Fed Leaves Rates Unch, Extends Repo Bailout Facility, Downgrades Consumer Health

Since the last FOMC meeting on Dec 11th, a lot has happened:

- World War 3 fears after US killing Soleimani and Iran retaliation

- Iran downs Ukrainian plane

- Trump impeachment

- Russian PM resigns

- Philippines volcano eruption

- Turkey earthquake

- Kashmir avalanche

- Australian fires

- Indonesia floods

- Kobe dead

- New strand of coronavirus goes globally viral

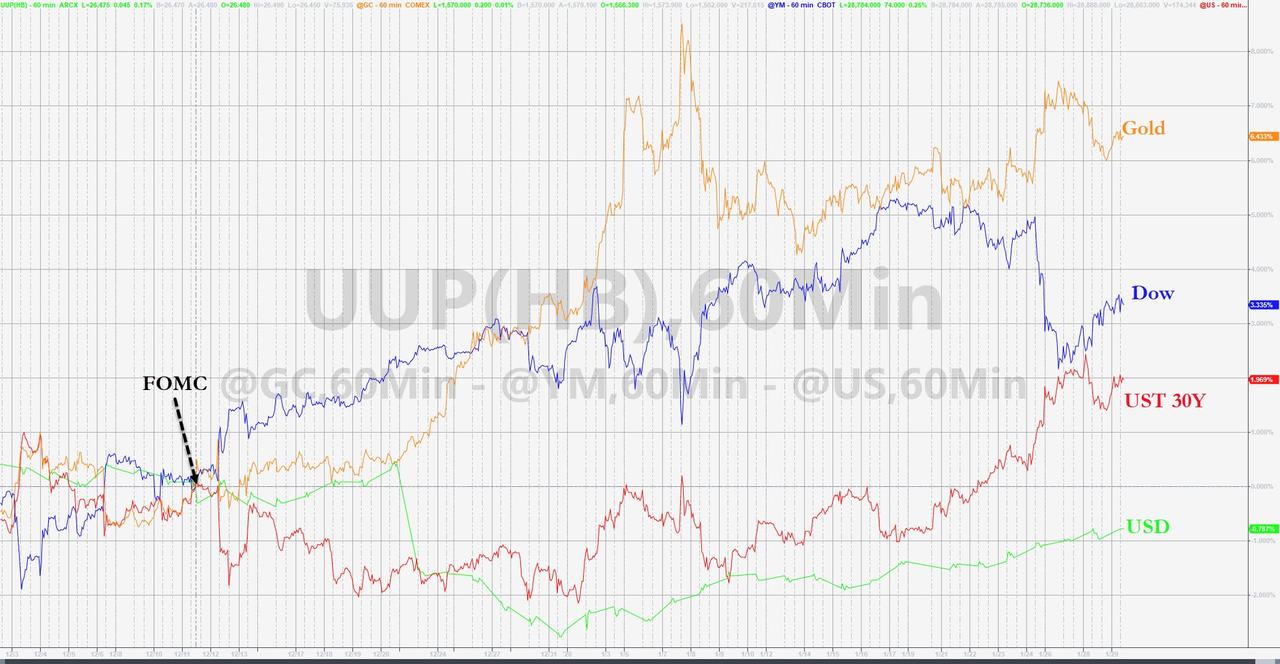

And while gold has reacted as one might expect to this chaos (and bonds), we note that stocks just refuse to drop…

Source: Bloomberg

As stocks have soared on the back of The Fed’s dramatic balance sheet expansion (but we note that expansion has slowed in recent weeks)…

Source: Bloomberg

But do not forget the massive escalation in Fed-provided liquidity that is occurring daily in the repo markets…

Source: Bloomberg

But while volatility has been suppressed, it is back at the same level as the Dec FOMC ahead of today’s statement…

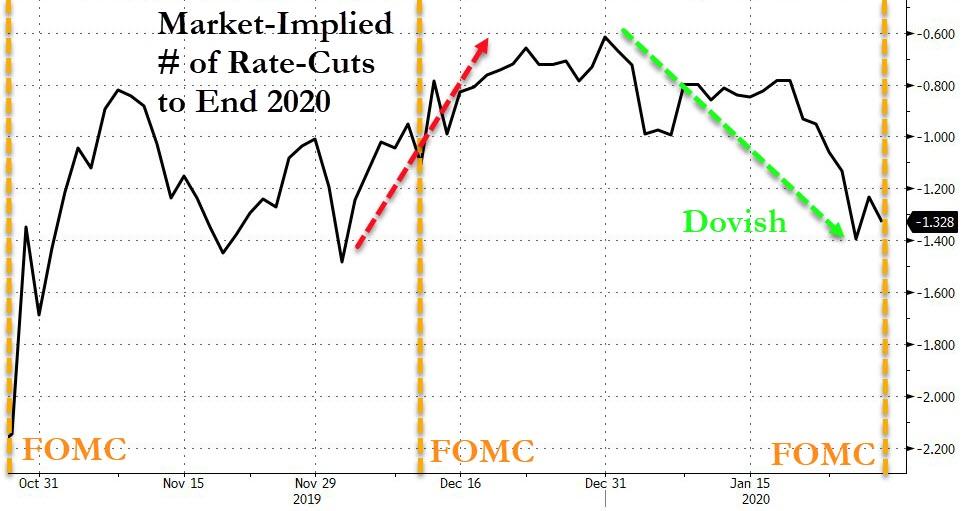

And market participants are pricing in increasingly dovish behavior by The Fed…

Source: Bloomberg

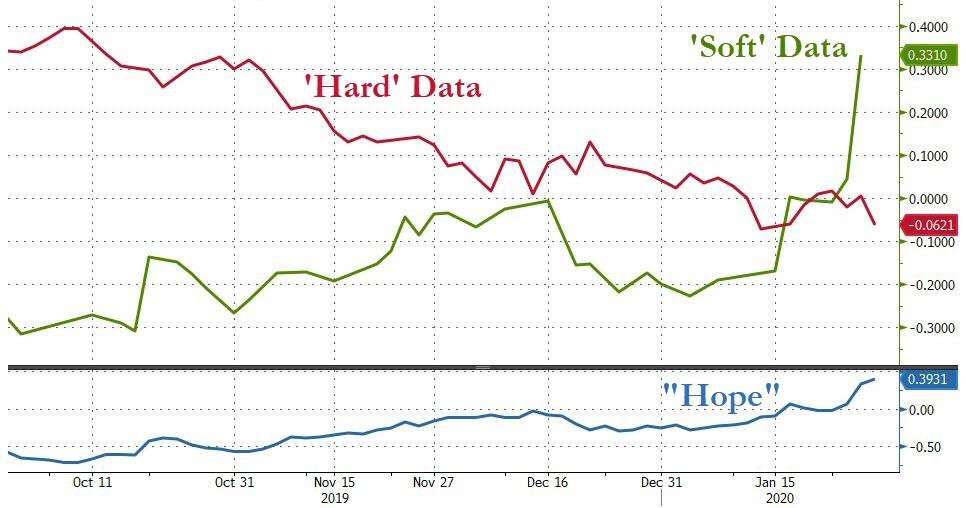

Hope has screamed higher since The Fed started expanding its balance sheet but ‘hard’ actual economic data has collapse…

Source: Bloomberg

So all eyes today are on The Fed balance sheet (please keep printing or we’re all doomed) and any soothing comments from Powell on the impact of the Wuhan coronavirus (please say you’re monitoring and have the tools to manage it)…

As we mocked earlier, Sven Henrich has the best preview of what to expect…

Powell preview:

We see no bubbles.

Nothing we do juices stocks higher.

There’s uncertainty so we stay easy.

Rate hikes? Ha ha.

Rate cuts? Maybe, if the market wants them.

Wealth inequality is bad.

The Bezos party was awesome.— Sven Henrich (@NorthmanTrader) January 29, 2020

However, overall, expectations aren’t particularly high for any surprises: rates will almost certainly remain on hold at 1.50%-1.75%, with only a technical adjustment of a 5bp upward move on the IOER the most likely shift (after several downward adjustments previously).

* * *

Here are Bloomberg’s key takeaways from today’s FOMC decision:

-

For the second straight meeting, the Fed left the federal funds target range unchanged at 1.5%-1.75%, as expected, following last year’s three quarter-point cuts; the FOMC repeated language that rates are currently “appropriate” to support growth, jobs and inflation.

-

The Fed raised a secondary interest rate, covering banks’ excess reserves, by 5 basis points to 1.6% in what officials will likely characterize as a technical adjustment to maintain control of the benchmark federal funds rate. A related tool, the rate on overnight reverse repos, also rose by 5 basis points, to 1.5%. The central bank had previously telegraphed in meeting minutes that it might make such moves.

-

In another move telegraphed earlier this month, the central bank extended its plan to address strains in money markets, saying it will inject funds through repo operations at least through April, compared with January previously. That will help cover any additional volatility during the U.S. tax-filing season, when payments would reduce reserve levels.

-

The Fed reiterated its plan to buy Treasury bills at least into the second quarter.

-

While most language on the economy was unchanged, the Fed downgraded household spending, saying it has been rising at a “moderate pace,” ahead of GDP data expected to show consumption cooled in the fourth quarter. The December statement had referred to a “strong pace” of spending gains.

-

The unanimous decision reflected support from the four regional Fed presidents who rotated into voting slots this month, including Minneapolis’s Neel Kashkari, Dallas’s Robert Kaplan, Patrick Harker of Philadelphia and Loretta Mester of Cleveland.

Now we all wait for the press conference for any hope on rescuing us all from coronavirus.

* * *

Full Redline below:

Perhaps most ominously from the statement, while most language on the economy was unchanged, the Fed said household spending has been rising at a “moderate pace,” ahead of GDP data expected to show consumption cooled in the fourth quarter. The December statement had referred to a “strong pace” of spending gains.

Tyler Durden

Wed, 01/29/2020 – 14:14

via ZeroHedge News https://ift.tt/2GzU8sY Tyler Durden