Yellen Says Fed Should Buy Stocks In The Next Crisis

Back in June 2017, there were several odd moment of bizarre honesty coupled with schizophrenic confusion under Janet Yellen’s Fed.

First there was San Fran Fed president John Williams, who would eventually on to become the Fed’s #2 when he took over as head of the NY Fed in 2019, who said that “there seems to be a priced-to-perfection attitude out there” and that the stock market rally “still seems to be running very much on fumes.” Williams added that “we are seeing some reach for yield, and some, maybe, excess risk-taking in the financial system with very low rates. As we move interest rates back to more-normal, I think that that will, people will pull back on that.”

Then it was then-Fed vice chairman Stan Fischer’s turn, who echoed Williams in saying that “the increase in prices of risky assets in most asset markets over the past six months points to a notable uptick in risk appetites…. Measures of earnings strength, such as the return on assets, continue to approach pre-crisis levels at most banks, although with interest rates being so low, the return on assets might be expected to have declined relative to their pre-crisis levels–and that fact is also a cause for concern.” Fischer then also said that the corporate sector is “notably leveraged”, that it would be foolish to think that all risks have been eliminated, and called for “close monitoring” of rising risk appetites.

Finally, none other than then-Fed Chair Janet Yellen said that some asset prices had become “somewhat rich” although like Fischer, she hedged that prices are fine… if only assumes record low rates in perpetuity: “Asset valuations are somewhat rich if you use some traditional metrics like price earnings ratios, but I wouldn’t try to comment on appropriate valuations, and those ratios ought to depend on long-term interest rates.”

But while these three moments of rare honesty prompted surprised stares among investors – as a reminder, back then the S&P was trading at “only” 2,400, the Fed was only starting to hike rates and QE4 was more than two years ago – it is what Yellen said next that shocked virtually everyone.

Responding to a question on financial system stability, Yellen said post-crisis regulations had made financial institutions much “safer and sounder”, and as a result she went on to predict that there would never again be a financial crisis “in our lifetimes” to wit:

“Will I say there will never, ever be another financial crisis? No, probably that would be going too far. But I do think we’re much safer and I hope that it will not be in our lifetimes and I don’t believe it will.”

While some were quick to compare this statement by Yellen (who then was 70–ears old) to Neville Chamberlain infamous – and very, very wrong – 1938 prediction of “peace in our time”, perhaps she was hiding a trump card all along… A trump card which she revealed only now, almost three years later.

Speaking via video conference with bankers in Kansas City, Yellen said that the Fed would take a page out of the SNB and BOJ playbook, and “might be able to help the U.S. economy in a future downturn if it could buy stocks and corporate bonds.” Of course, by “US economy” she meant the “top 1%” and their political cronies.

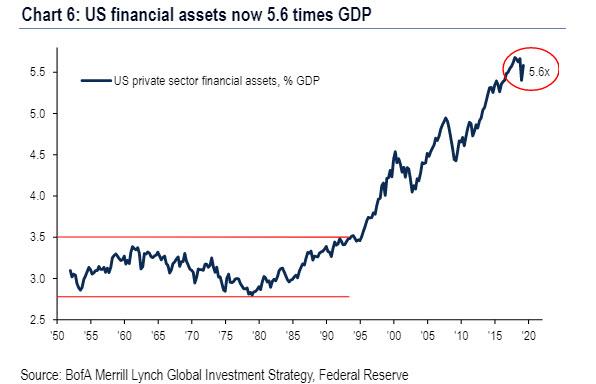

And while Yellen was quick to walk back this “hypothetical” scenario, saying that “the issue was not a pressing one right now” and pointed out the U.S. central bank is currently barred by law from buying corporate assets, the idea was already “incepted” in the heads of America’s political rulers (whose fate is just as tied to the vagaries of the stock market) and the law can be changed literally overnight. And after all, it is only a matter of time before a crisis does hit, and now Yellen has explained has to happen to avoid an all out social catastrophe in a country where financial assets account for nearly 6x of GDP.

To validate her point, Yellen said that the Fed’s current toolkit might be insufficient in a downturn if it were to “reach the limits in terms of purchasing safe assets like longer-term government bonds.”

“It could be useful to be able to intervene directly in assets where the prices have a more direct link to spending decisions,” she said, adding that buying equities and corporate bonds could have costs and benefits…. But mostly benefits, if only for the Fed, the politicians and the very, very rich.

Keep in mind that what Yellen said was merely a paraphrase of Ben Bernanke’s famous April 2010 WaPo oped in which he defended easy monetary policy is facilitating higher stock prices, which would “boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.”

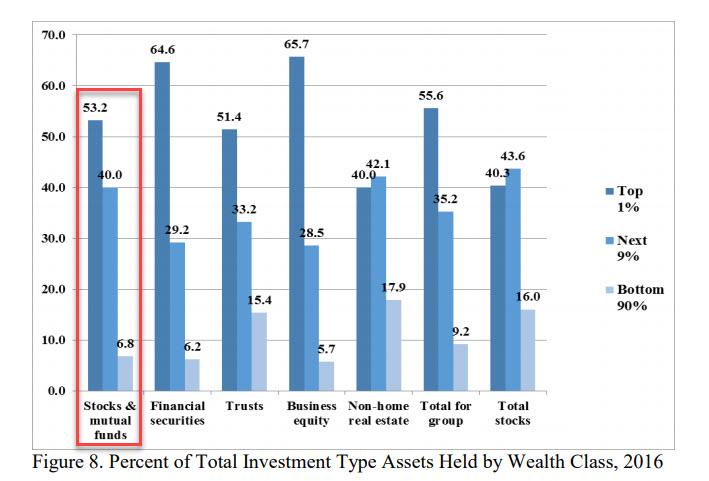

Of course, none of this “trickle-down” ever happened, and instead what did happen is that the top 10% of US society who own 93% of all equities got fantastically rich…

… while the bottom 90% who own virtually no stocks and owe most of the debt, got very, very angry as they watched how the Fed plundered their future and hopes to become wealthy, and resulted first in the election of Trump, and the upcoming election of a socialist candidate as America goes full-on populist in response to the Fed’s catastrophic policies.

However, thanks to Yellen we now know that the Fed won’t go down without a fight… or at least without monetizing everything before the Marriner Eccles building is finally burned down.

Last month, Yellen told a conference the Fed would fight a future recession by buying government debt and jaw boning interest rates lower with pledges on future policy. But she said other tools might be necessary, including expanding the range of assets it would purchase.

And so, thanks to Janet Yellen, we now we know that before the current fiat regime of central banks finally ends and before stocks go limits up as the revolution starts, the Fed will order a POMO of, well, everything in one final, last ditch effort to keep social stability by creating the impression that stocks are stable and rising even as society implodes.

Will it be successful? Normally we would say “not a chance.” But when one considers that that’s precisely what has happened for the past decade, and one has to think really hard just how much further the Fed can keep kicking the can before it all comes crashing down.

Tyler Durden

Tue, 02/18/2020 – 20:45

via ZeroHedge News https://ift.tt/2uZjBK9 Tyler Durden