Job Openings Rebound But Hiring Tumbles

One month after US job openings unexpectedly tumbled to an 18 month low, while the drop in the quits level confirmed the US labor market had cooled off substantially, moments ago the BLS reported that in October, there was a substantial rebound in the labor market from the perspective of Janet Yellen’s favorite indicator, the JOLTS report.

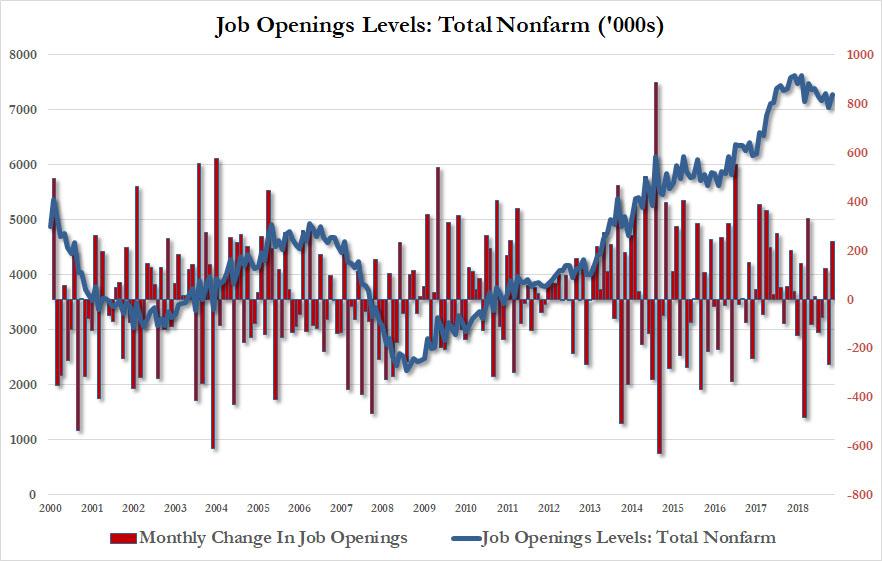

According to the BLS, in October the total number of job openings rebounded sharply, and after last month’s 277K plunge to 7.024, in October the number of job opening jumped by 235K to 7.267K, the biggest one-month increase since March, and well above the 7.009MM expected.

The largest increases in job openings levels were in retail trade (+125,000), finance and insurance (+56,000), and durable goods manufacturing (+50,000). The largest decreases in job openings were in nondurable goods manufacturing (-36,000), information (-33,000), and arts, entertainment, and recreation (-26,000). The number of job openings was little changed in all four regions.

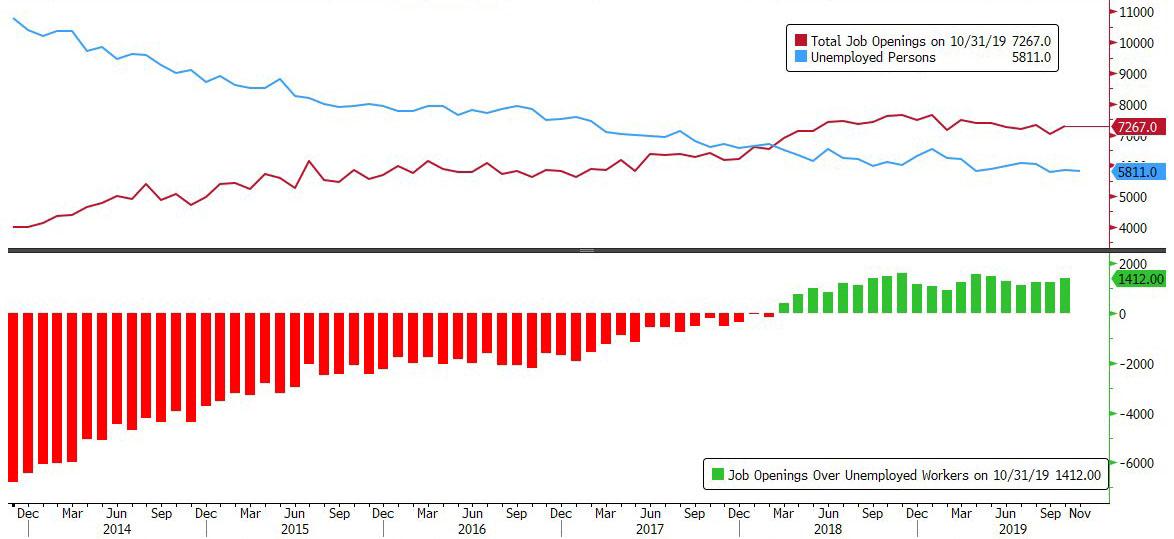

Thanks to the latest rebound in job openings, there have now been more US job openings than unemployed workers for a record 20 consecutive months, and in October there were 1.4 million Job Openings (7.267MM) than unemployed workers (5.811MM).

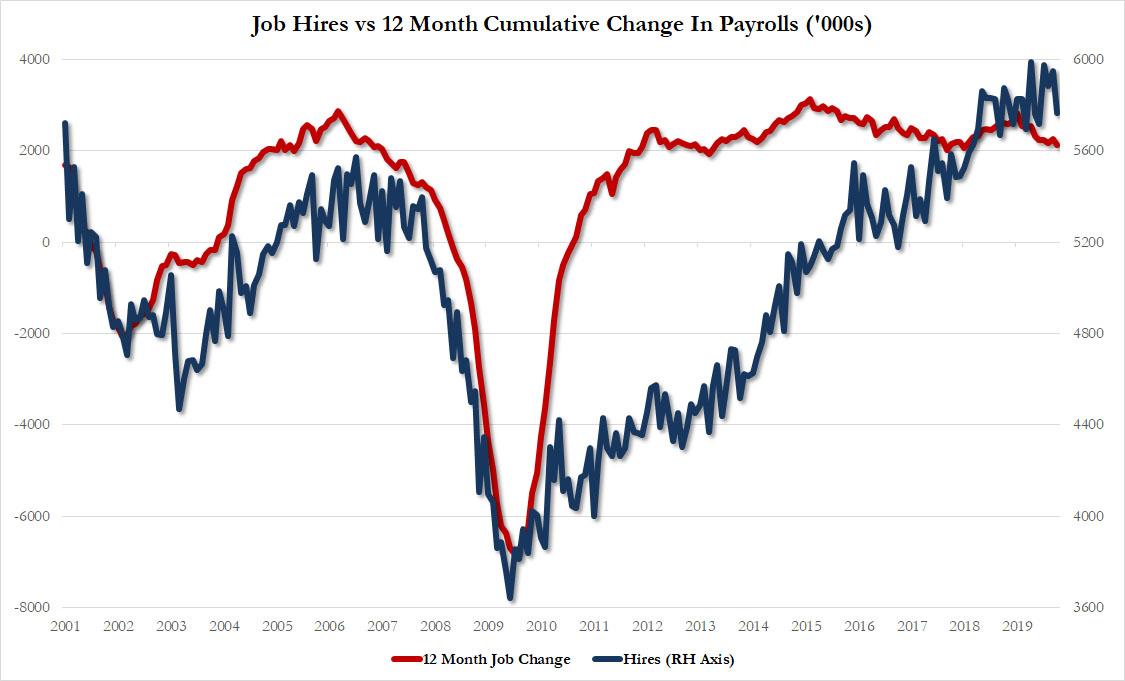

Yet while the rebound in job openings was clearly favorable for the US labor market, unlike last month, though, when there was a modest rebound in the rate of hires, in October the number of hires dropped by 187K to 5.764 million, the lowest level of hiring since June. The number of hires edged down for total private (-194,000) and was little changed for government. The hires level decreased in retail trade (-97,000).

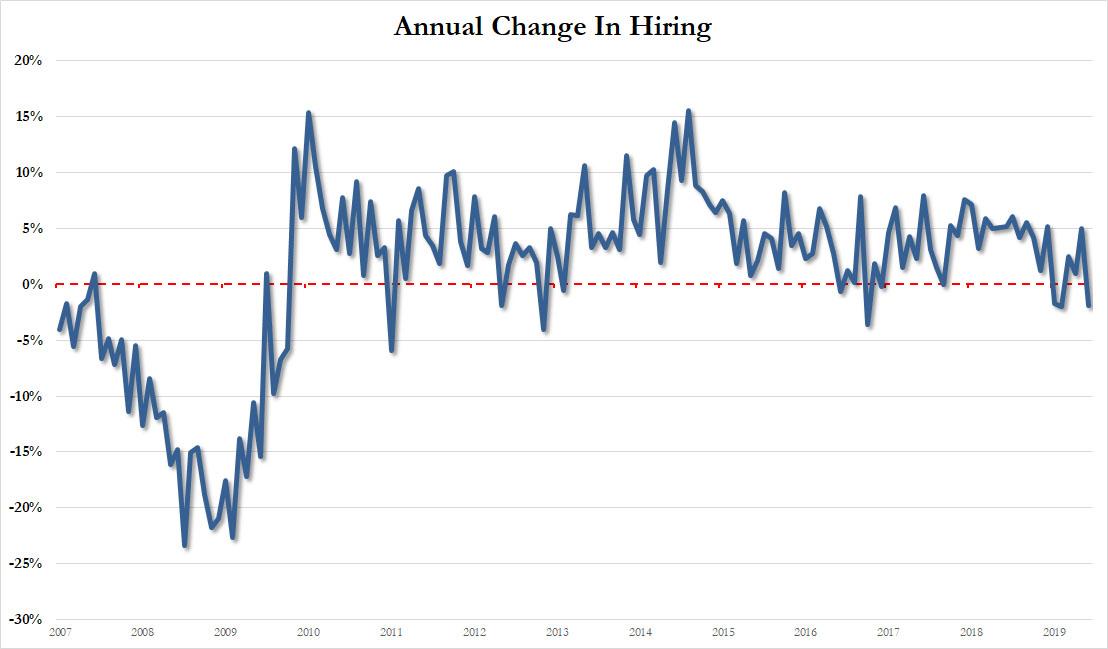

The drop in hiring meant that after expanding for three months, hiring once again slumped into contraction, dropping by 1.9% in October, down sharply from from the 5% increase in September.

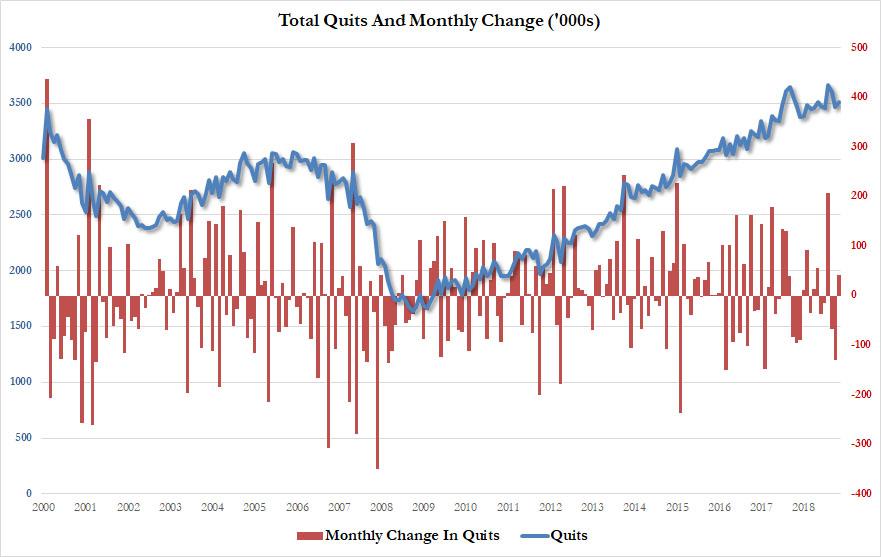

Finally, according to the final closely watched JOLTS metric, the so-called “take this job and shove it” indicator – the total level of “quits” which shows worker confidence that they can leave their current job and find a better paying job elsewhere – rose for the first time after two months of declines, and in October quits rose by 41K to 3.512MM from 3.471MM.

Quits increased in other services (+66,000) and educational services (+12,000). Quits decreased in retail trade (-63,000) and in durable goods manufacturing (-21,000).

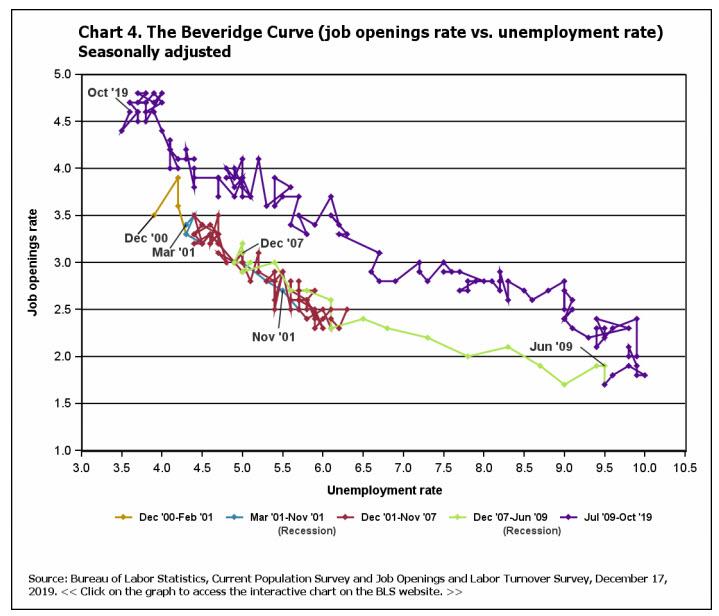

As of October, the Beveridge curve looked as follows:

During an expansion, the job openings rate is high and the unemployment rate is low moving to points along the curve up and to the left. During a contraction, the job openings rate is low and the unemployment rate is high moving to points along the curve down and to the right. A shift in the Beveridge curve can indicate a structural shift in the economy due to industry-based structural mismatch and geography-based structural mismatch. For example, if the job openings rate and the unemployment rate are both high, this could shift the entire curve up and to the right. From the start of the most recent recession in December 2007 through the end of 2009, the series trended lower and further to the right as the job openings rate declined and the unemployment rate rose.

Tyler Durden

Tue, 12/17/2019 – 10:35

via ZeroHedge News https://ift.tt/35uFaiJ Tyler Durden