China Shutdown Fears Spark Dip-Buying Frenzy In Stocks As Gold Soars, Yield Curve Inverts

As the numbers of companies issuing guidance cuts or outlook warnings have mounted, the stock market has pushed ever higher. Even as the world’s largest company issues its second outlook cut in 13 months…

Source: Bloomberg

…the stock market barely even blinks… in fact Nasdaq surged off the overnight lows into the green…

Source: Bloomberg

But as the machines bought the dip in stocks, yuan didn’t bounce at all and gold was bid along with safe-haven bonds…

Can u spot the odd one out?

Source: Bloomberg

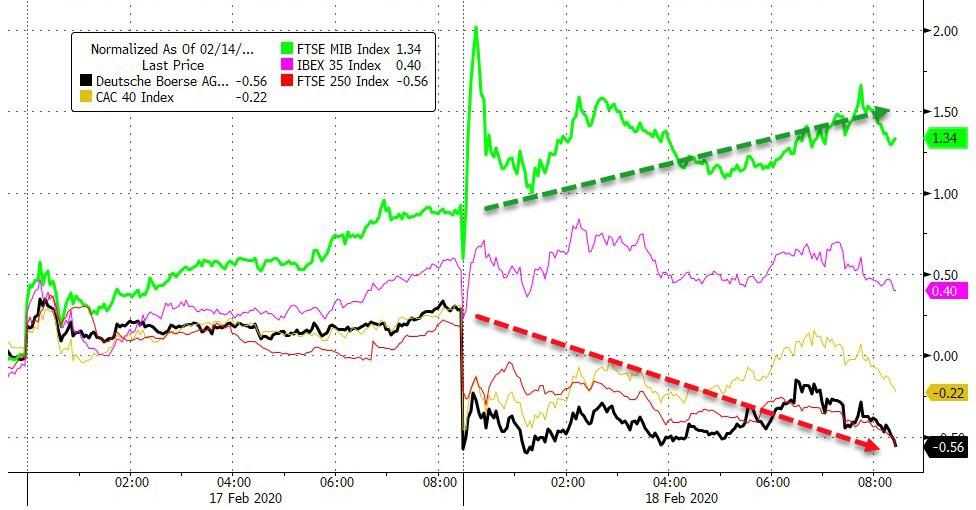

The divergence between small-cap momo tech and the bigger Chinese stocks was extremely evident overnight…

Source: Bloomberg

Only the UK’s FTSE managed gains in Europe today with Germany’s DAX the laggard…

Source: Bloomberg

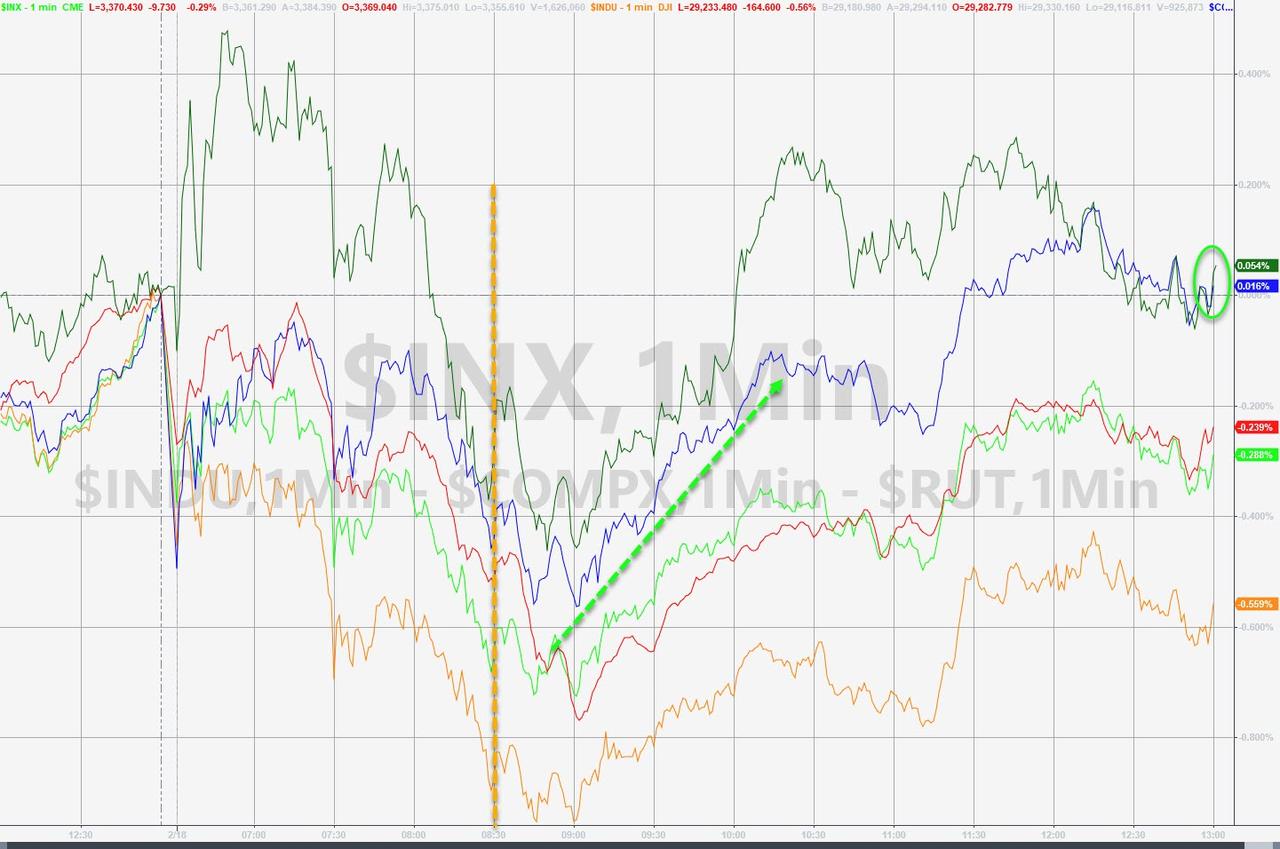

In the US, Trannies and Nasdaq roared back into the green (from Friday) while the Dow was the laggard…

Defensives dominated price action today…

Source: Bloomberg

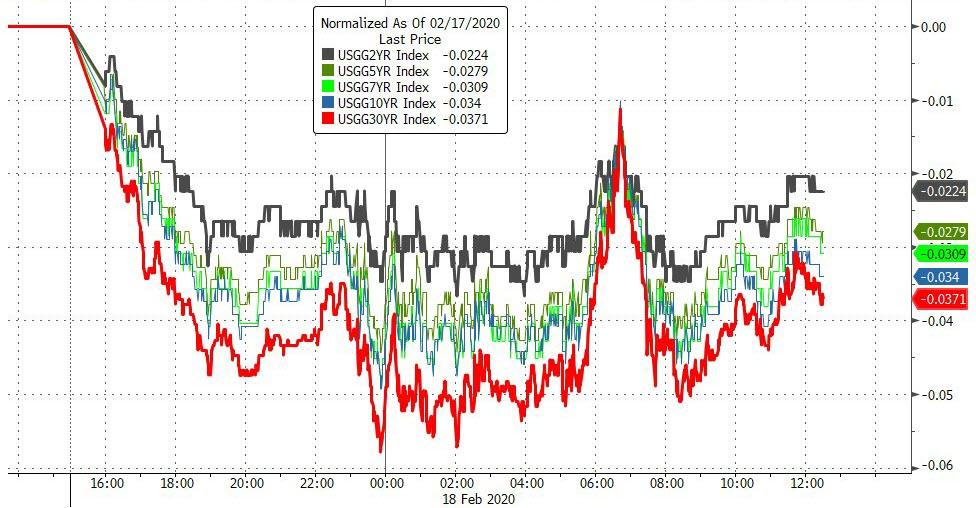

Treasury yields dropped across the curve today with the long-end outperforming…

Source: Bloomberg

The yield curve re-inverted today with 3m10Y dropping to -2bps…

Source: Bloomberg

The Dollar closed at its highest since Oct 10th 2019…

Source: Bloomberg

A close up on Yuan’s drop today shows the decoupling with Nasdaq…

Source: Bloomberg

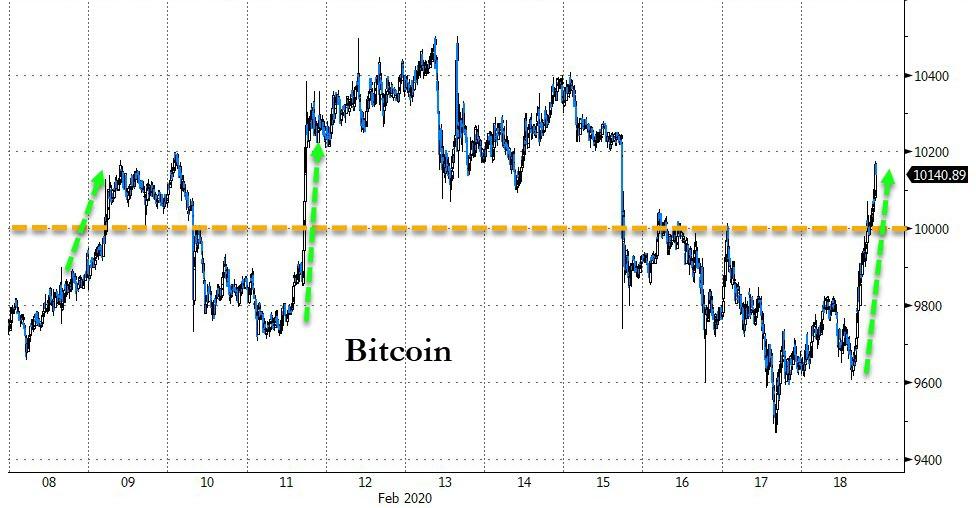

Cryptos were bid today after sliding across the long weekend…

Source: Bloomberg

Bitcoin jumped back above $10,000 today

Source: Bloomberg

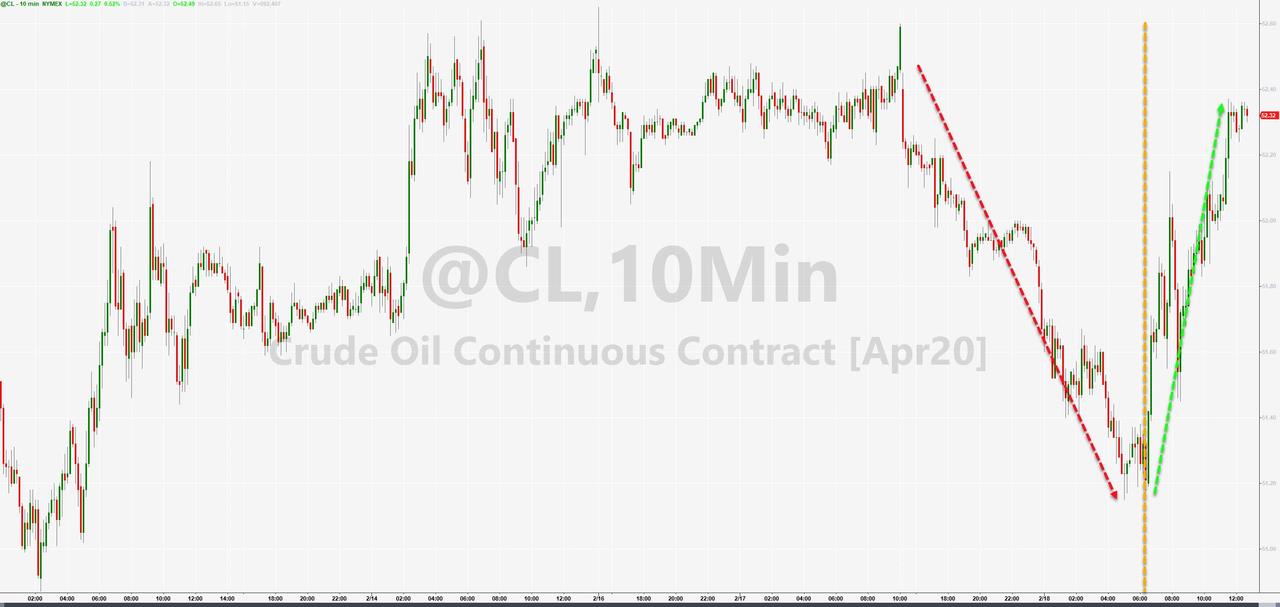

Copper ended the day lower but crude clung to yesterday’s gains on a big bounce back as PMs soared…

Source: Bloomberg

WTI surged from the open of the US equity market…

Gold spiked above (and held) $1600 (back to Iran WW3 levels)… This is gold’s highest close since March 2013

Silver outperformed gold, rising 2.5%, back above $18…

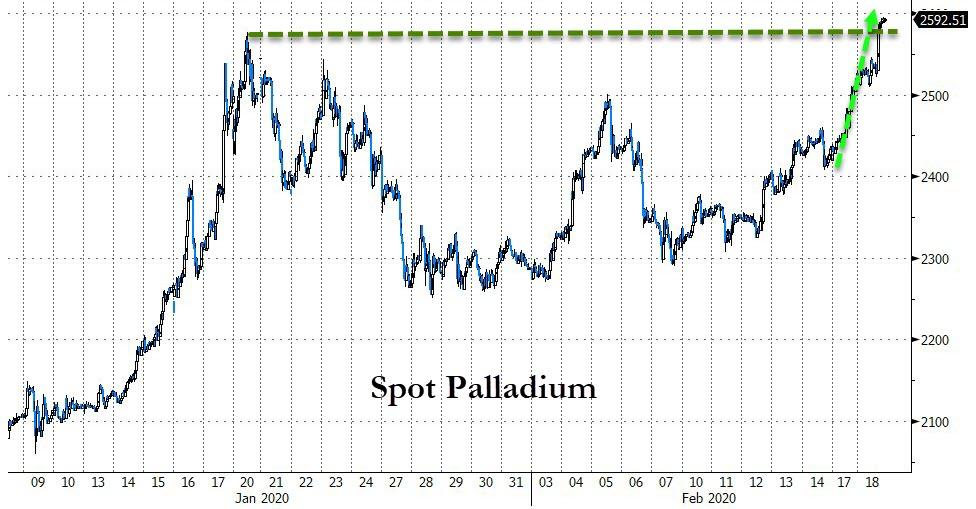

Meanwhile, Palladium continues to surge to a new record high, testing very close to $2600 today…

Source: Bloomberg

Finally, just a little more and it’s all over…

Source: Bloomberg

And Short Interest in the SPY (S&P ETF) has reached its lowest since pre-Lehman…

Source: Bloomberg

Tyler Durden

Tue, 02/18/2020 – 16:00

via ZeroHedge News https://ift.tt/2SC6s2S Tyler Durden