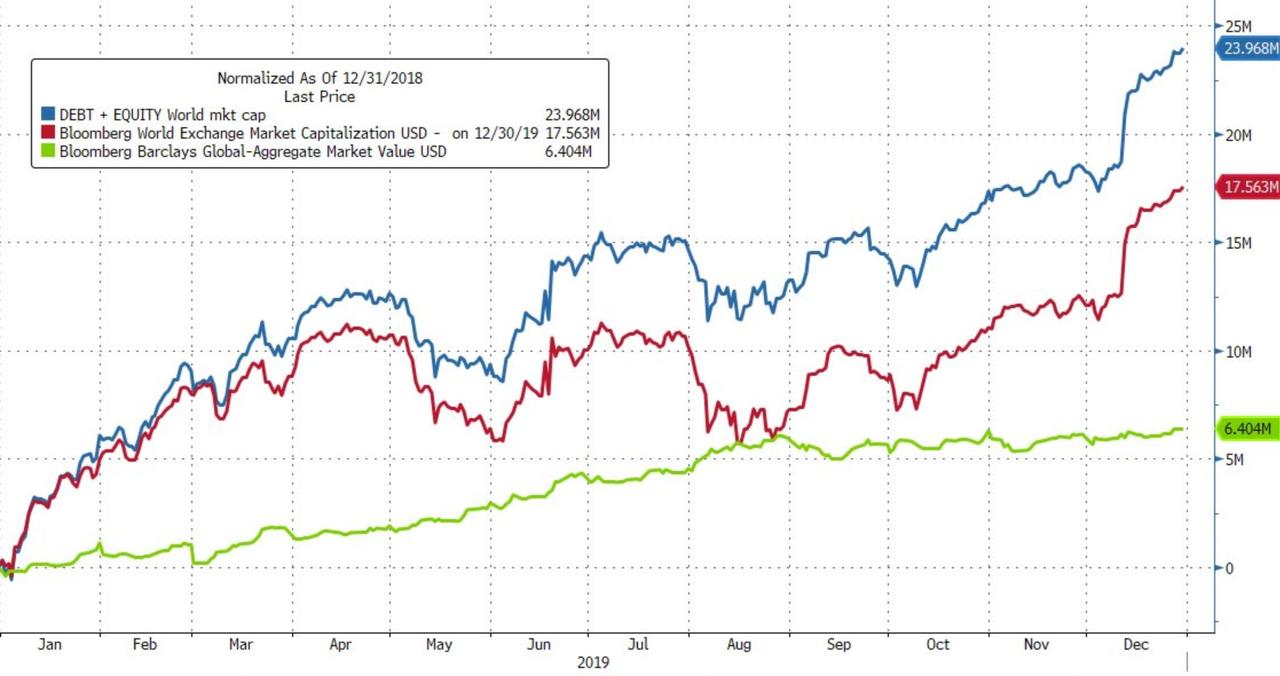

2019 – The Year Of Buying Everything

The global bond and stock markets added $24 trillion in market value ($17.5 tn stocks, $6.5 tn in bonds)

Source: Bloomberg

The Dollar ended 2019 at the same level it started – but stocks, bonds, and gold all rallied on the heels of an unprecedented surge in global liquidity…

Source: Bloomberg

Remember, correlation is not causation, especially when your career depends on people thinking you’re a guru stock-picker…

Source: Bloomberg

And as central banks spewed liquidity, they stomped on the throat of all risk in all asset classes…

Source: Bloomberg

In global equity land…

-

FTSEMIB (Italy) – best year since 1998

-

CAC – best year since 1999

-

Europe 500 – best year since 2009

-

MSCI World – best year since 2009

-

DAX – best year since 2012

-

IBEX (Spain) – best year since 2013

-

S&P – best year since 2013

-

SHCOMP (China) – best year since 2014

-

FTSE – best year since 2016

-

Dow – best year since 2017

In the US, Trannies lagged as Nasdaq soared (but everything was green)…

Source: Bloomberg

All of which makes perfect sense, because fun-durr-mentals…

Source: Bloomberg

And it’s not just 2019…

Source: Bloomberg

This won’t end well…

Defensives modestly outperformed Cyclicals in 2019…

Source: Bloomberg

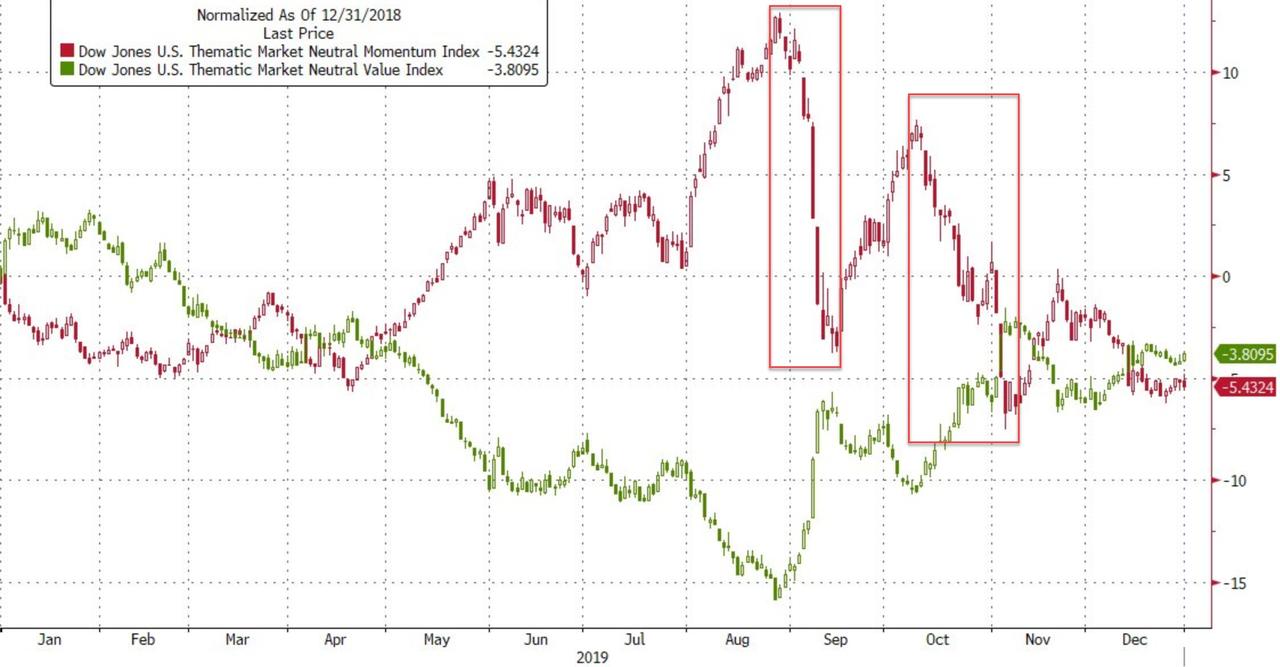

Amid considerable intra-year vol, Momo and Value ended only marginally lower…

Source: Bloomberg

Apple added a stunning $550 Billion in market cap in 2019 (best year since 2009)…

Source: Bloomberg

…as its Fwd EPS tumbled…

Source: Bloomberg

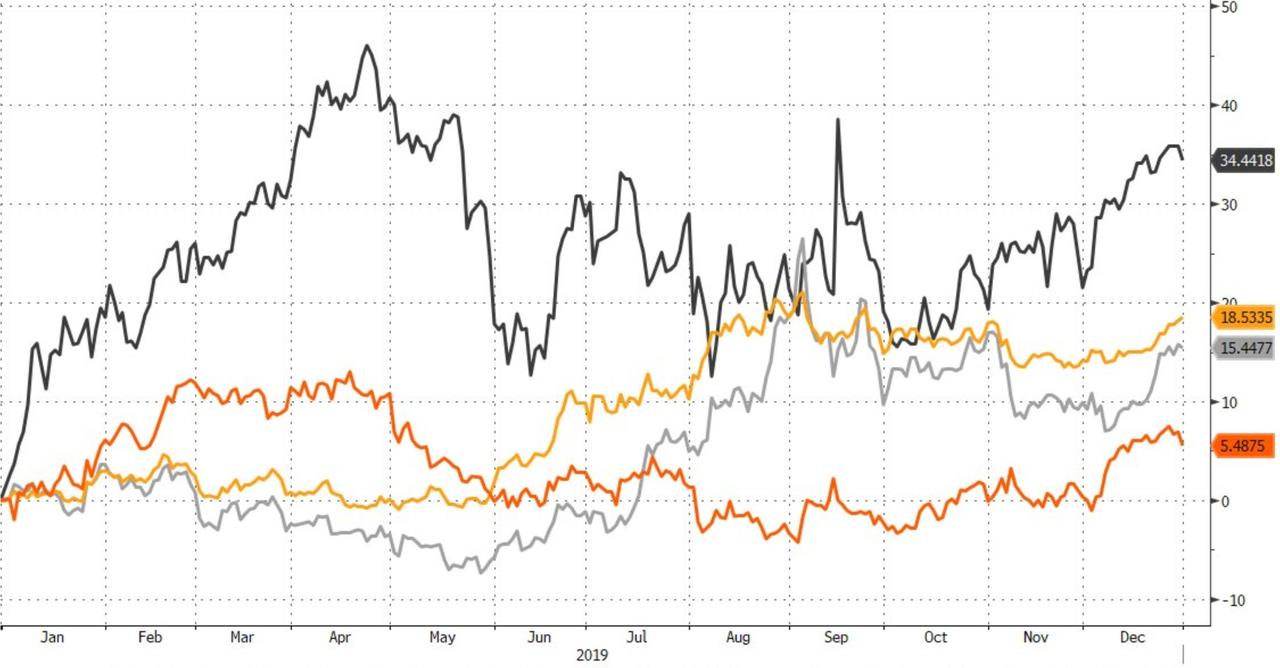

Credit protection dramatically outperformed equity protection (thanks to a late collapse in spreads)…

Source: Bloomberg

Bonds were bought with both hands and feet as treasury yields collapsed in 2019…

Source: Bloomberg

-

30Y Yields fell their most since 2014

-

2Y Yields fell their most since 2008

-

2s30s yield curve steepened 29bps – the first year the curve has steepened since 2013

Source: Bloomberg

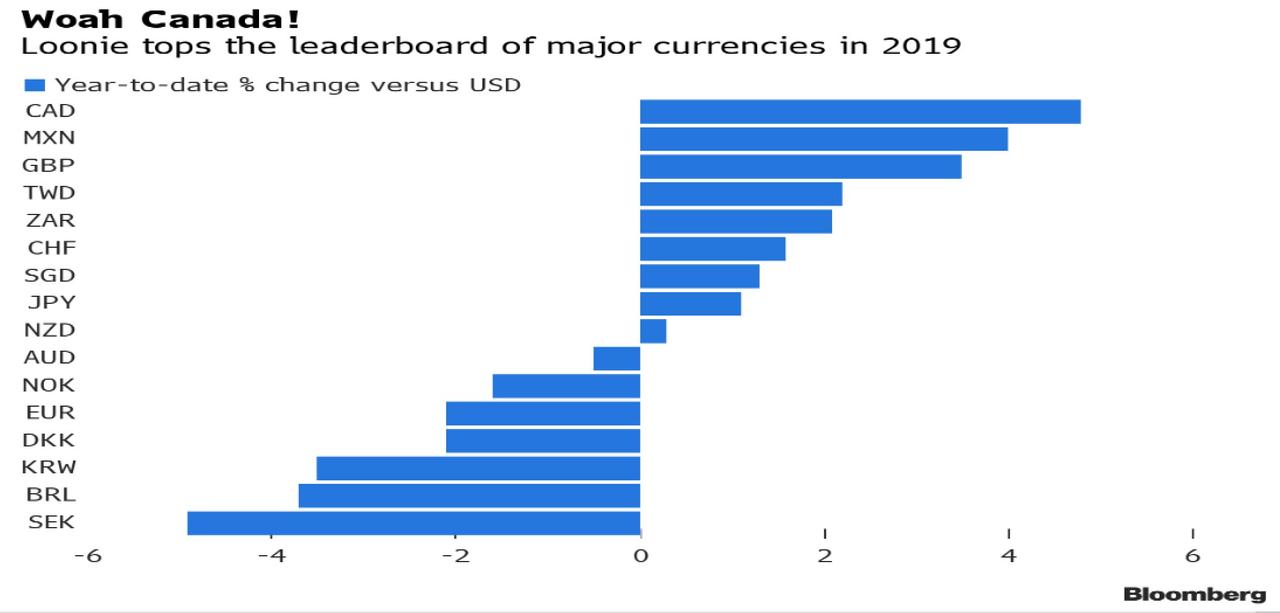

In FX-land, the Loonie was the year’s best performer… and the Swedish Kroner was the worst

Source: Bloomberg

The Dollar tumbled into year-end, erasing its gains against a broad trade-weighted basket of fiat malarkey…And the three legs lower all started as the “Phased One” deal with China was ‘completed’…

Source: Bloomberg

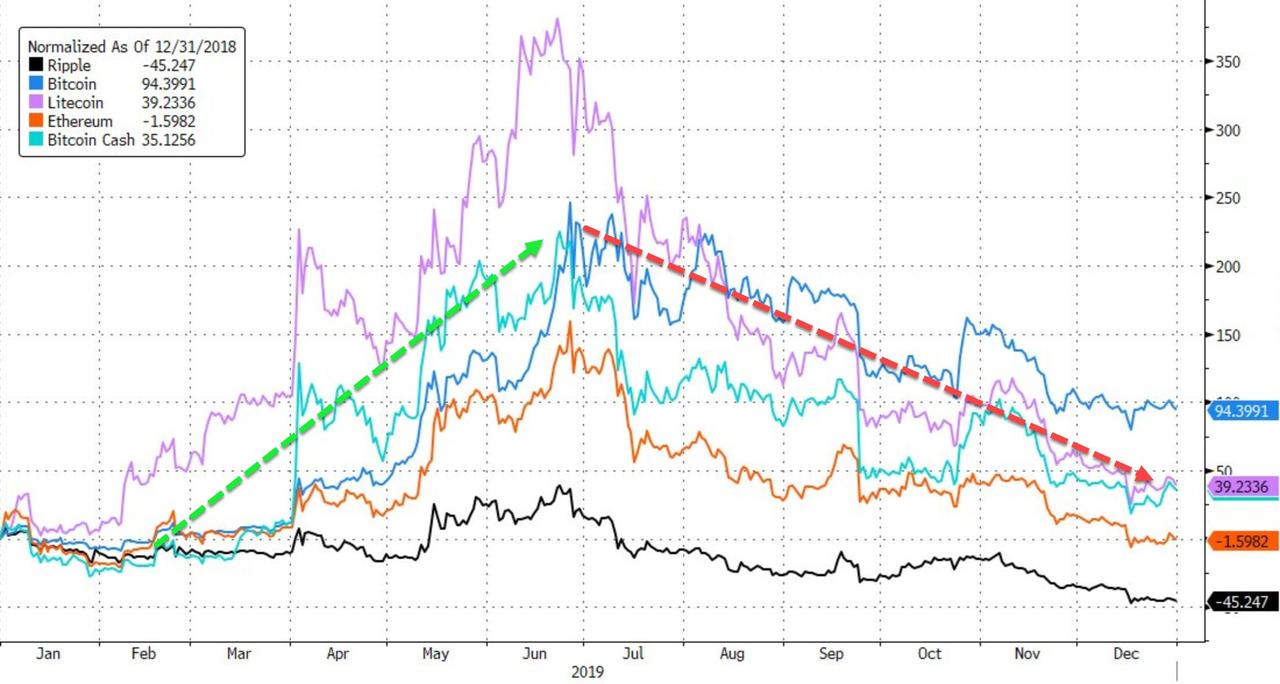

Cryptos broadly speaking had a yuuge year, but it was a tale of two halves with gains halved after peaking around late June…

Source: Bloomberg

Commodities had a big year

-

Gold had it best year since 2010

-

Silver had its best year since 2010

-

Oil had its best year since 2016

Source: Bloomberg

But Palladium was the year’s big commodity/precious metal winner…

Source: Bloomberg

And while the dollar’s slide is accelerating into year-end against global fiat currencies, it has a long way to catch down to its weakness against hard assets…

Source: Bloomberg

Finally, in case you wondered, “you are here”…

Source: Bloomberg

And with a huge h/t to CNBC’s Joumanna Bercetche, an ode to 2019:

‘Twas the Night before Xmas

Stock markets at record highs

Tech sector breaking into new territory

Brushing off trade war & recession cries

But what a year 2019 was,

Let’s rewind back to last December

The world was looking a little different

One last hike the Fed would rather not remember

Only took 7 months to reverse course

“A mid cycle adjustment” Powell mumbled

followed by two step September and October cuts

“Where did I find this guy” the President grumbled

But of course there was another battle front

The China US trade war raged on

In April a deal was “about 90% done”

Took another 8 months to get to Phase One

Tariffs went up on both sides

a terrible year for manufacturing and trade

PMIs slumped into contractionary territory

“95% Republican approval rating, I get top grades!”

The President tweeted, with one eye on the election

“It’s all one big witch hunt, am fully exonerated”

Not everyone agreed, as Democrats pressed on

“The evidence suggests, he is NOT fully exculpated”

Meanwhile, we sat glued watching the House of Commons,

an equally tumultuous year back in the UK

“Order Order” no one really understood the amendments

But could the bill with the Irish Backstop pass? Three times Nay..

After multiple cabinet resignations and brexit deadlock

The writing was clearly etched on the wall,

Prime Minister May , resigned in May,

and of course Tory Euroskpetics were enthralled.

Then commenced the Tory leadership contest

Ten eager contenders, to be whittled down to one

Never mind trust issues,

“Let’s get Brexit done”

But first PM Johnson had a cunning plan ,

proroguing Parliament and giving unlawful advice to the queen

“Don’t worry its a do or die Brexit,

We will be out by Halloween!”

Back from Brussels, brandishing a deal

Deadlock in Parliament persisted,

“Time for a General Election” all parties squealed

Even Jeremy Corbyn who had resisted

And so it was on December 12th

The Conservative party secured its biggest majority in 30 years

The withdrawal bill now passed with flying colours

Brexit on January 31st with no free trade deal yet… Cheers.

2020 will also see a new BOE governor

Andrew Bailey confirmed in the seat,

Will the Bank hike or cut we wonder,

Managing brexit will be no easy feat

But in all of this let’s not forget about Europe,

Caught in a brexit quagmire and manufacturing slump

“Europe treats us worse than China”

Perpetual threat of tariffs being dangled by Trump

Trouble in paradise with the German coalition:

new SPD leadership want to re-negotiate the terms

“while we poll low, we want rules of our volition”

As CDU’s fiscal campaign made us all squirm

And oh the Italians kept us on our toes

The 5-Star Lega coalition fell apart

Another political crisis as the economy slows?

PD theatrically swept in with 5 Star : “it’s a new start”

What about NATO the transatlantic alliance

“Braindead” declared French President Macron

“This isn’t just a spending partnership but a political one”

We shook our heads, where did this all go wrong

Meanwhile OPEC+ continued with production cuts

Oil apparently too oversupplied

“we want full compliance this time: no if , no buts”

Aramco went for a local listing, not quite $2T (but they tried)

And of course the central banks, still standing firm,

The ECB unleashed its latest round of easing

A month before the end of Draghi’s term

Now it’s up to Lagarde to do the hawks appeasing

“We will do whatever it takes” Draghi’s words

Echoing forever in the annals of history

“I am neither a dove nor a hawk

but an owl” Lagarde said fervently

Another memorable speech at the UN

“How dare you, you stole my dreams”

Green warrior Greta Thunberg

Warning of climate change in its extreme

A 2019 that was hectic to say the least:

The US President impeached

Hong Kong riots in the East

Codes of civility breached

While we don’t know what 2020 has in store

Perhaps one of less uncertainty

Happy New Year to you all

and thank you for watching CNBC! – Jou

* * *

Happy New Year!

Tyler Durden

Tue, 12/31/2019 – 16:00

via ZeroHedge News https://ift.tt/37rtzSh Tyler Durden