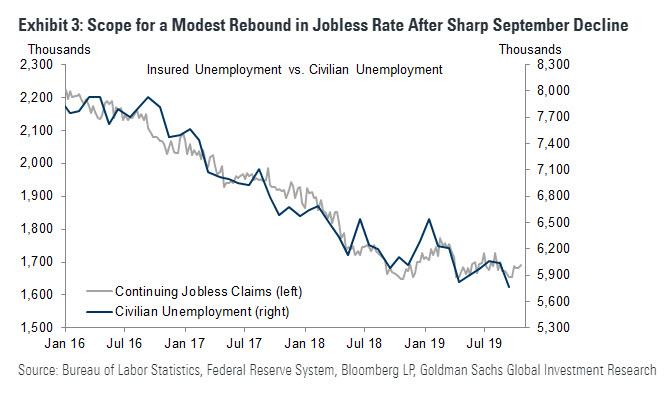

The unemployment rate likely rebounded a tenth to 3.6%. While the participation rate still appears somewhat elevated (63.2%, vs. 6-month average of 63.0%), continuing claims rebounded by 27k from survey week to survey week, and their level…

… suggests scope for a partial reversal of last month’s 50-year low in the jobless rate. At the margin, seasonal distortions in continuing claims would also argue for a higher underlying stock of unemployed workers. Note that the BLS treats striking workers as “employed not at work,” so we do not expect the strike to affect the jobless rate.

Tyler Durden

Thu, 10/31/2019 – 23:02

via ZeroHedge News https://ift.tt/2Wuk54i Tyler Durden