Futures Slide On Last Day Of Stellar Year, Dollar Tumble Accelerates

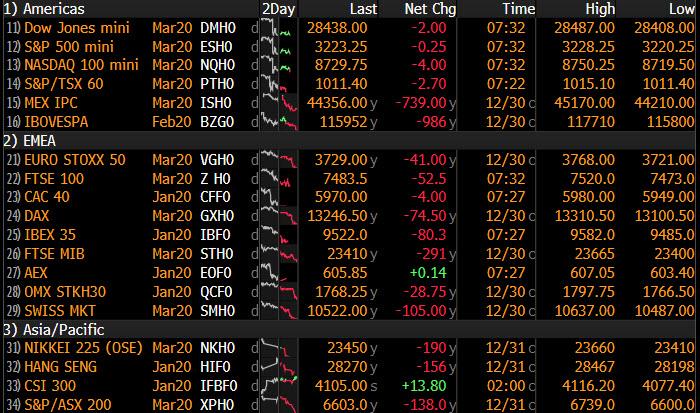

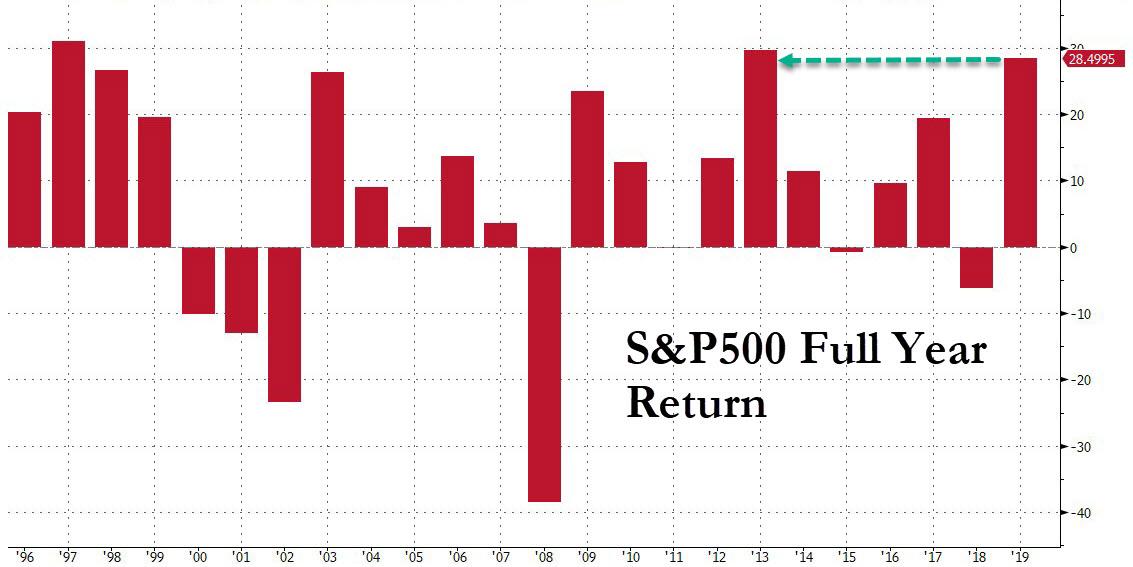

Global markets and US index futures dipped on the last day of the year after retreating from record highs in the previous session, as a spectacular Wall Street rally which saw the S&P return almost 29% in 2019 fizzled out in the final days of the decade.

Indeed, with a handful of major markets already shuttered and trading volumes dismal, the dominant moves on Tuesday reflected common investor expectations for 2020: caution that the remarkable rally of 2019 is now over and dollar weakness.

The market slide came despite the capitulation of even the staunchest trade hawks in Trump’s circle: on Monday, White House trade adviser Peter Navarro said the Phase 1 China-U.S. trade deal will likely be signed in the next week, hours after South China Morning Post reported that Chinese Vice Premier Liu He would travel to Washington this week. However, for once trade deal optimism failed to boost spirits, and Emini futures completely ignored Navarro’s comments to post their worst day in over four weeks. The benchmark S&P 500 closed Monday at its lowest level since Dec. 20, and the weakness continued on the last day of the year.

Still, despite Monday’s dip, the S&P 500 is still on track for its best year since 2013 and its best December in nine years, driven by a fresh burst of ultra loose monetary policy by the Federal Reserve and other central banks. The question for today is whether the S&P can rise 1.1% to post a 29.6% full year return: that would surpass the S&P’s annual performance of 2013 making it the best year for stocks since 1997.

European stocks were down modestly after paring an early selloff, and the Stoxx 600 was down -0.1% as of 2pm local time with many of the top European markets such as Germany, Switzerland and UK closed.

Earlier in the session, Asian stocks fell on the last trading day of 2019. Shares dropped in Australia and Hong Kong but gained in China. Hong Kong’s Hang Seng Index closed 0.5% lower, led by technology and basic materials stocks. Markets in Indonesia, Japan, the Philippines, South Korea and Thailand were closed for the year-end holiday. Australia, Hong Kong, New Zealand and Singapore closed early Tuesday.

As reported last night, the latest data from China showed manufacturing activity expanded for a second straight month in December, even as Services missed badly. The manufacturing PMI was flat at 50.2 (better than the expected 50.1) and non-manufacturing PMI lower at 53.5 (from 54.4) and below expectations of 54.2. New non-manufacturing orders slowed as prices (selling and buying fell), pushing employment further into contraction (48.3). The data aligns with other early signs of stabilization in the Asian economy, including last week’s figures that showed profits at China’s industrial firms grew at the fastest pace in eight months in November.

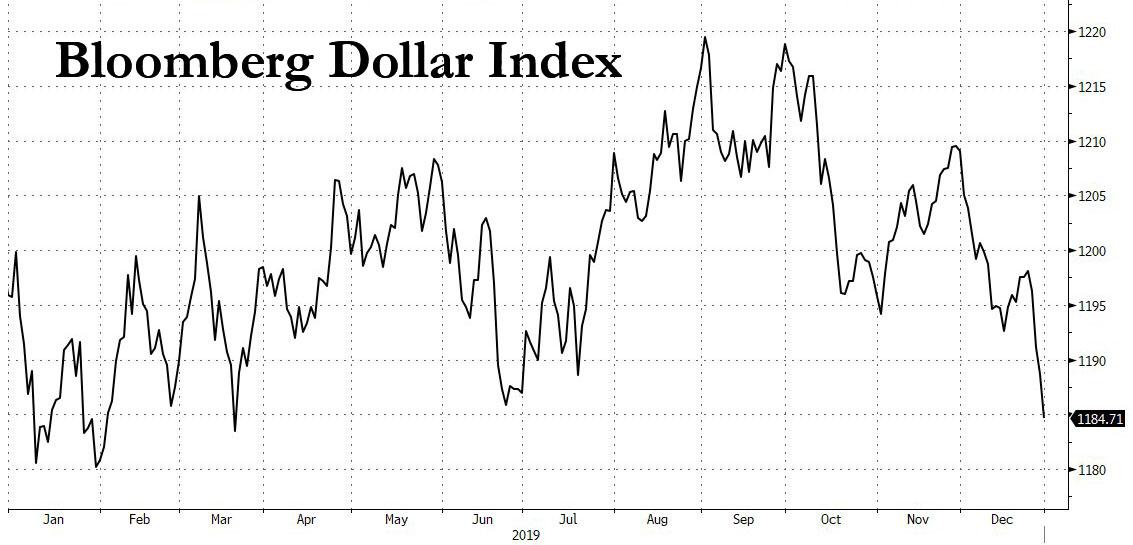

While trading in stocks remained subdued on the last day of the year, the same can not be said for currencies, where the dollar’s recent hammering accelerated. The Bloomberg Dollar index dropped to its lowest level since March, taking its losing streak to four days. As a result, the euro, the pound and a handful of trade-sensitive currencies rallied as the dollar slid to a six-month low on Tuesday, with investors confident that global growth prospects are improving and U.S.-China trade relations significantly better. The pound led G-10 gains to head for its best quarter since 2009; the Canadian dollar is the best G-10 performer this year.

After staying strong for much of 2019 thanks to the relative outperformance of the U.S. economy and investors’ preference for a safe-haven currency amid the trade dispute between Washington and Beijing, the dollar’s gains for the year have shrivelled in December. The buoyant end-of-year sentiment enocouraged investors to buy up currencies linked to trade and global growth, sending many such as the Australian dollar, Chinese yuan and Scandinavian crowns to multi-month or multi-week highs against the greenback.

The Taiwan dollar strengthened past 30 versus the greenback for the first time in 18 months. Meanwhile, as the dollar slumped, China’s yuan jumped offshore after Peter Navarro said Monday that a preliminary trade deal with Beijing is completed.

Analysts did not attribute the moves to any specific new developments: “I can’t see much reason for the movement in the FX market except end-year position squaring, or just being careful and cutting positions ahead of the New Year’s holiday and the start of 2020. As a result I wouldn’t draw any big conclusions from it,” said Marshal Gittler, currency analyst at ACLS Global.

As Bloomberg writes this morning, investors are sifting through outlooks for 2020 as a weakening dollar, stabilizing global economy and easing of U.S.-China trade tensions all set a different scene from just a few months ago. The lull across markets on Tuesday draws a line under a year of spectacular returns for many asset classes.

“Politics has to remain front and center for investors” in 2020, wrote JPM Asset Management strategist Hannah Anderson. “The U.S.-China trade war is far from resolved. Returns will depend on just how tolerant investors can be of their fears in a low growth world.”

In rates, the 10-year Treasury followed the dollar and also drifted lower, though it is on track to end the year yielding about 1.89%, down around 80 basis points from where it began; U.K. gilts steadied after Monday’s sell-off.

Meanwhile, West Texas oil futures declined following a report that Iran detained a fuel tanker. Gold rose, headed for its biggest annual advance since 2010.

Looking ahead, economic data include home prices, consumer confidence. Most global markets will be closed on Jan. 1. U.S. fixed-income markets also close early at 2 p.m. EST Tuesday.

Market Snapshot

- S&P 500 futures up 0.1% to 3,226.00

- STOXX Europe 600 down 0.04% to 416.00

- MXAP down 0.2% to 170.78

- MXAPJ down 0.4% to 553.12

- Nikkei down 0.8% to 23,656.62

- Topix down 0.7% to 1,721.36

- Hang Seng Index down 0.5% to 28,189.75

- Shanghai Composite up 0.3% to 3,050.12

- Sensex down 0.6% to 41,296.86

- Australia S&P/ASX 200 down 1.8% to 6,684.10

- Kospi down 0.3% to 2,197.67

- German 10Y yield rose 7.1 bps to -0.185%

- Euro up 0.1% to $1.1214

- Brent Futures up 0.1% to $66.74/bbl

- Italian 10Y yield rose 3.8 bps to 1.241%

- Spanish 10Y yield rose 5.9 bps to 0.468%

- Brent Futures up 0.1% to $66.74/bbl

- Gold spot up 0.5% to $1,523.39

- U.S. Dollar Index down 0.1% to 96.61

Top Overnight News from Bloomberg

- China’s manufacturing output continued to expand in December, adding to evidence that the economy is stabilizing. The manufacturing purchasing managers’ index remained at 50.2, according to data released Tuesday

- Chinese President Xi Jinping is expected to deliver his annual New Year’s Eve address amid mounting pressure at home and abroad on issues from economic slowdown to protests against Beijing’s rule in Hong Kong and a looming “phase one” trade deal with the U.S.

- As Japan enters a six-day New Year break, a sense of anxiety over the possibility of another flash crash is gripping currency traders. The Financial Futures Association of Japan has already warned of market instability as the holidays create a liquidity vacuum

- European gas and power prices extended declines after a last-gasp Russia-Ukraine accord on natural gas flows averted a winter supply crisis

- Carlos Ghosn, the former head of Nissan Motor Co. and Renault SA facing trial in Japan for financial crimes, fled to Lebanon to escape what he described as a “rigged Japanese justice system.” Lebanon, where he grew up and has citizenship, has no extradition agreement with Japan

Top Asian News

- India Curbs Year-End Spending by Ministries Amid Fiscal Worries

- Billionaire Hinduja Brothers Said to Prepare Bid For Jet Air

- China Set to Approve Local GMO Corn to Boost Food Security

- Acme International Slumps 80% Within an Hour in Hong Kong

Top European News

- French Strikes May Be Starting to Fade as Train Crews Return

- Italy Bank Rescues Keep Coming With Bailout Set for Bari Lender

- European Gas Prices Fall as Ukraine, Russia Deal Averts Crisis

- Turkish Stocks Extend Winning Streak to End Best Year Since 2017

In currencies, the Bloomberg Dollar Spot Index declined 0.3%. The British pound increased 0.7%. The euro advanced 0.3% to $1.123. The Japanese yen gained 0.3% to 108.53 per dollar. The offshore yuan climbed 0.3% to 6.965 per dollar.

In commodities, West Texas Intermediate crude declined 0.7% to $61.24 a barrel. Gold increased 0.6% to $1,523.70 an ounce.

Tyler Durden

Tue, 12/31/2019 – 08:13

via ZeroHedge News https://ift.tt/2ZJ6PdJ Tyler Durden