Hong Kong Retail Sales Suffer “Very Enormous” Crash As Tourism Collapses

Hong Kong’s retail industry crashed again in October, as the city spirals lower into a recession that could lead to a collapse of the economy, reported Reuters.

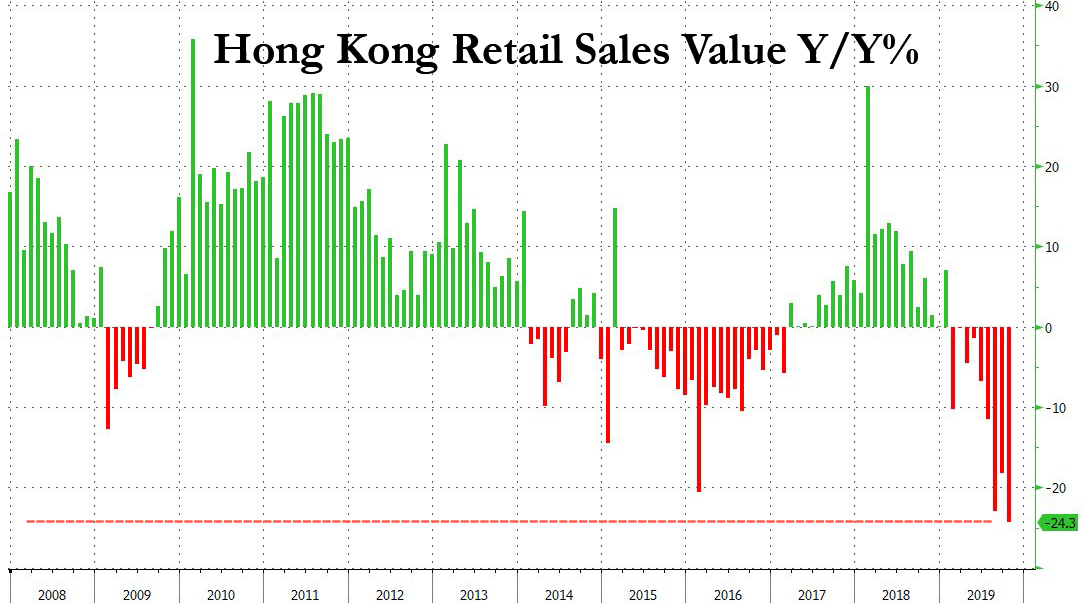

Retail sales in October plunged 24.3% YoY, according to government data published on Monday. This was by far the worst print on record as the tourism industry in the last six months has evaporated.

Retail sales fell to $3.85 billion in October, a ninth consecutive month of declines, following violent clashes between pro-democracy protesters and police around shopping districts, malls, and eateries. Many Mainlanders now view Hong Kong as far too dangerous for travel, one of the main reasons why the retail industry has tanked.

“The local social incidents with increasing violence depressed consumption sentiment and severely disrupted tourism- and consumption-related activities,” a government spokesman said.

Financial Secretary Paul Chan Mo-po said retail sales decline will continue to be “very enormous” heading into the new year.

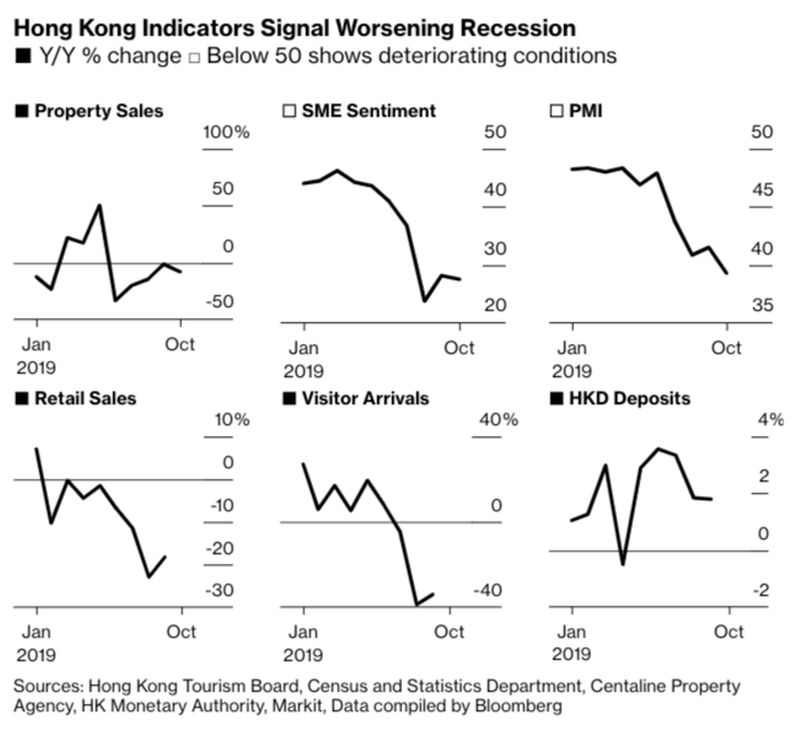

Last month, it was confirmed that Hong Kong stumbled into a recession for the first time in a decade in 3Q.

More than six months of protests and nearly 17 months of a trade war between the US and China dampened economic activity in the city.

With no end in sight to neither the protests and trade war, Hong Kong’s economy is expected to continue decelerating through 1Q20, will likely face a deeper slump than what was seen in the 2008 financial crisis.

“Domestic demand worsened significantly in the third quarter, as the local social incidents took a heavy toll on consumption-related activities and subdued economic prospects weighed on consumption and investment sentiment,” the government said last month.

GDP data was revised lower for full-year growth to -1.3%. That marked the first annual decline since 2009.

Chinese Mainlanders and tourists from across the world have canceled bookings, as retailers have been severely damaged from crashing sales, and the stock market continues to trend lower, which has been compounded by the ongoing trade war between the US and China.

Tourism numbers for October arrivals plunged 43.7% YoY to 3.31 million, according to the Hong Kong Tourism Board. September figures showed a 34.2% drop.

We’ve noted that luxury retailers have been hit the hardest, also putting pressure on the global diamond industry.

The Hong Kong Retail Management Association has told landlords to halve rents for retailers as the city’s economy is expected to plunge through 2020.

The government has deployed stimulus measures since August, but monetary policy is widely ineffective when social-economic chaos continues to gain momentum.

The outlook for 2020 could be absolutely disastrous for retailers in the city, there’s the chance that if the retail industry remains depressed, then a massive wave of store closures could nearing. This would also trigger enormous job losses and feed through the system, likely tilting the economy into a depression.

Imagine that, and it only took six months of violent protests in Hong Kong to trigger economic disaster. Now the real question remains, what are the global implications to the financial system of an imploding Hong Kong?

Tyler Durden

Mon, 12/02/2019 – 22:05

via ZeroHedge News https://ift.tt/2RcYGw3 Tyler Durden