Savings Slump As US Spending Jumps With Income Growth Weakest In 2 Years

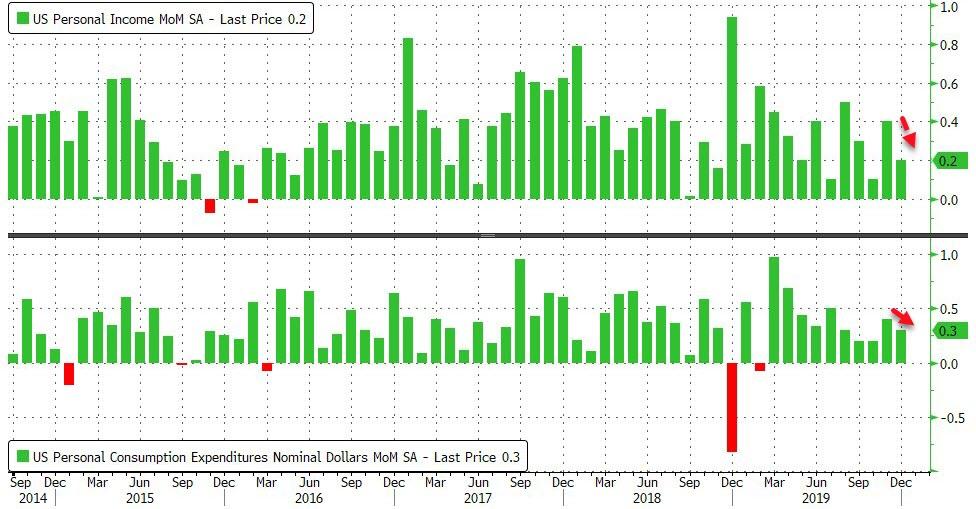

After surging higher in November, analysts expected US personal income and spending growth to slow modestly in December and it did with income growth disappointing.

Personal Spending rose 0.3% MoM (as expected) in December, slightly slower than November’s 0.4% MoM jump.

Personal Income disappointed, rising 0.2% MoM against expectations of a 0.3% rise (and November’s data was revised down from +0.5% to +0.4%).

Source: Bloomberg

But on a YoY basis, the good ‘ol American consumer refused to be restricted by weaker growth in their income (+3.9% – slowest since Jan 2017) and surged spending at a 5.9% YoY rate…

Source: Bloomberg

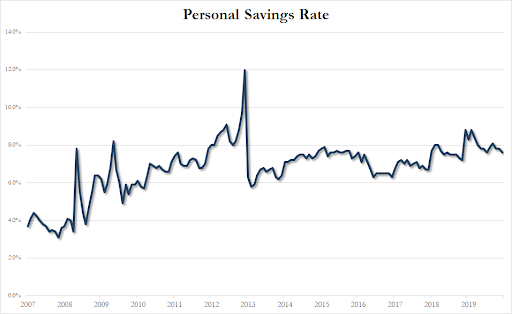

Sending the savings rate to 6-month lows…

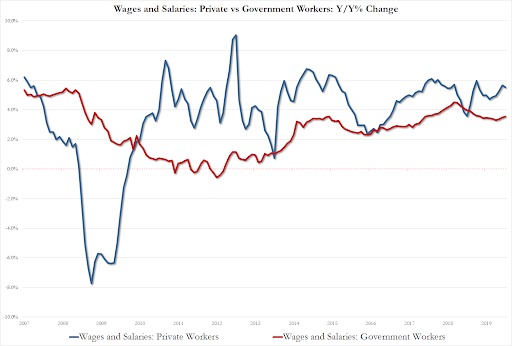

Income gains accelerated for government workers in December but slowed for non-government workers…

After adjusting for inflation, spending climbed 0.1%. That gain was driven by prescription drugs and health care, suggesting that discretionary outlays may be less robust than the headline figures indicate.

Finally, we note that The Fed’s favorite inflation indicator – The PCE Deflator – ticked up in December to its highest in 12 months…

Source: Bloomberg

Tyler Durden

Fri, 01/31/2020 – 08:40

via ZeroHedge News https://ift.tt/38TR3Qx Tyler Durden