China Services PMI Drops To 12-Month Low, Hong Kong Business Activity Crashes Most On Record

Despite China’s surprise surge in Caixin Manufacturing PMI (to its highest since Dec 2016), Services were expected to show a modest decline which it did (down from 51.3 to 51.1).

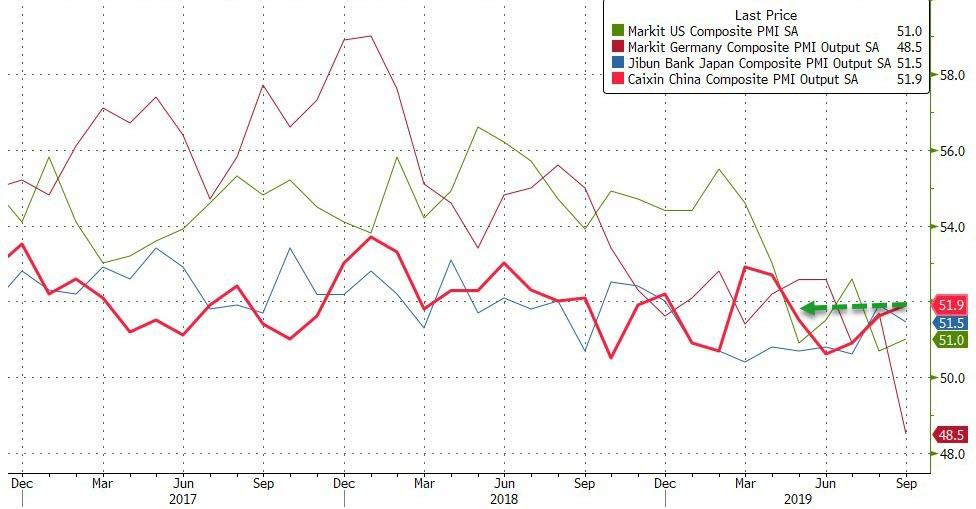

Note that the only one of the four PMIs to rise was the Caixin manufacturing index – massively bucking the trend of the rest…

Source: Bloomberg

Commenting on the China General Services PMI™ data, Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said:

“The Caixin China General Services Business Activity Index dipped to 51.1 in October from 51.3 in the previous month, marking the slowest expansion in eight months amid subdued market conditions.

1) Demand across the services sector grew at a reduced pace, with the gauge for new business falling to the lowest level since February. The measure for new export business picked up slightly.

2) While the job market expanded at a weaker clip, with the employment gauge falling from the previous month’s recent high, the measure for outstanding business rose further into expansionary territory. This implied a mismatch between labor supply and demand.

3) Both gauges for input costs and prices charged by service providers edged down, but they remained in positive territory, reflecting relatively high pressure on costs, including those of workers, raw materials and fuel.

4) The measure for business expectations dropped to the lowest point in 15 months, indicating depressed business confidence.

Additionally, the Caixin China Composite Output Index inched up to 52 in October from 51.9 in the month before, amid an improvement in manufacturing, but a softer service sector performance.

Source: Bloomberg

“The employment gauge dipped into contractionary territory, indicating renewed pressure on the labor market, which was likely due mainly to structural unemployment. The measure for backlogs of work climbed to the highest level since early 2011, highlighting bottlenecks in production capacity and inventories due to weak business confidence.

“China’s economy continued to recover in general in October, thanks chiefly to the performance of the manufacturing sector. Domestic and foreign demand both improved. However, business confidence remained weak, constraining the release of production capacity. Structural unemployment and rising raw material costs remained issues. The foundation for economic growth to stabilize still needs to be consolidated.”

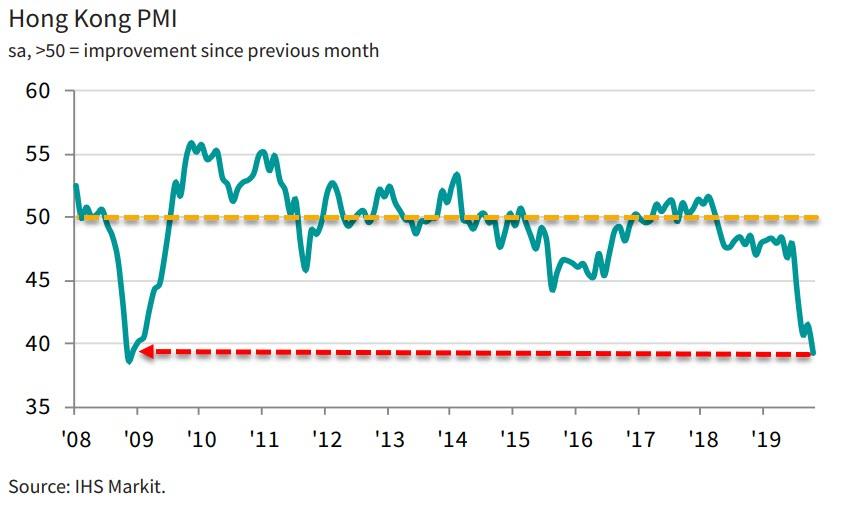

But then again, it could be worse – it could be Hong Kong, which saw its PMI crash to 39.3 in October – the lowest since November 2008 with business activity crashing at the fastest pace in the survey’s 21-year history. So much for the bounce in August that everyone declared as the bottom…

Commenting on the latest survey results, Bernard Aw, Principal Economist at IHS Markit, said:

“Hong Kong’s private sector remained mired in one of its worst downturns for the past two decades during October, with the latest PMI survey signalling a deepening economic malaise.

“The ongoing political unrest and impact of trade tensions saw business activity fall at the sharpest pace since the survey started over 21 years ago. Anecdotal evidence revealed that the retail and tourism sectors remained particularly affected.

“As new orders continued to fall sharply, led by a record decline in demand from mainland China, firms were becoming increasingly pessimistic about the outlook.”

Which doesn’t sound like a picture of ‘recovery’ or bottoming for the Chinese economy as a whole.

And finally, both attempts to juice stocks today on US-China trade deal talk have failed…

Better keep tweeting.

Tyler Durden

Mon, 11/04/2019 – 20:52

via ZeroHedge News https://ift.tt/33fOwxH Tyler Durden