Global Stocks Slide After Apple Guidance Cut Is “Wake Up Call” To Zombified Investors

Two weeks ago, when looking at the supply-chain crippling consequences of the Coronavirus epidemic, we asked “Is Tech About To Suffer A “Dot Com” Bubble Collapse?” and concluded that “It’s now all in China’s hands” noting that “…while the market leaders did not disappoint in the last quarter of 2019 when stocks exploded higher with the blessing of the Fed’s QE4, what about the current quarter and the future? What happens to revenues and demand, to established supply chains, to profit margins, if the Coronavirus epidemic keep spreading and tens of millions of Chinese remain under quarantine? What happens to Apple’s iPhone sales in China if the Cupertino company is unable to reopen its store for a month, or two, or three?”

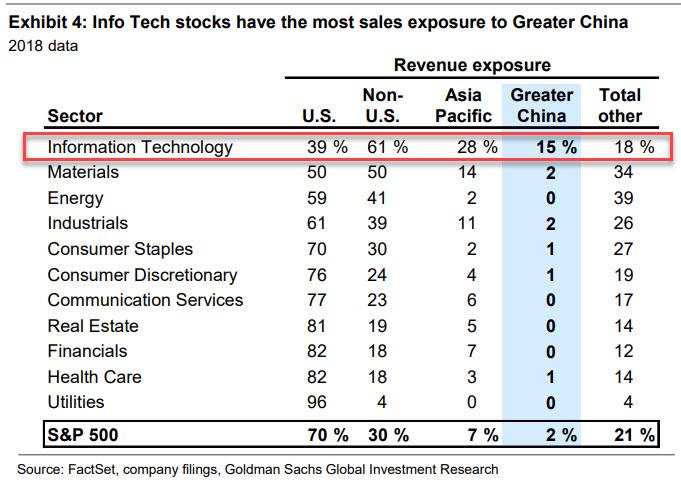

Then, a week later, just in case algos were still unclear who is most at risk to the coronavirus pandemic, we showed that “the one sector with the greatest exposure to Greater China and Asia Pacific in general, is also the sector that has outperformed the most in recent months. Tech.”

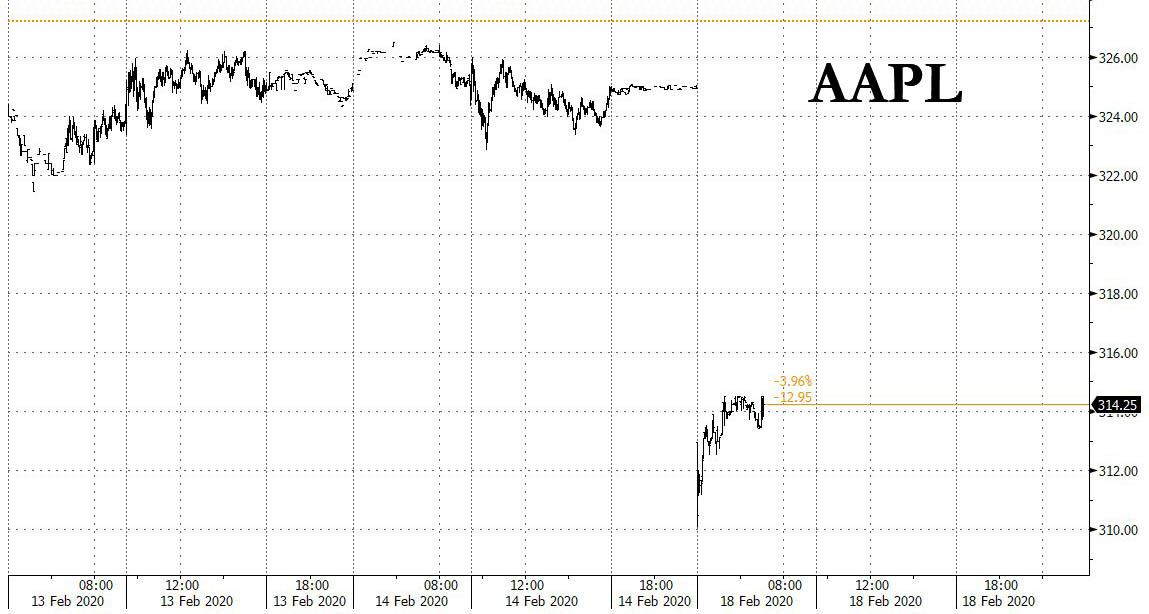

As such, while we were certainly not surprised to learn that AAPL took advantage of the quiet President’s Day Holiday to cut revenue guidance for the current quarter – guidance which it laid out just three weeks ago on Jan 28 – warning that production and retail store closures have lasted longer than “anticipated” just a month ago (despite our warning that AAPL would cut guidance just days after the company’s earnings release due to the coronavirus), judging by the plunge in AAPL stock which tumbled as much as 4% this morning, the AAPL news sure came as a surprise to all the millennials and algos that set marginal prices in this “market.”

“Work is starting to resume around the country, but we are experiencing a slower return to normal conditions than we had anticipated. As a result, we do not expect to meet the revenue guidance we provided for the March quarter due to two main factors.

The first is that worldwide iPhone supply will be temporarily constrained. While our iPhone manufacturing partner sites are located outside the Hubei province — and while all of these facilities have reopened — they are ramping up more slowly than we had anticipated. The health and well-being of every person who helps make these products possible is our paramount priority, and we are working in close consultation with our suppliers and public health experts as this ramp continues. These iPhone supply shortages will temporarily affect revenues worldwide.”

And to be fair, while many companies have by now issued warnings it seems it had to take Apple for the market to wake up, spooked amid hopes for a limited economic impact from the deadly coronavirus.

It wasn’t just AAPL however: HSBC – Europe’s largest bank – announced a massive restructuring that involved shedding $100 billion of assets and slashing 35,000 jobs over three years. It also warned about the impact of the coronavirus on its Asia business. The stock fell more than 2% in Hong Kong trade.

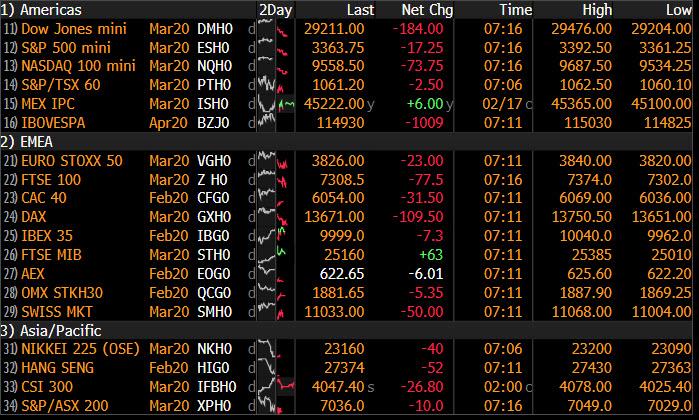

And as two of the world’s mega companies reported damage from the coronavirus outbreak, world stocks markets were knocked off record highs on Tuesday, with equities around the globe a sea of red, while Treasuries rose and the dollar edged higher.

The warning from Apple sobered investors who had hoped fiscal stimulus from China (which we reported over the weekend is not coming after the Global Times warned to brace for austerity) and other countries would protect the global economy from the effects of the epidemic, sending contracts on the three major U.S. equity benchmarks sharply lower, with Apple shares slumping as much as 4.2% in pre-market trading. We know, shocking, right: you can’t print your way out of a global viral pandemic.

“We have been pointing out that the market reaction in past weeks was excessively constructive and this could be a wake-up call to all investors that ignored so far potential negative impact,” analysts at UniCredit said.

“Apple is saying its recovery could be delayed, which could mean the impact of the virus may go beyond the current quarter,” said Norihiro Fujito, chief investment strategist at Mitsubishi UFJ Morgan Stanley Securities. “If Apple shares were traded cheaply, that might not matter much. But when they are trading at a record high, investors will be surely tempted to sell.”

In Europe, tech stocks were the biggest laggards in the Stoxx 600 index as Apple suppliers including Dialog Semiconductor Plc and AMS AG slid. HSBC Plc tumbled the most in more than a decade after saying it will slash jobs in a “fundamental restructuring,” while also flagging risks due to the virus. Europe’s 0.4% to 0.5% declines came after Tokyo’s Nikkei dropped 1.4% as tech stocks globally reacted to Apple’s warning. There was more bad news in Europe after Germany’s latest ZEW Economic Sentiment printed at a dismal 8.7, far below the 26.7 in January and a huge miss to the 21.5 expected, confirming that Germany’s economy is set for another slump and this time recession may be unavoidable.

Earlier in the session, Asian stocks fell as semiconductor equities took a hit on the Apple news, and as investors finally realized the virus outbreak in China is taking a bigger-than-predicted toll on one of the world’s most-valuable companies. The MSCI Asia Pacific Index dropped 1.1%, led by declines in technology and communication services shares. Most markets in the region were down, with South Korea’s Kospi index, Hong Kong’s Hang Seng Index and Japan’s Topix index sliding more than 1%. India’s Sensex index declined to two-week low. China’s CSI300 gave up 0.5% after gaining on Monday, encouraged by a central bank rate cut and government stimulus hopes. TSMC lost 2.9%. Samsung Electronics dropped 2.9% and Sony Corp shed 2.5% after the Apple coronavirus warning.

Meanwhile, as China’s authorities try to prevent the spread of the disease or at least fabricate data suggesting Beijing is winning the war on the coronavirus, the economy is paying a heavy price. Some cities remain locked down, streets are deserted, and travel bans and quarantine orders are preventing migrant workers from getting back to their jobs. In short, as we showed on Friday, China’s economy is “disintegrating” and frankly it is shocking it took the market as long as it did to finally realize it. As Reuters finally admits, “many factories have yet to re-open, disrupting supply chains in China and beyond, as highlighted by Apple.”

As investors dumped risk assets, bonds were in demand, with the 10-year U.S. Treasuries yield falling 4 basis point to just above 1.5%, while safe-haven gold rose to its highest in two weeks and oil prices fell nearly 2% after five days of gains. China’s 10-year government bond yield declined following a two-day rise, amid risk-off sentiment in Asia after Apple warned. Futures contracts on notes of the same tenor also rose for the first time in three days. That came despite the People’s Bank of China’s net withdrawal of 220 billion yuan worth of cash from the financial system on Tuesday. The central bank drained another 700 billion yuan Monday, even though it provided medium-term loans to commercial banks and cut the rate its charges for the money by 10 basis points.

“Sentiment toward global risk turned sour today,” said Dariusz Kowalczyk, an EM strategist at Credit Agricole. “We continue to believe that markets have not yet fully priced in the magnitude of the hit to China’s economy as a result of the Covid-19 outbreak.”

In FX, the yen rose 0.15% to 109.69 yen per dollar while the risk- and China-sensitive Australian dollar lost 0.4% to $0.6686. The yuan was steadier, trading at 6.9950 per dollar. The euro was near a three-year low versus the dollar at $1.0830 before Germany’s ZEW survey, which is expected to fuel growing pessimism about Europe’s largest economy. [/FRX]

Expected data include U.S. Empire State Manufacturing Survey. PG&E, Walmart, Air Canada, and Agilent are among companies reporting earnings

Market Snapshot

- S&P 500 futures down 0.5% to 3,363.50

- STOXX Europe 600 down 0.6% to 429.56

- MXAP down 1.1% to 168.17

- MXAPJ down 1.1% to 550.53

- Nikkei down 1.4% to 23,193.80

- Topix down 1.3% to 1,665.71

- Hang Seng Index down 1.5% to 27,530.20

- Shanghai Composite up 0.05% to 2,984.97

- Sensex down 0.6% to 40,806.11

- Australia S&P/ASX 200 down 0.2% to 7,113.70

- Kospi down 1.5% to 2,208.88

- German 10Y yield fell 2.1 bps to -0.422%

- Euro down 0.06% to $1.0829

- Italian 10Y yield fell 1.5 bps to 0.74%

- Spanish 10Y yield fell 2.4 bps to 0.265%

- Brent futures down 1.9% to $56.60/bbl

- Gold spot up 0.5% to $1,588.52

- U.S. Dollar Index up 0.2% to 99.22

Top Overnight News from Bloomberg

- Apple Inc.’s shares fell 4.1% in pre-market trading after the company said the fallout from the coronavirus will cause it to miss its sales targets this quarter, sending shockwaves across tech stocks globally

- Intesa Sanpaolo SpA launched one of the biggest European banking deals since the financial crisis with an unsolicited 4.9 billion-euro ($5.3 billion) bid for smaller rival Unione di Banche Italiane SpA

- Investors have been plunged back into a gloomy mood over the German economy on concern the coronavirus outbreak in China will disrupt global trade, with expectations for the next six months falling below even the most pessimistic estimate in a Bloomberg survey

- The U.K. economy created jobs at an impressive pace in the fourth quarter, defying the political turmoil over Brexit, with the jobless rate at a four-decade low of 3.8%

Asia-Pac equities traded with losses across the board following a non-existent lead from Wall Street, but as sentiment was dented following a profit warning by Apple, citing the coronavirus outbreak. At the electronic open, major US equity futures experienced downside, with Nasdaq Mar’20 futures immediately giving up the 9600 mark as Apple carries an 11%+ weighting in the index. ASX 200 (-0.2%) was led lower by broad losses across the majority of its stocks in the index, and with material names pressured amid a pullback in base metal prices and as mining-giant BHP traded lower despite topping Adj. EBITDA and underlying profit forecasts, as the miner anticipates net demand losses in the near term amid the virus outbreak. Nikkei 225 (-1.4%) conformed to the overall risk tone but underperformed the region throughout a bulk of the session amid currency dynamics, and with Nissan shares under renewed pressure after its CEO foresees challenges to earnings and cashflow for the remainder of the FY. Other notable movers from the Apple fallout included Samsung Electronics, Taiwan Semiconductor, SK Hynix and Pegatron whose shares all traded lower by 1.5-3.0%. Elsewhere, Hang Seng (-1.5%) and Shanghai Comp (U/C) joined the downbeat performance across the region, with the former weighed on by its heavyweight financials and oil-giants, whilst the latter fared slightly better following yesterday’s PBoC stimulus injection.

Top Asian News

- How Fast Can China’s Economy Bounce Back from Virus Lockdown

- Apple’s Outlook Cut Revives Questions About China Over- Reliance

- Singapore Aims to Phase Out Internal Combustion Vehicles By 2040

- AXA-Affin Insurer Said to Draw Great Eastern, Generali Interest

European equities (Eurostoxx 50 -0.4%) mostly reside in negative territory as the fallout from Apple’s (pre-market -3.3%), revenue warning reverberates across the marketplace. Apple ‘s warning for Q1 revenue guidance was attributed to the coronavirus with the Co. noting it is experiencing a slower return to normal conditions than had anticipated and noted slower demand in products in China alongside iPhone supply constraints. Given that rival peers will likely be subject to similar supply-chain disruptions, IT names lag this morning with ASML International (-2.0%), Dialog Semiconductor (-4.5%), STMicroelectronics (-3%) and Infineon (-1.5%) all enduring losses. From a more medium-term perspective (referring to the US semiconductor sector), Credit Suisse notes “while we expect Semis to trade lower – we would recommend investors who can look into 2H and beyond should use weakness to accumulate best in class companies with a solid structural outlook”. Elsewhere, given the broader macro implications of Apple’s warning, material names are also softer thus far with uninspiring updates from Glencore (-3.9%) and BHP (-2.6%) pressuring the sector. Financials are falling victim to lower yields and a lacklustre update from HSBC (-5.7%) with the Co. unveiling a 33% decline in profits and a restructuring plan that will lead to a job cull of around 35k. Bucking the trend of the pessimism in Europe is the FTSE MIB (+0.3%), in the wake of Intesa Sanpaolo’s (+2.0%) takeover approach for UBI Banca (+22%), which has also stoked optimism around the prospect of further sector consolidation in Italy.

Top European News

- InterContinental Hotels Full Year Revenue Meets Estimates

- U.K. Employment Surges as Labor Market Shrugs Off Weak Economy

- Emissions Clampdown Sends Europe Car Sales to January Slide

- German Investor Confidence Plunges Amid Coronavirus Risks

In FX, although daily updates from China continue to signal that the worst may be over in terms of coronavirus cases and casualties, Apple has joined others issuing warnings about the fallout hitting Q1 production and sales targets with wider repercussions for the tech sector and risk sentiment in general. Hence, the traditional safe haven currencies (and assets) have regained a firm bid after losing some appeal at the start of the week and the DXY is back on track to post higher 2020 peaks as it edges further above 99.000 with only the likes of the Yen, Franc and Gold managing to keep pace or stay ahead of the Greenback. Indeed, Usd/Jpy has eased back a bit further from recent 110.00+ levels, while Usd/Chf is gravitating back towards 0.9800 alongside Eur/Chf on the 1.0600 handle and Usd/Xau is just below Usd1590/oz compared to a low of Usd1579 yesterday. Back to the index, 99.249 resistance has been eclipsed and 99.500 is the obvious next target for bulls ahead of last year’s 99.667 best.

- NZD/AUD/SEK/NOK – The Antipodes are vying with their Scandi peers for the unenviable, though largely unavoidable tag of biggest G10 lower, and the Kiwi is shading it as Nzd/Usd slips under 0.6400 and Aud/Nzd holds near 1.0450 even though Aud/Usd has lost grip of the 0.6700 handle in wake of RBA minutes also flagging the Chinese nCoV outbreak as the biggest near term threat and keeping a rate cut on the table. Meanwhile, the Swedish Crown has been undermined by a rebound in jobless rates and its Norwegian counterpart by a sharp retreat in crude prices amidst the broad deterioration in risk appetite, with Eur/Sek up over 10.5600 at one stage and Eur/Nok near the top of a 10.0220-10.1100 range.

- GBP – Bucking the overall trend, and seemingly gleaning a belated fillip from encouraging UK jobs data (claimant count and employment change) Cable has recouped all and more of its losses around 1.3000 after testing major technical support at 1.2971 (where the 10 DMA aligns with a 50% Fib retracement), while Eur/Gbp has reversed from circa 0.8350 to just above 0.8300. Note, some selling subsequently noted in the headline pair around the 200 WMA (1.3038).

- EUR/CAD – Both succumbing to widespread Usd strength, with the single currency also weighing up divergent independent factors in the form of a worrying ZEW survey in contrast to reports that all Eurogroup Finance Ministers are on board with apportioning some budget finances in the event of an economic downturn, whatever that is deemed to be in terms of severity and how much cash will be allocated. Eur/Usd skirting last week’s 1.0821 base vs around 1.0837 at one stage, while Usd/Cad straddles 1.3250 ahead of Canadian manufacturing sales and with the Loonie also hampered by the aforementioned recoil in oil.

- EM – Further depreciation vs the Dollar across the board, but the Rand also wary about more Eskom load-shedding, while the Lira and Rouble are still embroiled in Syria-related issues, and the latter also undermined by heightened conflict in the Ukraine.

In commodities, WTI and Brent front month futures are subdued this morning with losses just shy of USD 1/bbl at present in-line with the general risk sentiment. Newsflow has picked up on the geopolitical front, although not enough to dictate price action at present; with focus returning to the ongoing dispute between Russia and Ukraine which has flamed up once more on reports of heavy fighting in the Lugansk province. Ukraine has one of the largest gas transmission systems in the world, which is heavily linked to Russian, Belarus, Poland and other surrounding nations; the region in question does contain a number of gas pipelines but it is unclear as to whether they are currently in use as a bypass has been constructed. Focus will remain on how this escalates, and if it leads to disruptions to gas supply. Sticking with Russia, the Kremlin this morning noted that Energy Minister Novak is still considering his position with reference to the recommended JTC production cuts. In terms of outlook, given the coronavirus ING have revised down their price forecasts as the virus causes consumption to drop; with cuts of USD 5/bbl for Q1 Brent (from USD 60/bbl to USD 55/bbl), although their forecasts are unchanged by 2021. Note, given the US holiday the weekly API and EIA metrics will be released one day late on Wednesday and Thursday respectfully. Turning to metals, where spot gold is firmer this morning on the aforementioned geo-political tensions and as the coronavirus begins to impact US tech giants; albeit, the metal has dipped marginally from session highs in recent trade ahead of the US’ entrance to market. Elsewhere, copper prices are little changed but were hit overnight in-line with general risk sentiment.

US Event Calendar

- 8:30am: Empire Manufacturing, est. 5, prior 4.8

- 10am: NAHB Housing Market Index, est. 75, prior 75

- 4pm: Net Long-term TIC Flows, prior $22.9b

- 4pm: Total Net TIC Flows, prior $73.1b

DB’s Jim Reid concludes the overnight wrap

In the same way a solar eclipse requires the sun and earth’s orbit to be completely in synch, tonight the orbits of my work travel and my favourite football team’s all conquering path through world football are perfectly aligned. After a busy day of meetings in Madrid (I had to say that) I’m off to the Wanda Metropolitan stadium to watch Liverpool take on Athletico Madrid in the Champions League. I’ve got a feeling I’m in the home end so if you’re watching it on the telly and see one guy with the opposite reaction to the rest of the surrounding crowd then you’ll know it’s me.

If you had to describe yesterday in football parlance it would be a dull 0-0 with no shots on target for either side. The US holiday and half term drove down activity to a crawl. However after the time that the US market would have closed had it not been on holiday Apple issued a revenue warning for Q1 and became the highest profile market victim of the virus impact so far.

The company said in a statement that while work is starting to resume in China, “we are experiencing a slower return to normal conditions than we had anticipated,” and global iPhone supply will be “temporarily constrained.” Apple suppliers including TDK Corp. (-3.87%) and Tokyo Electron Ltd. (-5.06%) slumped after the warning. Comments from Apple came after similar comments by the American Chamber of Commerce in Shanghai. They said that most US factories in China’s manufacturing hub around Shanghai will be back at work this week, but the “severe” shortage of workers due to the coronavirus will hit production and global supply chains. Our FX Analysts updated a piece yesterday that shows that our proprietary shipping data still hasn’t recovered yet post the NY holidays and virus shutdowns (link here). We’ll continue to watch this data for signs of economic activity picking back up.

Also impacting sentiment overnight is news from Bloomberg that the White House is considering new restrictions on exports of cutting-edge technology to China in a push aimed at limiting Chinese progress in developing its own passenger jets and also on clamping down further on Huawei’s access to vital semiconductors. The report added that senior officials are expected to decide by the end of this month whether to block exports of jet engines made by a JV of General Electric and France’s Safran to China. Further, the administration is also considering separate measures to broaden export controls related to the existing restrictions on Huawei by blocking foreign chipmakers, such as Taiwan’s TSMC and US suppliers, from selling components made overseas to Huawei.

Markets are heading lower in Asia this morning on the back off these stories with the Nikkei (-1.46%), Hang Seng (-1.45%), Shanghai Comp (-0.37%) and Kospi (-1.47%) all down. As for Fx, the onshore Chinese yuan is down -0.21% to 6.9958 and the Australian dollar is down -0.36% as the RBA said that it considered a rate cut at its last meeting but shied away from it to avoid extra borrowing as house prices rise. Elsewhere, futures on the S&P 500 are down -0.30% while yields on 10yr USTs are down -3.7bps as they reopened post a holiday with 30yrs back below 2% again. Brent crude oil prices are down -1.04% and spot gold prices are up +0.29%.

The latest on the virus is that in China the total confirmed cases now stand at 72,436 with the death toll at 1,868. Japan also said overnight that it will remove all passengers from the quarantined cruise liner by Friday. There were 454 confirmed cases of the virus on the ship by yesterday. Also worth flagging was the news yesterday that Macau casinos will reopen this Thursday, albeit conditional based on unspecified criteria according to the secretary for economy and finance in Macau.

This all followed a very uneventful session in Europe yesterday. The STOXX 600 closed up +0.34%, bucking two consecutive down days and traded in a range of less than half a percent as sentiment got a boost from the China stimulus announcement which came before Europe had walked in. There were similar gains also for the DAX (+0.29%) and CAC (+0.27%) while the FTSE MIB outperformed with a +1.02% gain. BTPs also had a better day than their counterparts, with yields down -1.6bps versus +0.1bps for Bunds although there didn’t appear to be any specific Italy-related news which helped the outperformance so it’s probably more the high beta element driving the price action.

Elsewhere, the euro was little changed after losing ground almost every day in February so far, while in commodities there wasn’t much to talk about in Oil or Gold either, with both also trading fairly flattish through the last 24 hours. Meanwhile in credit, HY spreads in Europe were -1.8bps tighter. Speaking of credit its worth seeing how Kraft Heinz bonds trade today following their downgrade to HY by Fitch and then later S&P on Friday. Given that the S&P move came very late in the day we haven’t really seen the full reaction yet. Craig and Nick put out a note yesterday which looked at the technical impact the downgrade will have on the HY market. It also looks at other potential fallen angel candidates and where their bonds trade relative to the average BBB- and BB+ bonds. See the US note here and the Euro one here. As we said yesterday this is a real glimpse into the future problems in credit markets. When the economy turns there will likely be a huge problem given the weight of weaker BBBs out there. For now though this is likely idiosyncratic.

BBB used to mean Brexit, Brexit and more Brexit until the recent lull in newsflow. In another glimpse of problems down the line, the U.K. chief Brexit negotiator David Frost last night aggressively pushed back on the EU’s insistence on a level playing field provision in trade talks saying that “We must have the ability to set laws that suit us” and that having to abide by EU rules “simply fails to see the point of what we are doing”. Not a surprise but confirms the expected likely high tensions ahead.

In other news, Bloomberg ran a story yesterday looking at the political frictions impeding another ECB rate cut. On a similar vein it’s worth highlighting a report our economists in Europe published on asking whether the ECB was heading for another showdown between the monetary policy technicians on the one side and the monetary policy politicians on the other. The team discuss the rising risks to their baseline assumption that ECB policy will remain unchanged this year. These are: First, the coronavirus. Second, the weakness of the euro area economy just before the virus. Some on the ECB see space for further easing, if needed. Others would find it more difficult to ease. There are arguments supporting a more patient attitude, that is, a less reactive policy stance. One main reason is that the more the ECB reacts to events the more it delays fiscal policy which is ultimately what the ECB wants. We suspect patience is also what Lagarde would prefer, as long as the euro area is not facing a substantial downgrading of the outlook.

Looking at the day ahead, this morning it’ll be worth keeping an eye on the December and January labour market data in the UK before we get the February ZEW survey in Germany. With the US returning, data releases will include the February empire manufacturing print and February NAHB housing market index reading.

Tyler Durden

Tue, 02/18/2020 – 07:51

via ZeroHedge News https://ift.tt/2vGSFPq Tyler Durden