Gold: How High In 2020?

Authored by Mike Shedlock via MishTalk,

Gold broke out of a six year consolidation. Things look up in 2020.

Gold Monthly Chart 2004-Present

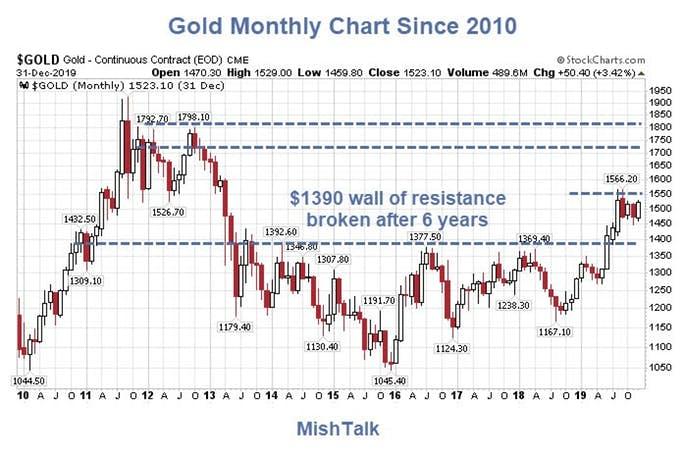

Gold Monthly Chart 2010-Present

Smart Money Shorts

I ignore short-term COT “smart money” warnings although I would prefer there to be fewer bulls.

For discussion of “smart money“, please see Investigating Alleged Smart Money Positions in Gold.

Pater Tenebrarum at the Acting Man blog pinged me with this idea: The only caveat remains the large net speculative long position, but at the moment this strikes me almost as a “bear hook” that is keeping people on the sidelines waiting for the “inevitable” pullback while the train is leaving the station.

With the 6-year consolidation over, there is every reason fundamentally and technically for gold to continue up.

So, be my guest if you want to time gold to COT positions.

Technically Speaking

Technically, there is short-term monthly resistance between here and $1566. Perhaps there’s a pullback now, but with technical and fundamentals otherwise aligned why bet on it?

The next technical resistance area is the $1700 to $1800 area so any move above $1566 is likely to be a fast, strong one, perhaps with a retest of the $1566 area from above that.

Gold Fundamentals

Gold fundamentals are in excellent shape as I noted in How Does Gold React to Interest Rate Policy?

Much of the alleged “fundamentals” are noise, not fundamental price factors.

Not Fundamentally Important

- Mine supply

- Central Bank Buying

- ETF analysis

- The ever popular jewelry buying in India discussion

Aso, gold does not follow the dollar except superficially and in short-term time frames.

Gold vs the Dollar

Many people believe gold reacts primarily to changes in the US dollar.

Last week, I rebutted than notion in Gold’s vs the US Dollar: Correlation Is Not What Most Think.

True Supply of Gold and Reservation Demand

It is important to note that nearly every ounce of gold ever mined is still in existence. A small fraction of that mined gold has been lost, and other small fractions sit in priceless statues in museums etc., and is thus not available for sale.

Otherwise, someone has to hold every ounce of gold ever mined, 100% of the time. That is the true supply. Jewelry buying and mine output are insignificant in comparison. We are not about to run out of gold as some gold shills suggest.

Mises refers to the desire to hold gold as “Reservation Demand“, that is the desire of people to hold their gold coins, bullion, bars, and jewelry rather than trading it for something else.

If we strike out jewelry buying, central bank buying, the dollar, and mine supply, what then determines “Reservation Demand” to own gold vs some other asset?

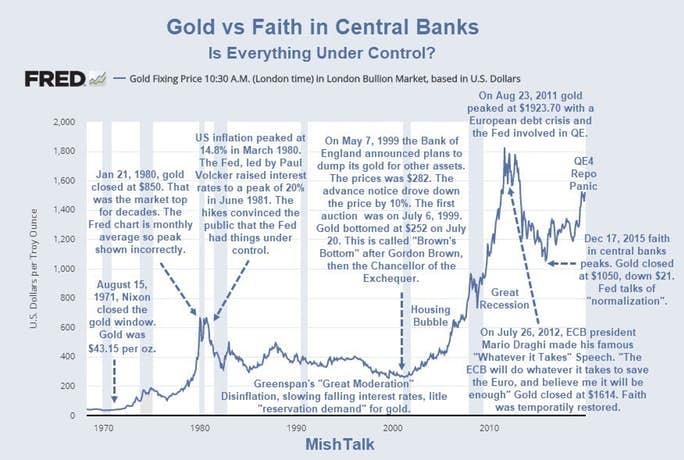

Faith in Central Banks

Talk of normalization was nonsense, as were various “Dot Plots” that suggested the Fed was on a major hiking cycle.

For an amusing chart of where the Fed projected interest rates would be in 2020, please see Dot Plot Fantasyland Projections.

The market did not believe the Fed, neither did I, and neither did gold.

Once again we are back to my central gold theme question.

Is everything under control or not?

Tyler Durden

Thu, 01/02/2020 – 15:10

via ZeroHedge News https://ift.tt/37srVQg Tyler Durden