Game Over?

Authored by Sven Henrich via NorthmanTrader.com,

What happens if you toss $97.9B in liquidity at an extended market and it sells off anyways? Maybe nothing, but maybe everything.

The unholy alliance surely has succeeded in elevating asset prices in recent weeks, indeed prices have exceeded the level I suggested as a potential key target in April in Combustion, 3102 on $ES:

Today $ES hit 3157 or 1.7% above that level I outlined then.

Back then I discussed an apex of trend lines possibly converging in October 2019. October came and went and the Fed went full repo and QE and markets kept ascending relentlessly. Until today.

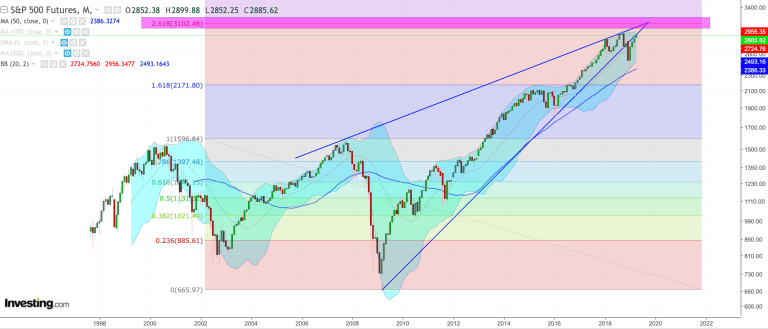

And guess what. Despite all the rallying $ES still hasn’t managed to recapture its broken 2009 trend line. It still hasn’t overcome its 2007 trend line. And it still hasn’t overcome its broken 2019 trend.

No Sir. What this rally has done to run relentlessly toward a trifecta apex of trend lines. When? This morning. In pre-market:

Got within 20-25 handles of that apex peak point and on a negative monthly divergence again.

Now there’s nothing that says we can’t get above it with all this liquidity, but I note $ES got near the apex and suddenly rejected even with $97.9B in liquidity thrown at it.

This convergence of trend lines ends this month. It may simply mean nothing by the end of the month or it may mean everything. It’s simply too early to tell. If it means everything then it may be game over for this bull run.

If it’s a meaningful level then even a basic .236 fib level retrace risks a move ultimately toward 2584. A proper technical move toward the .382 fib would target 2,218. Again, way too early to tell, I’m just outlining the potential technical ramifications.

So December will be critical to get a better sense of the validity of this chart.

Perhaps of note the rejection today came at key trend line resistance points in the form of throw overs. The throw overs occurred last week during the shortened low volume holiday week.

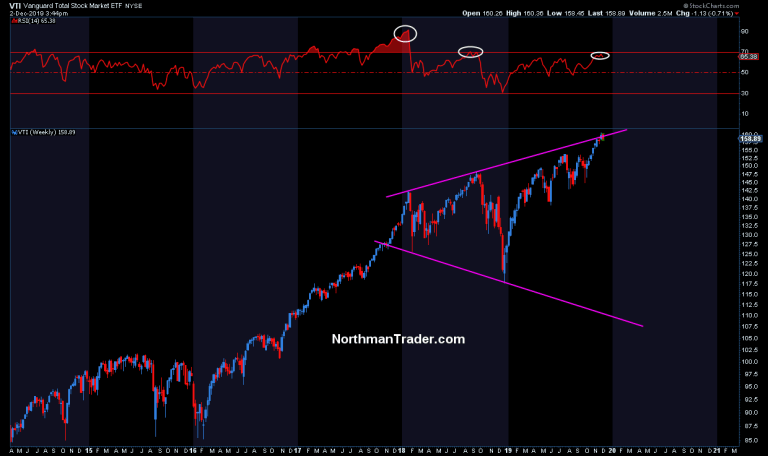

The broad all market ETF $VTI:

The rejection today then leaves its megaphone structure technically still intact.

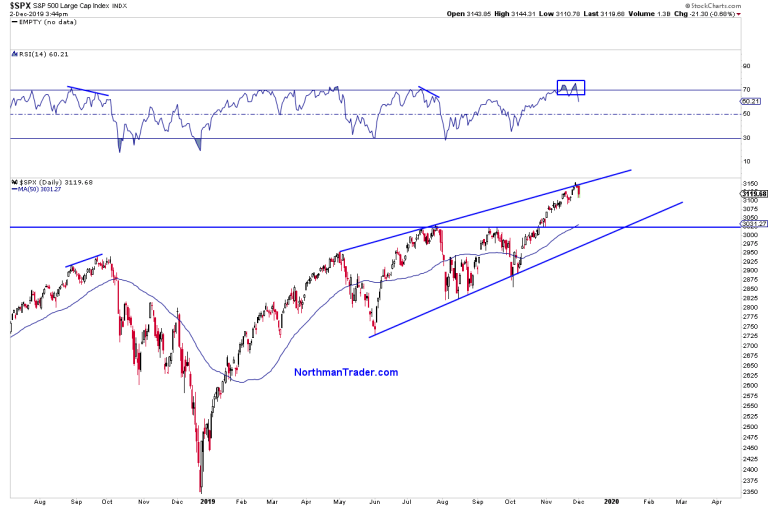

On the short time frame $SPX has formed a new channel in recent months and it rejected today as well:

Note $SPX hit its highest RSI readings in 2019 on the recent rally hence it became very much overbought. As long as this channel remains intact the game can continue and there are plenty support levels below on a proper technical retrace, think the 50MA, thing the July highs, think the lower trend line. All of these could offer support for coming rallies.

All we can say for certain now is that $ES reached a massively important confluence area and so has the larger market.

Tops are only known in hindsight and we are far from confirming anything here, but at least we know where we are relatively to several key trends. And for today at least all of these trends have asserted themselves in form of resistance and if they prove meaningful it may be game over for this liquidity soaked bull run.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Mon, 12/02/2019 – 17:49

via ZeroHedge News https://ift.tt/2sE2pZj Tyler Durden