China Non-Manufacturing PMI Slides Back Near Multi-Year Lows

Following a big, surprise jump in November, China’s official PMIs were expected to fall back a little in December (but remain – handily – above 50 and the ‘expansion/contraction’ divide), helped by an improvement in industrial production and hopes after the ‘phase one’ trade deal was (allegedly) completed.

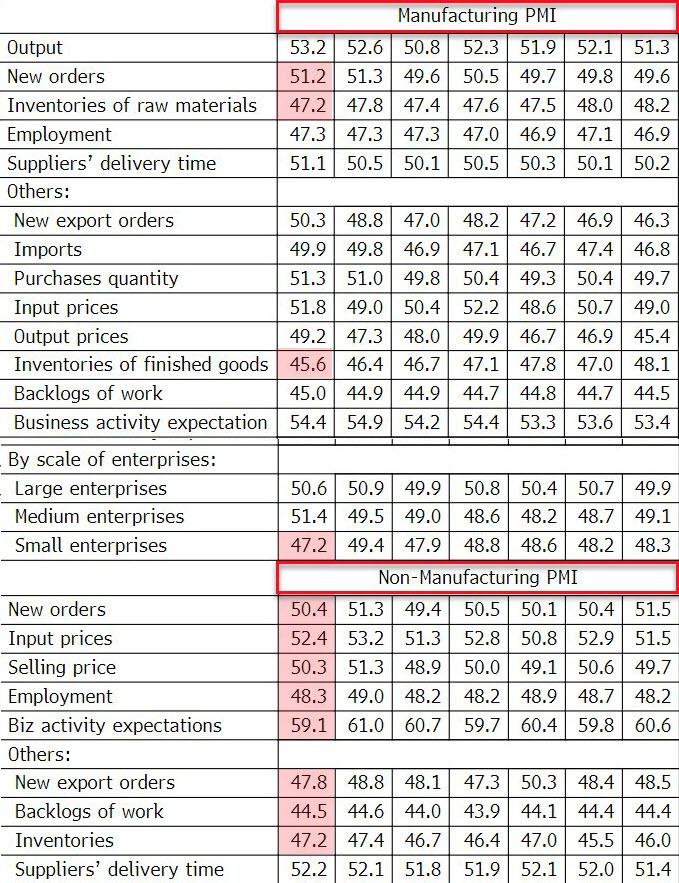

A mixed bag though with manufacturing PMI flat at 50.2 (better than the expected 50.1) and non-manufacturing PMI lower at 53.5 (from 54.4) and below expectations of 54.2.

Source: Bloomberg

New manufacturing orders picked up (the last time the reading was above 50 was May 2018), but the improvement in manufacturing was concentrated in large- and medium-sized enterprises with small enterprises plunging deeper into contraction (at 47.2).

New non-manufacturing orders slowed as prices (selling and buying fell), pushing employment further into contraction (48.3).

The slide in Services dragged the composite PMI for China overall lower (but still well above the rest of the major world economies)…

Source: Bloomberg

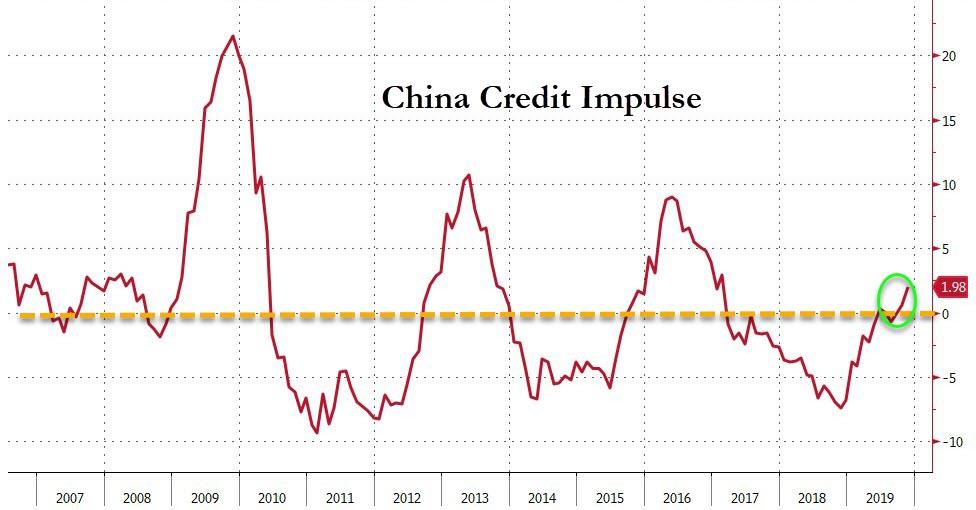

We wonder how long this re-excitement of hope about Chinese economic growth will last given the massive amount of stimulus has produced a very meager credit impulse…

Source: Bloomberg

“The potential de-escalation of China-U.S. trade tension, improved global manufacturing demand, inventory restocking driven by lessening demand headwinds, and accelerated infrastructure investment growth in China may continue to support a moderate cyclical recovery,” China International Capital Corp. economist Eva Yiwrote in a note.

“Gross domestic product growth in the fourth quarter may pick up on a sequential basis compared with the third quarter.”

The government is also reportedly rolling out a range of policies to support the economy in 2020.

Tyler Durden

Mon, 12/30/2019 – 20:11

via ZeroHedge News https://ift.tt/35cc3Qv Tyler Durden