Finance Professors: Buybacks Done As Open-Market Repurchases Should Be Banned

Authored by William Lazonick, Mustafa Erdem Sakinç, and Matt Hopkins via Harvward Business Review,

Even as the United States continues to experience its longest economic expansion since World War II, concern is growing that soaring corporate debt will make the economy susceptible to a contraction that could get out of control.

The root cause of this concern is the trillions of dollars that major U.S. corporations have spent on open-market repurchases — aka “stock buybacks” — since the financial crisis a decade ago. In 2018 alone, with corporate profits bolstered by the Tax Cuts and Jobs Act of 2017, companies in the S&P 500 Index did a combined $806 billion in buybacks, about $200 billion more than the previous record set in 2007. The $370 billion in repurchases which these companies did in the first half of 2019 is on pace for total annual buybacks that are second only to 2018. When companies do these buybacks, they deprive themselves of the liquidity that might help them cope when sales and profits decline in an economic downturn.

Making matters worse, the proportion of buybacks funded by corporate bonds reached as high as 30% in both 2016 and 2017, according to JPMorgan Chase. The International Monetary Fund’s Global Financial Stability Report, issued in October, highlights “debt-funded payouts” as a form of financial risk-taking by U.S. companies that “can considerably weaken a firm’s credit quality.”

It can make sense for a company to leverage retained earnings with debt to finance investment in productive capabilities that may eventually yield product revenues and corporate profits. Taking on debt to finance buybacks, however, is bad management, given that no revenue-generating investments are made that can allow the company to pay off the debt. In addition to plant and equipment, a company needs to invest in expanding the knowledge and skills of its employees, and it needs to reward them for their contributions to the company’s productivity. These investments in the company’s knowledge base fuel innovations in products and processes that enable it to gain and sustain an advantage over other firms in its industry.

The investment in the knowledge base that makes a company competitive goes far beyond R&D expenditures. In fact, in 2018, only 43% of companies in the S&P 500 Index recorded any R&D expenses, with just 38 companies accounting for 75% of the R&D spending of all 500 companies. Whether or not a firm spends on R&D, all companies have to invest broadly and deeply in the productive capabilities of their employees in order to remain competitive in global markets.

Stock buybacks made as open-market repurchases make no contribution to the productive capabilities of the firm. Indeed, these distributions to shareholders, which generally come on top of dividends, disrupt the growth dynamic that links the productivity and pay of the labor force. The results are increased income inequity, employment instability, and anemic productivity.

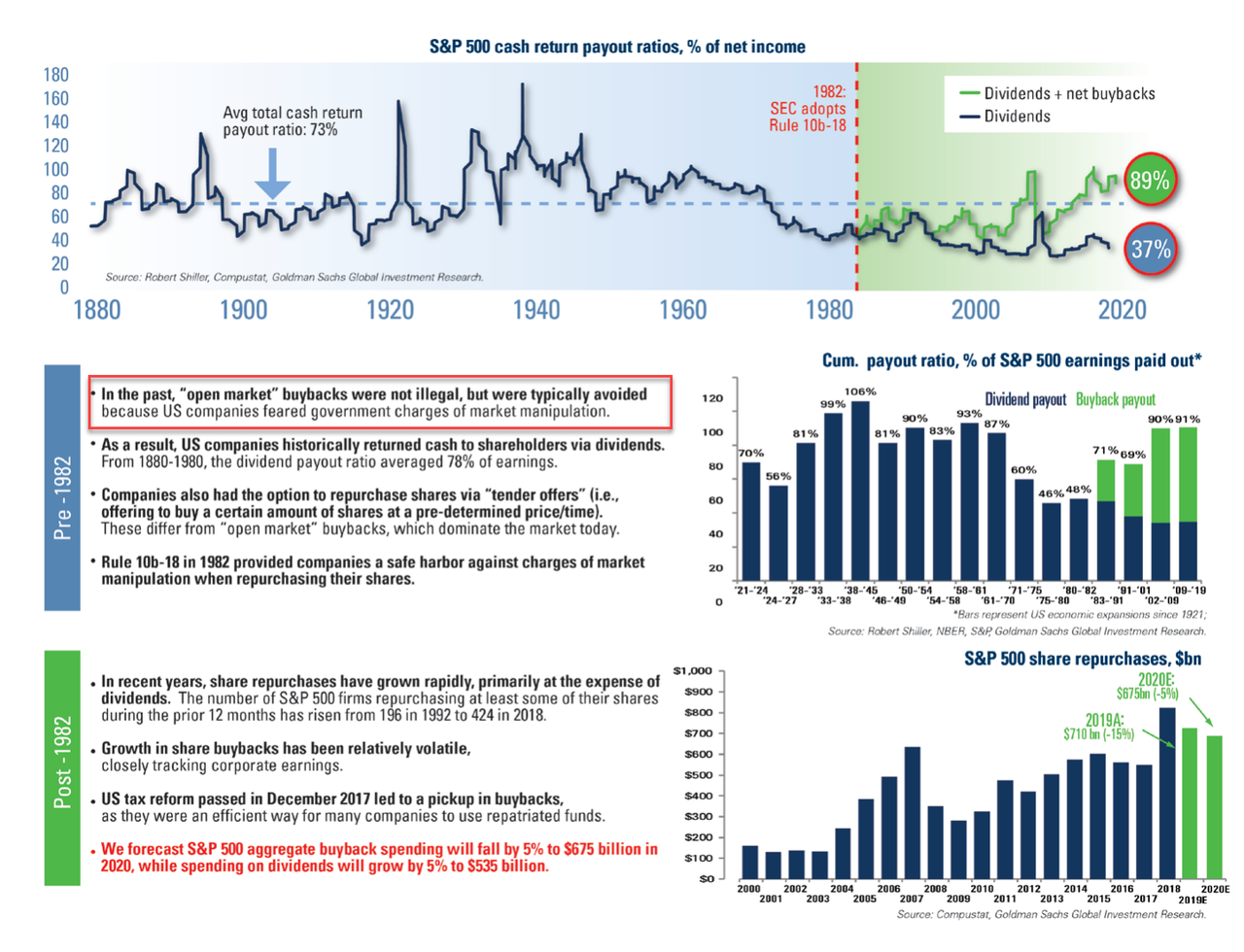

Buybacks’ drain on corporate treasuries has been massive. The 465 companies in the S&P 500 Index in January 2019 that were publicly listed between 2009 and 2018 spent, over that decade, $4.3 trillion on buybacks, equal to 52% of net income, and another $3.3 trillion on dividends, an additional 39% of net income. In 2018 alone, even with after-tax profits at record levels because of the Republican tax cuts, buybacks by S&P 500 companies reached an astounding 68% of net income, with dividends absorbing another 41%.

Why have U.S. companies done these massive buybacks?

With the majority of their compensation coming from stock options and stock awards, senior corporate executives have used open-market repurchases to manipulate their companies’ stock prices to their own benefit and that of others who are in the business of timing the buying and selling of publicly listed shares. Buybacks enrich these opportunistic share sellers — investment bankers and hedge-fund managers as well as senior corporate executives — at the expense of employees, as well as continuing shareholders.

In contrast to buybacks, dividends provide a yield to all shareholders for, as the name says, holding shares. Excessive dividend payouts, however, can undercut investment in productive capabilities in the same way that buybacks can. Those intent on holding a company’s shares should therefore want it to restrict dividend payments to amounts that do not impair reinvestment in the capabilities necessary to sustain the corporation as a going concern. With the company plowing back profits into well-managed productive investments, its shareholders should be able to reap capital gains if and when they decide to sell their shares.

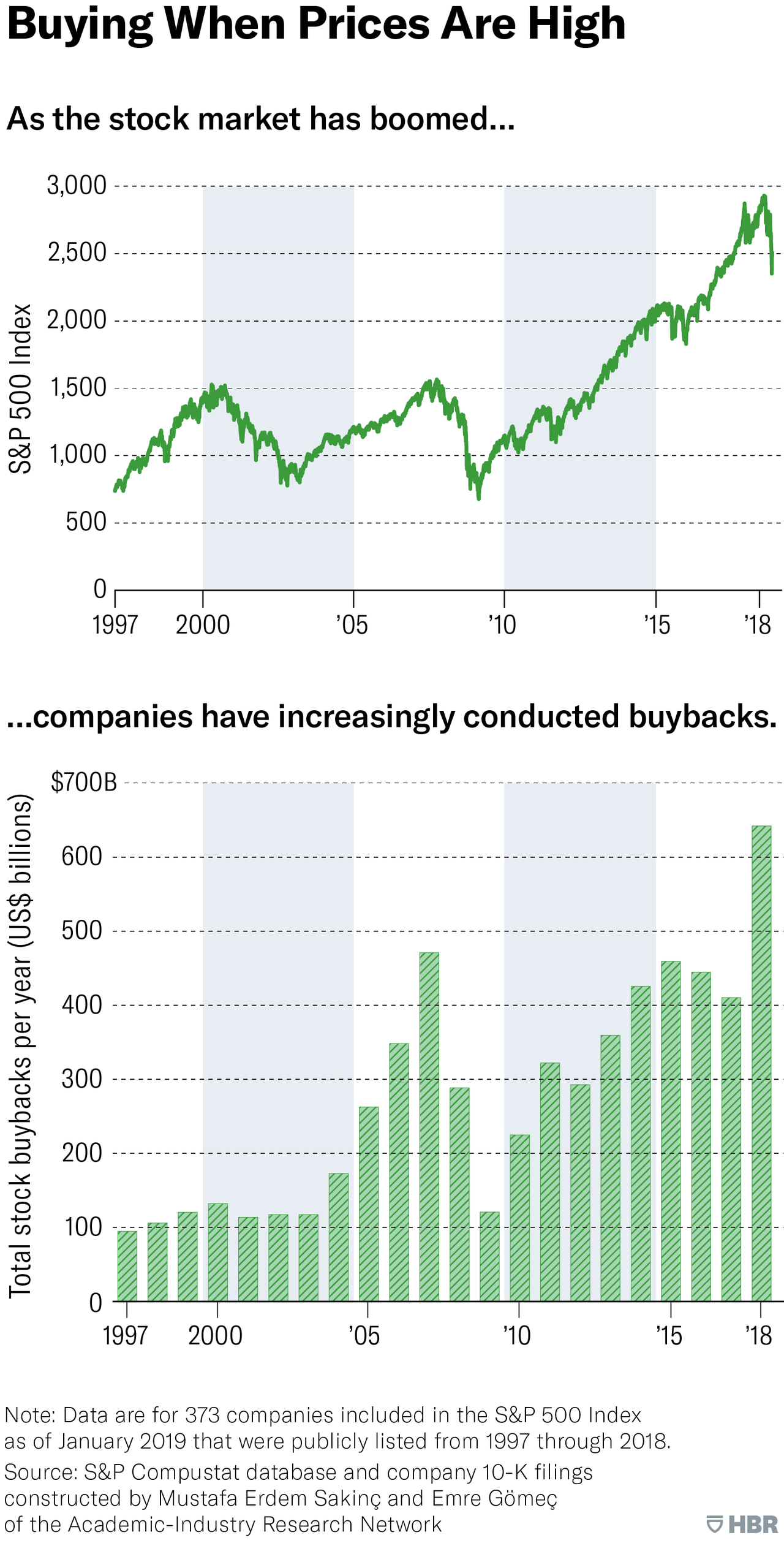

Stock buybacks done as open-market repurchases emerged as a major use of corporate funds in the mid-1980s after the Securities and Exchange Commission adopted Rule 10b-18, which gives corporate executives a safe harbor against stock-price manipulation charges that otherwise might have applied. As a mode of distributing corporate cash to shareholders, buybacks surpassed dividends in 1997, helping to elevate stock prices in the internet boom. Since then, buybacks, which are much more volatile than dividends, have dominated distributions to shareholders when the stock market is booming, as companies have repurchased stock at high prices in a competition to boost their share prices even more. As shown in the exhibit “Buying When Prices Are High,” major companies have continued to do buybacks in boom periods when stock prices have been high, rendering these businesses more financially fragile in subsequent downturns when abundant profits disappear.

JPMorgan Chase has constructed a time series for 1997 through 2018 that estimates the percentage of buybacks by S&P 500 companies that have been debt-financed, increasing the financial fragility of companies. In general, the percentage of buybacks that have been funded by borrowed money has been far higher in stock-market booms than in busts, as companies have competed with one another to boost their stock prices.

In 2018, however, as stock buybacks by companies in the S&P 500 Index spiked to more than $800 billion for the year, the proportion that were financed by debt plunged to about 14% in the last quarter. Why was there a sharp decline in 2018, when the dollar volume of buybacks far surpassed the previous peak years of 2007, 2014, and 2015?

The answer is clear: Corporate tax breaks contained in the Tax Cuts and Jobs Act of 2017 provided the corporate cash for the vastly increased level of buybacks in 2018. First, there was a permanent cut from 35% to 21% in the tax rate on corporate profits earned in the United States. Second, going forward, the 2017 law permanently freed foreign profits of U.S.-based corporations from U.S. taxation (Under the Act, the U.S. Treasury has been reclaiming some tax revenue lost because of a tax concession dating back to 1960 that had enabled U.S.-based corporations to defer payment of U.S. taxes on their foreign profits until repatriating them).

In 2018 compared with 2017, corporate tax revenues declined to $205 billion from $297 billion, hypothetically increasing the financial capacity of U.S.-based corporations to do as much as $92 billion more in buybacks in 2018 without taking on debt. Given that from 2017 to 2018 stock buybacks by S&P 500 companies increased by $287 billion (from $519 billion to $806 billion), the reality is that, through the corporate tax cuts, the federal government essentially funded $92 billion in buybacks by issuing debt and printing money to replace the lost corporate tax revenues.

Since the total federal government deficit increased by $114 billion (from $665 billion in 2017 to $779 billion in 2018), we can (again hypothetically) think of $92 billion of this additional government debt as taxpaying households’ gift to business corporations to enable them to do even more buybacks debt-free, shifting the debt burden of stock buybacks from corporations to taxpayers. If, as a “transfer payment,” we add $92 billion to the $150 billion in debt that, according to the JPMorgan data, S&P 500 companies used to fund buybacks in 2018, the percentage of their 2018 buybacks that were debt-financed rises to 30%, greater than the proportion of 29% for 2017. But because of corporate tax cuts, in 2018 taxpaying households were burdened with about 38% of the combined government and business debt that enabled corporations to do buybacks.

Whether it is corporate debt or government debt that funds additional buybacks, it is the underlying problem of the corporate obsession with stock-price performance that makes U.S. households more vulnerable to the boom-and-bust economy. Debt-financed buybacks reinforce financial fragility. But it is stock buybacks, however funded, that undermine the quest for equitable and stable economic growth.

Buybacks done as open-market repurchases should be banned.

Tyler Durden

Tue, 01/07/2020 – 21:00

via ZeroHedge News https://ift.tt/37EIiJA Tyler Durden