2019 Greatest Hits: The Most Popular Articles Of The Past Year And A Look Ahead

One year ago, when looking at the 20 most popular stories of 2018, we admitted that perhaps as a result of too many conflicting narratives and storylines that emerged in 2017 and earlier in the decade, it was difficult to find a coherent theme to the key events that shook the world, and which you, our readers, found most interesting and notable.

Indeed, we said that “it is difficult to say that 2018 provided much needed closure to many of the themes and narratives that emerged in the previous year and earlier, most of which played out in the political arena, where for the first time in decades the non-establishment president of the world’s biggest superpower, a manifestation of the “protest vote” that had built up over the past decade, shook to the core everything that the world had taken for granted, setting the stage for a dramatic revulsion from widely accepted norms and principles.”

As we had warned for years, the vast if silent majority, feeling snubbed and neglected by the political oligarchy and the world’s central bankers, decided to take the power back which they did within the confines of the democratic process, sending the establishment reeling, by rejecting years of legacy narratives by replacing decades of a failed, and flawed, political regime in the US with something… different. And yet, looking back over the past 12 months, and in fact past decade, it remains to be seen if these changes will be successful and bear fruit, or if they will be a change for the worse.

However, amid this confusion, some clarity did emerge: as we look back at the past year, and past decade for that matter, the one thing that becomes clear amid the constant din of markets, of politics, of social upheaval and geopolitical strife, in fact a world that is so flooded with constant conflicting newsflow and changing storylines that some say it has become virtually impossible to even try to predict the future in a world bombarded with a relentless stream of flashing red headlines, that despite the people’s desire for change, for something original and untried, the world’s established forces will not allow it and will fight to preserve the broken status quo at any price, which is perhaps why it always boils down to one thing – capital markets, that bedrock of Western capitalism and the “modern way of life”, where control, even if it means central planning the likes of which have not been seen since the days of the USSR, and an upward trajectory must be preserved at all costs, as the alternative is a global, socio-economic collapse.

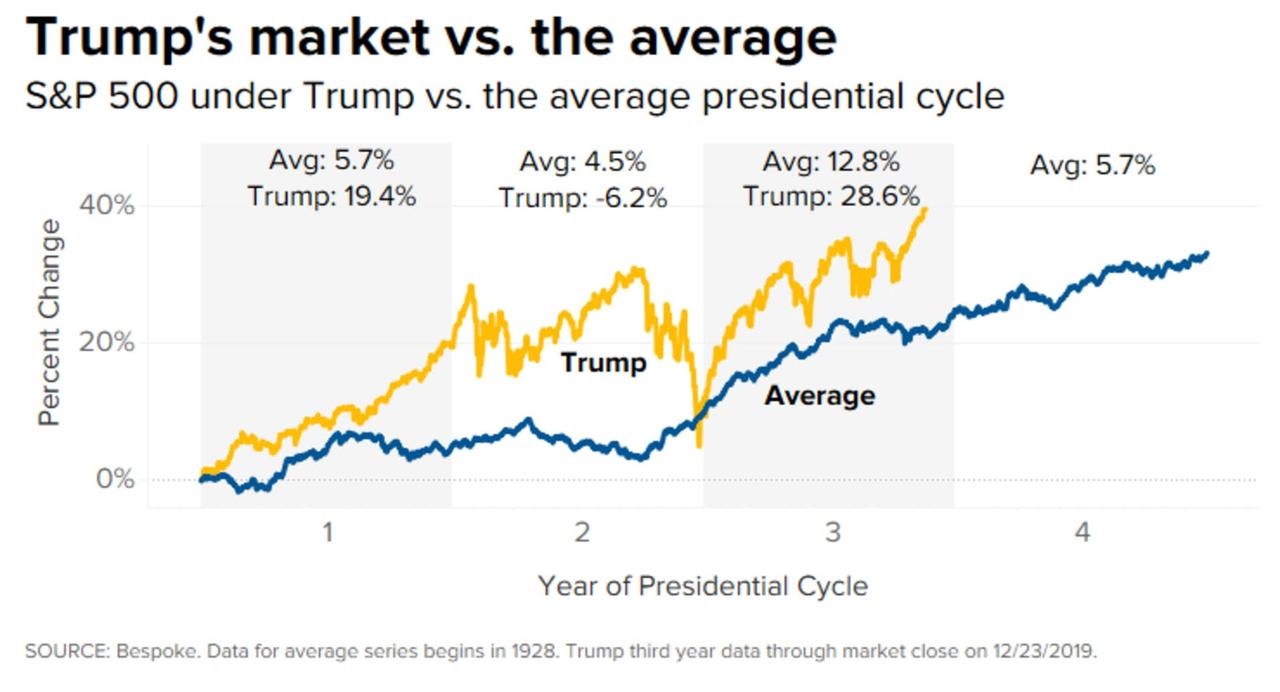

And since it is the daily gyrations of stocks that sway popular moods – and explains why none other than the US president is now tweeting almost daily on how the S&P closed on any given day to boost his approval rating and bolster his credibility – the interplay between capital markets and politics has never been more profound or more consequential. Indeed, in a historic moment when the president was impeached by the House (if not the Senate), Trump’s natural response was to point to the record high hit that very day in the S&P500. To be sure, so far Trump has been successful – although the correct word is lucky – in that the stock market cooperated in 2019 when it returned an impressive 28.50%, just shy of the best annual return in the past 22 years when it posted a slightly higher return in 2013. Indeed, the S&P has returned more than 50% since Trump was elected in 2016, more than double the 23% average market return of presidents three years into their term.

The more powerful message here is the implicit realization and admission by politicians, not just Trump but also his peers and challengers, that the stock market is now seen as the consummate barometer of one’s political achievements and approval. Which is also why capital markets are now, more than ever, a political tool whose purpose is no longer to distribute capital efficiently and discount the future, but to manipulate voter sentiments far more efficiently than any Russian election interference attempt ever could.

Which brings us back to 2019 and the past decade, which is best summarized by a recent Bill Blain article who said that “the last 10-years has been a story of massive central banking distortion to address the 2008 crisis. Now central banks face the consequences and are trapped. The distortion can’t go uncorrected indefinitely.“

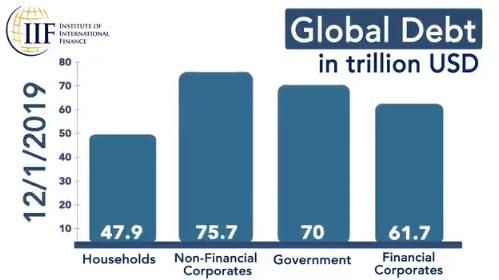

That, in a nutshell, is what every decade introspective boils down to (or should): we had a decade in which the excesses of the past were not only not corrected, but swept under the rug… and under a mountain of debt. Because the tradeoff of pulling years if not decades of growth from the future means that we ended 2019 with global debt of a record $255 trillion, up from $185.4 billion at the start of the decade, and a staggering 330% of global GDP, a level which not even the most liberal economists harbor any belief will have a happy ending.

And while helicopter money, or MMT, is likely the next and final stop for a world careening into the fiat money abyss, for now the music is playing and everyone must dance, to quote Chuck Prince.

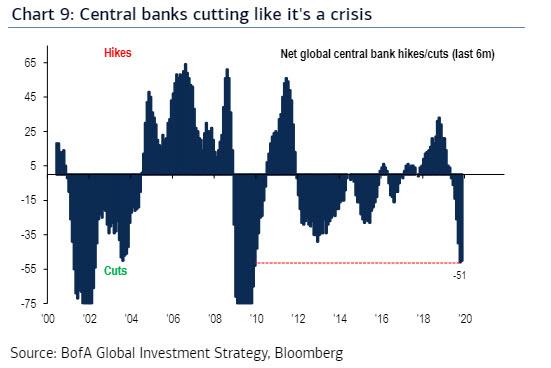

Which, in turn, brings us back to the point why 2019 tied a lot of loose ends: you see, in many ways the transition from 2018 to 2019 was a neat recapitulation of some of the core themes of the past decade. When the S&P briefly entered a bear market – one which literally lasted just a few seconds on Dec 24, 2018 – central banks threw in the towel on any attempt to renormalize monetary policy. As a result first the Fed, then all of its central bank peers, proceeded to ease massively in order to avoid a catastrophic market crash, one which would undo a decade of central bank interventions and the injections of over ten trillion in newly-created liquidity, and went all in on perpetuating a failed status quo. The best summary of this came from Bank of America which in a moment of striking honesty, said that “central banks are cutting like it’s a crisis” and indeed, the number of rates cuts into late 2019 matched those last seen during the 2008/2009 financial crisis when the global financial system was on the verge of collapse. And yet, this time the global economy was growing at a solid, if not stellar pace (or so we were told), there was no imminent crisis on the horizon with global stocks already trading near all time highs.

Amusingly, it was in our year-end recap from last year published exactly one year ago when we said that “the question we have: how far will the tide be allowed to recede before central banks step in again.” We now know the answer: it was just a few months.

What happened? Simple – in late 2018 central banks panicked that they had lost control – and credibility – and they not only reversed all their “renormalization” success, with the Fed going from predicting two rate hikes in Dec 2018 to cutting three time in the summer of 2019, while also launching QE4 (under the pretext of fixing a repo system which was brought to its knees by none other than JPMorgan, which just happens would benefit greatly from a new round of QE), even as the ECB both cut rates deeper into negative territory as it also restarted its own QE less than a year after it ended it.

One explanation for this “crisis” response: China, which over the early part of the past decade had emerged as the world’s emergency economic kickstarter, has by now accumulated too much debt to provide the spark needed to reflate the global economy, and drowning under a mountain of (increasingly bad) debt, Beijing was relegated to the economic sidelines unable to trigger another massive debt injection into the domestic economy already suffering from record debt defaults and bank failures, and forcing the Fed and other central banks to take its place. Ironically, the Fed did so even though as former NY Fed president (and ex-Goldman Sachs economist) Bill Dudley admitted in an scandalous op-ed in August, that the Fed could effectively crash the market to secure a recession and prevent a Trump re-election, and it should think hard and deep if it shouldn’t do just that. In the end, however, Powell – who had emerged as the target of Trump’s angry tweets about the market and economy, sparking debate whether Trump would tell him “You’re fired” next – picked kicking the can, even it meant 4 more years of Trump.

And so, with the Fed fully behind Trump and helping the S&P return nearly 30% in 2019, 4 more years of Trump is now virtually assured (barring some unexpected calamity in 2020) because while Nancy Pelosi’ crusade to impeach the president ended up being a massive dud, one which has backfired spectacularly with Trump only benefiting from even more moderate support as a result ahead of an inevitable acquittal in the Senate, it was the impressive market performance and resilient economy that won Trump the 2020 re-election one year before the vote even took place. And no, the outcome of the 2020 presidential election has nothing to do with the motley crew of Democratic presidential candidates, ranging from ultra-billionaires to raging socialists who literally are pushing for helicopter money and MMT, or the endless noise that was the “made for popular consumption and flashing red headlines” trade war spectacle between the US and China that bored traders for over 560 days (as the two sides had long ago agreed on the “trade war’s” amicable resolution behind closed doors). So for all those Democrats tearing their hair out why Trump is an odds-on favorite to win next year’s presidential election, the answer is simple: the Fed, and the Fed’s realization that it must capitulate on its renormalization ambitions if it wishes to preserve the artificial levitation of US and global capital markets.

In other words, going back to what we said above, 2019 helped crystalize the realization that politics is now markets, and markets have become political weapons, and why the past decade was, as Bill Blain put it, “a story of massive central banking distortion to address the 2008 crisis.” The problem is that this distortion has only made the mess even greater, and the only hope central banks have – in their own words – is if government fiscal stimulus takes over where monetary stimulus ends. Only there is just one problem, or rather 255 trillion problems as shown above, because whereas one could argue that fiscal stimulus is a credible option if the world’s wasn’t drowning in debt, when global debt to GDP is 330%, it is tantamount to saying that only more debt can fix a debt crisis. Which is effectively what the world’s smartest people are saying.

That said, whether the story of 2020, and the next decade for that matter, is one of fiscal or monetary stimulus is of secondary importance: what is key, and what we learned in the past decade, is that the status quo will throw anything at the problem to kick the can. And while many already knew that, the events of 2019 made it clear to a fault that not even a modest market correction can be tolerated going forward. That in turn may explain why the last quarter of 2019 was a mirror image of events from the fourth quarter of 2018. After all, if central banks aim to punish all selling, then the logical outcome is to buy everything, and investors, traders and speculators did just that armed with the clearest backstop guarantee from the Fed in the form of both rate cuts and QE 4.

Meanwhile, for all those lamenting that relentless coverage of politics in a financial blog (which sadly also includes every tweet from Donald Trump), why finance appears to have taken a secondary role, and why the political “narrative” has taken a dominant role for financial analysts, the past year showed vividly why that is the case.

Ironically, if there was one event in 2019 that threatened the status quo, it had nothing to do with capital markets, Trump, the Fed’s balance sheet, or the repo market, and everything to do with the repeat arrest of Jeffrey Epstein. Having been unexpectedly arrested for the second time for his involvement in a giant child prostitution ring, one which threatened to take down some of the world’s most powerful people, Epstein’s incarceration proved extremely uncomfortable to those same people… and then Epstein simply “committed suicide” despite constant surveillance. And just like that the risk that he may name names disappeared forever.

What about China? After all when looking ahead last year, we said that “another assumption that will be tested in the coming year is whether “China no longer matters” for US markets, something which was certainly not the case in 2018.” We added that we “have a nagging suspicion that whether or not the US manages to avoid a recession in 2019 any global shock will ultimately come out of Beijing, regardless of whether Trump and Xi manage to find a common language and put the trade war between the two nations aside.” The answer is that despite much speculation that 2019 would be the year that China’s economic and financial bubble (at $40 trillion, the country’s financial system is double that of the US) finally bursts, Beijing managed to once again avoid a hard landing. Ironically, it did so on the back of the trade war with Trump, which provided Xi Jinping with just the right amount of scapegoating on which to blame not only China’s economic slowdown, but the complete failure of its credit impulse to rebound from cycle lows, and the sharp spike in both bank failures and record corporate defaults. After all, who will pay much attention to the underlying Chinese economy is Beijing can blame the US trade war for all its ills? And that’s precisely what happened in 2019, a year when China blamed Trump for all its woes, even if in reality China’s slowdown started years ago, and will only accelerate in the coming year, especially if much of the “trade war” is now resolved.

Ironically, as China’s Xi Jinping blamed trade war with Trump for its slowdown, Trump in turn used the buoyant US economy and record US stock market to redirect public attention from the 3-year long attempt by democrats to overthrow the sitting US president. As a reminder, 2019 was the year when the Mueller probe into Trump “collusion” with Russia crashed and burned to the chagrin of much of the liberal “fake news” propaganda; however, just months later the narrative was reborn when a “whistleblower” triggered in a carefully staged script which saw Trump become only the third US president to be impeached by the House over what Democrats claimed was an illegal attempt to force Ukraine to “interfere with US democracy.” The end result was twofold: the House, where Democrats have had a majority since the midterm elections, impeached Trump and… the nation yawned, realizing that the GOP-controlled Senate would nullify the impeachment especially since the Democrats failed in their primary mission: to convince moderate voters that Trump indeed deserves to be thrown out.

And yet, with the 2020 elections looming, it is certainly true that anything can still happen, only as with all true “black swans”, it won’t be what anyone had expected. And so while many themes, both in the political and financial realm, did get some closure, dramatic changes in 2019 persisted, and will continue to manifest themselves in dramatic, often violent and unexpected ways – from the unprecedented obsession with everything Trump does, says and tweets, to “populist” upheavals in Europe and around the developed world, to China’s fight with soaring food inflation in a time when the central bank desperately needs to ease financial conditions.

As always, we thank all of our readers for making this website – which has never seen one dollar of outside funding (and despite amusing recurring allegations, has certainly never seen a ruble from the KGB either, although now that the entire Russian hysteria episode is over, those allegations have finally quieted down), and has never spent one dollar on marketing – a small (or not so small) part of your daily routine. Which also brings us to another amusing topic: that of fake news, and something we – and others who do not comply with the established narrative – have been accused of. While we find the narrative of fake news laughable, after all every single article in this website is backed by facts and links to outside sources, we find it a dangerous development, and a very slippery slope that the entire developed world – is pushing for what is, when stripped of fancy jargon, internet censorship under the guise of protecting the average person from “dangerous, fake information.”

To preserve its counter-establishment aura, it goes without saying that the current administration should overturn this blatant attack on the First Amendment, and let people decide for themselves what is and isn’t fake news. If anything, it is the conventional, mainstream media, most of which is owned by a handful of corporations with extensive ties to the government, that demonstrated on many occasions not only in 2019 but in the past decade that it is the primary creator and distributor of “fake news”, something which has not escaped the broader US population the majority of which no longer trust conventional news media.

In addition to the other themes noted above, we expect the crackdown on free speech to accelerate in the coming year, especially as the following list of Top 20 articles for 2019 reveals, many of the most popular articles in the past year were precisely those which the conventional media would not touch out of fear of repercussions, which in turn allowed the alternative media to continue to flourish in an orchestrated information vacuum and take significant market share from the established outlets by covering topics which the public relations arm of established media outlets refused to do, in the process earnings itself the derogatory “fake news” condemnation.

We are grateful that our readers – who hit a new record high in 2019 – have realized it is incumbent upon them to decide what is, and isn’t “fake news.”

* * *

And so, before we get into the details of what has now become an annual tradition for the last day of the year, those who wish to jog down memory lane, can refresh our most popular articles for every year during our no longer that brief, almost 11-year existence, starting with 2009 and continuing with 2010, 2011, 2012, 2013, 2014, 2015, 2016, 2017 and 2018.

So without further ado, here are the articles that you, our readers, found to be the most engaging, interesting and popular based on the number of hits, during the past year.

- In 20th spot, with just over 400,000 reads, was a question or rather “7 Unanswered Questions About Epstein’s Death That The Mainstream Media Is Not Talking About“ and for good reason: with few media outlets daring to touch the “Jeffrey Epstein” topic when he was alive, it only emerged after his death that at least one major network, ABC News, spiked a piece on Epstein’s potential ties with the top echelons of American power. As TV anchor Amy Robach was heard saying on a hot mic, “Do I think he(Epstein) was killed? 100% I do…He made his whole living blackmailing people. There were a lot of men on those planes. A lot of men who visited that island. A lot of powerful men who came into that apartment.” The spiking of the Epstein story came around the time it emerged that NBC deliberately suppressed evidence that Michael Avenatti lied about Brett Kavanaugh and fabricated a false accusation against him. In light of so many attempts by America’s mainstream press to keep the population in the dark, is it any wonder that trust in media institutions has collapsed and that Americans increasingly seek out alternative venues of information?

- In 19th spot of the year’s most popular articles, we received another vivid reminder that in US society a handful continue to be “much more equal” than everyone else, and the only thing that really matter is the size of one’s bank account. Over 401,000 readers were shocked to learn that “Feds Arrest Dozens, Including Actresses and Ex-Pimco CEO, In “Largest College Admissions Scam Ever Prosecuted. ” While most Americans’ children had to fight tooth and nail, study countless hours and dedicate even more time to extracurricular and charitable activities to get into the college of their choosing, the kids of a more than a handful of rich Hollywood parents and financial oligarchs had found a short cut – their parents paying bribes to fast track their admission into top universities across the land. And yet, even here the elite remained “more equal” – while a handful of prison sentences have been handed down, the longest one so far was a mere 6 months, with most parents getting a few token days in jail or some community service. It remains to be seen if college bribery has been snuffed out, although if that is the full extent of the deterrence we seriously doubt it.

- in 18th spot, with nearly 403,000 reads, was our report on the Fed’s emergency response to what some had predicted would be a year-end repo market crisis. Just days after Credit Suisse and former NY Fed repo guru, Zoltan Pozsar predicted that the Fed would be forced to unleash hundreds of billions in liquidity in the form of QE4 to avoid a lock up of the repo market following the September repo market fireworks which briefly saw the overnight repo rate soar as high as 10%, the Fed did just that, only instead of launching QE4, the US central bank unveiled that it would backstop up to $500 billion in liquidity in the one month period following mid-December to prevent another repo market crisis as we explained in “Massive… Huge… Largest Ever”: Fed Will Flood Market With Gargantuan $500 Billion In Liquidity To Avoid Year-End Repo Crisis.” The result was a remarkable surge in the Fed’s balance sheet which soared by $400 billion since its late August nadir, in the process unleashing an unprecedented year-end stock market meltup which helped send stocks soaring to new all time highs just in time for the 2019 holidays which in turn translated into record online spending as US consumers were delighted to see the value of their brokerage accounts and 401(k)s hit all time highs. The question now is whether – and if – the Fed will be able to drain all of this freshly created liquidity as we enter the new year.

- In 17th spot was a bizarre twist in what was part of the biggest political scandal of 2019 – Trump’s impeachment – which was started after second-hand “whistleblower” accused Trump of threatening to withhold funding to Ukraine unless former VP Joe Biden, and Trump’s current democratic challenger for the 2020 elections, was investigated for corruption. And while by now the identity of the “secret” whistleblower, who appears to have been an ideologically biased, never-Trump CIA officer, is known 405,000 readers were surprised to read that he had gotten cold feet about testifying after revelations emerged that he worked with Joe Biden, former CIA Director John Brennan, and a DNC operative who sought dirt on President Trump from officials in Ukraine’s former government. In the end, Trump was impeached in the House, although with impeachment in the Senate impossible and with moderate voters increasingly appalled by Nancy Pelosi’s tactics, it appears that this gambit backfired dramatically for the Dems.

- We were not the only one surprised to receive an email from a Fed staffer in August seeking more information on an article we had written which not only predicted the September repo fireworks, but also explaining why the Fed would soon be forced to launch QE: over 408,000 readers agreed with us that “When You Get An Email Like This From The Fed, It May Be Time To Panic.” As we wrote in the article, which came out a full month before the Sept 11 repo crisis and two months before the Fed’s restart of QE, “based on the Fed’s email, we wonder if it means the Fed is now seriously contemplating [QE4], and if so, does the market crash first, or is it about to price in QE4 and soar. We expect to find out very soon.” We did: one month later the repo market tanked, sparking a mini stock market swoon, which immediately gave way to a massive liquidity injection by the Fed, and as stocks priced in QE4, they indeed soared. incidentally, as we also predicted earlier in August, the Fed indeed launched QE4 in early October. The rest is record stock market history.

- In 15th spot, and going back to the propaganda front that is US mainstream “media”, we quoted a CBS News reported who said “I’m Committing Professional Suicide” after admitting that “Mostly Liberal” Journalists Are Now “Political Activists.” Nearly 420,000 readers heard CBS reporter Laura Logan admitting that “the media everywhere is mostly liberal, not just the U.S.,” adding that it was nearly impossible for viewers to decipher if they were being told the truth at any given time. She also admitted that journalists today are more or less lobbyists for liberal interests, adding that the weight of the liberal media machine overwhelms “the other side” unless people actively seek outlets such as Breitbart. With more and more lies emerging from the mainstream, it is hardly a surprise that that’s precisely what people are doing.

- Shifting back from media to central banks, the 14th most read article of the year involved a stunning warning by the Dutch Central Bank whose Freudian slip that “if the system collapses, the gold stock can serve as a basis to build it up again” amazed nearly 430,000 people. In additional to admitting that systemic collapse is not only possible, it may be just a matter of time, the bank also added that “gold bolsters confidence in the stability of the central bank’s balance sheet and creates a sense of security.” The bank’s admission that “a bar of gold retains its value, even in times of crisis. This makes it the opposite of “shares, bonds and other securities” all of which have inherent risk and prices can go down” sounded like the pitch from a gold ad which is why it was especially surreal and prompted question if there is more to the wholesale gold repatriation among European nations than meets the eye.

- From central bank printers of money, to printing money with the world’s oldest profession, in 13th spot and seen by over 443,000 readers was our question “Why Are So Many Top-Tier College Girls Turning To ‘Soft Prostitution‘?” The question, in retrospect, was rhetorical and undoubtedly linked to the country’s $1.5 trillion student debt problem. Still, it poses some unpleasant social questions if 15,277 female students at Georgia State, nearly one in ten girls at the college, were willing to whore themselves out to websites such as Sugar Babies.com in order to make ends meet.

- And from prostitution to pedophilia, in 12th spot we go back to Jeffrey Epstein, whose death left far too many questions unanswered. Which is why the emergence of his ‘tapes’ was a matter of great public interest and why over 443,000 readers tuned in to listen to the “Epstein Tapes: Dead Pedophile Describes His Lifestyle In Unearthed Recordings.” The tapes, the remnant of an Epstein 2003 interview, offered his thoughts on subjects ranging from mathematics, to exorbitant wealth, to the important of prenuptial agreements. Alas, there was no hint who may have “suicided” Epstein himself some 16 years later. More importantly, this was most likely the last time we’ll ever hear from Epstein, as dead pedophiles tell no tales.

- In 11th spot, 445,000 readers got a vivid reminder that the “science” behind global warming can be as “scientific” as the propaganda behind mainstream media. As we reported in “Glacier National Park Quietly Removes Its “Gone By 2020” Signs“, officials at Glacier National Park had begun quietly removing and altering signs and government literature which told visitors that the Park’s glaciers were all expected to disappear by either 2020 or 2030. Why? Because GNP’s most famous glaciers such as the Grinnell Glacier and the Jackson Glacier have been growing – not shrinking – since about 2010. Of course, don’t ever let facts stand in the way of good propaganda narrative, something which 16-year-old anti-global warming crusader Greta Thunberg and her fame and limelight hungry parents discovered at roughly the same time.

- When it comes to politics, 2019 wasn’t just about the collapse of the Russia collusion narrative in the first half of the year, and Trump’s impeachment in the second: the “other” big story throughout the year was the (seemingly endless) field of Democratic presidential candidates, yet where one name was missing: that of Hillary Clinton. Which is why in September we asked “Is Hillary Gearing Up For Late-Stage Do-Over Against “Corrupt Human Tornado” Trump?” in which we cited bookies’ bets and a few recent actions, which sparked fresh speculation that Hillary Clinton may be about to enter the Democratic Party presidential nominee race. So far such speculation has not materialized, although just like Mike Bloomberg, Hillary may merely be waiting for her competition to tear itself apart before she makes her glorious entrance, culminating with a repeat of the 2016 presidential election.

- And from politics back to capital markets, where as more than 475,000 people learned there was no more market moving report than the one published on December 9 by Credit Suisse repo guru Zoltan Pozsar, titled “Countdown to QE4”, in which the former Fed and Treasury staffer predicted that “It’s About To Get Very Bad”, and that the Fed would lose control of the repo market into year end due to a massive liquidity shortage resulting in an imminent market crash, and only another massive liquidity injection in the form of QE4 could prevent a crisis. In the end, the Fed did not launch QE4 – after all it had already started QE4 back in October (the expansion from T-Bills to coupons will happen some time in early to mid-2020), however the Fed’s massive, $500 billion year-end liquidity injection and backstop would almost certainly not have happened without the Pozsar report sparking a mini panic within the Fed. As such while Pozsar did not correctly predict the Fed’s reaction, his lucid explanation of the faults within the repo system prevented what could have been a dire year-end crisis (which we assume earned the Hungarian a Christmas Card from the Trump administration).

- It may come as a surprise to some that Central banks are not only in the market rescuing and money printing business: they are now active agents when it comes to fighting climate change. And since the past decade has demonstrated that any gospel accepted by central banks as fact is almost certainly a lie, we were not shocked to learn, although it did comes as a surprise to over 530,000 readers that in a “Bombshell Claim: Scientists Find “Man-made Climate Change Doesn’t Exist In Practice. ” The study, which resulted in our 8th most popular article of 2019, and which has yet to be featured by any mainstream media, has crippled flawed fundamental assumptions underlying controversial climate legislation after scientists in Finland found “practically no man-made climate change” after a series of studies. “During the last hundred years the temperature increased about 0.1°C because of carbon dioxide. The human contribution was about 0.01°C”, the Finnish researchers bluntly state in one among a series of papers. Or, as Greta Thunberg would say, “how dare they.”

- In 7th spot, with over 540,000 reads, was the surprise news that bizarrely, and for no reason at all, in mid-March Facebook decided to ban Zero Hedge. In some ways we were lucky: unlike other websites, only a tiny fraction of our inbound traffic originates at Facebook, with most of our readers arriving here directly without the aid of search engines or referrals. And while after several days of vocal complaints by our readers about the ban, Facebook reversed the ban, we are confident it is only a matter of time before Facebook – and other social media sites – bans a “conspiracy theory” site like Zero Hedge for good. Which reminds us that it is time to start thinking of Plan B.

- In 6th spot, with over 575,000 views was a reminder that even as the US economy continues to grow, for millions of student-debt borrowers life remains unbearable. And so, as we wrote in “Debt-Laden Americans Flee Country To Escape Crushing Student Loans “, faced with crushing student loans and little ability to repay them, some Americans have taken to fleeing the country in order to escape their debt. “It’s kind of like, if a tree falls in the woods and no one hears it, does it really exist?” said 29-year-old Chad Haag, a millennial who – like millions of his peers – is about to find out the hard way that one can’t just pick up and disappear from his problems.

- In 5th spot was a surprising report from the Rand corporation, according to which the US better not escalate its trade war with China into something more “kinetic.” 687,000 readers learned that during simulated World War III scenarios, the U.S. lost against both Russia and China: “In our games, when we fight Russia and China, blue gets its ass handed to it.” Of course, the report had a simple, ulterior motive: to boost the defense budget with more taxpayer money: “$24 billion a year for the next five years would be a good expenditure” to prepare the military for World War III.

- Over 708,000 people tuned in, shocked to learn in August that despite being placed in a maximum security holding cell, and having been on suicide watch, pedophile millionaire Jeffrey Epstein managed to kill himself by chocking himself with a bed cover. Of course, nobody believed it, which is why “Outrage Surged Over Epstein’s Mysterious Suicide. ” Alas, with the video camera recording Epstein mysteriously broken, and with a lengthy probe into the guards who were supposed to keep Epstein safe only just beginning, the likely outcome is that one that Epstein’s killer wanted: to shut the pedophile with the massive rolodex for good.

- Something odd happened on June 2: for a few minutes that dayGoogle Cloud went offline, an outage which adversely affected Gmail, YouTube, SnapChat, Instagram, and Facebook. And while over 812,000 people wondered alongside us if “the Government Just Test The Internet Kill Switch”, making this the 3rd most popular post of the year, even a more innocuous explanation left many questions unanswered, namely if just one cloud service going offline can cripple the key nodes of the modern internet, what will happen during the next major cyberattack on US soil, and will US economic productivity finally jump at that moment?

- Not one year passes without Deutsche Bank somehow making its way into the Top 20 article, and 2019 was no exception. Over 1.1 million readers tuned in to ask and debate whether “A Bank With $49 Trillion In Derivatives Exposure Is Melting Down Before Our Eyes.” One look at Deutsche Bank’s stock price and the answer becomes self-evident.

- Finally, in what was a surprise to us, the most read post of the year with 1.4 million hits, had nothing to do with capital markets, with politics, or with the latest failed CIA coup in some middle-eastern nation. Instead, it was a report exposing the hypocrisy of those “greens” who buy electric cars to virtue signal, yet are unaware that doing so results in far worse environment consequences as we wrote in “Electric Car-Owners Shocked: New Study Confirms EVs Considerably Worse For Climate Than Diesel Cars.” We can only hope that our conclusion that “maybe Elon Musk’s plan to save the world with electric cars is the biggest scam of our lifetime” will prompt at least one or two readers to think again before splurging on that brand new Model S.

* * *

With all that behind us, and as we wave goodbye to another bizarre if exciting yet and a truly surreal decade, what lies in store for 2020, and the next decade?

We don’t know: as frequent and not so frequent readers are aware, we do not pretend to be able to predict the future and we don’t try despite endless allegations that we constantly predict the collapse of civilization: we leave the predicting to the “smartest people in the room” who year after year have been consistently wrong about everything, and never more so than in the last three years, which destroyed the reputation of central banks, of economists, of conventional media and the professional “polling” and “strategist” class forever. We merely observe, try to find what is unexpected, entertaining, amusing, surprising or grotesque in an increasingly bizarre, sad, and increasingly crazy world, and then just write about it.

We do know, however, that after $16 trillion in liquidity has been conjured out of thin air by the world’s central banks, as QE makes a triumphal return to both the US and Eurozone, and as interest rates are once again sliding to unprecedented lows, the entire world is floating on an ocean of excess money, which in 2019 once again succeeded in masking just how ugly the truth beneath the calm surface is.

We are confident, however, that in the end it will be the very final backstoppers of the status quo regime, the central banking emperors of the New Normal, who will eventually be revealed as fully naked. When that happens and what happens after is anyone’s guess. But, as we have promised – and delivered – every year for the past ten, we will be there to document every aspect of it.

Finally, and as always, we wish all our readers the best of luck in 2020, with much success in trading and every other avenue of life. We bid farewell to 2019 with our traditional and unwavering year-end promise: Zero Hedge will be there each and every day – usually with a cynical smile – helping readers expose, unravel and comprehend the fallacy, fiction, fraud and farce that the system is reduced to (ab)using each and every day just to keep the grand tragicomedy going for at least one more year.

Tyler Durden

Tue, 12/31/2019 – 13:35

via ZeroHedge News https://ift.tt/2SIKqM8 Tyler Durden