Even More Colleges Are Now Taking Equity Stakes In Their Students As Tuition

The trend of colleges foregoing traditional tuition in favor of now taking an “equity stake” in their graduates looks like it is catching on.

The idea was first floated by Milton Friedman back in 1955, who suggested an incoming sharing agreement between the universities and the graduates once they enter the work force and begin to earn a regular salary. This obviously shifts much of the liability to make “workforce ready” graduates to the institution.

The Wall Street Journal recently profiled 27 year old Alex Ross, who took advantage of General Assembly coding school’s $14,700 design boot camp. She hasn’t been able to find work yet, but that’s not bothering her, as she took advantage of General Assembly’s income-share-agreement program, which requires her to make monthly payments of 10% of her paycheck for 48 months – but only after she lands a job paying $40,000 per year or more.

No matter how much she earns, her payback won’t exceed a $22,000 cap.

Ross said: “I considered taking out a loan, but didn’t want to start making payments right away. I didn’t want the pressure before I was employed full-time.”

Tonio DeSorrento, co-founder and CEO of Vemo Education, a company that helps schools design and implement income sharing programs, said: “It’s not the best thing for everyone, every time. But the fact that the school stands behind its product serves as proof it offers value.”

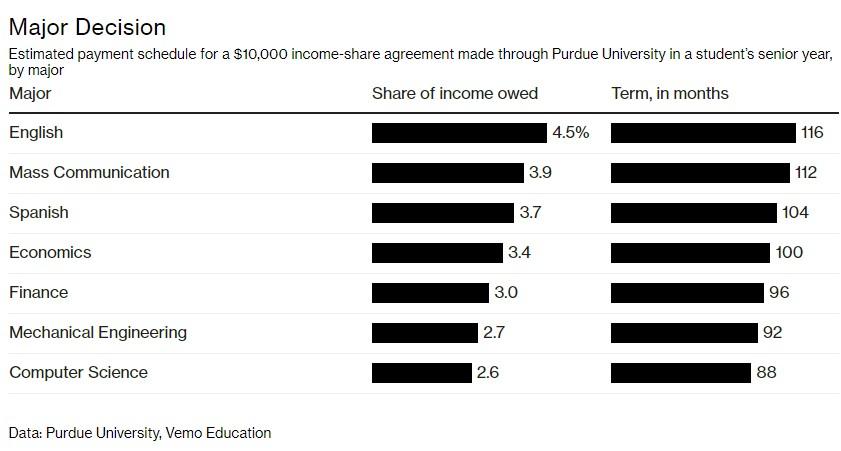

There’s now more than 60 universities that offer ISAs nationwide, including Purdue and the University of Utah. In the New York City metropolitan area, there is the Flatiron School and Holberton School, in addition to General Assembly.

Why might this process be working out so well, aside from its “free market” thinking? There’s been no federal laws defining or regulating ISAs, and terms vary widely. A typical university takes 2% to 10% of a graduate’s income for the first 5 to 10 years after graduation, starting as soon as the graduate lands a job paying at least $20,000 to $30,000.

Total payback is often capped at 110% to 120% of the amount borrowed.

Coding boot camps, like the one attended by Ross, mostly offer accelerated terms.

…a graduate typically pays 10% to 15% of their income for the first three to five years after graduating, starting as soon as the person lands a job paying at least $40,000 to $50,000. Total payments are typically capped at 1.5 to 2 times the amount fronted.

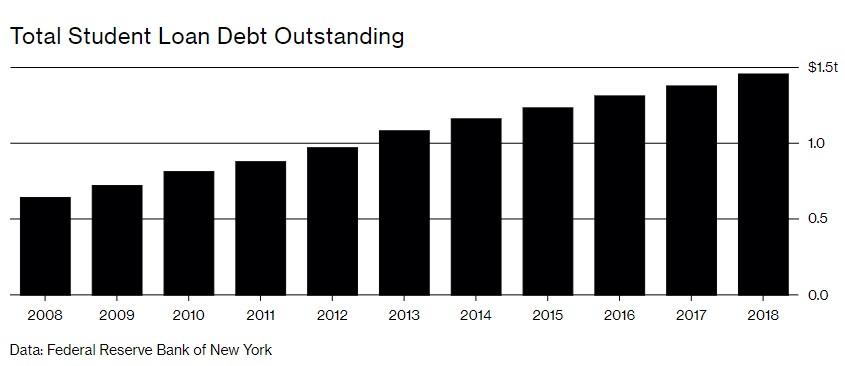

Whether an ISA costs more than a traditional student loan depends on how much the graduate earns.

For example:

…a student graduating with a traditional 10-year, $10,000 student loan with a 7.5% interest rate would make monthly payments of $117 until he or she paid off the loan. The payments would total $14,090.

Graduates with an ISA for the same amount could wind up paying back anything from $0—if they never land a good-paying job—to $20,000 if they obtain a job earning $100,000 a year.

“The lowest earners pay the least. It’s very progressive that way,” Mr. DeSorrento said.

And there have already been success stories, like Jane Zhu. Five months into a 10 month program from Pursuit coding school, she was applying to jobs. After finishing the program, she had a “near six figure job” already lined up as a junior software engineer. She pays back $900 a month and, while it’s a “squeeze” with two kids, she says it’s manageable and it’s “only for 3 years”.

Recall, we first wrote about this trend back in April 2019. Shortly after we wrote about an online software engineering school that was allowing students to pay their tuition by forfeiting 17% of their income after they graduated, we wrote about how the new method for funding college was starting to make its way to the mainstream.

Oh and, by the way – paging Neel Kashkari and Paul Krugman – if Friedman is right about this tuition model – what else do you think he could have been right about?

Tyler Durden

Thu, 01/02/2020 – 22:25

via ZeroHedge News https://ift.tt/2QJg9dp Tyler Durden