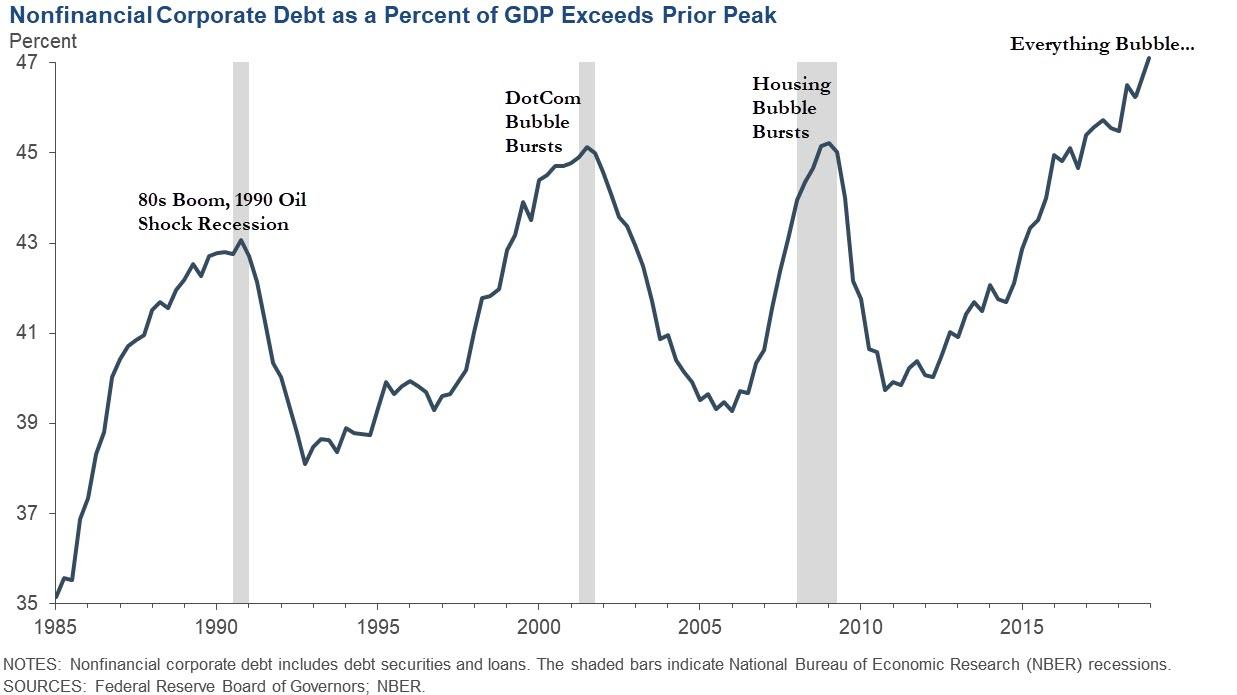

47% Of GDP – This Is Definitely The Scariest Corporate Debt Bubble In U.S. History

Authored by Michael Snyder via TheMostImportantNews.com,

We are facing a corporate debt bomb that is far, far greater than what we faced in 2008, and we are being warned that this “unexploded bomb” will “amplify everything” once the financial system starts melting down.

Thanks to exceedingly low interest rates, over the last decade U.S. corporations have been able to go on the greatest corporate debt binge in history. It has been a tremendous “boom”, but it has also set the stage for a tremendous “bust”. Large corporations all over the country are now really struggling to deal with their colossal debt burdens, and defaults on the riskiest class of corporate debt are on pace to hit their highest level since 2008. Everyone can see that a major corporate debt disaster is looming, but nobody seems to know how to stop it.

At this point, companies listed on our stock exchanges have accumulated a total of almost 10 trillion dollars of debt. That is equivalent to approximately 47 percent of U.S. GDP…

A decade of historically low interest rates has allowed companies to sell record amounts of bonds to investors, sending total U.S. corporate debt to nearly $10 trillion, or a record 47% of the overall economy.

In recent weeks, the Federal Reserve, the International Monetary Fund and major institutional investors such as BlackRock and American Funds all have sounded the alarm about the mounting corporate obligations.

We have never witnessed a corporate debt crisis of this magnitude.

Corporate debt is up a whopping 52 percent since 2008, and this bubble is continually growing.

And actually the 10 trillion dollar figure is the most conservative number out there. Because if you add in all other forms of corporate debt, the grand total comes to 15.5 trillion dollars. The following comes from Forbes…

Total corporate debt is actually much higher. Adding the debt of small medium sized enterprises, family businesses, and other business which are not listed in stock exchanges ads another $5.5 trillion. In other words, total US corporate debt is $15.5 trillion, 74% of US GDP.

Needless to say, this mountain of corporate debt is definitely not sustainable, and I have already noted that defaults are rising. One expert recently explained that all of this debt is “an exploded bomb” and that at some point something will come along to “trigger the explosion”…

“We are sitting on the top of an unexploded bomb, and we really don’t know what will trigger the explosion,” said Emre Tiftik, a debt specialist at the Institute of International Finance, an industry association.

Right now a lot of large corporations are so maxed out that they can barely service their debts. So when things start getting really bad for the economy, we could be facing a wave of defaults unlike anything we have ever seen before.

When asked about what this will mean during the next recession, a finance professor at the University of Pennsylvania warned that it will “make everything happen faster, larger, worse”…

“It’s going to amplify everything,” said Krista Schwarz, a finance professor at the University of Pennsylvania’s Wharton School. “It’s going to make everything happen faster, larger, worse. The recession would just be that much deeper.”

It sounds like she could be a writer for The Economic Collapse Blog.

Of course I am being a bit silly, but the truth is that there is nothing silly about the giant mountain of debt that our society is facing.

In addition to our looming corporate debt crisis, U.S. consumers are 14 trillion dollars in debt, state and local government debt levels are at record highs, and the U.S. national debt just hit the 23 trillion dollar mark.

If you can believe it, we have actually added another 1.3 trillion dollars to the national debt just since last Thanksgiving…

The federal debt has increased by $1,303,466.578.471.45 since last Thanksgiving, according to data released by the U.S. Treasury.

That is the largest Thanksgiving-to-Thanksgiving increase in the debt in nine years. The last time the debt increased more from Thanksgiving to Thanksgiving was in 2010, when it increased by $1,785,995,360,978.10.

It also equals approximately $10,137.48 per household in the United States.

Adding 1.3 trillion dollars to the national debt in 12 months while things are still relatively stable is utter insanity, and what we are doing to future generations of Americans is beyond criminal.

And we aren’t even spending the money well. In fact, Senator Rand Paul continues to document how we are wasting money in some of the most ridiculous ways imaginable…

Sen. Rand Paul is continuing to expose the rampant waste of tax dollars by our government agencies. In a special Fall edition of his Waste Report, the Kentucky senator highlights some of the most wasteful expenditures of our federal government, including a half-a-million-dollar toilet nobody could use and a $22 million project to bring Serbian cheeses up to international standards.

“Once again, The Waste Report takes a closer look at just some of what the federal government is doing with the American people’s hard-earned money, this time including stories of it continuing to turn over so many taxpayer dollars to the Washington Metropolitan Area Transit Authority, funding research that involves hooking Zebrafish on nicotine, buying textbooks for Afghan students that are subpar or sitting in warehouses, and more in a list that totals over $230 million,” states a press release from Sen. Paul’s office.

Of course it isn’t just the United States that is drowning under an ocean of red ink. As Bloomberg has detailed, when you total up all forms of debt in the world it comes to a grand total of 250 trillion dollars…

Zombie companies in China. Crippling student bills in America. Sky-high mortgages in Australia. Another default scare in Argentina.

A decade of easy money has left the world with a record $250 trillion of government, corporate and household debt. That’s almost three times global economic output and equates to about $32,500 for every man, woman and child on earth.

So if you have a household of four, your share comes to $130,000.

Are you ready to pay up?

In the end, all of this debt will never be paid off. Instead, the bubble will just keep ballooning until it inevitably bursts.

And when it finally bursts, many are warning of a complete and total meltdown. In fact, Rick Ackerman believes that “a Mad Max scenario” is likely…

Ackerman contends, “I am a little more bearish than that. I see a Mad Max scenario as inevitable. . . . I try not to think about it because we’ve all got lives to live and kids to raise. . . . When you go back to the calculous of deflation and that every penny of every debt must be paid, if not by the borrower then by the lender, we have already put ourselves into a condition where Social Security is going to fail. Medicare is going to fail. All the ‘just-in-time’ deliveries are going to be in jeopardy. Food from the grocery stores, one day shipping from Amazon, I don’t see how all these things can continue to operate in a condition other than in the false prosperity that we have now. We are at the pinnacle of affluence.”

I haven’t been able to find anyone that can logically argue that the road that we are currently on has a positive ending.

The truth is that we are headed for complete and total disaster, and the only real debate is about how long it will take for us to get there.

So enjoy these moments of relative stability while you still can, because it is only a matter of time before we go over the precipice.

Tyler Durden

Mon, 12/02/2019 – 20:25

via ZeroHedge News https://ift.tt/380O75h Tyler Durden