Beware The ‘Unholy Alliance’ Of Trump & Powell

Authored by Sven Henrich via NorthmanTrader.com,

Some things can’t be proven, but they can be observed. Correlation is not necessarily causation, but when the evidence keeps mounting so does credulity. And the cumulative evidence increasingly points to an unholy alliance between Donald Trump and the US Federal Reserve with the Fed succumbing to political pressure and delivering Donald Trump what he needs most: A soaring stock market to ward off political problems and to help ensure a 2020 re-election.

Fantasy talk? Let’s examine the evidence and take a closer look at the historicity of it all. Nobody has done it and I sense it needs to be done for all to see and judge for themselves. May as well be me doing the legwork here.

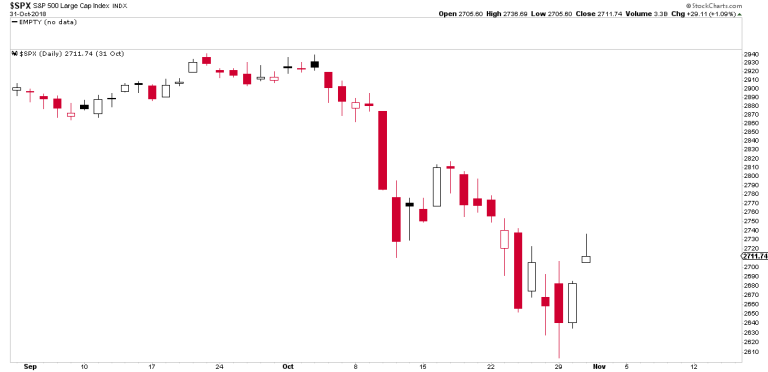

It all began in October of 2018. The S&P 500 had made new all time highs in September of 2018. The $DJIA made an all time new high in early October 2018. Things were going well. The US tax cuts rewarded corporations with massive tax benefits which many of them unleashed on US markets in the form of record buybacks and markets were soaring, US GDP growth was moving above 3% all was well.

Indeed Donald Trump, known for having tweeted critically about the Fed dozens of times in 2019, had not mentioned the Fed once in 2018. Not until this happened:

Markets sold off in October and suddenly the first tweet about the Fed, a subtle hint quoting a Wall Street strategist:

“If the Fed backs off and starts talking a little more Dovish, I think we’re going to be right back to our 2,800 to 2,900 target range that we’ve had for the S&P 500.” Scott Wren, Wells Fargo.

— Donald J. Trump (@realDonaldTrump) October 30, 2018

Backing off of course referring to the Fed’s efforts to use market and economic strength to finally attempt to normalize its bloated balance sheet from $4.5 trillion to something more in line with pre financial crisis levels.

The larger hint: Use the Fed to re-inflate asset prices.

Whatever you may think of of Donald Trump he knows quite well the power of the Fed and its impact on asset prices. Sinking stock prices are bad for business, bad for the economy and bad for a president.

And what better way to increase stock prices than to have the Fed increase its balance sheet. Here, Donald Trump in 2012:

QE creates artificial numbers for short term market gains. https://t.co/ISHw2Seey8

— Sven Henrich (@NorthmanTrader) November 27, 2019

QE creates artificial numbers for short term gains. His words. He knows.

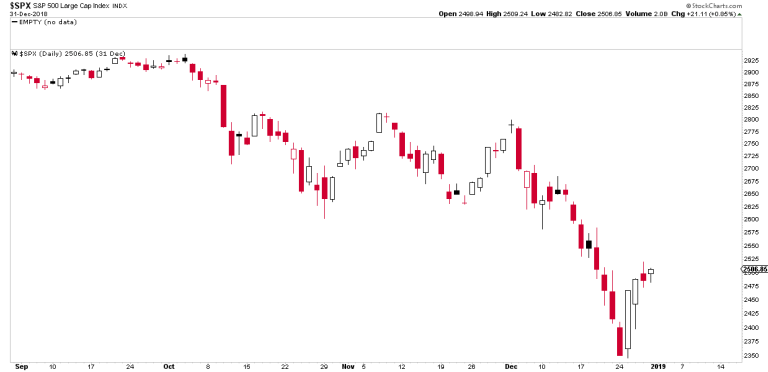

QE was needed, especially as markets collapsed into late 2018:

Suddenly the pace of Fed tweeting increased, the tone more direct with specific instructions:

I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make yet another mistake. Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!

— Donald J. Trump (@realDonaldTrump) December 18, 2018

Stop the 50 B’s. The 50 B’s of course referring to the Fed’s quantitative tightening program on “autopilot” as Jay Powell had declared it to be.

The collapse in markets now prompted more aggressive signaling as only 4 days following the above tweet Trump threatened to fire Powell.

Pressure was on. Treasury Secretary Mnuchin was hitting the phones hard only a day later with his now infamous liquidity calls with banks. It doesn’t take a conspiracy theorist to presume Jay Powell’s phone was on speed dial as well.

Markets, vastly oversold and technically disconnected, bottomed following these phone calls. And Jay Powell’s autopilot program crumbled in principle and suddenly signaled being “flexible” on the balance sheet roll-off only a few days later.

Stop the 50Bs. Yes sir. A message received and likely very well reinforced during an ‘informal dinner” in early February.

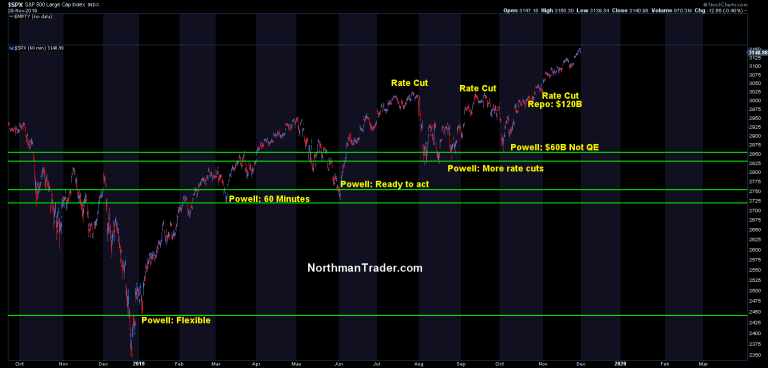

And thus began a long windy road to ensure asset price levitation and stop any corrective activity in its tracks and Jay Powell became the savior at every low in 2019:

But the Fed ran into problems during its initial rate cuts in 2019 as each time markets sold off.

All the while the present kept the pressure on in dozens of tweets. Type in “Fed” in the tweet archive and see for yourself.

Here are a few select goodies again linking market performance to the Fed:

If the Fed had done its job properly, which it has not, the Stock Market would have been up 5000 to 10,000 additional points, and GDP would have been well over 4% instead of 3%…with almost no inflation. Quantitative tightening was a killer, should have done the exact opposite!

— Donald J. Trump (@realDonaldTrump) April 14, 2019

Jay Powell is claimed to be clueless as markets were correcting in August:

..Spread is way too much as other countries say THANK YOU to clueless Jay Powell and the Federal Reserve. Germany, and many others, are playing the game! CRAZY INVERTED YIELD CURVE! We should easily be reaping big Rewards & Gains, but the Fed is holding us back. We will Win!

— Donald J. Trump (@realDonaldTrump) August 14, 2019

Powell has let us down, need a big cut:

Doing great with China and other Trade Deals. The only problem we have is Jay Powell and the Fed. He’s like a golfer who can’t putt, has no touch. Big U.S. growth if he does the right thing, BIG CUT – but don’t count on him! So far he has called it wrong, and only let us down….

— Donald J. Trump (@realDonaldTrump) August 21, 2019

No, the pressure was on to deliver big, not only on rate cuts but also on QE:

Political independence? Really?

Within 2 months following this tweet the Fed has cut rates for a total of 75 basis points, introduced repo, $60B a month in treasury bills buying & now expanded their balance sheet by $280B in 2.5 months

I submit the Fed did exactly what was asked. https://t.co/ZQneBqfj0h— Sven Henrich (@NorthmanTrader) November 27, 2019

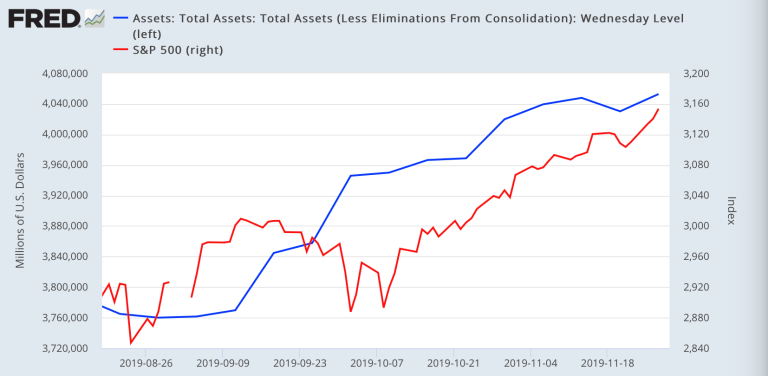

And Powell delivered. 3 rate cuts, and then came the big repo program and then QE, although the Fed sheepishly claimed it not to be QE. The Fed increased its balance sheet hard, over $290B now and markets listened.

Indeed the only down week markets have had since then was precisely the only week the Fed actually reduced its balance sheet. Correlation is not causation?

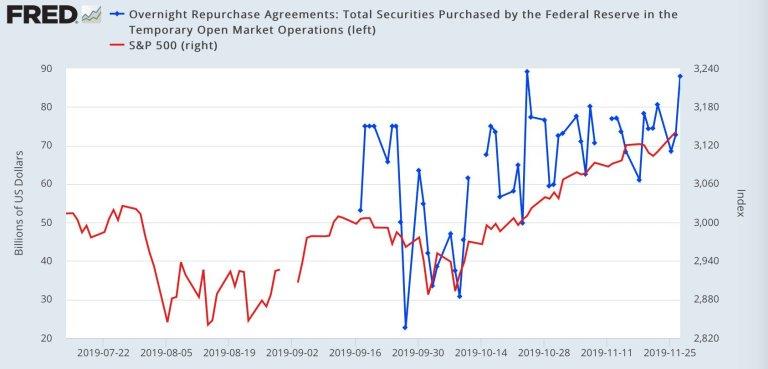

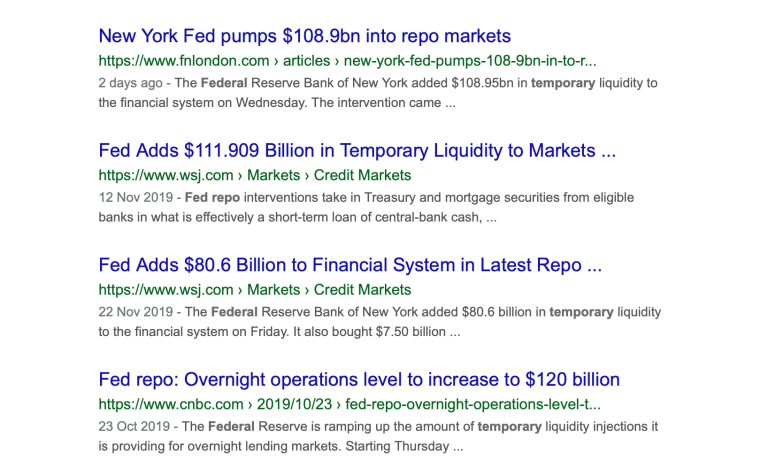

Hardly, especially considering the Fed is running a massive daily liquidity program on top of QE, called repo:

As markets volumes have dwindled in the run up of the rally the Fed is relentlessly injecting liquidity into these markets with over $106B added just on the Wednesday in front of the Thanksgiving holiday. My question:

What would happen if they didn’t?https://t.co/RYsBk9eSlw

— Sven Henrich (@NorthmanTrader) November 29, 2019

My larger point: “The Federal Reserve Bank of New York added $108.95 billion in temporary liquidity to the financial system on Wednesday.”. If it’s temporary, but happens every single day it’s not temporary, it’s a permanent daily liquidity boost.

It’s distorting markets.

And indeed it is.

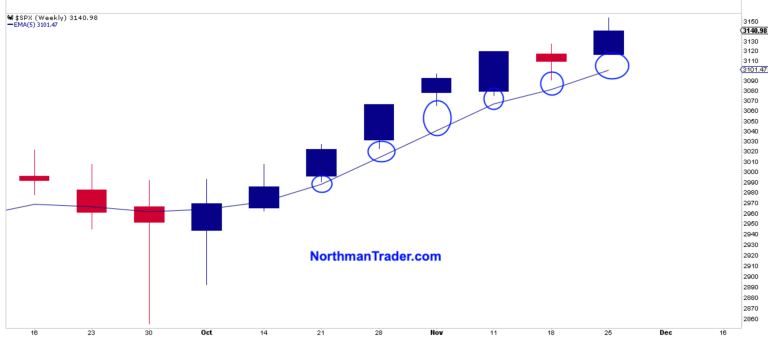

Following the introduction of QE not only went markets on a tear to new highs, but left the weekly 5EMA in the dust, not touching it for 6 weeks in a row:

Weekly 5 EMA disconnects happen during big rallies and during big sell offs. Nothing unusual about that. How often do weekly 5 EMA disconnects happen 6 weeks in a row? Well, never:

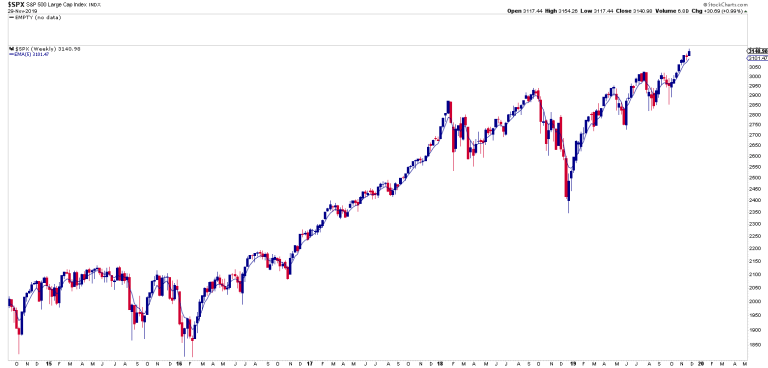

Not even during the blast off rally into January 2018 did this happen, but since the Fed has been drowning markets in liquidity with its daily liquidity injections and treasury bills buying markets have blasted off into the melt-up/combustion scenario.

And suddenly we get to witness a miraculous conversion. From Jay Powell the beaten puppy, the clueless terrible communicator and derelict if he doesn’t stimulate…

Jay Powell and the Federal Reserve Fail Again. No “guts,” no sense, no vision! A terrible communicator!

— Donald J. Trump (@realDonaldTrump) September 18, 2019

The Federal Reserve is derelict in its duties if it doesn’t lower the Rate and even, ideally, stimulate. Take a look around the World at our competitors. Germany and others are actually GETTING PAID to borrow money. Fed was way too fast to raise, and way too slow to cut!

— Donald J. Trump (@realDonaldTrump) October 24, 2019

…to getting a very good and cordial meeting:

Just finished a very good & cordial meeting at the White House with Jay Powell of the Federal Reserve. Everything was discussed including interest rates, negative interest, low inflation, easing, Dollar strength & its effect on manufacturing, trade with China, E.U. & others, etc.

— Donald J. Trump (@realDonaldTrump) November 18, 2019

We’re all friends again, cause that’s where you meet with friends, not in the Oval office, but in the private residence of the White House.

I submit the timelines, the actions, the words, the results speak for themselves.

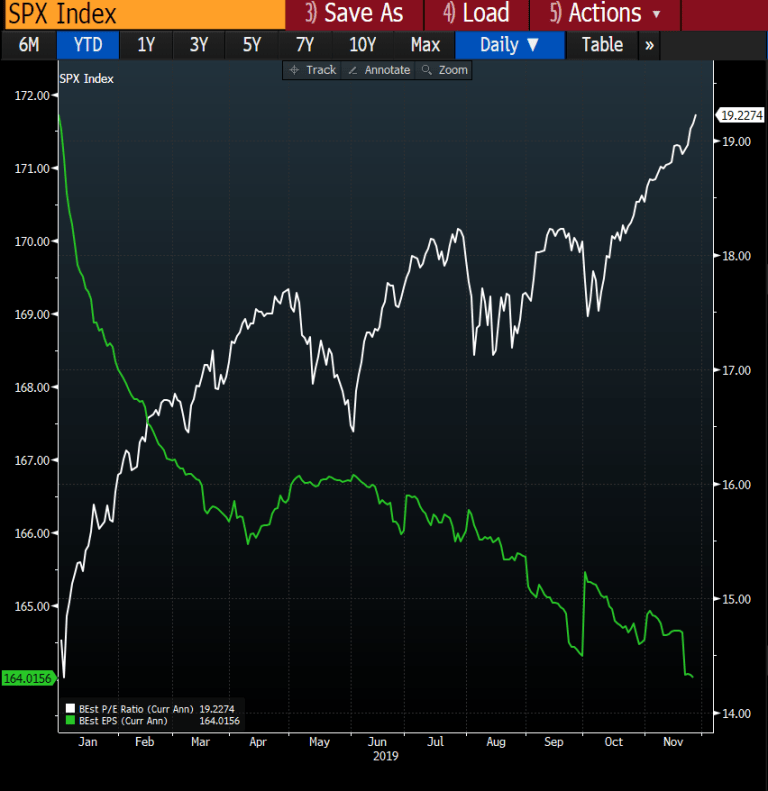

The US Fed under Jay Powell has manufactured a massive market rally producing vast P/E multiple expansion in the face to declining earnings and growth:

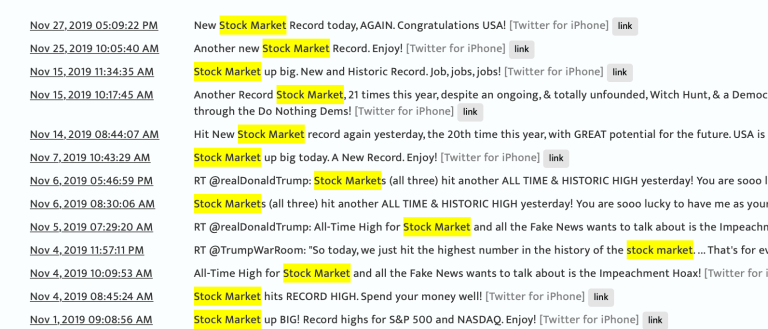

Wall Street gets to celebrate, wealth inequality is made great again, Powell’s no longer clueless, his job is safe and the president gets to take victory laps on twitter:

Will it last for the long term?

Not according to this guy:

QE3 is going to further sink the dollar into oblivion. Creates artificial numbers for short term market gains. (cont) http://t.co/8mORe86h

— Donald J. Trump (@realDonaldTrump) September 14, 2012

It just needs to last until November 2020.

And the Fed claiming political independence? That claim rings as hollow as its September declaration of repo being just temporary. Sure Sherlock:

Look, I can’t prove an unholy alliance between Trump and the Fed. I’m not sitting at the dinner table or in the White House residence or listen to phone calls. There are no transcripts, no minutes, nothing of the transparent sort.

But we have dates, we have tweets, we have price action, we have speeches and we have policy actions and we can see the correlations between all these things and the impact on US stock markets and all of these lead to an inevitable conclusion: The Fed has been doing the administration’s bidding, willingly or not is besides the point. They have for the ultimate reason: No bull market without central bank intervention, for they know the larger truth:

10 years after the financial crisis we’re exactly back to where we started: Requiring intervention, low rates and QE.

Except now the world has $250 trillion of debt.

And the only solution is to do more of the same.

Genius.— Sven Henrich (@NorthmanTrader) November 28, 2019

I’ll aim to post a technical update separately in the days ahead, but know that this rally is not based on fundamentals or growth, it’s a manufactured melt-up that is stretching charts far above the historic mean and therefore increase risk of a massive reversion. Melt-ups are awe-inspiring, but they are also dangerous if not supported by fundamentals and the Fed may come to regret the liquidity monsters it has unleashed for the Fed will ultimately take the blame blowing the largest asset bubble since 2000.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Sat, 11/30/2019 – 10:30

via ZeroHedge News https://ift.tt/2DuT0Fz Tyler Durden