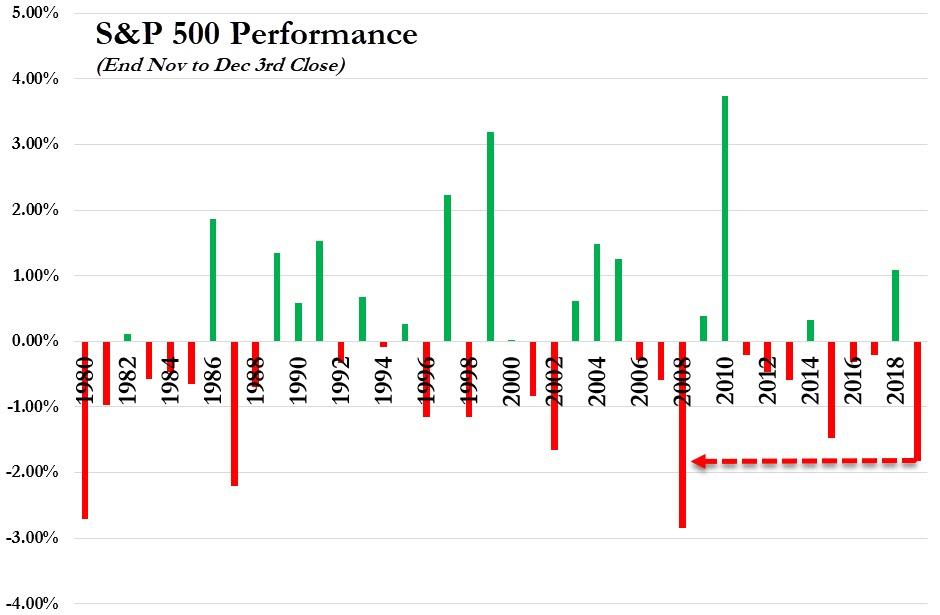

Tariff-Tantrum Sparks Worst Start To December For S&P Since 2008

Trump’s trade-deal-related comments, combined with Pence and Ross confirmations that Dec 15th tariffs are still on the table unless a deal is struck imminently, sent the market’s expectations for a trade deal tumbling….

Source: Bloomberg

Sparking the worst start to December since 2008…

Source: Bloomberg

As US equities caught down to bond-land’s all-knowing levels…

Source: Bloomberg

Dow Transports are suffering most since the start of December (and Small Caps are relative outperformers, but still down hard)…

Source: Bloomberg

Trannies briefly broke below their 200DMA…

Notably, today’s bounce took the S&P futs back to VWAP (and tried to get back to the critical 3100 gamma level, after bouncing off the 3070/75 gamma-flip level)…

Source: Bloomberg

Cyclicals were monkeyhammered today…

Source: Bloomberg

European markets slid as Trump raises the threat of tariffs of EU exports…

Source: Bloomberg

VIX spiked to 17.99 intraday before fading back (and the short-end term structure inverted briefly intraday)…

Source: Bloomberg

Are stocks getting ready to catch down to credit?

Source: Bloomberg

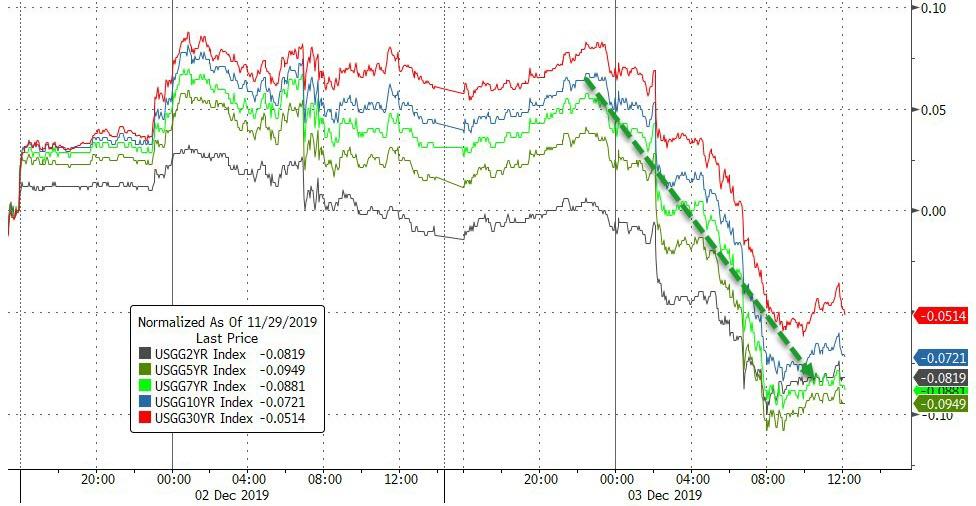

Treasury yields plunged today (biggest daily drop since mid-August)…

Source: Bloomberg

With 30Y Yields tumbling to their lowest since early October

Source: Bloomberg

And the yield curve flattened dramatically (most since early August)…

Source: Bloomberg

The Dollar dived again to its lowest in a month…

Source: Bloomberg

And offshore yuan suffered its biggest drop in 2 months to 7 week lows…

Source: Bloomberg

Cryptos dumped and pumped intraday but remain lower on the week…

Source: Bloomberg

Gold and Silver soared intraday and copper was clubbed like a baby seal…

Source: Bloomberg

WTI ended higher on OPEC production extension hopes…

Source: Bloomberg

Silver surged higher (best day in 2 months)…

And gold rallied back to a key resistance level (best day on over a month)…

Finally, this seemed appropriate…

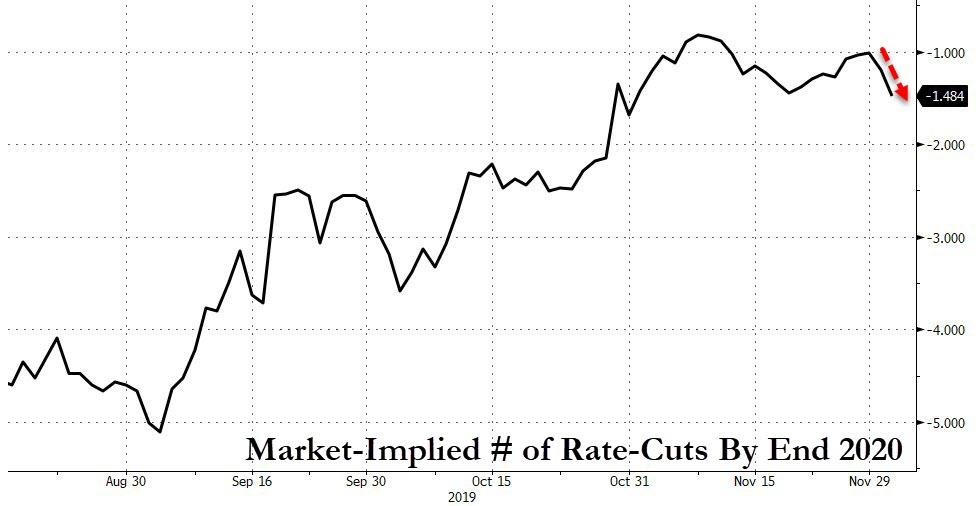

Of course, one wonders if Trump’s delay comments might be a way to force The Fed back to its Dovish ways – and the market has added half a rate-cut to expectations in the last two days….

Source: Bloomberg

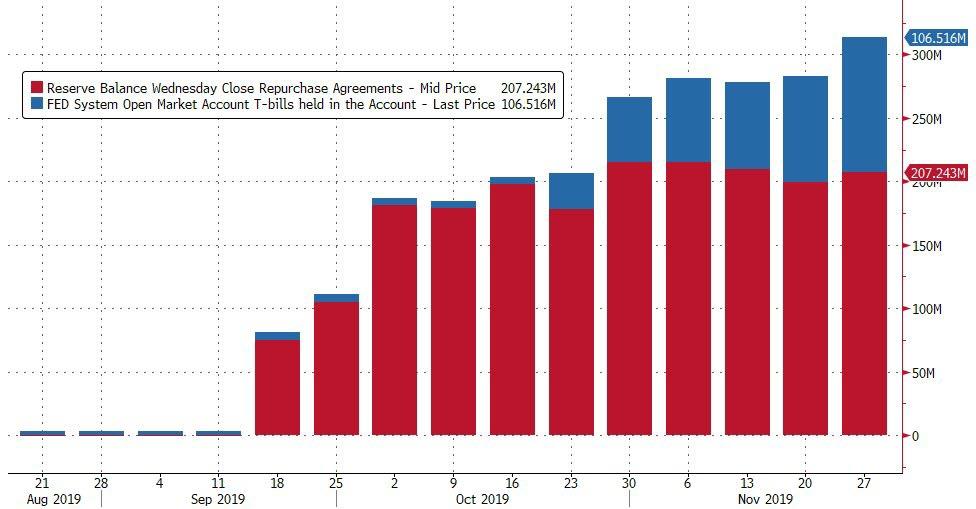

And the real QE4 continues to placate the repo markets – for now…

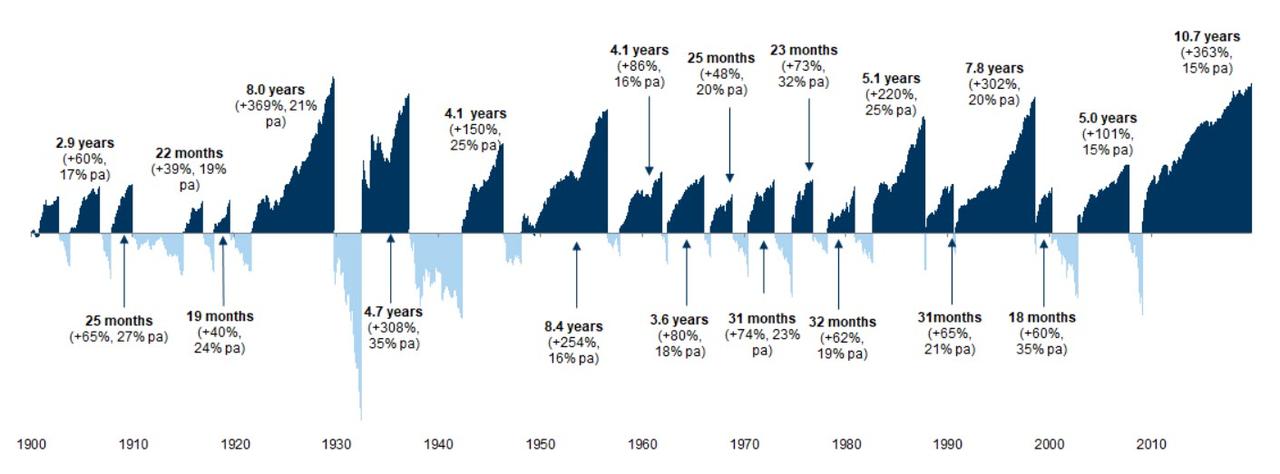

And don’t forget this is, by far, the longest bull market without a 20% correction in history…

Source: Goldman Sachs

Tyler Durden

Tue, 12/03/2019 – 16:01

via ZeroHedge News https://ift.tt/34NZN9j Tyler Durden