Berkshire Becomes Global Cash King: $128BN Cash Pile Bigger Than Apple, Google

It hasn’t been a good year for Berkshire Hathaway shareholders.

While Warren Buffett’s conglomerate reported that it earned just $4.0 billion in GAAP profits in fiscal 2018, down 90% from $45 billion the previous year, prompting the WSJ to describe 2018 as “one of Buffett’s worst years ever” largely due to an unexpected write-down at Kraft Heinz and unrealized investment losses, shareholders have turned increasingly cautious on the soon to be nonagenarian of Omaha’s (Buffett turns 90 next August) investment vehicle, with Berkshire A shares rising only 5.7% YTD, barely a quarter of the S&P’s 22.3% 2019 increase.

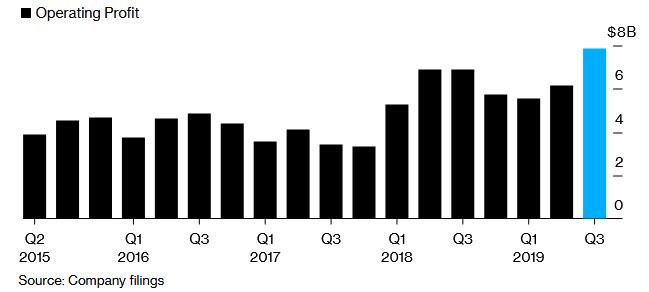

In a redemption attempt with its stock on track for its worst underperformance vs the S&P since 2009, Berkshire today reported that in the third quarter, its operating profit jumped 14% to a record high; largely thanks to investment gains at the company’s insurers and an increase in earnings from its railroad helped, operating profit jumped to $7.86 billion in Q3, or $4,816 per Class A share, from $6.88 billion, or $4,189 per share, a year earlier. The operating profit, which beat consensus analysts estimates of $4,405.16 per share, was the highest quarterly print on record.

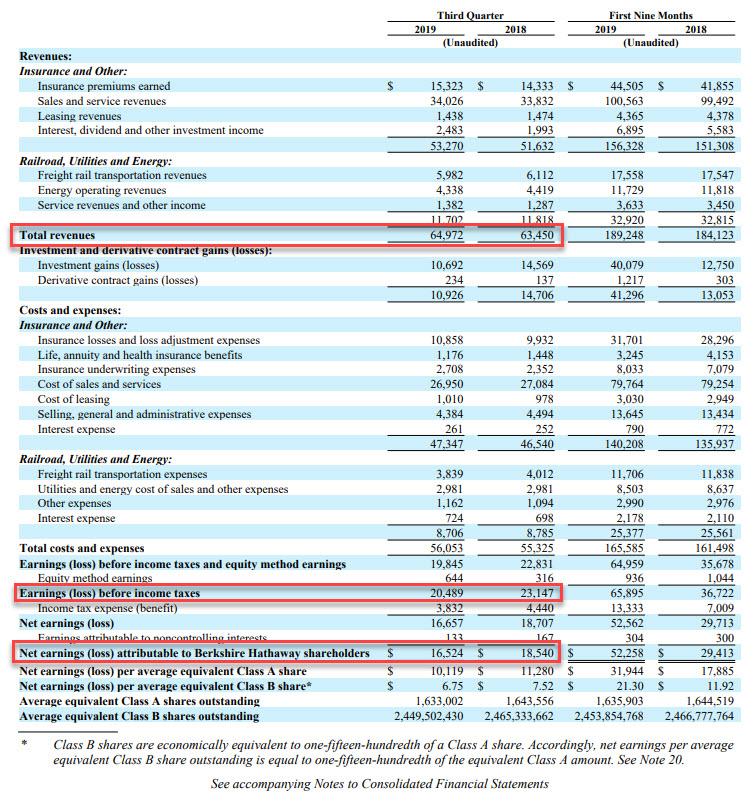

Berkshire benefited as a surprisingly resilient US consumer continued to spend even as economic growth slowed the most in years, offsetting a contraction in business investment. BNSF, one of Berkshire’s largest businesses, was able to boost profit 5% to $1.47 billion. The railroad’s cost-cutting helped offset lower revenue as demand for consumer, coal, industrial and agricultural products declined, the latter in part because of new trade policies. Berkshire also blamed U.S. tariffs for cutting into sales of gas turbine and pipe products by its Precision Castparts unit.

Meanwhile, insurance underwriting profit was essentially unchanged at $440 million according to Reuters, as improved results from reinsurance offset higher loss claims at Geico, Reuters noted. Berkshire warned that Typhoon Hagibis, which caused widespread damage in Japan last month, will likely hurt fourth-quarter underwriting results.

And even as total revenues increased by just over $1.5 billion Y/Y, net earnings slipped 11%, or $2 billion, to $16.5 billion, reflecting fewer gains from Berkshire’s investments. Under new accounting rules, Berkshire has to report swings in its investment portfolio in its net income figures. The unrealized gains during the third quarter were about $8 billion compared to a gain of $10.2 billion in the same period a year earlier.

Profit from manufacturing, services and retailing rose 2%, to $2.46 billion, as higher sales from Berkshire’s auto dealer and Clayton Homes mobile home units offset lower revenue from the Duracell battery, Forest River RV, and apparel and footwear businesses. Tax credits, meanwhile, helped Berkshire Hathaway Energy boost profit 8%, to $1.18 billion.

Float, a major driver of Berkshire’s growth that reflects insurance premiums collected before claims are paid, rose about $2 billion in the quarter to $127 billion, to wit:

Float was approximately $127 billion at September 30, 2019 and $123 billion at December 31, 2018. Our average cost of float was negative in the first nine months of 2019 as our underwriting operations generated pre-tax earnings of $1.5 billion.

Yet while the company posted another quarter of procyclical ascent, the biggest challenge it faced once again, was record high stock prices which continue to impede Buffett’s efforts to find places to invest. In lieu of pursuing full-blown acquisitions in companies with “sky high valuations”, Berkshire has had to make do with equity purchases in public companies: he has built a $50.5 billion stake in Apple and controversially committed $10 billion in April to help Occidental buy rival Anardako.

However, even when it comes to what upside is left in stocks Buffett appears to be having second thoughts as he was a net seller of stocks last the quarter: Berkshire generated $513 million in realized gains on the sales of investments during the third quarter (down from $995 million in realized gains the company reported a year earlier).

The billionaire’s market skepticism was also visible in the company’s buybacks of its own stock: Berkshire repurchased only $700 million of its own shares in the quarter, which while up from the paltry $400 million in Q2 repurchases, was down sharply from $1.7 billion in the first three months of the year.

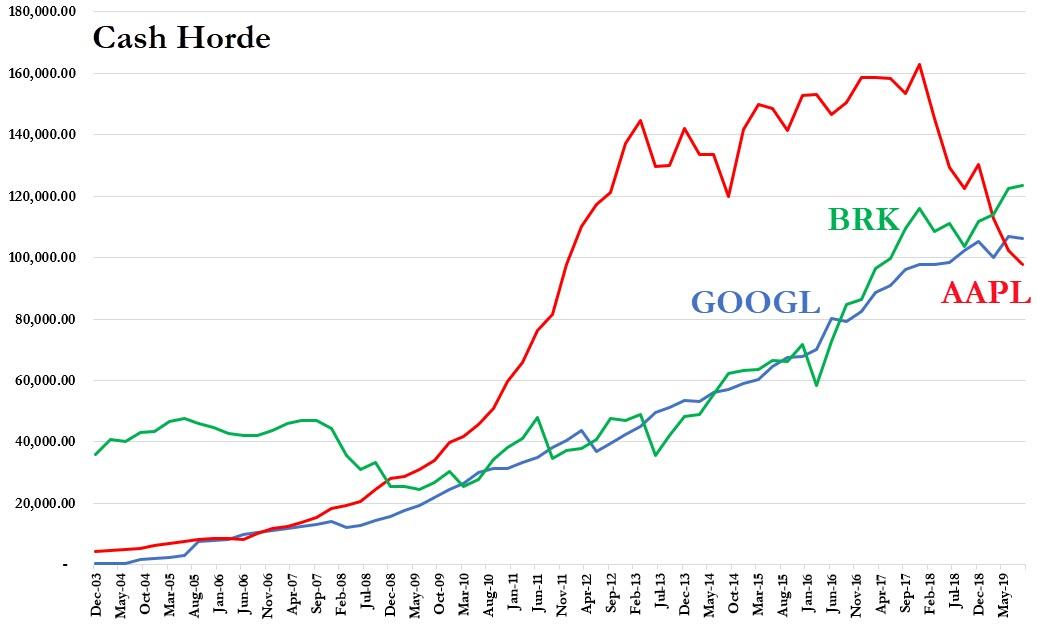

Which brings us to the most impressive state of all: with nothing notable to invest in, one quarter after Berkshire surpassed Apple and Google as the world’s biggest corporate cash holder, in Q3 Berkshire reported a record cash pile of $128 billion, pushing past the record set in the second quarter, in the process putting even more distance away from both former cash king Apple, and the resurgent Google.

Tyler Durden

Sat, 11/02/2019 – 15:00

via ZeroHedge News https://ift.tt/2N9ojLF Tyler Durden