Mystery S&P Put Buyer Makes $31 Million Profit In 24 Hours, Covers Half Of Position

Yesterday we reported that a mystery trader, who was expecting a sharp drop in the market over the next 6 weeks, bought 16,000 January 2,980 S&P puts, spending $32 million to protect against a 4.5% drop in the index at 9:44am on Monday morning, about 15 minutes before the latest dismal Manufacturing ISM sent stocks tumbling.

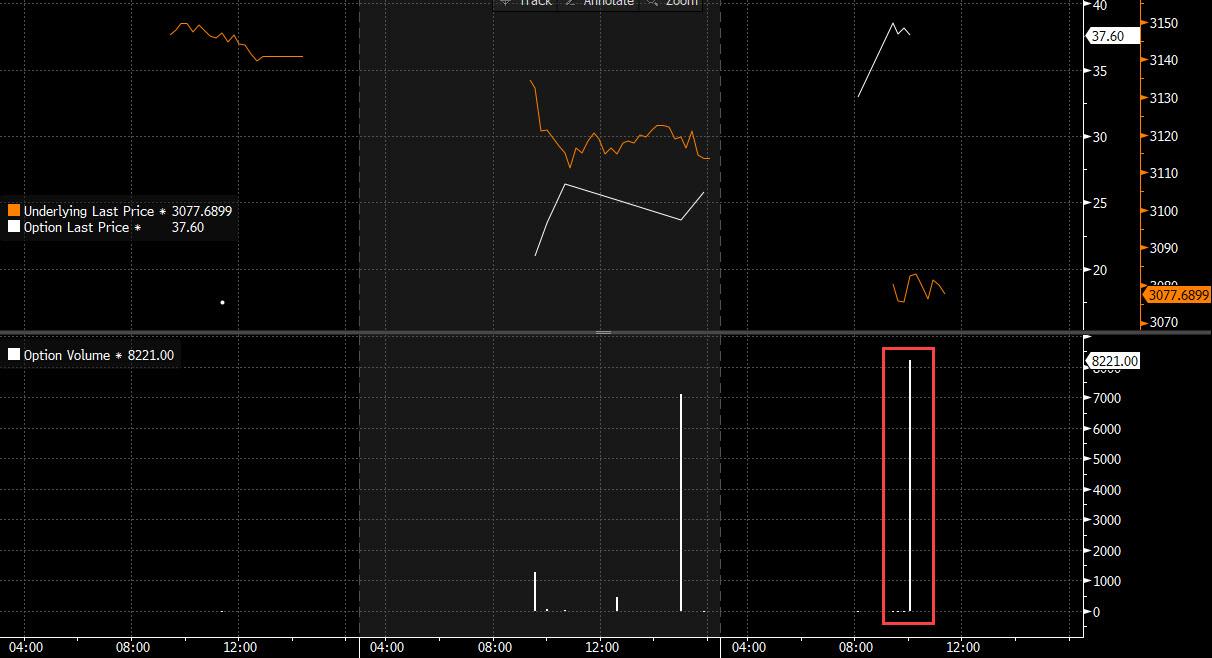

One day later, that specific put is once again one of the most active ones, and it now appears that the same put buyer is back, only this time he is covering about half of his position, selling 8,221 puts.

Today’s trade took place at $37.60, which means yesterday’s trader who bought his original batch of 16,000 puts at $19.80, has basically doubled his money…

… and in what is probably a smart move, he has covered half his original position, making a $30.9 million profit on the 8,221 puts sold, as his original $32 million position rose in value to $60.2 million.

It also means that he now has what is effectively a free, costless hedge, protecting him from any major market selloff.

Tyler Durden

Tue, 12/03/2019 – 12:11

via ZeroHedge News https://ift.tt/2Ya134c Tyler Durden