Stocks, Bonds, Silver, & The Dollar All Soar As 2020 Starts

Overheard in Apple’s corporate treasury office…

Chinese stocks were up on the first day of 2020…

Source: Bloomberg

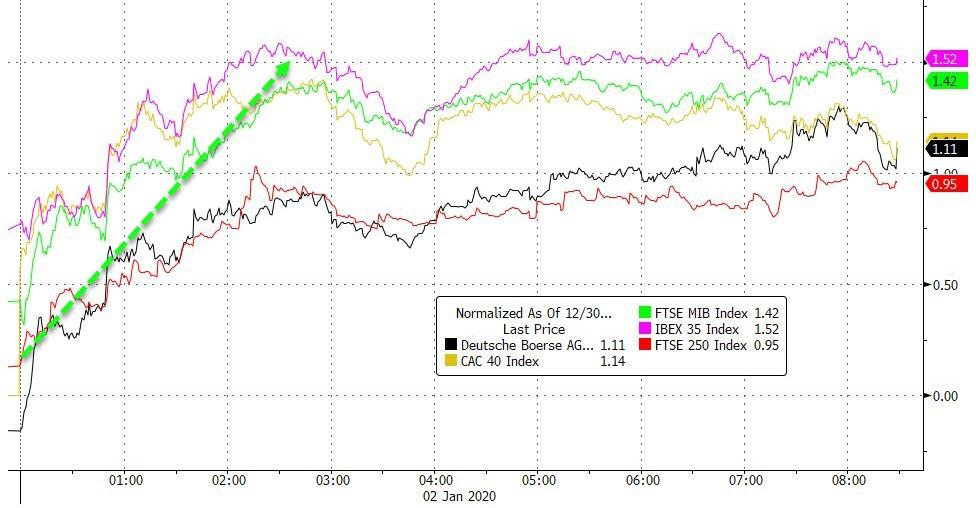

European markets were also all higher today…

Source: Bloomberg

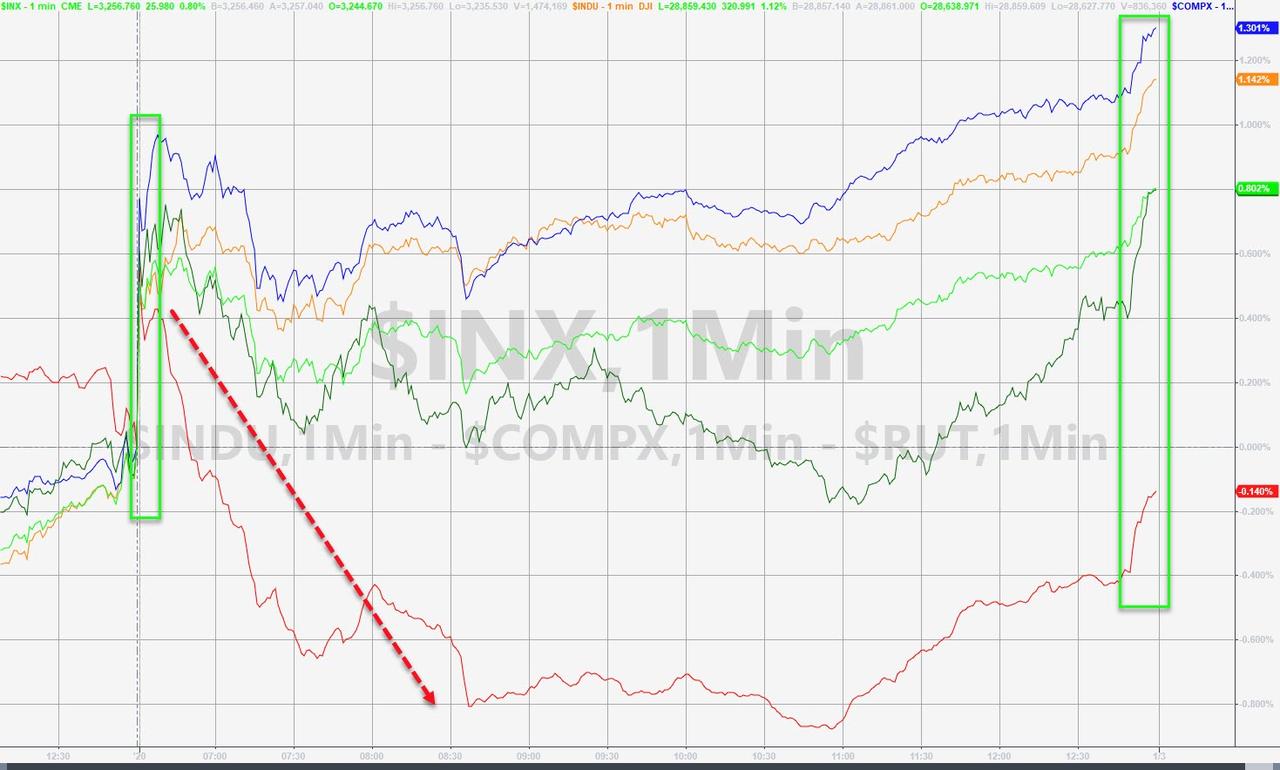

And while most of the US major equity indices were higher, Small Caps notably underperformed…

Nasdaq was back above 9,000 and the S&P spiked back above 3250 (the massive gamma level)…

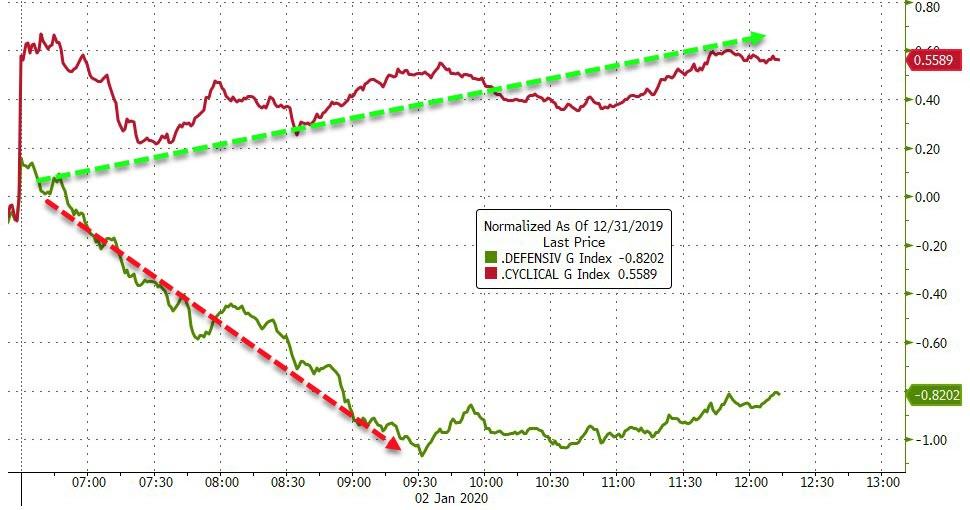

Defensives were discarded in favor of cyclicals…

Source: Bloomberg

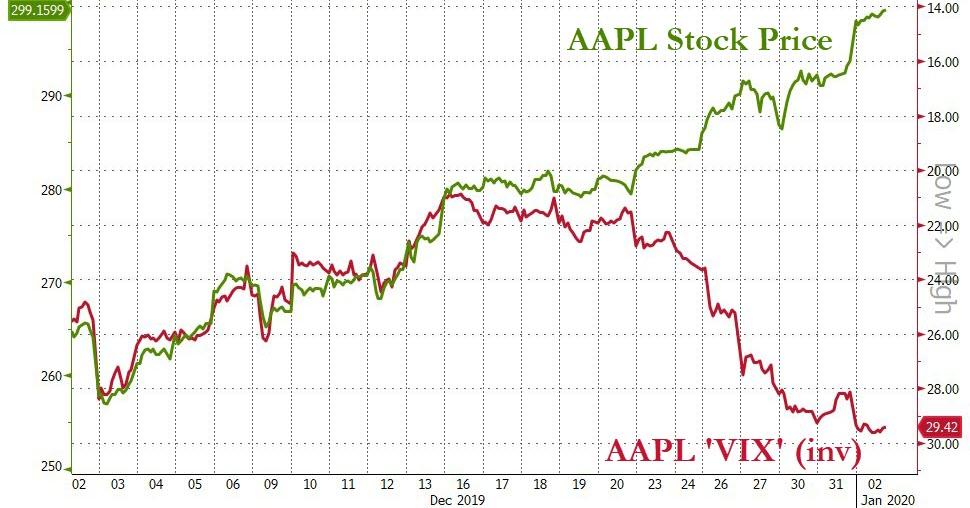

AAPL kept on doing what it does – rallying 2% today above $300…

…to its most overbought since Sept 2018…AAPL added more market cap today that all of Twitter’s market cap.

Source: Bloomberg

With AAPL’s vol completely decoupling (is everyone now buying AAPL calls?)

Source: Bloomberg

VIX began to recouple with stocks today…

Source: Bloomberg

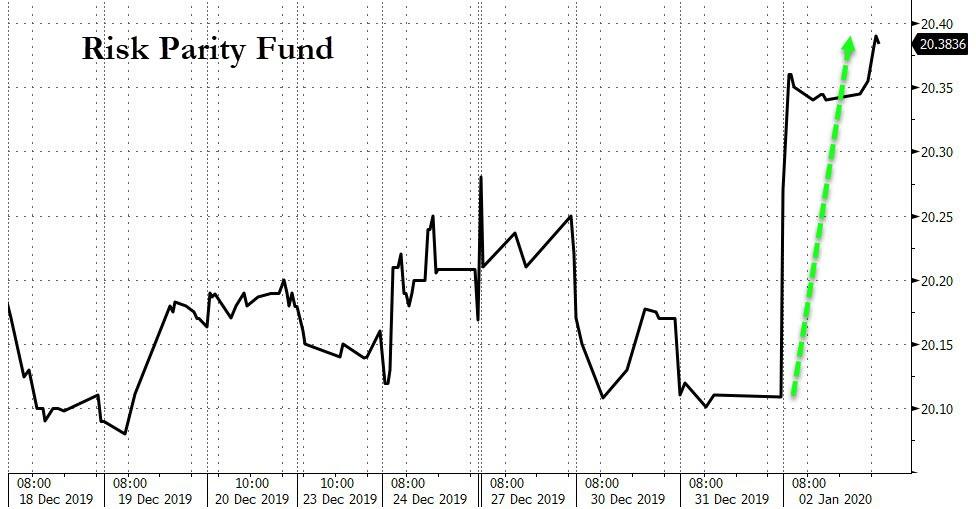

So VIX was slammed and stocks and bonds bid… smells like Risk-Parity reallocations… and sure enough…

Source: Bloomberg

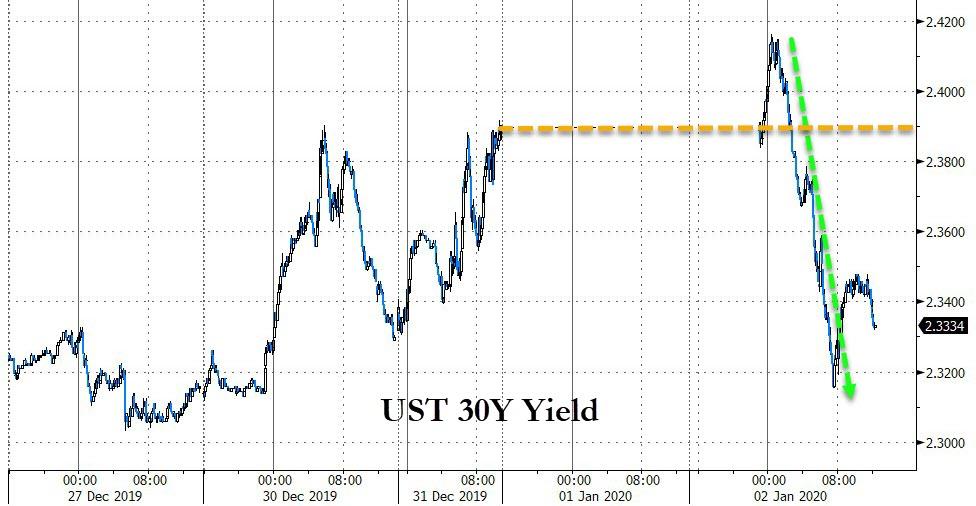

Treasury yields were a little mixed today with the short-end unchanged and long-end yields tumbling most in a month today

Source: Bloomberg

30Y Yields fell 10bps from overnight highs!!!

Source: Bloomberg

Flattening the yield curve dramatically…

Source: Bloomberg

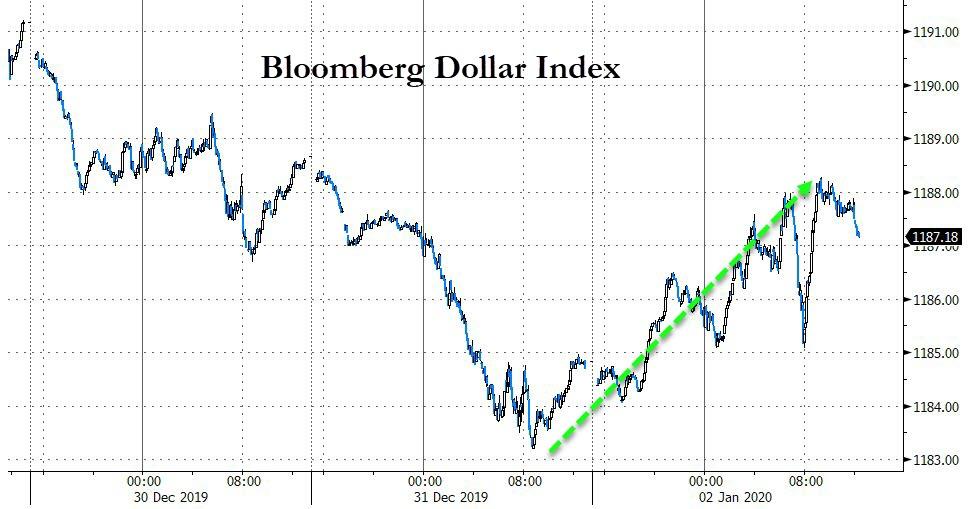

The Dollar was also bid today – rallying most in two months…

Source: Bloomberg

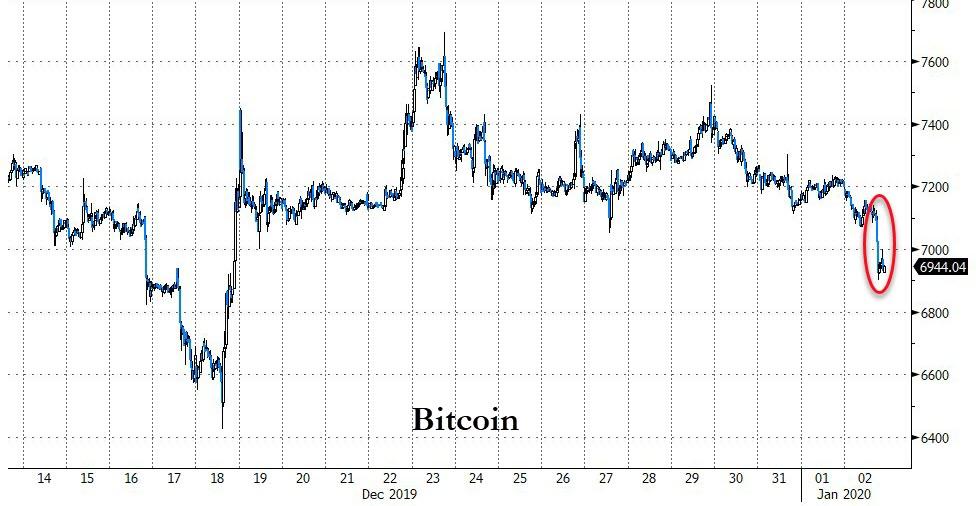

Cryptos legged lower again to start the year…

Source: Bloomberg

Bitcoin fell back below $7,000…

Source: Bloomberg

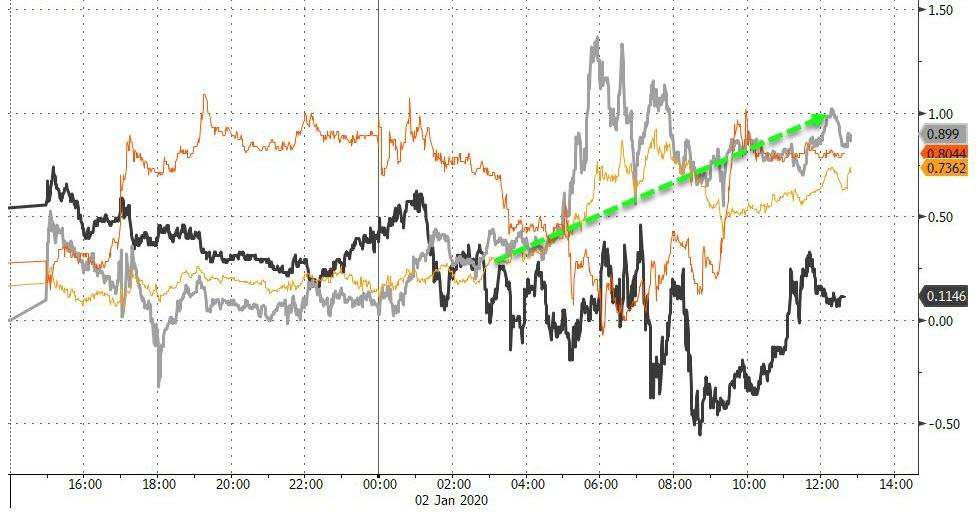

Silver outperformed on the day (despite a strong dollar) while oil lagged – despite China stimulus…

Source: Bloomberg

Gold extended gains…

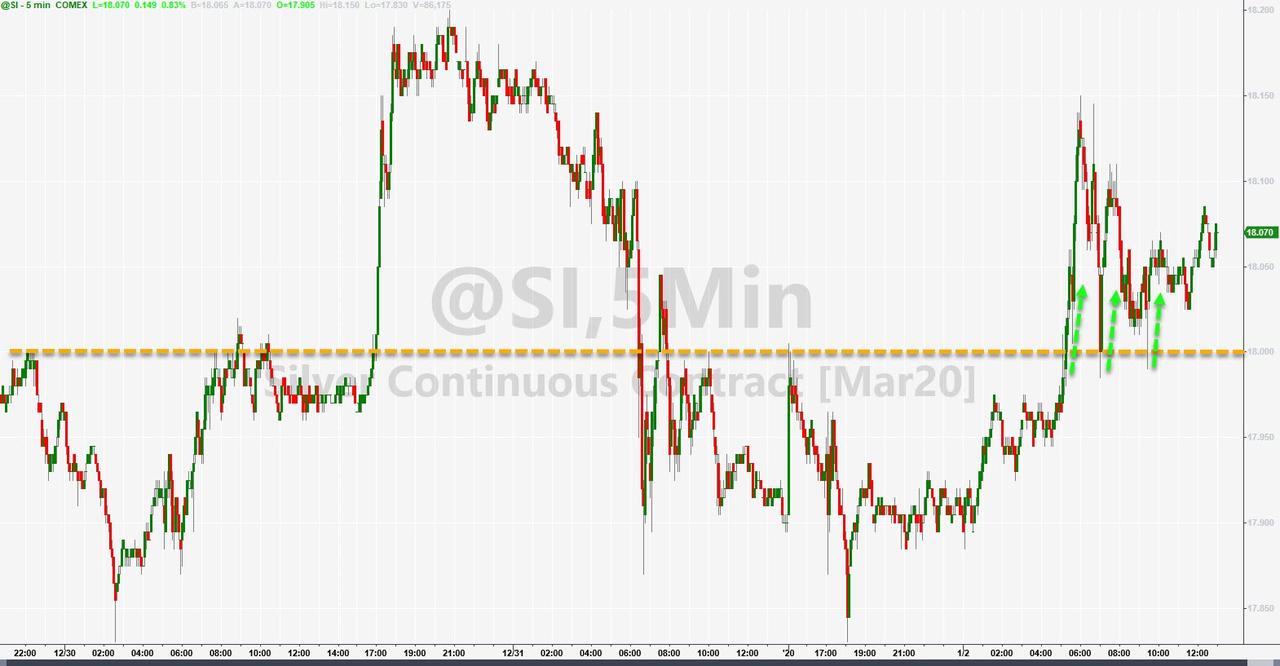

Silver continued to find support at $18…

Finally, the market has never, ever been more complacent…

And the market has never, ever been more highly priced. The last time that the S&P 500’s price-to-sales (far harder to manipulate that P/E) was March 2000 (right before the dotcom collapse) and late Jan 2018 (right before VIXmageddon)…

Source: Bloomberg

And the stock market has never, ever been more decoupled from actual (un-faked) earnings…

Source: Bloomberg

And here’s what happened the last time that The Fed piled billions of special liquidity into the market to support uncertainty (during Y2K)…

Source: Bloomberg

Tyler Durden

Thu, 01/02/2020 – 16:00

via ZeroHedge News https://ift.tt/36klm2a Tyler Durden