Trump Torpedoes Global Markets As Trade War Returns

Last week, when Trump signed the Hong Kong bill, we asked if Trump was willing to reignite the trade war now that the S&P hit an all time high of 3,150.

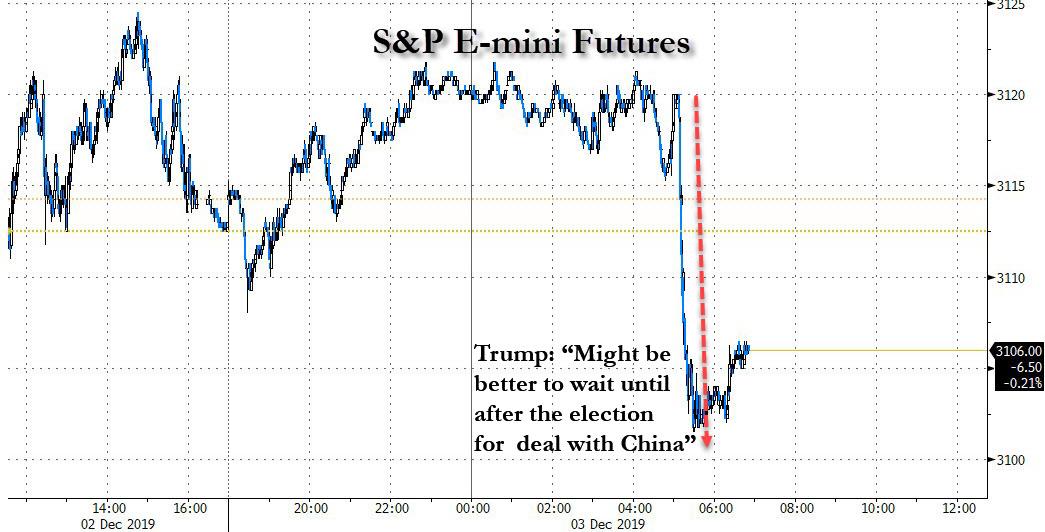

That question was especially apt this morning, when European shares slumped back into the red on Tuesday, reversing an earlier attempt to claw their way back from three days of falls, US equity futures tumbled for the second day in a row and the Chinese yuan sank on renewed trade tensions after President Trump said at the start of his British NATO summit visit that a that a trade deal with China might be delayed until after November 2020 elections, denting hopes of a quick resolution to a dispute that has weighed on the world economy.

“I have no deadline, no. In some ways, I think I think it’s better to wait until after the election with China,” Trump told reporters in London, where he was due to attend a meeting of NATO leaders. “In some ways, I like the idea of waiting until after the election for the China deal. But they want to make a deal now, and we’ll see whether or not the deal’s going to be right; it’s got to be right.”

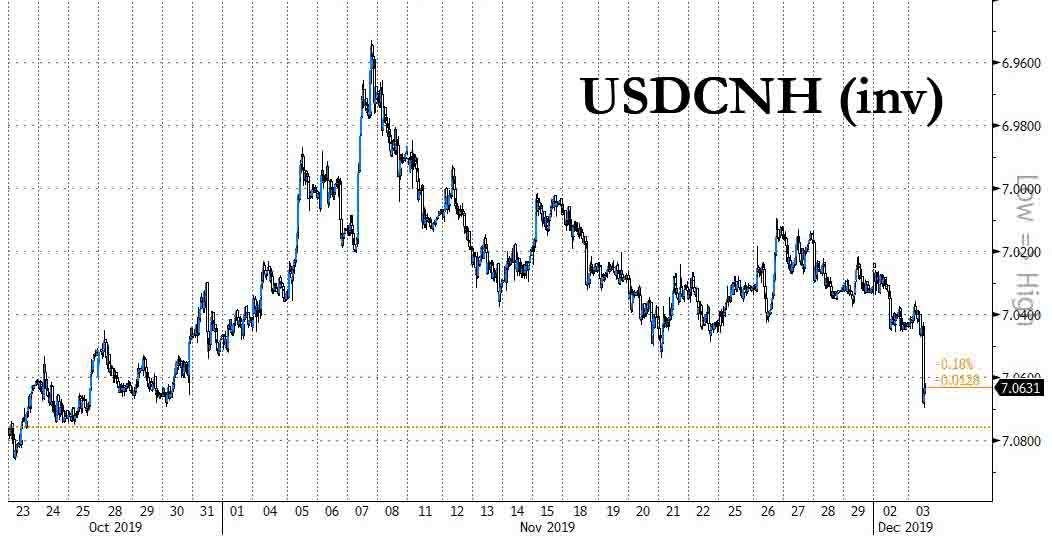

Those comments, made as Trump landed in Britain for a NATO summit, also sent the offshore-traded Chinese yuan to near five-week lows.

France, the latest U.S. trade war target, saw shares tumble more than 0.6% to a one-month low, and dragged Europe’s Stoxx 600 index down 0.2%, giving up earlier modest gains and extending Monday’s 1.6% tumble which was its biggest one-day loss in two months.

U.S. stock futures also turned negative, with S&P 500 futures down 0.4%.

“The markets were spooked because they didn’t expect Trump to be that severe on China,” said WisdomTree researcher Aneeka Gupta. “It’s worrying for Europe too, because it was waiting for a decision on the auto tariffs from the U.S. Investors weren’t expecting Trump to be launching trade wars on all fronts.”

Trump’s willingness to open new fronts in the trade war – with Argentina, Brazil and France – despite signs of economic damage and less than two weeks away from the China tariff deadline, spooked markets. Indeed, his latest comments dashed hopes that an agreement with China could be reached before another round of tariff hikes kicks in on Dec. 15, and suggests talks could in fact could drag on for another year.

As Reuters notes, markets had fallen sharply on Monday after Trump tweeted he would slap tariffs on Brazil and Argentina for what he saw as both countries’ “massive devaluation of their currencies.” The United States then threatened duties of up to 100% on French goods from champagne to handbags because of a digital services tax that Washington says harms U.S. tech companies.

“Each step back and each step forward is just part of a slow trend toward increased barriers to international trade,” said Jonathan Bell, CIO of Stanhope Capital. “The market’s taken an optimistic view so far this year on the likelihood of a successful outcome to trade negotiations and we worry … the market may turn back to being more concerned.”

Shares in some French luxury goods firms had been hit hard, with LVMH shedding almost 2% to one-month lows and champagne maker Vranken Pommery down 0.5%. “If history is any guide the Europeans are likely to find U.S. crosshairs start to move increasingly their way, the closer to next year’s U.S. election we get,” CMC Markets told clients.

As a result, the MSCI world equity index was down for the fourth day in a row to one-week lows. There were also hefty losses across Asian bourses earlier in the day, led by consumer staples firms, tracking U.S. declines. Most markets in the region were down, with Australia leading losses and China advancing. Japan’s Topix slid, dragged down railway companies and automakers. The Shanghai Composite Index reversed morning losses to close higher, as Ping An Insurance Group and Will Semiconductor offered support. Two Chinese companies failed to repay bonds worth a combined half a billion dollars Monday, as debt risks rose in a slowing economy. India’s Sensex declined, with ICICI Bank and HDFC Bank among the biggest drags.

Meanwhile, investors were waiting for even more shoes to drop and China’s next response: Beijing has already barred U.S. military ships and aircraft from Hong Kong in response to U.S. support for pro-democracy protesters in the Chinese-ruled territory. Fears that the prolonged tariff spat will snuff out any upturn in global growth were fanned on Monday when the U.S. ISM report said manufacturing had contracted for a fourth straight month as new orders slid. That crippled the cheer from upbeat Chinese factory surveys as well as higher-than-expected manufacturing and inflation readings from the euro zone.

So with trade suddenly in limbo, hopes are now being pinned on the U.S. consumer to keep the economy afloat. Cyber Monday sales were expected to hit a record following $11.6 billion in online sales during the Thanksgiving and Black Friday shopping bonanza.

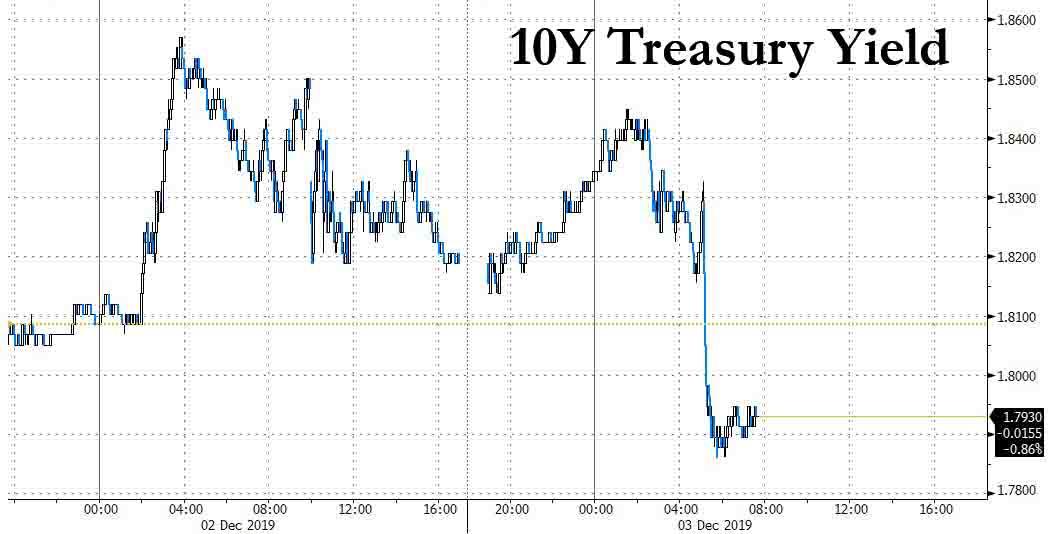

In rates, Trump’s hints of trade deal delays sent bond yields tumbling as investors dumped stocks, however, with 10-year U.S. Treasury yields falling 5 basis points to 1.79% from the previous day’s two-week high, despite a sharp selloff in Japanese bonds following a report that Tokyo is preparing a 25 trillion yen fiscal package, which in turn resulted in the worst bid to cover in the Japanese 10Y auction in three years.

German bond yields slipped off three-week highs but bond prices are likely to stay under pressure amid renewed risks of early elections or a minority government in the biggest euro zone economy.

The safe-haven bid was seen across FX too, with the yen at a one-week high to the dollar. The euro edged away from a near two-week peak versus the greenback, while the dollar reversed losses after Trump’s statement. “This may have run its course, but there’s no reason to chase the dollar’s upside from here,” Daiwa Securities’ foreign exchange strategist Yukio Ishizuki said, noting that the weak manufacturing data had forced many to cut long dollar positions. “Trade friction remains a lingering threat, which is not good for market sentiment.”

Elsewhere, oil fluctuated as traders gauge the probability of OPEC and allied producers tightening supplies when they meet later this week. Australia’s dollar rose after upbeat comments on the global economy by its central bank, while its government bonds dropped.

Looking at the day ahead in the US, the only data due out are the November vehicle sales numbers. Away from the data, we’re due to hear from the ECB’s Coeure and Hernandez de Cos. Elsewhere the NATO conference kicks off in London. Salesforce and Workday are among companies reporting earnings.

Market Snapshot

- S&P 500 futures down 0.3% to 3,103.50

- STOXX Europe 600 up 0.4% to 402.40

- MXAP down 0.4% to 164.17

- MXAPJ down 0.4% to 522.79

- Nikkei down 0.6% to 23,379.81

- Topix down 0.5% to 1,706.73

- Hang Seng Index down 0.2% to 26,391.30

- Shanghai Composite up 0.3% to 2,884.70

- Sensex down 0.3% to 40,676.21

- Australia S&P/ASX 200 down 2.2% to 6,712.29

- Kospi down 0.4% to 2,084.07

- German 10Y yield fell 0.4 bps to -0.285%

- Euro down 0.01% to $1.1078

- Italian 10Y yield rose 11.7 bps to 1.002%

- Spanish 10Y yield fell 0.9 bps to 0.481%

- Brent futures little changed at $60.96/bbl

- Gold spot up 0.6% to $1,470.47

- U.S. Dollar Index little changed at 97.78

Top Overnight News from Bloomberg

- ECB officials face increasing pushback against their negative interest-rate policy in private engagements with the region’s finance ministers, according to people with knowledge of the matter

- Pacific Investment Management Co. has become the latest high-profile critic of negative interest rates, warning that one of the key central-bank tools in economically beleaguered Europe and Japan may do more harm than good

- The ECB’s shift in net asset purchases to corporate bonds may become a more lasting and self- fulfilling feature of this QE leg, as it expands the shopping list while encouraging new issuance

- France’s government said the EU would retaliate if the U.S. follows through on a threat to hit about $2.4 billion of French products with tariffs over a dispute concerning how large tech companies are taxed

- At a summit in Brussels next week, EU leaders will commit to cutting net greenhouse-gas emissions to zero by 2050, according to a draft of their joint statement for the Dec. 12-13 meeting. To meet this target, the EU will promise more green investment and adjust all of its policy making accordingly

- After five years of negative rates imposed by the ECB, German lenders are breaking the last taboo: Charging retail clients for their savings starting with very first euro in the their accounts

- The Bank of Thailand said measures taken so far to curb capital inflows are “baby steps” and policy makers have plenty of tools available to deploy to curb the currency’s strength

Asian equity markets retreated amid headwinds from the US where the major indices all but wiped out last week’s gains due to fresh trade concerns with lacklustre ISM Manufacturing data also adding to downbeat tone. ASX 200 (-2.2%) and Nikkei 225 (-0.6%) were lower with underperformance in Australia due to hefty losses across its sectors including financials amid continued Westpac-related woes and with life insurers facing increased capital penalties, while sentiment in Tokyo was dragged by the adverse currency flows. Hang Seng (-0.2%) and Shanghai Comp. (+0.3%) also weakened on the trade uncertainty (although the latter pared losses heading into the close) with some analysts reading in between the lines of the metal tariff resumption on Brazil and Argentina, suggesting that it could be another front in the trade war following the nations’ recent agricultural deals with China. In addition, China’s retaliation to the Hong Kong bill by sanctioning US non-profit groups and barring US military visits to Hong Kong, as well as expectations for the US House to pass a Xinjiang-related bill further exacerbated the already-opaque trade environment. Finally, 10yr JGBs failed to take advantage of the widespread risk averse tone, as prices remained dejected following the recent bond rout and with selling also triggered after the 10yr JGB auction showed weaker results across all metric including the lowest b/c since August 2016.

Top Asian News

- Japan’s GPIF Stops Lending Shares in Blow to Short Sellers

- Dalio Out of Favor at Asia Wealth Manager as Flagship Fund Falls

- Hong Kong Economist Says His Views on China Cost Him His Job

- Nomura Sets Ambitious China Hiring Plans as Rebound Persists

Major European bourses (Euro Stoxx 50 Unch) are mixed, having reversed earlier gains US President Trump said that there was no deadline on a China deal, and that it may be better to wait until after the November 2020 Presidential Election to strike a deal. Elsewhere, some underperformance is being seen in the FTSE 100 on unfavourable currency effects, while the CAC 40 is being weighed by under performance in some of its heavy weight luxury names, Kering (-1.4%), LVMH (-1.4%) and Hermes (-1.9%), on US/EU trade concerns after the US responded to France’s digital sales tax.Meanwhile, sectors are mostly in the red, apart from Utilities (+0.4%), Tech (+0.5%) and Healthcare (+0.1%). In terms of individual movers of note; easyJet (-0.5%) shares were initially higher on the news that the Co. is set to return to the FTSE 100 and will replace Hiscox (-1.3%), although gains have since reversed. Elsewhere, Telenor (+1.2%) was buoyed by an upgrade at Citigroup. Laggards include Aston Martin (-5.5%), who sunk after being downgraded to neutral from buy at Goldman Sachs.

Top European News

- German Banks Open Floodgates to Negative Rates for all Savers

- ECB Sub-Zero Rate Policy Faces Pushback From Finance Ministers

- Italy’s Agnellis Add La Repubblica Publisher to Media Assets

In FX, both outperforming in the G10 FX sphere, more-so the Aussie in the aftermath of the RBA’s latest monetary policy meeting in which the Cash Rate was left unchanged. Key themes in the statement were largely a copy-and-paste job from recent meetings which repeated the gentle turning point in the economy but reaffirmed data dependency and the readiness to inject further stimulus if needed. However, desks note of a slightly more positive tone in the statement which linked rising house prices to a potential lift in spending and residential construction. AUD/USD extends its gains above the 0.6800 level and surpassed its 100 and 21 DMA (at 0.6818 and 0.6820 respectively) to a current high of 0.6860 (vs. low of 0.6815) with clean air until the psychological 0.6900 mark. The Kiwi piggybacks on its antipodean partner’s gains and covers more ground above the recently claimed 0.6500 level vs. the USD to a high of 0.6530 ahead of its 200 DMA at 0.6544.

- GBP, EUR – Sterling rose in the G10 ranks in early European hours after the retrieval of 1.2950+ status vs the Dollar spurred upside momentum (amid potential stops/orders), and with tailwinds from the latest election Kantar poll (showing a widening gap between Tories and Labour) underpinning the currency in recent trade. Cable rose to a current high of 1.2994 after eclipsing its Nov 18th high (1.2985) with eyes remaining on election developments as election day looms. Meanwhile, the Single Currency held onto most of its gains vs. the Buck despite France’s growing trade tension with the US which prompted the latter to propose duties of up to 100% on certain French imports. EUR/USD meanders around the middle of a tight 1.1072-1.1086 intraday band, ahead of potential resistance at 1.1097 (Nov 21st high), with little impetus derived from ECB Board nominees and sources reports of pushback on the ECB’s NIRP by EZ finance ministers.

- DXY, JPY, CNH – The broad Dollar and Index resumes their downward trajectories following yesterday’s dismal manufacturing prints and with little by way of fresh fundamental catalysts. DXY hovers around the bottom of today’s current 97.74-94 range with little on the today’s docket in terms of tier 1 data. Meanwhile, USD/JPY convincingly fell below the 109.00 mark (to a low of 108.84 vs. high 109.20) after US President Trump signalled no rush for a US-Sino trade deal. USD/JPY also sees hefty options of around USD 1bln expiring between strikes 109.00-10 and a further USD 1bln at 109.50. Subsequently, USD/CNH was bolstered to fresh session highs of 7.0690 (vs. low of 7.0360) in light of Trump’s comments on trade.

- EM – The EM space trades mostly on the backfoot with the Rand underperforming as South Africa’s economy contracted on a QQ basis, missing expectations for modest growth. USD/ZAR took out its 200 DMA to the upside (14.5772) to a high of 14.6900 with little seen by way of resistance ahead of 14.7000. Meanwhile, the Lira recovered from initial loses which emanated from US senators urging Secretary of State Pompeo to sanction Turkey over its purchase and testing of the Russian-made S-400 system. The TRY has since pared back a bulk of its losses as President Trump continues to support Turkey.

In commodities, crude markets are flat/higher and off best levels, as risk assets take a hit following the latest US President Trump’s trade comments. However, price action remains well within yesterday’s ranges; technicians will be eyeing resistance at the USD 56.65/bbl and USD 62.10/bbl levels and support at the USD 55.65/bbl and USD 60.78/bbl levels for WTI Jan’ 20 and Brent Feb’ 19 futures (yesterday evening’s trading range). Crude specific news flow has been light; Russian Energy Minister Novak said that Russia is yet to finalise their position for OPEC+ meeting in Vienna, which takes place at the end of the week. Amid rumours that OPEC+ are considering up to an additional 400k bpd in production cuts, the Russians are known to have been resistant to further cuts, instead preferring an extension of existing cuts until mid-2020. In terms of the metals, gold gained as risk soured, with the yellow metal briefly advancing above USD 1,470/oz from overnight lows of USD 1,460/oz. Meanwhile, trade concerns are hitting copper; the red metal has slumped from overnight highs of USD 2.6550/lbs to near USD 2.6300/lbs lows. , Iron Ore prices gained overnight after its largest miner, Vale, lowered its production outlook. On Monday, the miner said that it would cut output from it Brucutu mine in Brazil for up to two months while the stability of the nearby Laranjeiras dam in assessed.

US Event Calendar

- Wards Total Vehicle Sales, est. 16.9m, prior 16.6m

DB’s Jim Reid concludes the overnight wrap

In the last 24 hours we’ve gone from a potential Santa Claus rally to a more Scrooge-like environment as the ghost of trade wars past came back to haunt the market. Indeed sentiment took a hit following President Trump’s tweet that tariffs would be reinstated on steel and aluminium from Argentina and Brazil and then on Commerce Secretary Ross telling Fox that President Trump will increase tariffs on China if nothing happens between now and December 15th. That undid some of the good work from the majority of global PMIs released earlier in the day. However, a weaker US ISM manufacturing print did bring in an element of doubt and confusion to the picture.

More on the data shortly but first off President Trump’s tweet that “Brazil and Argentina have been presiding over a massive devaluation of their currencies which is not good for our farmers” and that “effective immediately, I will restore the tariffs on all steel and aluminium that is shipped into the US from those countries”. The President followed with the Fed “should likewise act so that countries, of which there are many, no longer take advantage of our strong dollar by further devaluing their currencies”.

The implications of President Trump’s tweet is important less for the direct economic impact and more because it shows the current state of President Trump’s thinking on tariffs, and thus the read-through to China. The latter came into play after Ross’ comments with the markets taking another leg down after the headlines hit. These were partially alleviated by subsequent comments from White House advisor Kellyanne Conway, who said that a deal is possible before year-end. So a fair bit resting on the next couple of weeks ahead of the December 15 tariff increase deadline. However, some reports have suggested they could still be suspended even without a deal, as long as productive talks are continuing. Nevertheless, this date is creeping up on us and something has to happen before it one way or another. Later in the day, and separately, the USTR said that it will consider higher tariffs on the EU to compensate for subsidies given to Airbus, citing a WTO ruling, though the dollar amounts under consideration are small.

After all this, the NASDAQ and trade-sensitive semi-conductor indices closed down -1.12% and -1.46%, respectively. The S&P 500 and DOW fared slightly better but still closed down -0.85% and -0.96%, while the VIX climbed to 14.64 and to the highest level since mid-October. European equities fared even worse, with the STOXX 600 ending -1.58%, its worst session since 2nd October. The DAX and CAC were down -2.05% and -2.01%, and the V2X mirrored the VIX by rising +2.72pts to 15.89.

Overnight the Global Times said that the Chinese government will soon publish a list of “unreliable entities” that could lead to sanctions against US companies. China had originally threatened to publish the list in May in response to the restrictions the US placed on Huawei. The timing seems to be linked to an accelerated US House of Representatives vote – expected today – on the Xinjiang bill, which was passed by the Senate in September. This could put sanctions on officials linked to alleged abuses of Uighur Muslims. It remains to be seen whether this will impede the path towards the Phase 1 deal, which according to President Trump yesterday has already been complicated by the signing of Hong Kong bill into law.

Elsewhere, after the US markets closed last night, Bloomberg reported that the US is proposing tariffs on roughly $2.4 bn in French products, in response to a tax on digital revenues that hits large American tech companies including Google, Apple, Facebook and Amazon. The office of the United States Trade Representative said in a statement that “France’s digital services tax discriminates against U.S. companies.” USTR Robert Lighthizer added that the agency is also exploring whether to open investigations into similar digital taxes by Austria, Italy and Turkey before saying that, “the USTR is focused on countering the growing protectionism of EU member states, which unfairly targets US companies.” The tariffs would be imposed after a public comment period concludes in early 2020. As we write this on a cold December morning it doesn’t feel like the global trade problems are going to thaw anytime soon.

A quick refresh of our screens this morning shows that most Asian markets are trading lower with the Nikkei (-0.72%), Hang Seng (-0.18%), Shanghai Comp (-0.04%) and Kospi (-0.43%) all down. However, most indices are off their intraday lows. As for FX, the Australian dollar is up +0.41% this morning after the RBA held its key interest rate unchanged and highlighted that past easing is having an impact. Yield on 10y USTs are up +2.1bps while those on 10y JGBs are up +3.3bps to -0.028% as demand for the benchmark debt fell at an auction. Elsewhere, futures on the S&P are up +0.18%.

In other news, Hong Kong’s Chief Executive Carrie Lam said overnight that the government would soon announce new moves to prop up the city’s flagging economy without giving any details of what those measure would be. She just mentioned that the measures would be “targeted.” Yesterday, Financial Secretary Paul Chan said that he expected the first fiscal year budget deficit since the early 2000s, and said that the turmoil has dragged down economic growth by some 2pp this year. Elsewhere, North Korea reiterated overnight that the US has until the end of the year to make a better offer in nuclear negotiations, saying the “Christmas gift” the US receives will depend on what it brings to the table.

The bond sell-off overnight follows a similar move yesterday where 10y Treasury yields rose +4.5bps. Front-end rates rallied though, possibly pricing in slightly higher odds that the Fed will end up having to cut again next year. Two-year yields fell -1.0bps, taking the yield curve +5.7bps steeper to 21.7bps. Bunds sold off +8.0bps to -0.284% after the shock weekend SPD news (updates below). Other European bond markets followed the German move, with OATs and Gilts +7.8bps and +4.1bps, respectively. BTPs underperformed, with 10-year yields up +11.9bps, as investors de-risked.

Alongside the SPD news, the earlier decent PMIs seemed to kick start the bond sell-off. In terms of the PMIs, after China’s beat, the PMIs in Europe saw the Euro Area manufacturing print revised up 0.3pts to 46.9. That is the second consecutive monthly increase – something that hasn’t happened since 2017, which is a stunning stat – and also to the highest reading since August. Half of the increase came from Germany and France – the former revised up to 44.1 and the latter to 51.7. Also encouraging was the fact that all of the key components – including new orders, new export orders and employment – saw slight upward revisions. The outright level of the PMI is still clearly a concern but it still lends an argument to seeing a stabilisation in the data.

In the afternoon the US manufacturing PMI was revised up 0.4pts to 52.6, which matches the April levels once again. However, to complicate the picture, 15 minutes later the November ISM manufacturing missed at 48.1 (vs. 49.2 expected). You could argue that the data has stabilised somewhat – the reading was only down 0.2pts from 48.1 and remains above the 47.8 low print from September. That being said, the gap to the PMI (and regional fed surveys) is muddying the waters. In addition, the details didn’t add much encouragement with new orders down to 47.2, employment down to 46.6 and new export orders down to 47.9.

Coming back to yesterday where the fallout from the SPD leadership election in Germany played out with German Finance Minister Scholz, despite losing the leadership bid, announcing that he will still attend a meeting of Eurozone finance ministers tomorrow. Our German economists published their thoughts post the election in a note yesterday, which you can find here . In their view, the vote for Walter-Borjans and Esken increased the probability of the Groko falling apart but does not translate into an automatic or immediate collapse of the government coalition. Their baseline view remains that the new party leaders and delegates at the SPD’s December 6-8 party conference will support a (possibly conditional) continuation of the Groko until the 2021 elections and that the SPD will not pull out of Groko immediately. Still, as the CDU/CSU are reluctant to renegotiate the Groko treaty, non-negligible risks of a premature end to the government coalition remain. It must be said that the internal debate within DB continues to be around how much more likely it is that fiscal spending eventually increases as a result of this political shockwave. There is little doubt that the chances have increased but the timing and scale of any policy changes are still up for much debate.

Elsewhere, new ECB President Lagarde testified to the European Parliament for the first time in her new position, but did not reveal any major policy details. She promised that policy will “continue to support the economy and respond to future risks in line with our price stability mandate.” She refused to prejudge the planned policy review, saying that the “direction and timeline” of the process is still to be determined. This tempers any expectations for near-term policy moves by the ECB, including at this month’s meeting. Notably, Lagarde did talk more about “the side effects of our policies,” which has thus far been the biggest departure from Draghi’s rhetoric and likely signals reduced appetite to cut the deposit facility rate deeper into negative territory.

To the day ahead now, which this morning includes Q2 labour costs and the November construction PMI in the UK and October PPI for the Euro Area. In the US the only data due out are the November vehicle sales numbers. Away from the data, we’re due to hear from the ECB’s Coeure and Hernandez de Cos. Elsewhere the NATO conference kicks off in London.

Tyler Durden

Tue, 12/03/2019 – 07:54

via ZeroHedge News https://ift.tt/382ZglS Tyler Durden