Global Auto Sales Expected To Crash More Than After The Financial Crisis

The global auto industry continues to deteriorate, namely due to broke consumers after a decade of low-interest rates and endless incentives.

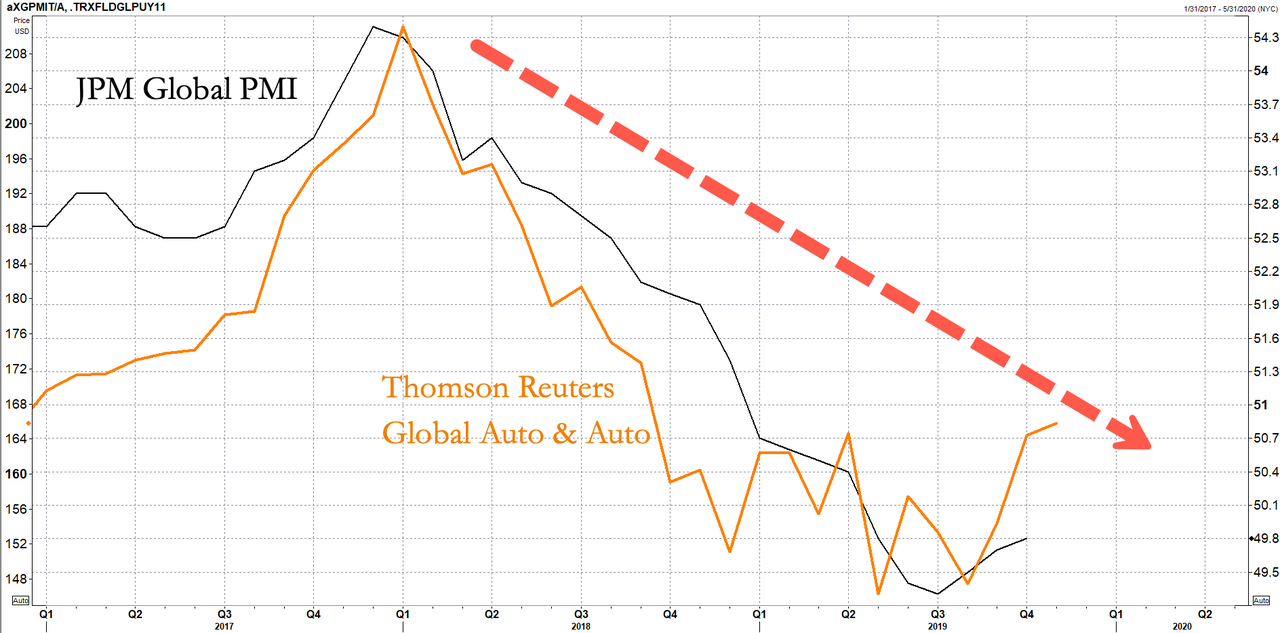

The auto slowdown has sparked manufacturing recessions across the world, including manufacturing hubs in the US, Germany, India, and China. A prolonged downturn will likely result in stagnate global growth as world trade continues to decelerate into 2020.

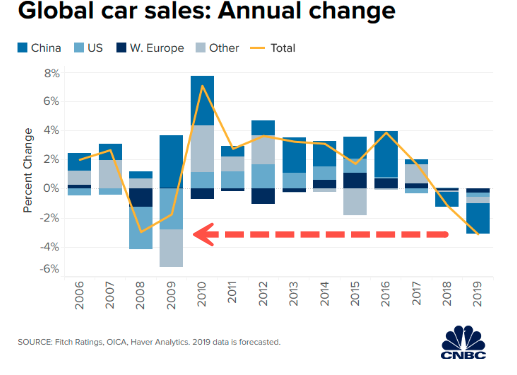

The Fitch Ratings economics team published a new report earlier this week, first reported by CNBC, outlining how global auto sales are expected to crash at a rate not seen since the last financial crisis.

Global auto sales fell to 80.6 million in 2018 from 81.8 million in 2017, which was the first annual decline in nearly a decade. 2019 sales are likely to fall by 3.1 million, or 4%, to 77.5 million, the most significant drop since 2008. The slowdown in auto sales has been one of the largest contributors to the global manufacturing recession.

“The downturn in the global car market since the middle of 2018 has been a key force behind the slump in global manufacturing, and the car sales picture is turning out a lot worse than we expected back in May,” Brian Coulton, Fitch Chief Economist, said in a statement.

China has been labeled as the primary source of falling demand. YTD auto sales in the country are down 11% versus the first ten months of 2018. There are no signs that a recovery in the industry will be seen in 2020. The US and Western Europe are expected to see declines of 2% this year. Brazil, Russia, and India are expected to record a drop of at least 5.5% YTD.

“Structurally, environmental concerns about diesel cars — and anticipated regulatory responses — and the growth of ride-hailing and car-sharing schemes are weighing on auto demand,” Coulton told CNBC.

Fitch also warned that the global auto industry won’t rebound in 2020, and it’s also likely the industry has entered a low growth period.

“While we don’t see a further sharp decline in global manufacturing in 2020, the auto outlook is pointing to stabilization at best rather than any sharp rebound,” Coulton said.

And with no sharp rebound in the global auto sales projected for next year, there can be no monster rebound in global manufacturing in the coming quarters.

Nevertheless, as we’ve explained in recent months, the driver of global growth is China, and currently, China continues to see economic deceleration with no troughing in sight.

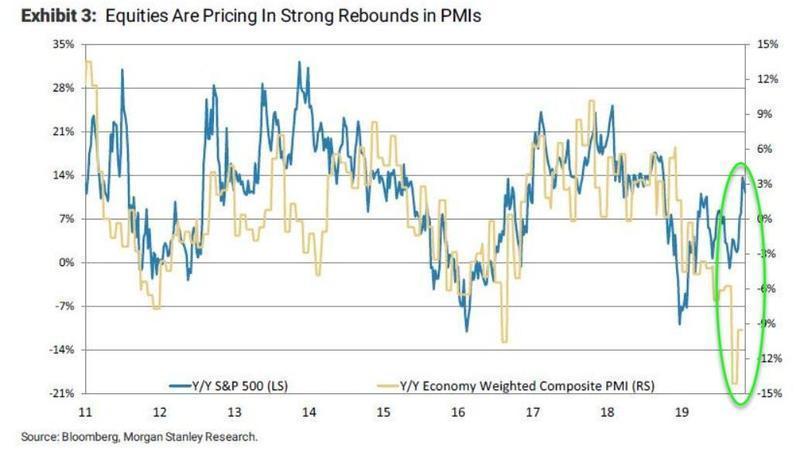

With that being said, global stocks have priced in a massive rebound in Global PMI, and, likely, the rebound won’t be coming early next year, making a case for blowoff tops in equities even stronger in the months ahead.

Tyler Durden

Fri, 11/29/2019 – 02:45

via ZeroHedge News https://ift.tt/2Y79Tjj Tyler Durden