As the global IPO market falters, Saudi state oil giant Aramco announced Sunday its IPO offering on the Tadawul exchange in Riyadh.

Saudi Crown Prince Mohammed bin Salman (MbS) and Aramco executives are scrambling to IPO Aramco before the IPO market shuts, and the global economy enters a trade recession.

The Aramco IPO has had nearly four years of delays but could start trading on the Tadawul exchange by December, with international offerings in 2020/21.

Aramco is expected to release the IPO prospectus on November 9, The Wall Street Journal said.

Chairman of Saudi Aramco and Governor of the Public Investment Fund Yassir al-Rumayyan and Aramco Chief Executive Officer Amin Nasser, delivered a statement to journalists at a press conference on Sunday:

“Today is a profoundly important day for the kingdom of Saudi Arabia,” al-Rumayyan said.

The price range of the Saudi Aramco IPO, The Journal noted, has been of a conflict between MbS, Aramco executives, and the underwriters of the deal.

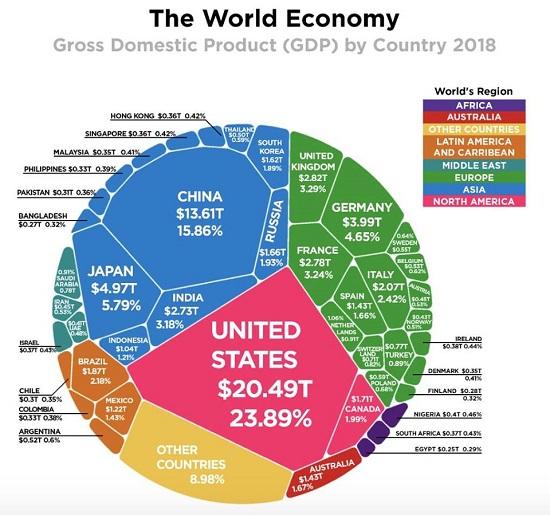

MbS values the company at $2 trillion, but bankers said no investor would buy at that level.

The deal is likely to price on the Tadawul exchange around a valuation of $1.7 trillion, with a low range of $1.6 trillion, and a high range of $1.8 trillion, sources told The Journal.

“Let the market dynamics and those discussions drive the value and what the pricing should be for that IPO,” said one banker. “The ego, pride, and everything should be secondary.”

At a $1.5 trillion valuation, Aramco would raise $45 billion for a 3% stake on the Tadawul exchange.

The purpose of the IPO is to diversify the Saudi economy away from the oil industry and to invest more in technology, healthcare, mining, and tourism sectors.

MbS is leading the transformation as apart of the Saudi Vision 2030 plan to reduce the country’s dependence on oil.

“To strengthen Tadawul and Saudi Arabia as a foreign investment destination, listing Saudi Aramco now is important,” Nasser said.

“It’s only Tadawul for now, anything else in the future will be announced at a later date,” Nasser said referring to the company’s plans for a foreign listing. He also added that Aramco did not just meet with international investors but “with national investors also.”

“We will continue to create value, for our shareholders, for our customers,” he said.

Still, many uncertainties surround the IPO.

Geopolitical tensions have been elevated in the country since an Iranian missile attack blew up part of the company’s oil processing plant in September.

Aramco made it clear that now is the time to move forward with the IPO, though they’ve been saying this for years (Aramco IPO timeline via Reuters):

Nov 3, 2019 – Saudi Arabia’s Capital Market Authority said its board had approved Saudi Aramco’s application for the registration and offering of a proportion of its shares.

Oct 18, 2019 – Saudi Aramco delays the planned launch of its initial public offering in hopes that pending third-quarter results will bolster investor confidence in the world’s largest oil firm.

Oct 8, 2019 – The Saudi central bank vets local lenders’ exposure to Saudi Aramco ahead of an initial public offering of the state-oil giant that will likely see large numbers of Saudi investors seek loans to buy its stock, three sources familiar with the matter said.

Oct 7, 2019 – Rating agency Fitch downgrades Saudi Aramco by one notch after attacks last month on two production facilities, putting the rating of the state-owned oil giant at par with the one of Saudi Arabia.

Sept 30, 2019 – Fitch downgrades Saudi Arabia’s credit rating to A from A+, citing rising geopolitical and military tensions in the Gulf following an attack on its oil facilities and a deterioration of the kingdom’s fiscal position.

Sept 25, 2019 – Saudi Arabia restores its oil production capacity to 11.3 million barrels per day, three sources briefed on Saudi Aramco’s operations tell Reuters, maintaining a faster than expected recovery after the Sept. 14 attacks.

Sept 14, 2019 – Two Saudi Aramco plants attacked in a drone strike, triggering the biggest jump in oil prices in almost 30 years. The attacks forced Saudi Arabia to shut down more than half of its crude output, leaving question marks over the timing and valuation of its IPO.

Sept 11, 2019 – Saudi Aramco hires nine banks as joint global coordinators to lead its planned initial public offering, sources say.

Sept 9, 2019 – Saudi Arabia plans to list 1% of Saudi Aramco on the Riyadh stock exchange before the end of 2019 and another 1% in 2020, sources tell Reuters.

Sept 2, 2019 – Saudi Arabia names head of the country’s sovereign wealth fund, Yasir al-Rumayyan, as Aramco chairman, replacing Energy Minister Khalid al-Falih.

Aug 30, 2019 – Saudi Aramco board sees too many risks for New York IPO, sources tell Reuters.

Aug 19, 2019 – Saudi Aramco asks banks to pitch for roles in IPO, sources say.

July 2, 2019 – Banks including JPMorgan, Morgan Stanley and HSBC scramble to re-pitch for Aramco IPO roles, sources say, with Saudi Arabia’s energy minister confirming plans for the listing to proceed in 2020 or 2021.

April 9, 2019 – Aramco sells $12 billion bonds out of record $100 billion demand.

April 1, 2019 – Saudi Aramco made core earnings of $224 billion in 2018, figures show, after Aramco had to reveal them in order to start issuing international bonds.

March 27, 2019 – Saudi Aramco says it would buy SABIC in $69 billion chemicals mega deal.

March 7, 2019 – Saudi Energy Minister says Aramco IPO to happen within two years, Okaz newspaper reports.

Aug 22, 2018 – Saudi Arabia scraps plans for the domestic and international listing of Aramco and advisers working on the listing have been disbanded as the kingdom shifts its attention to buying a stake in SABIC, sources say.

July 20, 2018 – Saudi Aramco’s plans to buy a stake in petrochemicals maker Saudi Basic Industries Corp (SABIC) would affect IPO timing, CEO says in an interview.

March 13, 2018 – Saudi Aramco international listing looks increasingly difficult, sources close to the process say

Jan 11, 2018 – Hong Kong, London, New York shortlisted for Aramco IPO, two sources with knowledge of the discussions say

Jan 10, 2018 – Saudi Aramco is working to raise cheap loans from banks seeking to strengthen their ties with the oil giant before its IPO, banking sources say.

Oct 26, 2017 – Saudi Aramco IPO is on track for 2018 and it could be valued at more than $2 trillion, Crown Prince Mohammed bin Salman tells Reuters in an interview.

Sept 25, 2017 – Saudi finance minister told bond investors Aramco IPO would go ahead in 2018, sources tell Reuters.

Aug 11, 2017 – Saudi Arabia favors New York for Aramco listing despite risks for the main foreign listing, people familiar with the matter tell Reuters.

Aug 3, 2017 – Goldman Sachs bought into Aramco $10 billion loan as it seeks IPO role, sources familiar with the matter tell Reuters.

May 3, 2017 – London tries to lure Saudi Aramco with new listing structure, sources familiar with the discussions say.

May 2, 2017 – Aramco sale won’t be far off 5%, will happen in 2018, Deputy Crown Prince Mohammed bin Salman says.

April 24, 2017 – HSBC has been formally mandated as an adviser on IPO of Saudi Aramco, HSBC’s chief executive says.

April 19, 2017 – China gathers state-led consortium that will act as a cornerstone investor in the Aramco IPO, people with knowledge of the discussions tell Reuters.

March 30, 2017 – Saudi Aramco formally appointed JPM, Morgan Stanley and HSBC as international financial advisers for its IPO, sources familiar with the matter tell Reuters.

March 23, 2017 – Saudi Aramco picks Samba Capital as local IPO adviser, sources tell Reuters.

March 6, 2017 – Saudi Aramco will list locally and abroad in second half of 2018, Chief Executive Amin Nasser says.

Jan 26, 2017 – Saudi Aramco selects U.S. firms to audit its reserves for IPO, industry sources says

May 27, 2016 – Saudi Aramco was boosting market share as it prepares for listing, Chief Executive Amin Nasser says in an interview.

May 10, 2016 – Saudi Aramco was finalizing proposals for the IPO of less than 5% of its value and will present them to its Supreme Council soon, its chief executive says.

April 25, 2016 – Saudi Arabia expects Saudi Aramco to be valued at more than $2 trillion and plans to sell less than 5% of it through an IPO, the Deputy Crown Prince Mohammed bin Salman says.

Jan 24, 2016 – Saudi Aramco chairman says IPO could be open to international markets, in an interview to Arabiya TV.

Jan 8, 2016 – Saudi Aramco issued statement saying it was considering options including the stock market listing “of an appropriate percentage of the company’s shares and/or the listing of a bundle of its downstream subsidiaries”.

Jan 6, 2016 – Saudi Arabia’s Deputy Crown Prince Mohammed bin Salman mentioned his interest in selling off parts of Aramco to private investors in an interview with the Economist.