Mania Returns, Futures Soar After China Halts Selloff

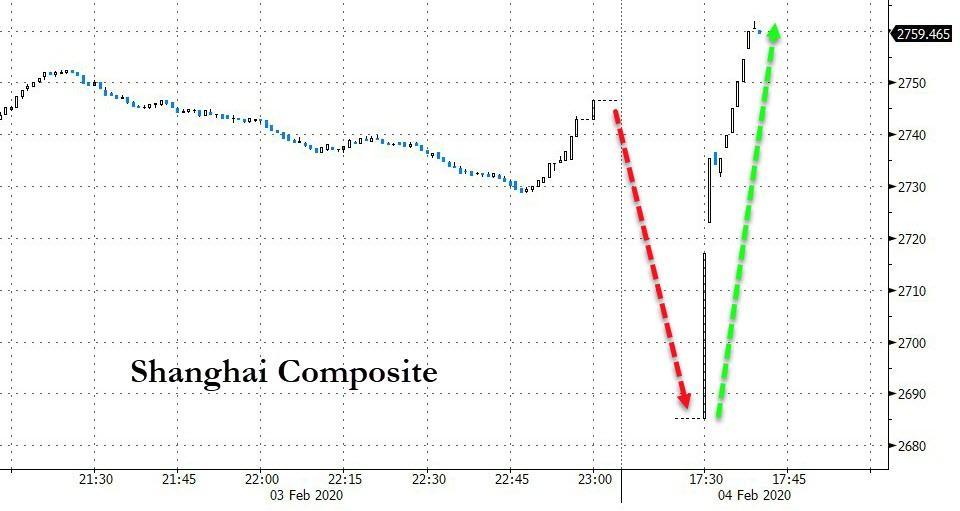

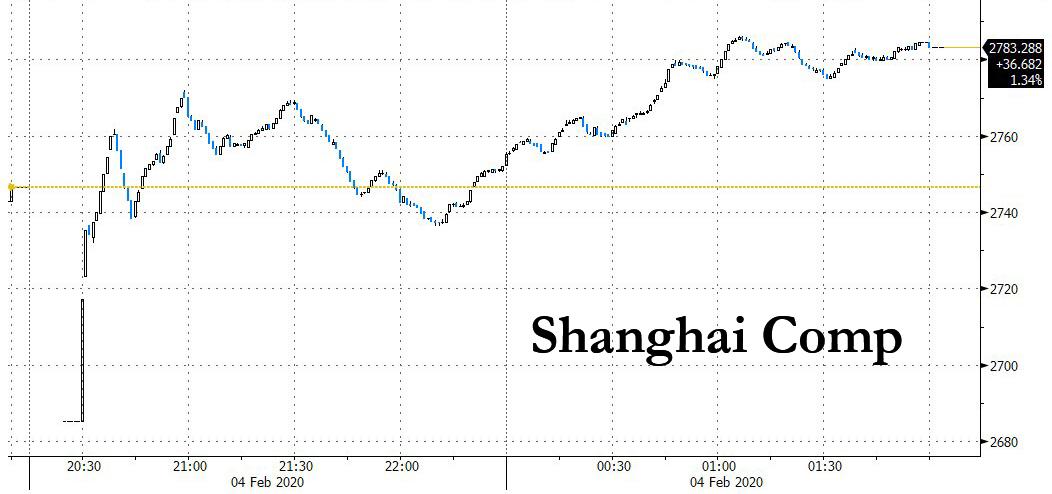

It was scary for a few moments: after the PBOC expanded its massive liquidity bazooka on Tuesday with another gargantuan injection of 400 billion yuan net with reverse repos, marking the largest single-day addition since January 2019, Chinese stocks initially tumbled as much as 3%, but then the cavalry, or rather China’s “National Team” stepped in, and the Shanghai Composite bounced hard…

… halting its selloff and ultimately closing at session highs, up 1.3%, while the blue-chip CSI300 rebounded 2.6% after a near 8% slide on Monday. Hong Kong’s Hang Seng advanced 1.2% even as Hong Kong reported the second foreign Coronavirus death outside of the mainland, after a 39-year old man died.

In an effort to halt the plunge, China’s state-backed Securities Times published an op-ed on Tuesday to call on investors not to panic. That followed moves by China’s securities regulator on Monday to limit short selling and stop mutual fund managers selling shares unless they face investor redemptions.

The apparent success of China’s liquidity bazooka – even as China’s economy has suddenly ground to a halt – was enough for traders across the globe who were nervously watching if Beijing, which has so far failed to contain the coronavirus epidemic to at least contain the selloff, and algos flooded markets with buy orders, resulting in a sea of green across the world…

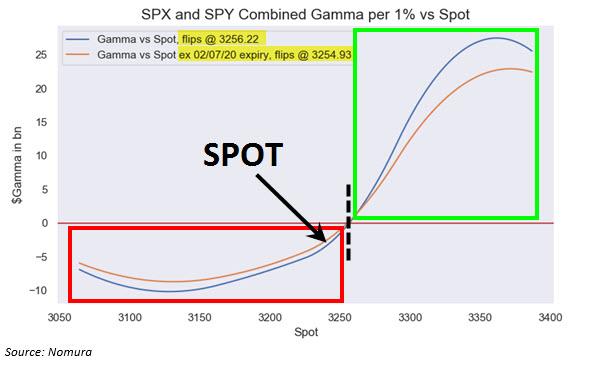

… and S&P futures which have not only defended the critical level of 3,254 where gamma flips negative as discussed yesterday…

… but have now almost closed the Friday plunge gap, even after disappointing earnings results from Google parent Alphabet, which missed on both on revenue and operating profit.

Commenting on the move, Nomura quant Masanari Takada said “This is just a typical reversal after a big fall. Vague concerns about (the) …virus are still weighing on U.S. stocks” although one would be hard pressed to see just where these concerns were on Tuesday morning.

MSCI’s world index rose 0.4%, led by gains in South Korea and Australia, the biggest leap in commodity-focused stocks in over three months, even as oil – which has emerged as the last unmanipulated indicator of the global economy – traded near 13 month lows.

European stocks surged by 1.4% led by the region’s heavyweight FTSE in London as it enjoyed both the mining rally and a tumble in the pound caused by renewed worries about Britain’s post-Brexit trade relations with the EU.

Yet despite the return of euphoria on Tuesday, the coronavirus outbreak continued to generate headlines with Hong Kong reporting its first coronavirus death – the second fatality outside mainland China – as the overall death toll reached 427.

“At the start to the week there was a fear that when China reopened there would be further disruption to the markets … (but) investors are tentatively going back into risk,” said Bank of Tokyo Mitsubishi strategist Lee Hardman.

“Given the extent of the shutdowns in China as well as the rapid rise in the virus that is likely to continue through March or April, a significant hit to China and regional growth is very likely,” said JPMorgan economist Joseph Lupton. “We would assume that in addition to bridging any funding stresses, fiscal policies will need to be ramped up to support growth once the contagion gets under control.”

Yet the market rebound was only a part of the story: the real highlight is the Volkswagen-like short squeeze that is taking place in Tesla, which has soared by as much as $120 overnight, hitting a ridiculous $888 (so far) pre market high, after trading in the mid-$500s less than a week ago.

While the move is clearly a continuation of the historic squeeze that has crushed any residual shorts in the name, and may be an attempt by Musk, who has pulled his borrow, to put prominent Tesla short David Einhorn out of business, it was assisted by Ron Baron speaking on CNBC, and predicting that Tesla revenue will hit $1 trillion in ten years. In short, Tesla is the new Volkswagen… and bitcoin. Is this surge real? Well if it is was, Tesla would be selling stock here and prefund itself for the next decade. That it isn’t, tell you all you need to know.

As mania returned to stock markets, safe havens were sold off, and 10Y Treasury yields jumped from yesterday’s lows, rising from 1.52% to 1.58%. The dollar firmed to 109.04 yen from an overnight low of 108.30, while the euro faded a fraction to $1.1059 but remained well within recent snug ranges.

In FX, the Bloomberg dollar index edged lower and Scandinavian currencies recovered ground in a rebound for riskier assets. The euro steadied around 1.1050 against the dollar while Treasuries extended declines, underperforming bunds, as the haven bid continues to be unwound. The pound recovered amid better-than-forecast construction data after touching its lowest since late December on pessimism about trade negotiations between Britain and the European Union; money-markets pared bets on BOE easing. The Australian dollar advanced after the central bank held rates at 0.75%, signaled economic improvement and kept virus fears in check. “In the short term, the bushfires and the coronavirus outbreak will temporarily weigh on domestic growth,” RBA said in statement. The Chinese yuan rallied and rose back above 7.00 vs the USD, as the central bank set the currency’s reference rate at 6.9779 per dollar, stronger than the currency’s official close on Monday.

In commodities, oil staged a modest rebound, one day after entering a bear market and dropping to the lowest in more than a year on worries about the impact of the coronavirus on demand. Brent crude added 0.8% to $54.90 a barrel, while WTI gained 1.1% to $50.67. A swath of commodities from copper to iron ore joined oil in the dumpster amid fears the drag on Chinese industry and travel would sharply curb demand for fuel and resources. The Dalian Commodity Exchange’s most-traded iron ore futures contract, expiring in May, slumped as much as 6.1% to 569.50 yuan a tonne, its lowest since Nov. 12. Spot gold was off at $1,572.41 per ounce, from a top of $1.591.46, as the dollar firmed and safe haven demand waned a little.

In other news, China Business Times cited analysts note “China is unlikely to urge the US to delay the execution of phase one trade deal. Though the outbreak of coronavirus will postpone China’s planned purchase of US goods in Q1” “China can scale up the purchase during the rest of the year to make up for the void”.

There was also the Iowa primary caucus debacle: as reported earlier, Democratic Iowa caucuses results were delayed due to quality checks amid inconsistencies and Iowa Democrats were said to be undecided if they will release caucus results on Monday night; results are expected to be released tonight. According to US Senator Sanders’ press release, Sanders is on track to win the Iowa Caucus with 29.66% of the votes, Buttigieg 24.59%, Warren 21.24%, Biden 12.37%, Klobuchar 11.00% [This is incomplete data and represents 40% of precincts in Iowa]

Expected data include factory and durable-goods orders. ConocoPhillips, Ferrari, Chipotle, Ford, Gilead, Snap, and Disney are reporting earnings

Market Snapshot

- S&P 500 futures up 1.2% to 3,284.50

- MXAP up 1.1% to 166.47

- MXAPJ up 1.7% to 537.87

- Nikkei up 0.5% to 23,084.59

- Topix up 0.7% to 1,684.24

- Hang Seng Index up 1.2% to 26,675.98

- Shanghai Composite up 1.3% to 2,783.29

- Sensex up 2.3% to 40,788.46

- Australia S&P/ASX 200 up 0.4% to 6,948.70

- Kospi up 1.8% to 2,157.90

- STOXX Europe 600 up 1% to 415.92

- German 10Y yield rose 3.6 bps to -0.406%

- Euro down 0.03% to $1.1057

- Italian 10Y yield rose 1.6 bps to 0.785%

- Spanish 10Y yield rose 2.9 bps to 0.271%

- Brent futures up 0.8% to $54.87/bbl

- Gold spot down 0.7% to $1,566.32

- U.S. Dollar Index little changed at 97.88

Top Overnight News from Bloomberg

- The U.K.’s beleaguered construction industry saw some relief last month as the general election paved a way to Brexit. IHS Markit’s index of building activity rose to 48.4, from 44.4 in December, although it remained below the 50 threshold that indicates expansion for a ninth month

- The Turkish central bank has kicked off its biggest government debt buybacks in over a decade, helping fill a void left by foreigners and adding momentum to the developing world’s strongest bond rally this year

- AllianceBernstein Holding LP, a powerhouse in fixed-income trading, is now allowing other investors to piggyback on its prowess. Through a new outsourcing service, the $600 billion asset manager will execute other buy-side firms’ bond trades

- The global stash of gold in exchange-traded funds has risen to a record after a long run of accumulation that’s been given added impetus in recent weeks by the fall-out from the widening coronavirus crisis

- Oil climbed to $51 a barrel in New York as officials from OPEC+ gathered on Tuesday for an urgent meeting to assess the impact of the coronavirus on global demand, and how the group should respond.

Asia-Pac equity markets traded higher after following suit to Wall St peers which were encouraged by China’s support measures and strong US data. The rebound extended into the region in which the Shanghai Comp. (+1.3%) recovered initial losses of more than 2.0% on aggressive bargain buying after having opened at its weakest in almost a year and following the 7.7% sell-off yesterday. The PBoC also continued to supply liquidity through CNY 500bln of reverse repos, while the Hang Seng (+1.2%) was lifted on the improved risk sentiment and after Q4 GDP showed a narrower than expected contraction which effectively overshadowed Hong Kong’s first coronavirus related death. ASX 200 (+0.4%) and Nikkei 225 (+0.5%) were kept afloat albeit with less conviction amid the RBA rate decision where the central bank kept rates unchanged and disappointed those anticipating a more dovish tone, while Tokyo sentiment contained by recent currency strength although firm gains were seen in Panasonic shares after it reported an increase in 9-month net and that its battery JV with Tesla turned profitable. Finally, 10yr JGBs and T-notes were subdued as the recovery in stocks sapped demand for safe havens which saw the former gap below the 153.00 level, with mixed 10yr JGB auction results also adding to the humdrum price action for JGBs.

Top Asian News

- Thailand Says It’s Now Confirmed 25 Novel Coronavirus Cases

- Virus Puts China’s Main Economic Goals on a Collision Course

- Asia Faces Rate-Cut Pressure to Curb Fallout From Virus

- China Adds Market Support With More Cash, Strong Yuan Fix

A solid day of gains for the European equity-space thus far [Eurostoxx 50 +1.3%] following on from Mainland China’s rebound from the prior sessions near 8% losses. Sectors are mostly in the green and reflect risk appetite as cyclicals outperform defensives. The energy sector is the main gainer amid the rebound in the complex – with materials also bolstered by a rebound in copper prices; Glencore (+4.5%), Antofagasta (+3.6%) and BHP (+2.8%) are among the top FTSE 100 winners. In terms of individual movers, BP (+4.6%) extended on gains seen at the open amid favourable earnings. On the flip side, Pandora (-4.4%) and Micro Focus (-16%) plumbed the depths and remain the Stoxx 600 laggards post earnings. Elsewhere, SGS (-4.7%) shares suffer after Von Finck family sold some CHF 2.3bln worth of shares in the Co.

Top European News

- Pandora Drops After 2020 Guidance Disappoints Analysts

- U.K. Construction Slump Eases After Election Breakthrough

- Czech Government Sees GDP Growth Quickening to 2.2% in 2020

- Carlsberg Warns on Coronavirus After Posting Record Earnings

In FX, a firmer start to the session for the broad Dollar and Index in a continuation of yesterday’s momentum, although with some support derived from Sterling’s slip below 1.3000 vs. the Buck. State-side, Democratic Iowa caucuses results were delayed to later today due to discrepancies, although an incomplete poll released by Sanders party (representing only 40% of Iowa precincts) show Sanders (29.66%) and Buttigieg (24.59%) leading whilst Klobuchar (11.00%) tails, followed by Biden (12.37%) . DXY remains north of its 100 DMA ~97.84 with the index eyeing 98.000 to the upside for potential resistance. In terms of the docket, Factory Orders and Durable Goods revisions are due just after the US cash open and US President Trump’s State of Union address will be closely watched overnight (0200GMT).

- Yuan – A complete reversal from yesterday’s price action and a total wipe-out of the prior session’s losses despite a firmer USD/CNY fixing by the PBoC overnight amid what seems to be a U-turn in sentiment. The CNY finished its domestic session sub-7.00 and with the session’s price action contained within its 100 and 200 DMAs at 7.0210 and 6.9889, similar trade is seen in the offshore. Some have pointed to China’s proactive measures to tackle the outbreak as a potential factor leading the turnaround.

- AUD, NZD – The Aussie leads the gains among the G10 in the aftermath of the RBA’s rate decision which proved to be less dovish than some had expected. Rates were left unchanged and the statement largely a copy-and-paste job from the prior meeting, albeit the commentary surrounding the bushfires and coronavirus seemed appeasing – with the Bank stating that effects will “temporarily weigh on growth” and its “too early” to assess the long-lasting impact. AUD/USD was bolstered above 0.6700 on the decision and thereafter hovered just off intraday highs, with the current risk-tone also underpinning the currency. Note: today sees some AUD 1.2bln in options expiring at strike 0.6765 at the NY cut. Meanwhile, Kiwi gleans some support from the risk sentiment, but gains remain capped as the AUD/NZD cross eyes 1.0400 to the upside, having tested the level in earlier trade (vs. low 1.0350)

- GBP, EUR – Sterling has seen a mild recovering following its earlier slide below the 1.3000 mark vs. the USD in a continuation of yesterday’s price action. Earlier in the session, Cable took out its overnight low (~1.2980) and the Jan low (1.2955) before printing a fresh 2020 low at 1.2942, with eyes on the Dec low (~1.2895) should the pair breach 1.2900. Cable recouped some losses and is testing 1.3000 to the upside at time of writing. Subsequently, EUR/GBP saw fleeting gains in which in the cross reached a high of 0.8537 (vs. low of 0.8495) ahead of the Jan 20th high of 0.8553. EUR/USD meanwhile remains flat in a tight intraday band of 1.1050-1.1065, with some ~EUR 1bln expiring around strike 1.1030-40.

- JPY, CHF – Safe-haven FX conformed to the overall risk appetite with the JPY and CHF the G10 underperformers. USD/JPY just about reclaimed 109.00 to the upside in early trade (vs. low of ~108.60) ahead of its potential resistance at 109.30 (Jan 29th high). The Swiss Franc meanwhile eyes 0.9700 to the upside vs. the USD having printed a low of ~0.9660.

- RBA kept the Cash Rate unchanged at 0.75% as expected. RBA reiterated it will ease policy if needed to support sustainable growth and rates are to remain low for an extended period, while it added that low rates are boosting asset prices which should lead to increased spending and that it will monitor developments in labour market. RBA added that wage growth is expected to remain at current levels for some time and the central scenario remains for the Australia economy to grow 2.75% this year, 3.00% in 2021 and underlying inflation is to be close to 2% this year and next. Furthermore, RBA noted that bushfires and coronavirus will temporarily weigh on growth although it is too early to determine how long-lasting impact from coronavirus will be.

In commodities, WTI and Brent front month futures feel some reprieve from the current overall turnaround in risk sentiment and with China’s proactive measures to stem the spread of the virus digested as a market positive. Furthermore, Russia’s Kremlin noted that Moscow is ready to cooperate with OPEC but declined to comment if Russia supports further cuts – which comes after Russian President Putin and Saudi Crown Prince MBS confirmed their readiness to continue cooperation. Regarding yesterday’s sources, which noted that Saudi might be on board for a temporary 1mln BPD cut, analysts at SGH Macro are sceptical as this may mean that the major oil producer could lose market share to the likes of Russia and the US. Moreover, analysts at ING noted that anything beyond a coordinated 500k BPD cut would be hard to achieve as “it becomes questionable who would be able to make significant cuts beyond Saudi Arabia and Russia,” while highlighting that Saudi is over-complying with their current quotas; thus further scope for the Kingdom to cut remains limited. WTI resides just below the USD 51/bbl mark having tested the level to the upside while its Brent counterpart looks at USD 55/bbl, having eclipsed the level in earlier trade. Traders will be monitoring the overall risk sentiment and OPEC jawboning (JTC will convene 4th/5th Feb ahead OPEC on 14th/15th) for any influence on prices ahead of the weekly API release later today. Elsewhere, spot gold is on the back foot due to the aforementioned risk appetite, with prices trading in close proximity to its 21 DMA around USD 1564.50/oz. Copper meanwhile staged an aggressive rebound amid the improvement in the risk tone and as Chinese markets nursed some losses, with prices catapulting to highs above USD 2.56/lb vs. a sub-2.50/lb low. That said, Dalian iron ore futures fell some 2.5% overnight amid delays of construction activities after the Chinese Lunar New Year break.

US Event Calendar

- 10am: Factory Orders, est. 1.2%, prior -0.7%; Factory Orders Ex Trans, est. 0.1%, prior 0.3%

- 10am: Durable Goods Orders, est. 2.4%, prior 2.4%; Durables Ex Transportation, est. -0.1%, prior -0.1%

- 10am: Cap Goods Orders Nondef Ex Air, est. -0.9%, prior -0.9%; Cap Goods Ship Nondef Ex Air, prior -0.4%

DB’s Jim Reid concludes the overnight wrap

Well this morning we had cleared the front page for the results of the Iowa Democratic caucus and were ready with expert opinion and interpretations. However the results have been delayed as the party have found ‘inconsistencies’ in the results. At the moment it seems blame is being put on a faulty app/technology rather than anything more sinister but at the time of writing there is no clarity on when the results will be released. Strangely all the candidates have given speeches proclaiming success in various forms without having the results to back them up. Not a great start for the Democratic primaries.

Moving onto Asia, there are now 20,438 confirmed cases of the Coronavirus (up from 17,205 yesterday) while the number of deaths stand at 425 (vs. 361). Hong Kong has also reported a death due to the virus overnight. This marks second fatality outside of mainland China. Meanwhile, the PBoC added CNY 400bn (c. $57 bn) into the banking system today, the largest single-day addition since January 2019, to stabilise the system. As we go to print Bloomberg is reporting that Macau has asked casino operators to suspend operations for half a month showing that the lockdowns are still continuing.

Asian markets are all trading in higher this morning with the Nikkei (+0.50%), Hang Seng (+0.94%), Shanghai Comp (+0.53%), CSI (+1.71%) and Kospi (+1.62%) all up. Chinese stock bourses were down c. -2% after the open but subsequently recouped all of their losses. The Chinese onshore yuan is up +0.36%. Elsewhere, futures on the S&P 500 are up +0.59% despite an overnight earnings miss from Alphabet (more below) and 10y treasury yields are up +2.4bps. Brent crude oil prices are also up +0.73% this morning erasing a small amount of yesterday’s decline.

In our DB Research-led conference call yesterday on the Coronavirus outbreak with Dr Michael Edelstein, Consultant Epidemiologist, Public Health England; he said that he believes that the most likely outcome is a disease that spreads moderately globally and continues to have a low fatality rate, with continued (but limited) trade and travel restrictions by governments. Those monitoring the situation should pay attention to what the rate of spread within other provinces of China is as well as what the spread is to other countries. There was lots more on the call. The replay details can be attained from this document (link here).

DB’s China economist put out another update yesterday (link here). His preliminary assessment, though there is considerable uncertainty, is that it’ll have a 1-1.75 percentage point impact negatively on China’s Q1 GDP growth. But assuming some modest catch-up of production and demand in the subsequent quarters of the year, the full-year impact will likely be limited to 0.2-0.3 ppts.

This morning’s Asian session followed the aftermath of Chinese markets re-opening yesterday after the extended holiday with the CSI 300 closing down -7.88% – its worst daily performance since August 2015. Other global equity markets bounced as the Chinese sell-off was orderly amidst heavy intervention. The S&P 500 (+0.73%) and the STOXX 600 (+0.25%) both advanced also supported by positive data from the PMIs/ISMs on either side of the Atlantic which showed that manufacturing data was steadily improving (more below) before the virus outbreak.

Markets closed off their highs though, seemingly helped by a story (Bloomberg) that Chinese oil demand has fallen 20% on the back of the virus. Brent crude fell -4.20% to hit a one-year low, while WTI (-3.05%) fell below $50/barrel in trading for the first time in over a year as well, and is now down more than 20% from recent highs in early January. According to OPEC officials, Saudi Arabia is likely to continue pushing for production cuts to prop up prices at a meeting of the Organization of the Petroleum Exporting Countries and its allies next Tuesday and Wednesday. Elsewhere in commodities copper fell for a 13th consecutive session as it closed down -0.46%.

Google’s parent company Alphabet reported after the US close yesterday, missing on revenues ($37.6bln vs. $38.4 exp), while still beating on EPS. The company was down over -4% in after-hours trading, after rallying +1.24% with the broader market intraday. Staying on the topic of earnings, see DB’s Binky Chadha’s Asset Allocation note (link here) for a recap of how the US Q4 earnings are progressing so far. He and his team note that while there have been some high profile beats and misses, overall the breadth and size of beats has so far been about average. Margins have surprised negatively, but remain high historically and the decline does not seem to reflect rising wage costs which is the normal culprit.

In fixed income, 10yr Treasury yields reversed much of their earlier sell-off that came after the ISM release (+c.6.5bps at the highs) before falling back to close just +1.5bps higher at 1.522%. 3m10yr continues to be inverted and 30yr yields dipped below 2% (back above in Asia). Similar to the US, European sovereign bond yields fell into the session end, with 10yr bund yields finishing flat on the day. It’s interesting that with US 30yr yields within a handful of bps of their all-time low and 10yrs within 15bps, last week the CBO announced that their forecast for US Debt/GDP by mid-century had risen from around 144% to 180%. So around an extra $13tn dollars of debt at the touch of a button. We put out a very short note out about this yesterday (link here), explaining the jump, and tied it to our view in last year’s long-term study (link here) that financial repression and central bank buying of bonds would likely be here for years and probably decades ahead.

Back to more immediate matters and recalling the data from yesterday now. The ISM manufacturing in the US rose to a 6-month high of 50.9 (vs. 48.5 expected), while the new orders index rose to 52.0 (vs. 47.7 expected), its highest level since May. Meanwhile in Europe, the Euro Area manufacturing PMI was revised up a tenth from the flash reading to 47.9, although it remained in contractionary territory for a 12th consecutive month. The French (51.1) and German (45.3) readings were also revised up a tenth each from the flash reading, while for Italy, where we didn’t have a flash reading to go off, the PMI rebounded to 48.9 (vs. 47.3 expected).

Here in post-Brexit Britain, we got a distinct sense of déjà-vu yesterday as the EU and the UK seemed at loggerheads once again over the negotiations on the future relationship set for this year. The first move came from the EU side, where chief negotiator Michel Barnier unveiled the draft negotiating directives for the negotiations with the UK. The document showed that the EU want commitments from the UK that they won’t seek to undercut the EU, saying that “the envisaged partnership must ensure open and fair competition, encompassing robust commitments to ensure a level playing field. … To that end, the envisaged agreement should uphold the common high standards in the areas of State aid, competition, state-owned enterprises, social and employment standards, environmental standards, climate change, and relevant tax matters.”

Over on the UK side however, Prime Minister Johnson made his position clear, saying in a speech yesterday that there was “no need for a free trade agreement to involve accepting EU rules on competition policy, subsidies, social protection, the environment, or anything similar”. He further said that the UK was seeking a “comprehensive free trade agreement, similar to Canada’s”, and said that if that wasn’t to succeed, then the UK would have a trading relationship with the EU like Australia’s, which has a much more limited “partnership framework” with the EU. The prospect that the UK might not agree to EU demands for a level-playing field, and hence find it harder to reach a free-trade deal this year, sent sterling tumbling yesterday, and the pound ended the day down -1.61% against the US dollar, the weakest performing G10 currency and on the biggest fall in over a year. It’s not clear why this should have been a surprise for currency traders though as yesterday’s news was very well flagged by both sides. For those wanting more on Brexit, we released a new podcast yesterday (link here) with DB’s Brexit analyst, Oliver Harvey, talking to Luke Templeman on my team about the next stage of talks during the transition period.

To the day ahead now, and it’s a lighter one for data with the UK’s construction PMI for January, Euro Area PPI for December and Italy’s preliminary CPI for January. Over in the US, there’ll also be December’s factory orders, the final December durable goods orders reading, along with non-military capital goods orders excluding aircraft. Earnings out include BP and Walt Disney, while there’ll also be President Trump’s State of the Union Address to Congress tonight.

Tyler Durden

Tue, 02/04/2020 – 07:55

via ZeroHedge News https://ift.tt/2GTF6hY Tyler Durden