Morgan Stanley Fires FX Traders Overt $140 Million Loss

2019 has been a ‘volatile’ year for traders in the foreign exchange markets, if not for actual currencies.

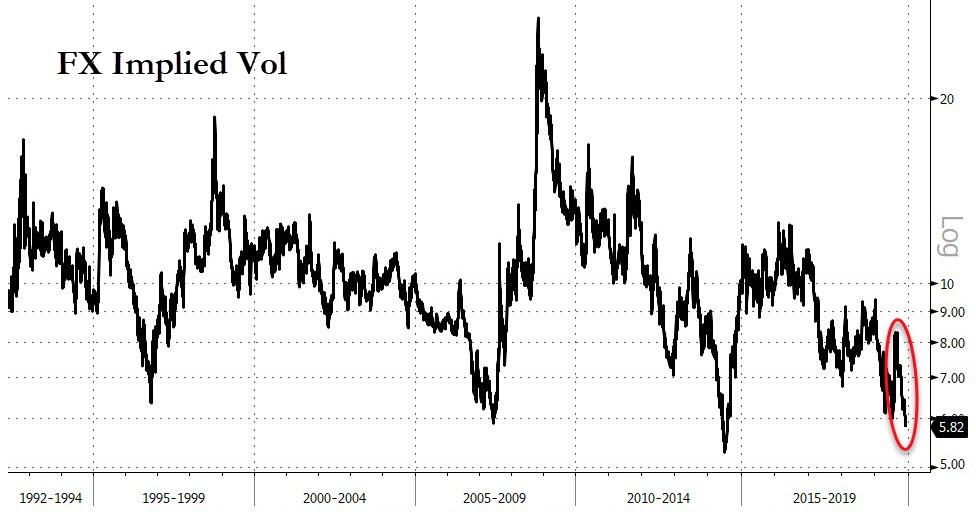

After early year chaos amid trade wars, global recession fears, and sanctions threats, FX volatility tumbled, spiked, and then collapsed (along with every other asset class vol) as central banks stomped their boots on the throat of uncertainty.

Source: Bloomberg

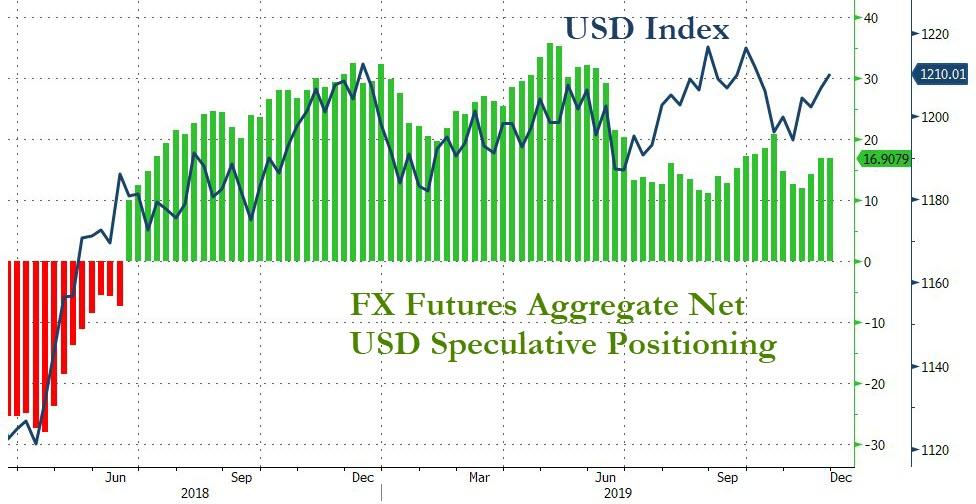

And with FX vol at or near record lows, traders have been unwilling to chase the dollar’s performance as much as they were earlier in the year…

Source: Bloomberg

But, according to Bloomberg, quite a few Morgan Stanley traders were heavily-positioned the wrong way.

According to “people with knowledge of the matter”, Morgan Stanley fired or placed on leave at least four traders amid a probe into alleged mismarking of trades linked to emerging-market currencies.

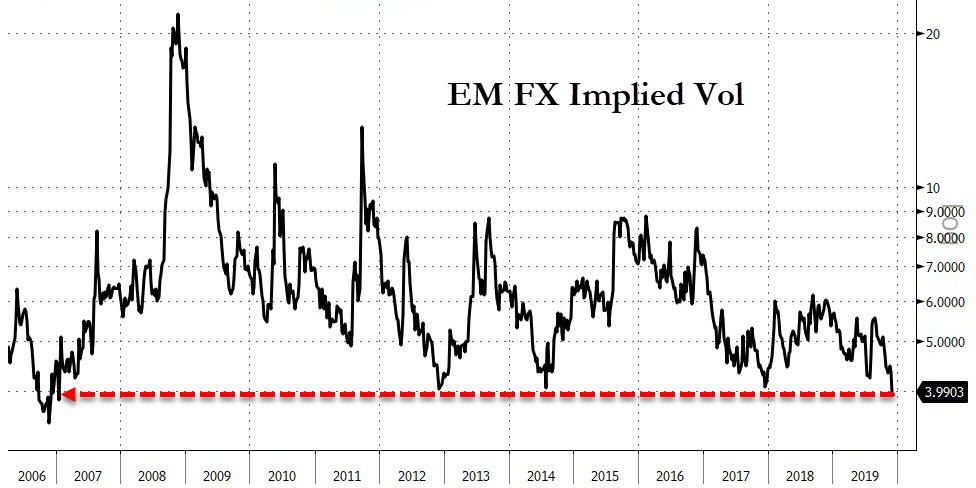

Emerging Market FX (broadly) has collapsed in 2019…

Source: Bloomberg

And along with it, EM FX vol has crashed to near record lows…

Source: Bloomberg

According to the report, the bank is investigating whether the suspected mismarking helped conceal a loss of $100 million to $140 million.

As Bloomberg details, and for those who are unfamiliar that his exact same process has been taking place in corporate bonds for decades (although woe to anyone who is caught doing it), in so-called mismarking the value placed on securities doesn’t reflect their actual worth. The probe at Morgan Stanley revolved around relatively more complex products such as FX options instead simple underlying cross, which may have given them confidence that the layer of complexity would prevent getting caught.

It did not.

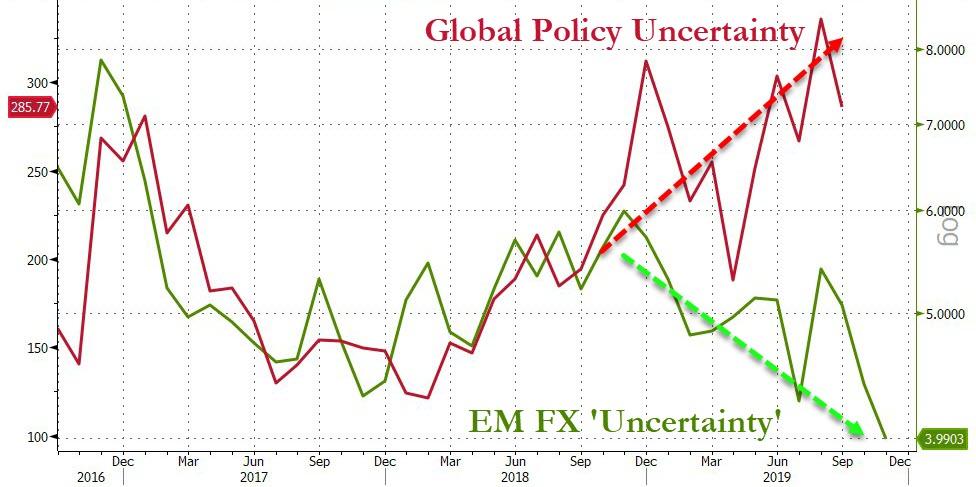

Making matters worse, Morgan Stanley’s FX options desk has struggled this year amid a slump in volatility, the swings in currencies that can generate profits for traders, even across more unruly emerging markets such as Turkey:

Source: Bloomberg

Then again, who can blame them for losing money in this market as EM FX vol has collapsed irrationally amid soaring policy uncertainty. Maybe the “criminal” traders in question can cop a plea and agree to rat out the central bankers who are responsible for the current disastrous state of “markets.” Surely the associated depositions and discovery alone will be worth the price of a bid/ask spread.

Source: Bloomberg

Tyler Durden

Fri, 11/29/2019 – 07:22

via ZeroHedge News https://ift.tt/2q1Tpfv Tyler Durden