The Real ‘Tragicomedy’ – Who’s Ready To Buy The ‘Dip’ Again Now?

Authored by Sven Henrich via NorthmanTrader.com,

We’re all frogs getting our perception of reality boiled in the pot of price perversion central banks have unleashed on the world.

A tragicomedy of epic proportions continues to unfold in front of our own eyes. On Friday global markets again closed at record highs and this week everybody is already crying again for more stimulus and central bankers across the world are too eager to oblige.

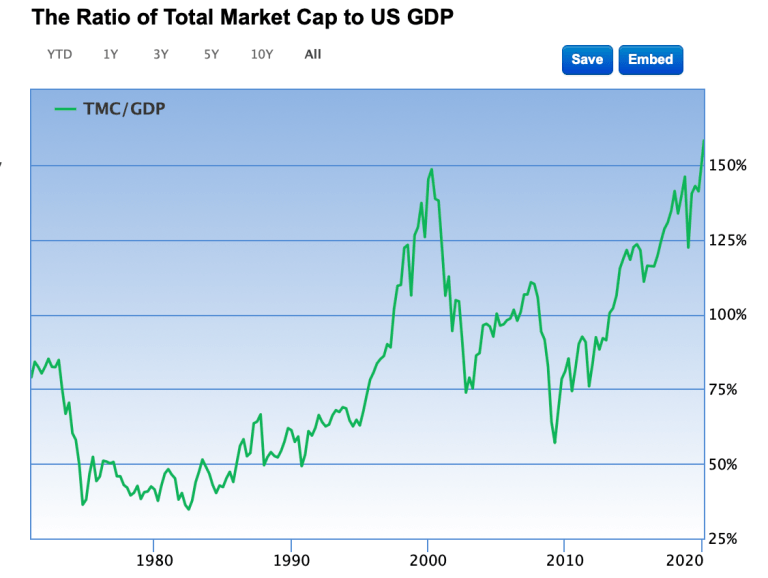

Having jammed markets already to a record 158% market cap to GDP by Friday on non stop interventions since the December 2018 lows, all in the name of preventing the next recession, central bankers self admittedly have precious little new ammunition left should a global recession unfold.

It looked like the can had successfully been kicked down the road just looking at equity prices, but the bond market has been screaming caution all along.

Along comes the coronavirus and everybody ignores it as well. Let’s go fully long and chase stocks into record highs while the 2nd largest economy with 330% debt to GDP goes into a standstill. What could possibly go wrong?

Central banks always have our backs right?

What?

You really thought the 2nd largest economy on the planet shutting down wouldn’t impact growth, or you thought the Fed would make it not matter or both?I really would like to know on what investment premise people are chasing markets at 157% market cap to GDP.

— Sven Henrich (@NorthmanTrader) February 17, 2020

And so last night came the obvious news: $AAPL issued a revenue warning and surely won’t be the only company to do so. The great irony of course would be if the greatest market cap expansion in any stock’s history that was sparked by a revenue warning in January 2019 would end with another revenue warning in February 2020 right at the time when the stock is showing some of the most technically extended readings in its history.

Price movements have become so distorted as a result of constant central bank intervention that everybody gets the joke:

BREAKING: Fed to launch not QE purchases of iPhones until $AAPL’s revenue numbers are met.

— Sven Henrich (@NorthmanTrader) February 17, 2020

As I said yesterday:

A market that never discounts any reality by force of constant intervention is by definition an artificial bubble.

Central banks have made a mockery of price discovery and the free flow of capital.

All markets are now are a central bank policy chase operation.

— Sven Henrich (@NorthmanTrader) February 17, 2020

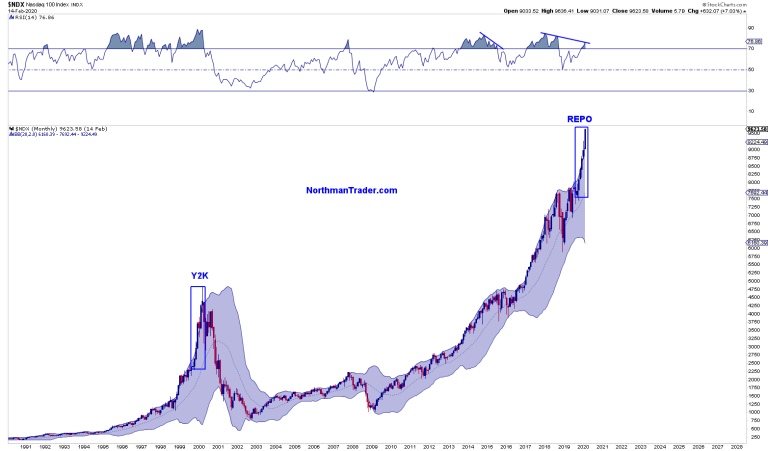

Now I don’t know if the $AAPL warning will trigger the larger correction that is suggested by the larger technical picture in indices such as $NDX or not, but it may well lead to it.

It may be worth pointing out that this market continues to be held up by 5 stocks and one of these 5 stocks just got dinged:

Yikes. Exclude the big 5 (Microsoft, Apple, Alphabet, Amazon and Google) and U.S. earnings were down 7.5% in the 4th quarter. H/t @AndrewLapthorne of SocGen

— John Authers (@johnauthers) February 17, 2020

The larger market of stocks is in a much larger earnings recession already and 5 stocks have been masking it all.

5 stocks are the safe haven in a market that’s been forced to chase yield and growth where it can find it. The stubborn approach to keep rates artificially suppressed has resulted in a perversion of price discovery.

And so global markets are at all time highs with Japan in a recession, Germany at 0% GDP growth and the second largest economy in the world with 330% debt to GDP at a virtual standstill. In the meantime the ECB is financing’s France’s richest man’s latest M&A acquisition:

France’s Richest Man Gets a Free Lunch From the ECB

The real continued unspoken tragedy of all this is that central banks with their policies keep exacerbating wealth inequality by their continued propping of assets disproportionally owned by the top 1%. This leads to political divisions, tensions and a sense of economic unfairness that some of the very richest fully recognize. Low taxes for the top 1% and a permeant central bank put on top of it. Bill Gates recognizes the unfairness perception:

It’s not so much that the economy is unfair it’s that central bankers keep employing monetary policies that disproportionately benefit asset class holders such as Bill Gates.

Innovators should get wealthy, but it’s not the role of central bankers to make that wealth obscene. https://t.co/vxN6oWUgcb— Sven Henrich (@NorthmanTrader) February 16, 2020

Keep believing that nothing matters because of central banks if you so choose. No, a tragicomedy is unfolding before our eyes and the ultimate ending of the perversion may well be written such as this:

Future history book: Central bankers in their arrogance believed they could control the business cycle forever, in process created the largest asset bubble ever.

When the bubble burst & the consequences laid bare, the power of central banks was heavily scrutinized & curtailed.— Sven Henrich (@NorthmanTrader) February 17, 2020

I can’t say if Coronavirus is the trigger that sparks the global recession that central bankers in 2019 and 2020 sought to avoid. All I can say at this moment is that the impact of the virus continues to be underestimated by market participants and $AAPL’s revenue last night serves as a warning piece of evidence.

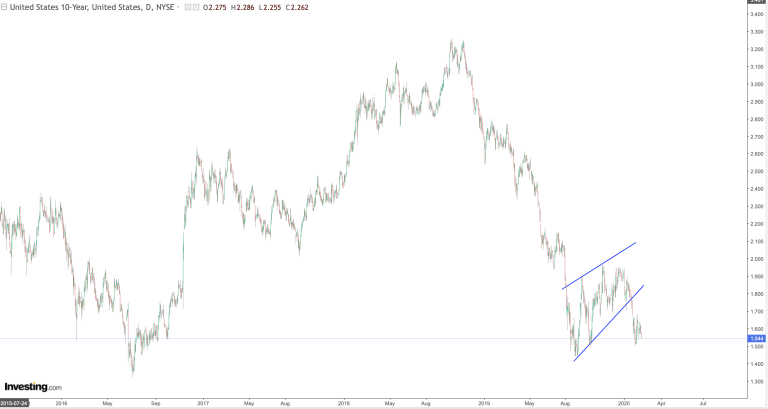

What I can say is that central bankers just threw their ammunition in the fire last year and the reflation evidence remains very much in doubt especially as yields continue to drop:

The real tragicomedy would be if central bankers went all in to prevent a global recession in 2019 and, as a result, got everyone to chase stocks into the highest valuations ever on many measures and now a global recession were to unfold anyways leaving long chasers trapped at extreme valuations and central banks with precious little ammunition left.

An already overstimulated world may find that any renewed stimulus will lack in efficacy. And perhaps it already does. After all why is the 10 year at 1.5%?

Who’s ready to buy the “dip”?

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Tyler Durden

Tue, 02/18/2020 – 09:55

via ZeroHedge News https://ift.tt/2P6mgIV Tyler Durden