“Inherently Unstable” US Pension System Will Require Federal Bailout, Former Illinois Pension Chief Says

Like Ray Dalio advised during a recent appearance with Paul Tudor Jones, it’s not the growing national debt that Americans need to worry about, so much as the liabilities that don’t appear in the federal budget.

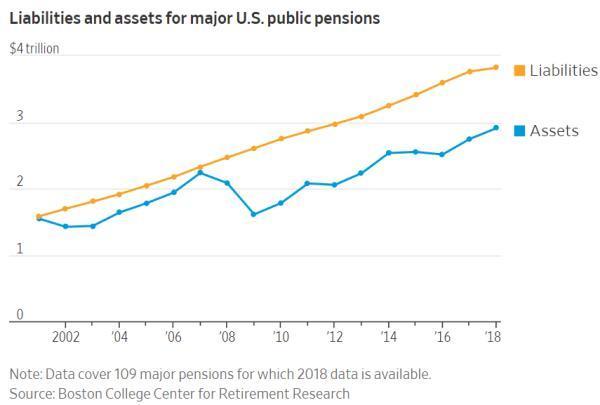

And a lot of those liabilities are centered around America’s crumbling pension system. According to some data providers, American public pensions are suffering from a trillion-dollar gap between their liabilities and assets.

Some pension managers have tried to combat this by firing expensive managers and allocating more money to low-cost passive strategies. Marc Levine, the former chairman of the Illinois Board of Investment, is known in the industry for firing hedge funds and other expensive active managers who were “destroying value” with their enormous fees. Levine said he still stands by the strategy that he embraced during his four years of running the Illinois Pension. Levine said he found soon after taking over that the state pension fund’s benchmarks for its hedge fund investments was a joke – it was an average of hedge fund performance. This prompted Levine to change it up and compare the actively managed hedge funds to index funds, and soon discovered that the hedge funds were extremely overpriced.

After offering viewers a handful of suggestions for passive funds that he would recommend for trying to track the broader US market.

Levine warned his audience that market timing rarely works, and if investors are saving for the long-term, they shouldn’t hesitate to invest now, before transitioning into a discussion of the endemic problems of state public-employee pensions funds.

Once you get these defined-benefit pensions rolling, Levine said, they’re “inherently unstable” and they end up hoovering up taxpayer money with their generous benefits.

“I think the federal government is going to have to do something about this because, basically, the potholes need to get fixed the traffic lights need to work. I think ultimately there will be some kind of grand bargain where they freeze benefits in exchange for federal money in some kind of grand bargain. Is that going to happen in the next couple of years, no, but in the next decade? I suspect it will.”

“Like a bailout?” asked MarketBrief’s Caroline Woods.

“Exactly,” Levine replied. “But I don’t worry the most about that because those are very rich benefits. Those beneficiaries are making more in retirement than they made while they worked.”

The real retirement crisis, Levine said, is the lack of retirement savings for all Americans (something that’s only going to get worse as time moves on).

The discussion of America’s pension crisis starts at around the 5-minute mark:

Tyler Durden

Tue, 12/03/2019 – 17:05

via ZeroHedge News https://ift.tt/2Riej5w Tyler Durden