Gundlach’s 2020 “Just Markets” Predictions: Live Webcast

Today at 4:15pm ET Doubleline founder Jeff Gundlach will host his traditional year ahead forecast titled “Just Markets” and which can be accessed by clicking on the slide below (or clicking here). While there is no fixed topic, Gundlach is expected to comment on the usual array of topics, from his outlook for the economy and market, to his take on gold and commodities, to his growing concern about the soaring budget deficit. Always a political activist, expect Gundlach to also share his latest view on who will win this year’s U.S. presidential election.

Today’s webcast follows almost exactly one year after Gundlach offered a mostly cautious outlook in January 2019 following what he called “the year no one made money” and which preceded a year in which virtually everyone made money, thanks to central banks.

So as we wait for Gundlach to begin, courtesy of Bloomberg, Here’s what Gundlach predicted a year ago and what happened.

Emerging Markets

- What he said: After years of under-performance, this is a good time to invest in emerging market equities “relativistically.”

- What happened: The MSCI Emerging Markets Index returned 19% last year, compared with 27% for the MSCI All World Index and 31% for the S&P 500 Index.

Europe

- What he said: The stocks are “a value trap.”

- What happened: The Euro Stoxx 50 returned 27% in dollar terms, the most since 2013. London’s FTSE 100 added 17% in local currency and 22% in dollar terms.

Dollar

- What he said: If the Fed becomes less hawkish, the dollar would probably weaken.

- What happened: The dollar hit its lowest point of 2019 on Jan. 9. The Fed went on to cut interest rates three times and the dollar index ended December little changed from where it started 2019.

Oil and Commodities

- What he said: There could be a zigzag pattern in energy prices and commodities.

- What happened: The Bloomberg commodities index zigzagged to a 5.4% gain in 2019. Oil prices climbed 34%, and they rallied early in 2020 as U.S.-Iran tensions flared.

Credit

- What he said: Get out of junk bonds while prices are strong and watch out for potential downgrades of investment-grade debt.

- What happened: Junk had its best year since 2016 while investment-grade debt gained the most since 2009, according to Bloomberg Barclays indexes.

Crypto

- What he said: Bitcoin, trading at the time for about $4,000, could easily make it to $5,000 though it isn’t for the “faint of heart.”

- What happened: Bitcoin reached high of $13,851 in June before bouncing down to almost $7,200 at year-end.

* * *

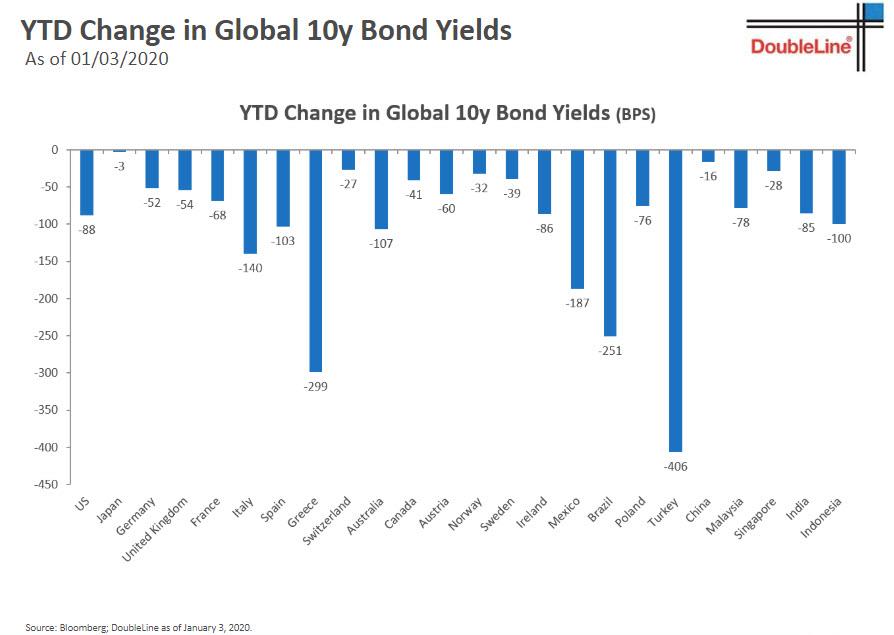

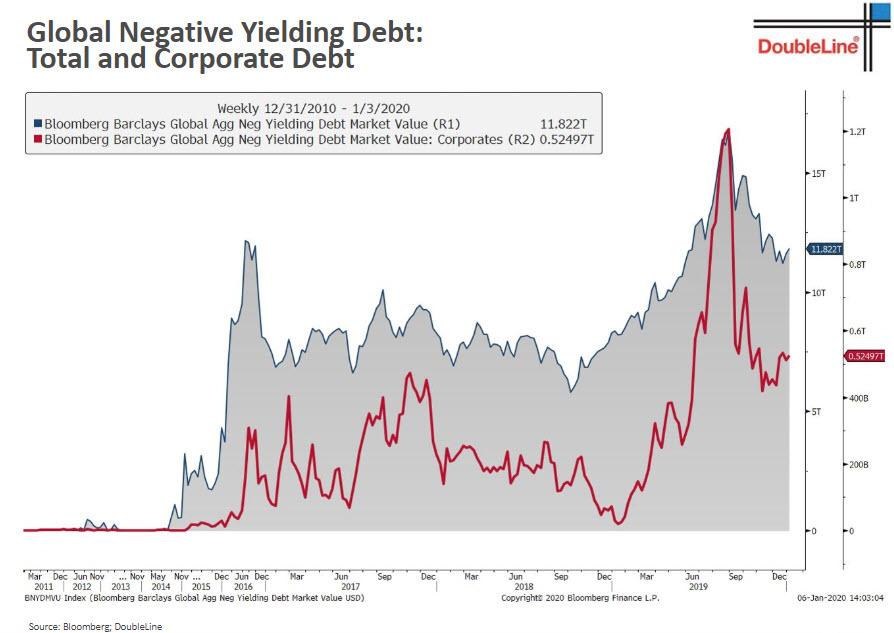

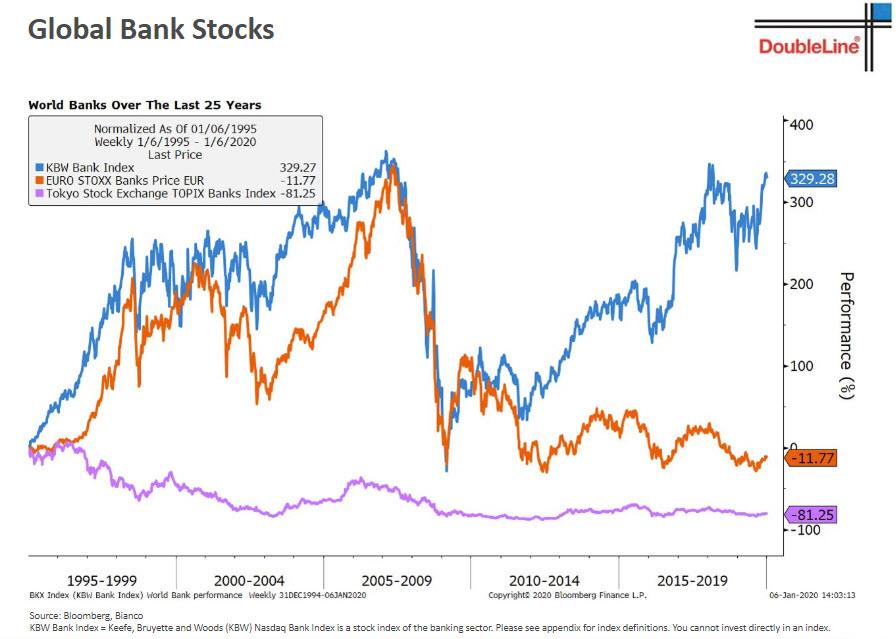

We will post the slides from today’s presentation as soon as we have them, until then here are some of the charts in his latest presentation.

Tyler Durden

Tue, 01/07/2020 – 16:17

via ZeroHedge News https://ift.tt/39JL7uZ Tyler Durden