Virus Shock Crashes Baltic Dry, Sparks China Hard-Landing Fears

The Baltic Exchange’s main sea freight index plunged on Friday, with rates for capsize vessels hitting a record low as an economic shock could be developing in China as two-thirds of its economy has been shut down because of the coronavirus outbreak.

The Baltic Dry Index, which tracks rates for capesize, panamax and supramax vessels, ferry dry bulk commodities across the world slipped 11 points, or about 2.2%, to 487, the lowest level since April 2016, reported Reuters.

The Baltic Dry Index is the most important indicator for the rates of bulk shipping. The rate is determined based on the rates that are paid to transport raw materials on the 25 busiest shipping routes. Prices are falling sharply due to the cooling global economy: -80,2%!!! pic.twitter.com/tIeaZSlwIu

— Karel Mercx (@KarelMercx) January 31, 2020

The Baltic index has plunged 10.5% this week as coronavirus cases in China soared, and factories and cities in some of the largest industrial hubs in the world ground to a halt. This in itself is producing an economic shock, first seen in industrial metals and energy prices plummeting in the last several weeks.

The capesize index has fallen by more than 99% this week, the sharpest drop on record as demand for large-sized bulk carriers and tankers typically above 150,000 deadweight tonnage, comes to an abrupt stop.

The panamax index declined 3.5% on Friday, down 14% on the week.

The supramax index lost 4 points to 524 on Friday.

We’ve noted that the “frontloading” effect ahead of tariff deadlines ended in late 3Q19 when the first signs of a trade resolution emerged between the U.S. and China.

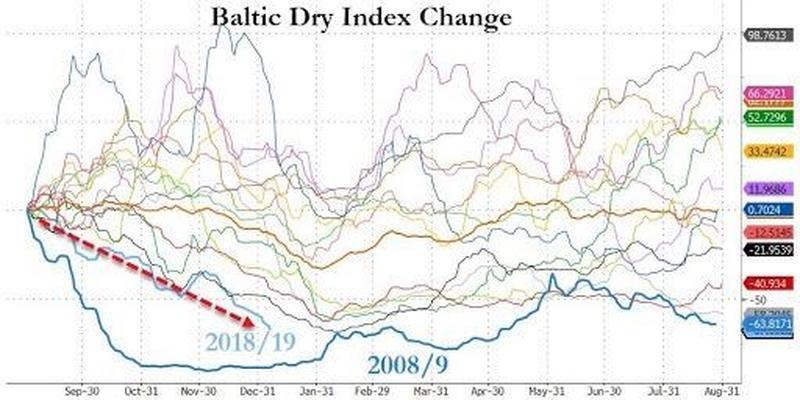

In the last four months, the Baltic index has crashed the most since 2008 and has confirmed our slowbalisation thoughts.

And now, the situation is much worse, and the reason is that the global economy was already weakening and susceptible to a shock.

The Federal Reserve’s tightening cycle, coupled with President Trump’s trade war blowing up complex supply chains around China and the world, did immense damage to the global economy and world trade. It opened up something cycle folks call a “period of vulnerability,” and it’s in this timeframe that the global economy could be tilted into recession if an exogenous shock is seen. That shock, as per the former Morgan Stanley Asia chairman Stephen Roach said this week, happens to be coronavirus outbreak shutting down China’s economy, and the shock may vibrate across the world in the weeks or months ahead.

“With the world economy operating dangerously close to stall speed, the confluence of ever-present shocks and a sharply diminished trade cushion raises serious questions about financial markets’ increasingly optimistic view of global economic prospects,” Roach said via his op-ed in Project Syndicate.

The coronavirus shock from China has already sent commodities tumbling; for instance, copper futures are on the longest losing streak since 1986. Dr. Copper suggests China’s economy is headed for a hard landing, along with continued deceleration across the world.

“The global economy continues to show declining rates of economic growth, originating from a US-based tightening cycle and a private sector deleveraging in China. The slowdown was exacerbated by a US-China trade spat, denting business confidence.

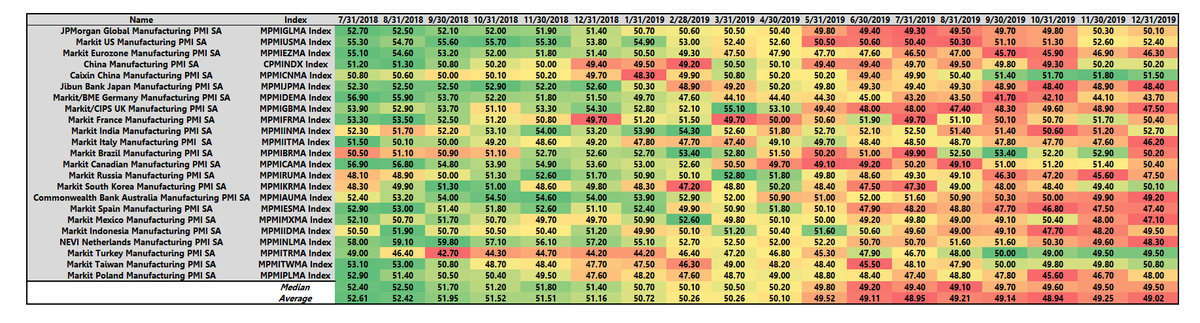

The global PMI heatmap shows over the last 18 months, the industrial economy has been weakening with the average and median reading below the 50 expansion-contraction line. The Baltic Dry Index has declined a staggering 80% since September 2019.

Historically, recessions occur when an organic economic slowdown clashes with a negative economic shock. Should the employment market weaken further, and job losses continue to spread throughout cyclical sectors of the global economy, a recessionary shock becomes an increasingly large concern,” noted Eric Basmajian, Founder of EPB Macro Research.

The collapse in the Baltic index, happened well in advance of the coronavirus outbreak, suggests that the virus shock will start reversing global economic data and lead to another episode of falling bond yields and soaring negative-yielding debt.

And the chatter on Twitter in the last several months as the stock market roared higher, was that the Baltic index had lost its predictive powers of suggesting economic doom. Though, the reason for it was due to the “frontloading of tariffs,” and with that widely over, now comes the payback period with a coronavirus shock that could tilt the world into recession.

Tyler Durden

Fri, 01/31/2020 – 18:05

via ZeroHedge News https://ift.tt/3b0q5sE Tyler Durden