‘Calm Before The Storm’ – How Will The Coronavirus Really Impact The Markets?

PeakProsperity’s Adam Taggart that, officials, the media, and globalist-driven organisations are downplaying Wuhan coronavirus risk, even as models suggest infections will soon soar.

The sudden slowdown in new information coming out of China has Chris Martenson spooked.

He walks us through the math here, showing how if the coronavirus follows its current geometric growth, over 100 million people could be infected by the end of February:

Don’t take the recent lack of ‘news’ as meaning the threat from this virus is dying down. This could very likely just be the calm before the storm.

In fact, as Martenson explains, it’s a true Black Swan event that stocks haven’t yet priced in.

The 2019-nCoV “coronavirus” outbreak remains serious and fluid.

Over the past several days, we’ve been publishing a steady stream of videos, reports and podcasts to keep you as up-to-date and informed as possible on the science behind this fast-developing situation. You can follow our full coverage of the coronavirus here.

But the TL;DR version is this:

The first order of business is stopping the spread of the disease, which means prevention. Your immediate and top concern should be readying yourself and your household and loved ones for the arrival of 2019-nCoV. We cover the most useful practices in this report.

Second, help your co-workers and students, passengers, or other such dependents become aware and prepared by practicing good hygiene and educating them about how the virus spreads.

IMPORTANT: Anyone who is sick, whether with nCoV or a standard flu/cold, needs to be isolated for the duration of the disease, which means 24 hours after their last fever. They should always, always, always wear a surgical mask to block virus particles before they are expelled into the air. Masks can be worn by everyone, but do the most good when worn by those who are ill.

But in addition to presenting a major public health risk, the coronavirus is already doing serious economic damage. China, the world’s second-largest economy, is essentially “closed for business” right now.

The disruption to global trade the coronavirus is likely to cause is going to be material, perhaps severe. And that will have serious negative consequences for the financial markets, which have been (and is still!) trading at the highest valuations in history.

The coronavirus has all the hallmarks of a true Black Swan event.

Markets & Global Economy Already Impacted

Note: This is an extremely fast-moving situation and the data is coming in so quickly that it has to be presented as a mosaic. I’ll do my best to make sense of it for you, but I really want you to allow yourself to trust your own assessment of what pattern the dots make. Much of this data has just been gathered this morning (1/28/20).

Remember: it’s not the fall that harms you, it’s how fast you stop.

For years now, the global economy has been debt-strangled and limping along, kept alive by constant central bank interventions and money printing. Like any weakened victim, the last thing it needs is any kind of serious shock.

The coronavirus has all the features of the proverbial Black Swan event we’ve long been worried about. Nobody saw it coming, it hit hard and fast, and is spreading far faster than government bureaucracies and the markets can adjust.

It’s the equivalent of slipping an iron bar into the front spokes of a moving bicycle.

We can’t possibly predict how all the implications of this will manifest. Our globalized economy is just too complex. We have a world-wide, just-in-time manufacturing and delivery system. Which just got a huge stick shoved between its spokes.

What does it mean to completely shut down the normal business activities of cities with 5, 10 and even 25 million inhabitants? Particularly in a country with massive property bubbles, where the median price-to-income ratio can be as sky-high as 40(!!)?

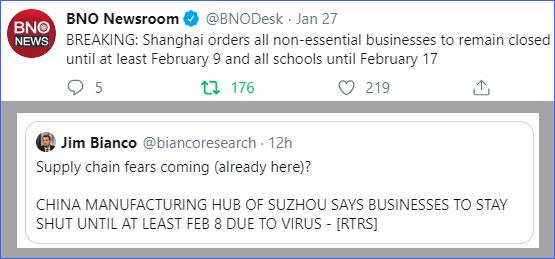

Shanghai has a population of 24 million and Suzhou another 10.7 million. Both are now all but completely shut down.

Shanghai is China’s equivalent of New York City. It hosts the main stock exchange and is where the Shanghai Gold Exchange (SGE) is located. Suzhou is a vital manufacturing hub.

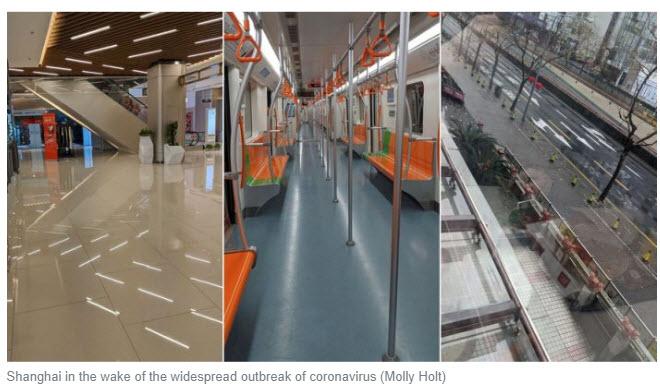

I can’t express just how crazy it is to see the videos and pictures from these towns showing empty 8-lane roads, which are normally crammed 24/7 with cars and trucks. Empty subway cars. Nearly abandoned railway stations. Empty sidewalks.

Like literal ghost towns. ‘Ghost cities’ in this case.

Shanghai

(Source)

No cars, no trucks, no people, no commerce.

If that isn’t a stick in the spokes, I don’t know what is. There’s just no way to plan for such an event. You just have to brace for the impact.

Once people self-isolate (which is exactly what they should be doing, and what I will do myself should the virus makes it to my town), economic activity just… stops.

And this is being woefully underappreciated by the global equity markets right now.

Of course, I’ve long ranted that we now have bastardized ““markets””, deformed by the terribly misguided and ultimately destructive actions of the world’s central banks and their misguided money printing.

Well, good luck trying to print your way past a virus. Or of a nation’s bus drivers and factory workers staying home.

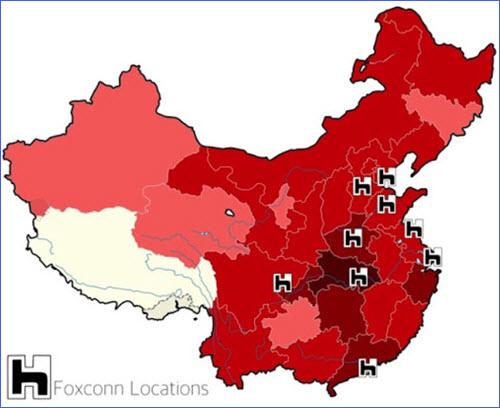

Below is a graphic showing the location of Apple’s Foxconn plants relative to the coronavirus outbreak:

And yet Apple stock is still trading within a whisker of its all-time high, up nearly 3% as I’m typing this.

See any disconnect?

Beijing

#CoronavirusOutbreak I never saw such few people in Beijing West Railway Station before. pic.twitter.com/bZRiIJLbCi

— Jierui Shi (@JerryAnakin) January 28, 2020

I can’t really wrap my head around this cavernous train station being all but completely deserted. Anyone who’s been to Beijing knows that this place is usually furiously humming with commuters like a beehive. The contrast is really stunning.

Wuhan

The above is a usually completely crammed intersection. All we see now is a single parked car.

(Source)

A few people just strolling across the equivalent of 5th Ave NY in the middle of the day without even bothering to look either way. There’s no one about.

Global Travel

Whether for business or pleasure, global travel is being impacted. Tourism is taking a huge hit. Again, there are almost too many data points to process. But here are a few:

Too Much To Process

I have too many other such data points to present. I don’t want to overload you or make this article encyclopedic. But hopefully I’ve provided enough examples above to give you a sense of the near-instantaneous halt the coronavirus has placed on China’s domestic economy and travel.

The data on its impact on manufacturing and trade won’t be known for a little longer, but it’s safe to guess it will be ‘significant.’

This is the nature of fast-moving situations. You have to rapidly grasp a lot of fragmentary data and turn it into something actionable.

And I’ll give you my sense: This is already a massive shock to the Chinese economy. Which in this hyper-connected world, will quickly translate into a shock to the entire global economy.

That hasn’t fully registered yet for most people, and therefore, the markets. But that’s coming. Soon.

The US Is Especially Vulnerable

In the US, healthcare costs are the #1 economic threat to households. More families go bankrupt due to our predatory and inhumane medical care system that any other cause.

Because people can’t afford to call an ambulance or dare to go to the emergency room for fear of being financially destroyed, they will resist seeking treatment until the very last minute. This means detecting people infected with the coronavirus will be slower than in many other countries. Which means the illness will be able to spread farther and faster as the unhospitalized sick and untreated infect more people.

“If The Dow Is Up, Everything’s OK. Right?”

Financial price bubbles require two things to sustain themselves: ample credit and a compelling story.

Ample credit has been supplied by increasingly desperate central banks willing to do “whatever it takes” to keep stock and bond prices elevated.

A normal market confronted with all the above evidence and uncertainty would be experiencing a sell-off here. Markets are supposed to based on future earnings. Less economic activity = less future earnings. Some sort of downwards repricing would be prudent, healthy and mathematically sound at this point.

But what are they doing?

Being bought furiously in the overnight ““markets””. Here’s a chart of the last week:

This is how silly and stupid things have become. The Fed and the Plunge Protection team (PPT) are now on a daily mission to keep stocks from selling off.

This is wrong, perhaps even evil. As it keeps people from appreciating the gravity of the situation. Falling markets would signal that maybe, possibly, something is wrong. That investors should start adopting more caution.

Which they should at this time. Current stock prices simply can’t be justified given what the coronavirus is doing to the world economy. No way, no how.

What Happens If….?

As I said, bubbles need two things: ample credit and a good story. The main “story” of the markets over the past few years has become almost entirely this; “The Fed won’t let them fall.”

There’s been a lot of truth to that sentiment. It’s not wrong. Or at least it hasn’t been.

But can Fed printing and market-propping make China’s empty mega-highways and grounded flights start burning more oil? No, it can’t. So, oil prices will fall. And US oil companies will suffer.

Can Fed printing and market-propping compel the Chinese workers to return to their factories? No.

Can Fed printing and market-propping make tourists return when no one wants to be around crowds? Again, no.

These and a dozen other such questions all end in “no.”

Which is why the story that has been driving the stock market bubble suddenly is breaking.

So, what will happen when the Fed is revealed to be impotent?

Well, then that’s the end. No narrative = no bubble.

And at today’s record highs?

A painful market correction, perhaps even a full-blown crash (stocks down 30-50%), will be the inevitable result.

Conclusion

Today markets are still clinging to the idea that the Fed “has got this.” The sell-off on Monday (just -1.5% on the S%P 500) was entirely too minor to count as anything at all. The vigorous futures buying the next morning says the same thing.

The market doesn’t yet believe that the coronavirus risk is real.

Which means that this may be one of those very rare moments in market history where the immediate future is briefly visible to us, just a little bit before everyone else.

Once you’ve taken the necessary steps to protect your family’s health against the coronavirus threat, then do the same for your money.

Minimize risk. Reduce your exposure to a market crash. And, for those with the risk tolerance, possibly position yourself to profit from one. (Full disclosure I am net short the US equity markets at present)

There are many ways to reduce risk in your portfolio. In this report for our premium readers, Positioning For A Downturn we detail out the wide range of options that investors have for both protecting against a downturn and, for the more courageous, profiting from one.

Again, we are in a rare and likely very brief moment where we see the risks from the coronavirus that the market does not. Use this time wisely.

Click here to read the report (free executive summary, enrollment required for full access).

Tyler Durden

Sat, 02/01/2020 – 09:20

via ZeroHedge News https://ift.tt/37Svi3C Tyler Durden