On Average, How Long From Inversion To Recession?

Authored by Mike Shedlock via MishTalk,

Let’s take a look at the last six recessions. How long did it take from inversion to recession?

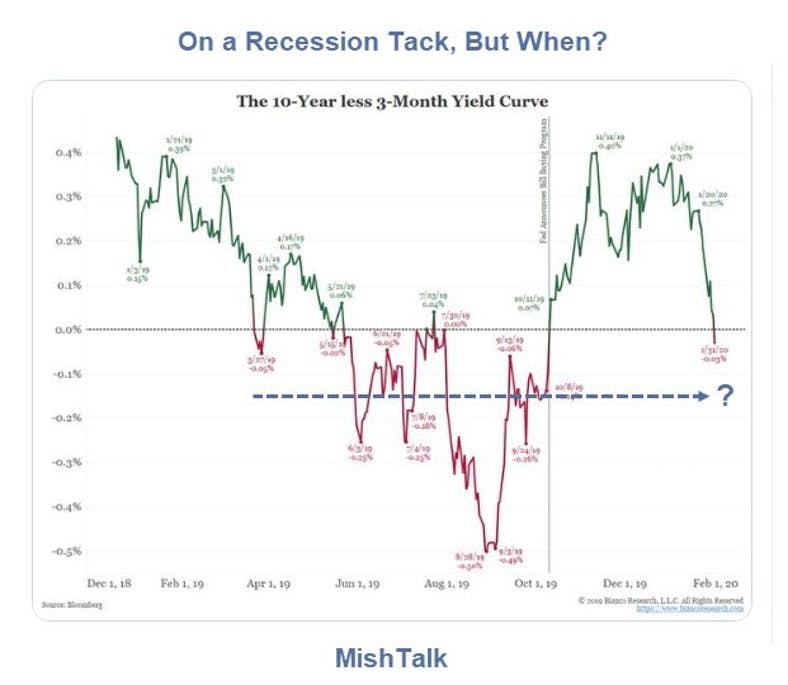

10-Year to 3-Month Inversions

In this post, we are analyzing the recession lead time from yield curve inversions as measured by by the 10-year yield minus the 3-month yield.

An inversion occurs when the result is negative, i.e. the 10-year note yield is lower than the 3-month T-Bill yield.

Let’s kick this discussion off with a Tweet from Jim Bianco.

The curve leads a recession by 311 days. That would be Q2 20, based on an in an initial inversion in Jun 19. It could be as late as Q4 20, if the lead equals 06.

Cannot say for another year if “the curve is wrong.” Until this, the “pancaking” curve is a worrisome mkt signal https://t.co/0R6fsZDU7s pic.twitter.com/EPWsFo02BJ

— Jim Bianco (@biancoresearch) February 2, 2020

Cause or Symptom?

Bianco says “the yield curve does not predict a recession, it causes it.”

This is a subtle point of difference, but I respectfully disagree.

The yield curve does not “cause” anything. After all, the yield curve has no decision-making ability or input. Rather, an inverted yield curve is a market “reaction” to Fed policy, government fiscal policy, or both.

Thus an inverted yield curve is a “symptom” that something is wrong or about to go wrong, not a cause of anything. Pragmatically speaking, the difference may not matter, but let’s put the blame where it belongs.

And the blame for the next recession does not go to the yield curve!

I believe we all know where it goes: Fed bubble blowing policies coupled with poor governmental fiscal policies.

With that distinction out of the way, let’s hone in on some charts.

December 1969 Recession

The recession was about a year from the first inversion. Bianco tracked 10-day sustained inversion.

November 1973 Recession

Heading into the 1973 recession you had about a 5-month lead-time warning.

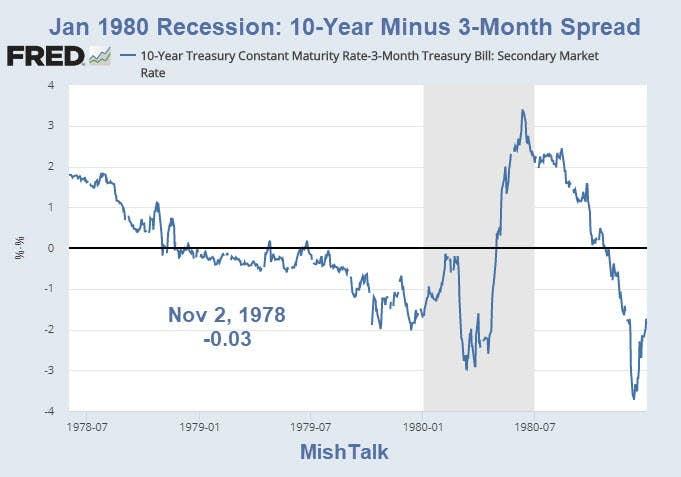

Jan 1980 Recession

Congratulations! You had a long lead time on this one.

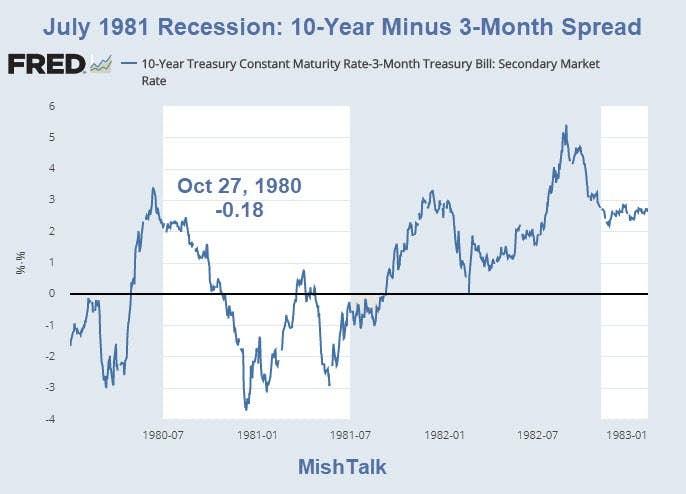

July 1981 Recession

This double-dip recession whipsaw gave you a warning of about 9 months.

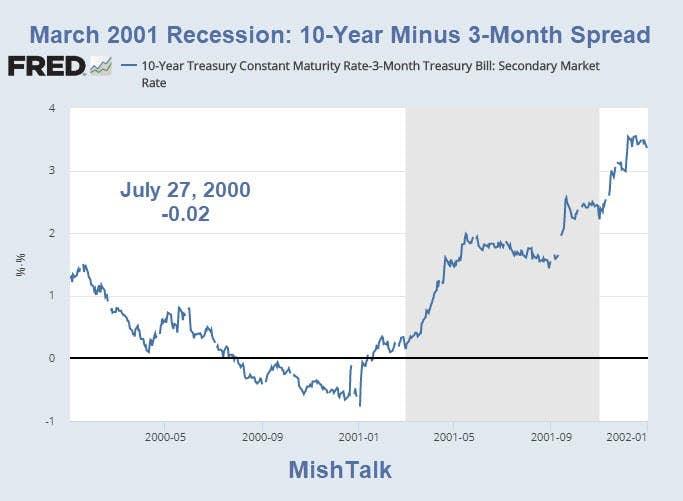

March 2001 Recession

The inversion signal for the March 2001 recession gave you 8 months warning, perhaps.

But many technology stocks started their collapse in early 2000.

From an investment standpoint, there was no warning at all for many issues.

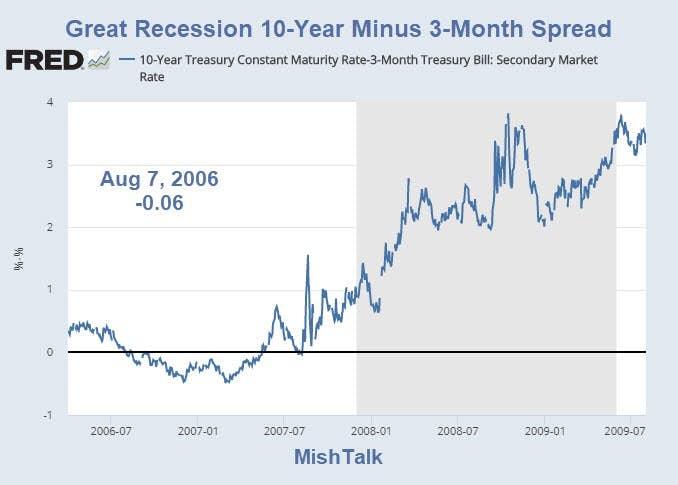

Great Recession

There was plenty of warning for this one. The stock market peaked in November of 2007. The Great Recession started the next month.

One of the more amusing aspects of the Great Recession is that in March, three months after the recession started, Fed Chair Ben Bernanke denied a housing bubble and a recession.

Also in March of 2008 the ECRI called it a recession of choice, insisting the Fed could have prevented it.

Yet, the ECRI insists it called that recession correctly.

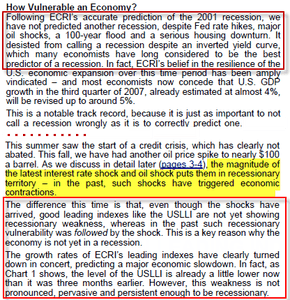

Flashback November 2007 ECRI Vol. XII, No. 11: Weakness In Leading Indicators Not Yet Recessionary

Please consider the following image snip. Highlighting is mine.

ECRI:

“The difference this time is that, even though the shocks have arrived, good leading indicators like the USLLI are not showing recessionary weakness … This is a key reason why the economy is not yet in a recession. …. weakness is not pronounced, pervasive and persistent enough to be recessionary. …. leading indexes are still holding up sufficiently for a recession to be averted.“

Window of Opportunity

Friday, January 25, 2008

ECRI Says There Is A Window of Opportunity for the US EconomyThe U.S. economy is now in a clear window of vulnerability, given the plunge in ECRI’s Weekly Leading Index (WLI) since last spring. Yet there is a brief window of opportunity within that window of vulnerability to avert a recession. That is why ECRI has not yet forecast a recession. ….

This is why, having correctly predicted the last two recessions in real time without crying wolf in between, we are not forecasting one yet.

ECRI Denial

The ECRI laid it on pretty thick, openly mocking the “best advertised [recession] in history” while claiming “This is why, having correctly predicted the last two recessions in real time without crying wolf in between, we are not forecasting one yet.“

The irony is the recession was about 2 months old at the time.

Recession of Choice

Friday, March 28, 2008

ECRI Calls it “A Recession of Choice”The U.S. economy is now on a recession track. Yet this is a recession that could have been averted. In January, given the plunge in the Weekly Leading Index, we declared that the economy had entered a clear window of vulnerability. Yet we emphasized the brief window of opportunity within that window of vulnerability for timely policy stimulus to head off a recession.

It is a somewhat different story with regard to GDP, because the cyclically volatile manufacturing sector still accounts for 36% of GDP. A mild downturn in that sector should limit the decline in GDP in this recession.

Poor Calls

The ECRI did NOT call that recession and it has since called one that did not happen. I am not picking on the ECRI, just setting the facts straight.

I have made a number of poor calls, including two recession calls that have not happened. On one of them, I sided with the ECRI on coincident indicators. That was a mistake.

It is not easy to get these calls correct and many who claim to have done that, didn’t, to put things politely.

Where to Now?

We are still on a recession track IMO. But you have six models to pick from.

One of them is that we are in a recession now, and no one even realizes it.

Feeling lucky like November 2007? Even if so, will you recognize the recession when it hits?

The worst scenario is not that the recession has started, or is about to, but rather this is now like March of 2000 or November 1978 with stocks tanking well in advance of a recession.

Tyler Durden

Mon, 02/03/2020 – 16:55

via ZeroHedge News https://ift.tt/2UlpnQL Tyler Durden