The Market Soars… As Corporate Profits Slump!

Authored by Patrick Hill via RealInvestmentAdvice.com,

The SPX recorded new highs this week. Investors appear to be excited about the U.S. – China Phase 1 trade agreement, which only goes so far in ending the trade war. Plus, the Fed is cutting interest rates, injecting $100 billion in repo financing over the next month, and embarking on a new round of QE. So, is it clear sailing for corporate America? Maybe companies are not as financially viable as record SPX levels would indicate.

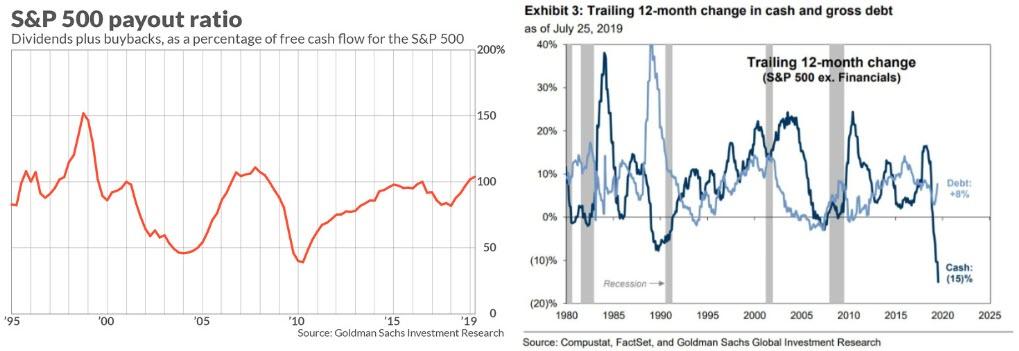

Let’s look at the lifeblood of a company, cash flow. Goldman Sachs analysis of corporate cash flows shows that SPX companies are actually running, in aggregate, negative cash flow at 103.8% while keeping stock buybacks and dividends flowing to shareholders. Debt is up 8% squeezing corporate cash flow to the point where aggregate cash flows are down 15% versus the prior year.

Source: Goldman Sachs – 7/25/19

Cash is the lifeblood of a company, but a company can’t borrow money forever without being a viable profitable entity able to pay back debt.

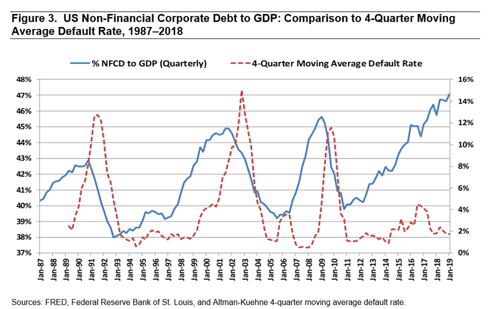

Non-financial corporations have taken on record debt at 47% to GDP. The last time corporations approached this level of debt was during the Great Recession. Yet, default rates have not gone up.

Sources: Federal Reserve Bank of St. Louis, Edward Altman – 8/5/19

Is this time for debt payment defaults different? It would seem this is a ‘benign credit cycle’ when defaults don’t rise. However, a more likely cause is that corporate cash flows are being pumped up by low interest rate loans. This corporate financial cliff maybe one reason the Fed is moving quickly to keep overnight and interest rates low. The Fed has said it is concerned about high levels of corporate debt. What is wrong with corporate debt at 47% of GDP?

The issue is when profits sink due to the trade war or as consumer spending slows, companies will no longer qualify for low interest loans. Banks and investors will hesitate to take on risky loans to companies raking up continuous losses. Without low cost loans to provide needed cash flows, sales decline will result in a freeze on hiring, the layoff of full time workers, and a closure of offices and plants. Management will take these measures to try to keep the company open until sales turnaround.

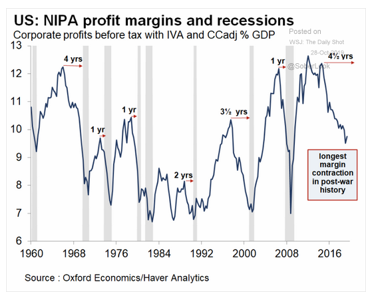

The profit margin squeeze has been happening over the past 4 ½ years, well before the trade war started. Profits were flat for the past nine years, supported by a huge corporate tax cut from the Tax Cut Bill of 2018. The contraction in profit margins has been the longest one on record since WWII. Note how recessions usually follow steep declines in profit margins at 1 to 4 years.

Source: Oxford Economics, The Wall Street Journal, The Daily Shot – 10/28/19

Why have margins been contracting? Margins can be increased by investing in automation, lowering material costs, deploying productivity enhancements, and other efficiencies. Instead of investing in margin increasing activities, corporate executives have been spending available cash from profits and debt on stock buybacks totaling $1.15 trillion in 2018. Stock buybacks are a way to boost corporate stock prices thereby increasing the income of shareholders and executives. Executives have squandered over the past ten years the opportunity to use profits for investments in research, productivity enhancements, raising wages, or cutting costs. Management has focused on short term stock gains at the cost of long term corporate viability. The chickens are finally coming home to roost.

In addition, profit margins are declining due to declining international sales. It is difficult to maintain healthy margins when sales are falling due to base spending for sales, support, and transportation to reach a certain sales threshold of profitability. Major corporations face increasing trade headwinds. For most S & P 100 corporations 50 to 60% of their sales come from overseas with prior growth rates from 15 – 25% per year in emerging markets. The Asia – Pacific region is the fastest growing sales region for many companies. Yet, the accumulating tax of trade tariffs and trade uncertainty is stifling sales growth.

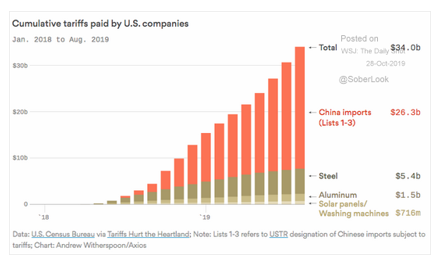

Sources: U.S. Census Bureau, Tariffs Hurt the Heartland, USTR Office, The Wall Street Journal, The Daily Shot – 10/28/19

Since January of 2018, U.S. companies have paid about $34 billion in tariffs. To hold price levels and market share, companies largely paid tariff costs themselves rather than passing them onto customers. Taking tariff costs onto corporate ledgers has squeezed profit margins. The loss of decent margins in high growth markets is creating a huge profit challenge for companies.

While the Phase 1 agreement with China may provide a pause to the trade war, breaking up into two major trade blocks. Corporations will have to navigate selling into two opposing markets with focused sales, support, and product features and pricing. For more details, see our post Navigating A Two Block Trade World to see how companies plan on changing supply chains, and the implications for investors.

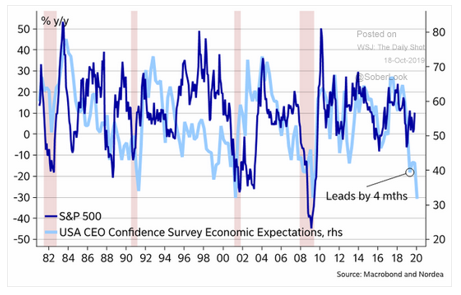

Corporate executives see a loss of profits and margin tightening in the future. A recent CEO survey showed confidence levels of SPX CEOs at recession levels. The survey results indicate a possible SPX decline beginning as soon as four months from now.

Sources: USA CEO Confidence Survey, Macrobond, The Wall Street Journal, The Daily Shot – 10/18/19

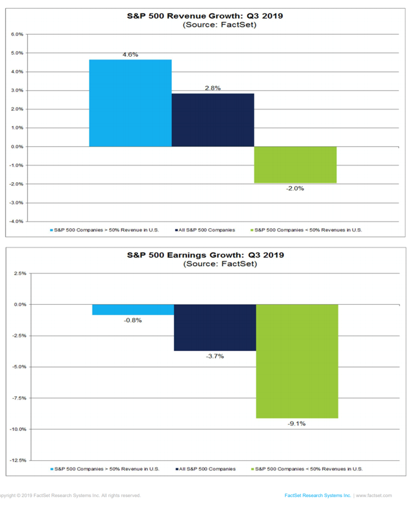

The concerns that CEOs see in revenue and profitability were borne out in 3rd quarter reports of 40% of S &P companies. Companies with more than 50% of sales in international markets report a 9.1% decline in profits and a 2.0% decline in revenue. All S &P companies report a 3.7% slip in earnings thus far for 3rd quarter of 2019.

Source: Factset – 10/25/19

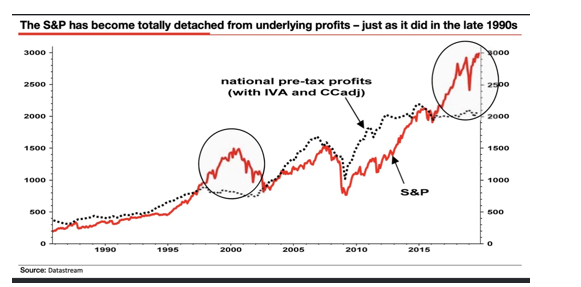

Are equity markets recognizing the decline in profits for corporations? The chart below shows the SPX rising despite flat national corporate profits since 2013, with a huge divergence emerging in the past four years. The SPX soaring to new heights tells us that stock market complacency is at record levels in appraising stock valuations versus actual corporate profits. The chart below shows how wide the gap has become which is about twice the gap size just before the Dotcom decline into 2002 from a peak in 2000.

Source: Soc Gen – Albert Edwards – Marketwatch – 10-28-19

The economic storm corporate executives see on the horizon is likely to be a future economic reality, and not liquidity fueled soaring valuations. Executives are closest to economic reality because they have to make the economic system work for their company day in and day out. A reversion of equity valuations to the reality of falling corporate profits is coming. The only question remaining is: when will the SPX reversion happen?

* * *

Patrick Hill is the Editor of The Progressive Ensign, https://theprogressiveensign.com/ writes from the heart of Silicon Valley, leveraging 20 years of experience as an executive at firms like HP, Genentech, Verigy, Informatica and Okta to provide investment and economic insights. Twitter: @PatrickHill1677.

Tyler Durden

Fri, 11/01/2019 – 13:11

via ZeroHedge News https://ift.tt/2C4rqy8 Tyler Durden