The Third Wave Of Globalization Has Ended

The global economy is certainly at crossroads. Protectionism and nationalism, a well-matched marriage of global chaos at the moment, has threatened to end the third wave of globalization that began in the late 1980s.

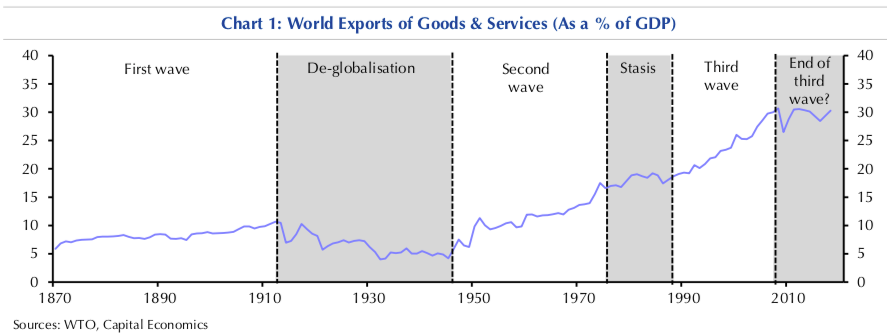

Capital Economics has published a compelling research note, titled “The end of globalization,” specifying how 150 years of globalization could’ve put in a significant peak in the last several years, all thanks to President Trump’s trade war with China.

The third wave of globalization began in the late 1980s, mostly driven by technological advancements and shifting labor and capital around the world to the most cost-effective regions.

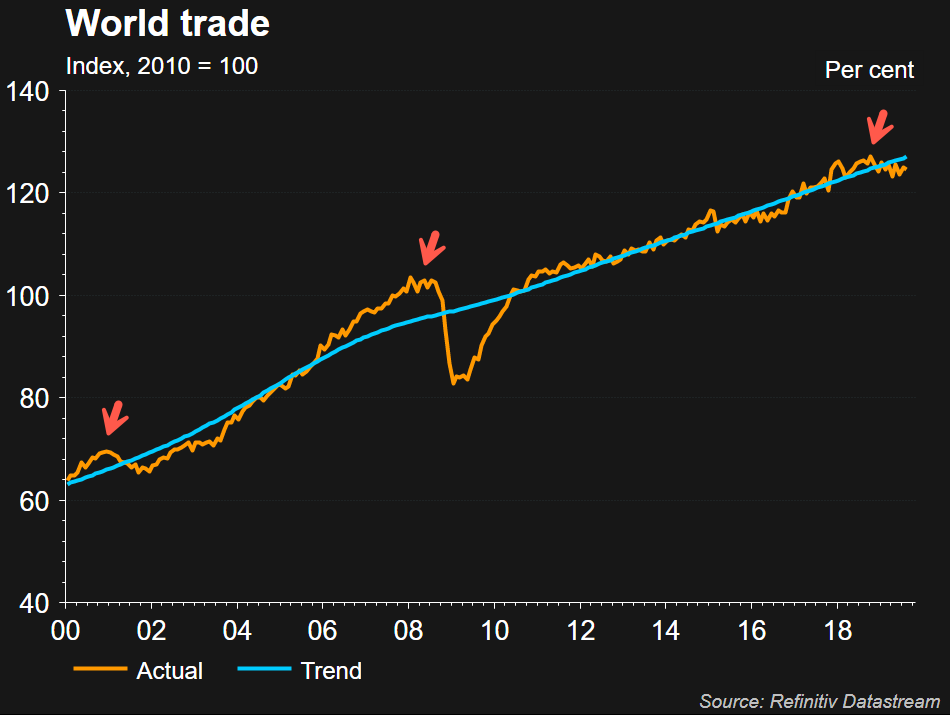

While the Western hemisphere consumed for three decades, the Eastern hemisphere manufactured the goods (which produced rising inequality in the West and thus how protectionism and nationalism were sparked), but the status quo of how supply chains are organized around the world could be changing as world trade volumes have hit a significant wall.

In terms of the Elliott wave principle, a third wave eventually gives out to a corrective fourth wave. Capital Economics believes the world is headed towards a period of de-globalization, or as history will call it a fourth corrective wave.

“It is possible that this is just a temporary hiatus and that an unforeseen technological breakthrough will trigger a new wave of globalisation. But such waves are rare. In fact, there are several reasons – even before we consider the trade war – why globalisation has peaked. First, all the major steps to integrate the global system have been taken. Second, advanced manufacturing techniques mean that the location of manufacturing no longer hinges on where labour costs are cheapest. Third, complex supply chains have reached their limit. Fourth, China is unlikely to open up its capital markets significantly.

Reaching the peak of globalisation is not necessarily a cause for alarm for the world economy. On the contrary; the technological developments that are partly driving these trends will boost productivity growth and widen consumer choice. That said, given that the most common development path begins with labour-intensive manufacturing in sectors such as textiles, life for the poorest countries will become more difficult. This will add to the structural headwinds already facing emerging markets.

What’s more, a more malign form of policy-driven de-globalisation – where cross-border trade and capital flows fall as a share of GDP – is looking increasingly likely. In the past, it is policy which has caused globalisation to roll back. While the first wave of globalisation ground to a halt during World War One, it was definitively ended by the protectionism of the 1930s. And the second wave drew to a close after the Nixon shock of 1971 which was followed by Reagan’s trade restraint policies.”

Now all this could change with a new president in 2020, tariffs could then be removed, and globalization returns, but overall, it’s likely that the damage to complex global supply chains has already been done, and will peak globalization through at least 2025. If President Trump wins another term, then the fourth corrective wave will dive deeper.

The emergence of China as a rising power was bound to cause economic disagreements between the West. More importantly, it has led to the Thucydides Trap, where the US, the status quo great power of the world, has threatened China, the rising power, with economic sanctions, all in the attempt to stop its ascension in becoming the next global superpower. There have been 16 cases in which rising powers threaten to displace the status quo powers in the last 500 years, and about 12 of these ended in a shooting war.

Over time, trade wars have sparked periods of de-globalization that have often led to shooting wars. Just look at how the first wave of globalization ended; WWI started shortly after that.

The fourth corrective wave of de-globalization is likely to “break-up of the world economy into competing regional blocs,” Capital Economics noted.

The implications of protectionism for the world economy over the coming decade could result in lower asset returns.

“If a policy-driven reduction in integration slowed economic growth and increased frictions to global financial markets, this effect could be a major drag on returns. But given the starting point of very low bond yields, the drag on equities would not stop them from outperforming bonds, unless de-globalisation took the most severe forms we have discussed,” Capital Economics wrote.

With globalization peaked, the depth of the fourth corrective wave is on our minds. No matter what, the world’s economy is fracturing into blocs that will produce lower global trade volumes and depressed returns for risk assets through the 2020s.

Tyler Durden

Sat, 11/02/2019 – 07:35

via ZeroHedge News https://ift.tt/32ai66C Tyler Durden