TSLA Tops $900 – Where Does The Parabolic Surge End?

On a morning when one of Tesla’s biggest bulls, New Street’s Ferragu downgrades the stock, saying:

“Limited sources of further appreciation in the next 12 months. .. We see 2020 playing out fine, but it is largely expected, and we see some risks on the stock: end of the short squeeze, 1Q20 miss on gross margins”

It is up almost 15% in the pre-market – topping $900 for the first time ever…

But Ron Baron was on CNBC earlier saying he isn’t selling a single share and sees Tesla rising to $1TN in revenue in 10 years.

Nothing to see here…

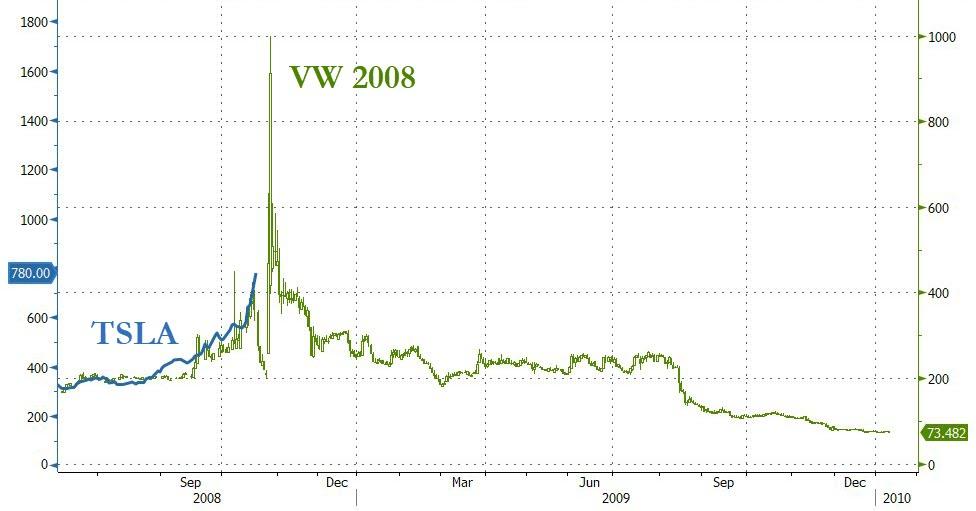

While the move is clearly a continuation of the historic squeeze that has crushed any residual shorts in the name, and may be an attempt by Musk, who has pulled his borrow, to put prominent Tesla short David Einhorn out of business, it was assisted by Ron Baron speaking on CNBC, and predicting that Tesla revenue will hit $1 trillion in ten years. In short, Tesla is the new Volkswagen… and bitcoin. Is this surge real? Well if it is was, Tesla would be selling stock here and prefund itself for the next decade. That it isn’t, tell you all you need to know.

So where does it stop?

If it’s like Bitcoin, maybe $1200?

It it’s like the VW squeeze in 2008, maybe $1600?

And it it’s the South Sea Company, it could hit $1800…

Updated for today’s price action. We can do it! pic.twitter.com/QQHvU76Q2m

— Keubiko (@Keubiko) February 3, 2020

TSLA is now 1.5% of the QQQ Nasdaq 100 ETF. For every 10% move in TSLA, Nasdaq is up ~14 points.

Trade accordingly.

Tyler Durden

Tue, 02/04/2020 – 08:15

via ZeroHedge News https://ift.tt/2RVRuEh Tyler Durden