WTI Extends Gains After Bigger Than Expected Crude Draw

Oil prices managed a modest gain today, after Friday’s big plunge (and yesterday’s modest gains) thanks to investors hope that the upcoming OPEC+ meeting that could lead to deeper supply cuts by some of the world’s biggest crude producers.

“With the OPEC meetings coming up, there are expectations that not only will there be an extension of the existing cuts but also a further production cut,” said Andy Lipow, president of Lipow Oil Associates LLC in Houston.

Crude also bounced above its 50-day moving average – and the dollar was weaker – which both helped technically but all eyes are once again on inventories tonight…

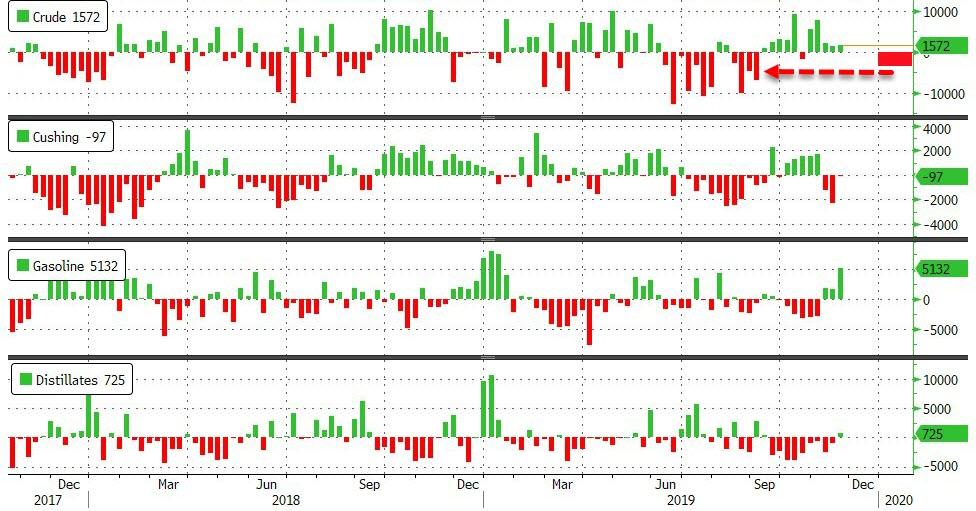

API

-

Crude -3.72mm (-1.5mm exp) – biggest draw since September

-

Cushing

-

Gasoline

-

Distillates

After 5 straight weeks of builds, API reports that crude inventories drew down more than expected in the last week (-3.72mm vs -1.5mm exp)…

Source: Bloomberg

WTI was hovering around $56.20 ahead of the data, and rose modestly on the API-reported bigger than expected draw

NOTE the chaotic spike as headlines that OPEC+ did not discuss deeper cuts hit.

Tyler Durden

Tue, 12/03/2019 – 16:37

via ZeroHedge News https://ift.tt/2remcOq Tyler Durden