Which Supply Chains Are Most At Risk: The Answer In One Chart

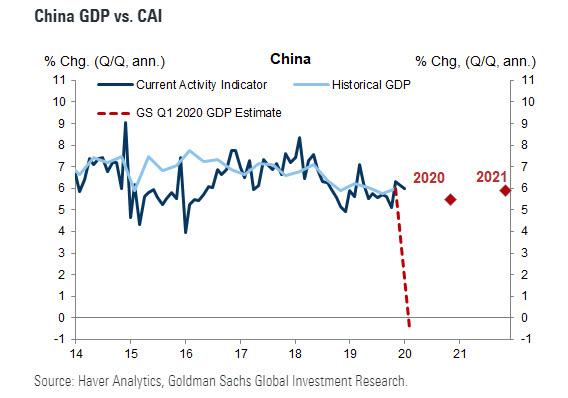

Now that Apple has broken the seal and made it abundantly clear that China’s economic collapse which could push its Q1 GDP negative according to Goldman as the second largest world economy grinds to a halt (as described here last week)…

… will have an adverse impact on countless supply-chains, which in today’s “just in time” delivery environment, are absolutely critical for keeping the global economy running smoothly (for a quick reminder of what happens when JIT supply chains stop functioning read our article from 2012 “”Trade-Off”: A Study In Global Systemic Collapse“), attention on Wall Street has turned to which other US sectors stand to be adversely impacted should the coronavirus pandemic not be contained on short notice and China’s economy crisis transforms into a supply shock.

Conveniently, Goldman Sachs just did this analysis.

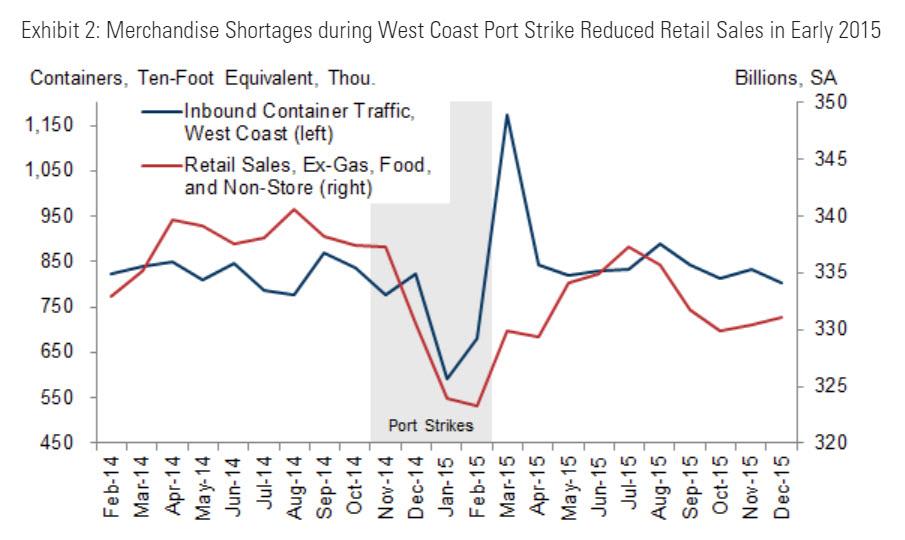

In a report looking at the impact of Chinese factory shutdowns on the US consumer, Goldman’s Spencer Hill first looks at historical precedent and finds that a somewhat similar supply shock emerged in the winter 2014-15—a four-month labor dispute affecting West Coast ports— which appeared to meaningfully affect retail spending on consumer goods in the first quarter of 2015 (though snowy weather was likely a factor as well). This is shown in the chart below.

Indeed, the March 2015 Beige Book noted that consumer spending in the San Francisco Fed district would have been stronger “if not for delays receiving merchandise caused by labor disputes at West Coast ports.”

Extrapolating this historical pattern, Goldman notes that “long shipping times to the US (generally 1 month or more by sea) imply the supply-chain effects of Chinese production shortfalls may not fully materialize until future quarters—at which point above-trend Chinese production or import substitution from other counties could offset some of the impact.”

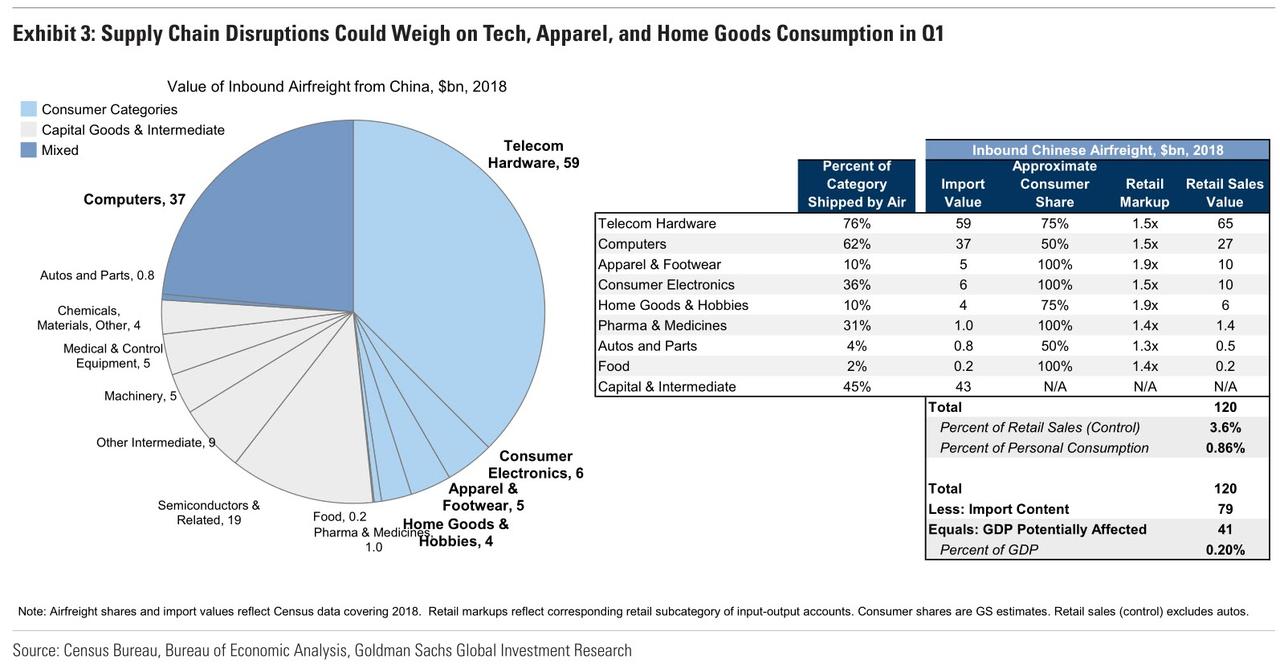

However, analyzing granular international trade data from the Census Bureau, Goldman finds that nearly a third of Chinese products arrive by air (by value, including over 75% of telecom hardware), with these goods representing 3.6% of US retail sales and just under 1% of personal consumption expenditures. The composition of these products (and their wholesale value) are shown in the left panel of the chart below, and represent the sector most likely to be impacted as China remains paralyzed. Unsurprisingly, airfreight imports are skewed towards high-value, light-weight products such as smartphones, laptops, and consumer electronics, representing a perfect storm for a company such as Apple which is reliant on all three. Additionally, a significant share of apparel and footwear (10%) also arrives from China by plane.

To summarize, here are the sectors more at risk from a continued crunch across Chinese factories:

Illustratively, Goldman notes that if air freight from Mainland China falls by 50% in February and returns to roughly normal in March, forgone sales could reduce monthly retail control by as much as 1.8%. Assuming only half of these spending dollars are used to purchase other goods and services, February retail spending would be depressed by 0.9%, lowering Q1 consumption growth by 0.3% (qoq ar).

The good news, until last night at least, is that virtually no companies had disclosed an immediate adverse impact emerging due to Chinese supply chains, sparking some hopes that most if not all had found alternative supply chain substitutes to offset the Chinese crisis. However, with Apple’s guidance cut, it now appears that US companies had merely hoped to delay as long as possible the guidance cuts. As a result we now expect a waterfall of negative earnings preannouncements from most companies that have even a modest exposure to Chinese output, which also means that Q1 earnings are looking increasingly gloomy after the modest EPS rebound in Q4, which as we detailed previously was entirely on the back of the “Big 5” FAAMG tech megacaps.

Tyler Durden

Tue, 02/18/2020 – 20:25

via ZeroHedge News https://ift.tt/2HGYD5r Tyler Durden