Covid Contagion Sparks Carnage As Stocks Wipe Out All 2020 Gains

Well, that escalated quickly…

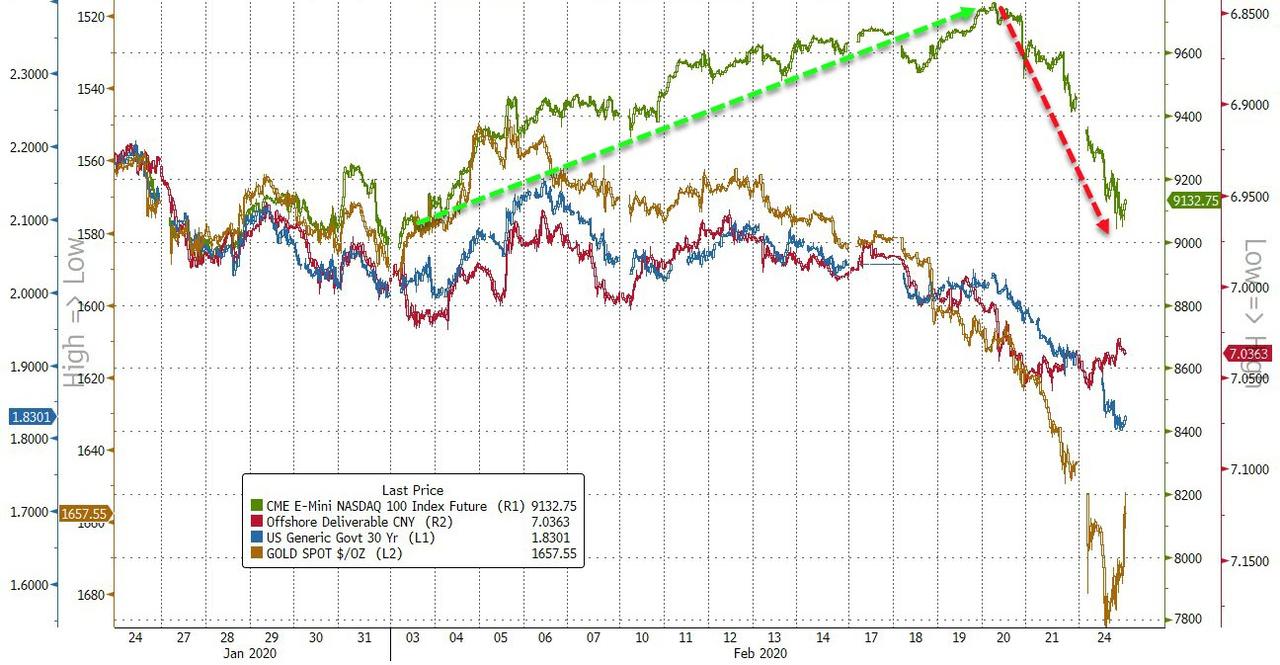

As stocks finally woke up from their complacent sleep and began to catch down to the reality in bonds, FX, and commodities…

Source: Bloomberg

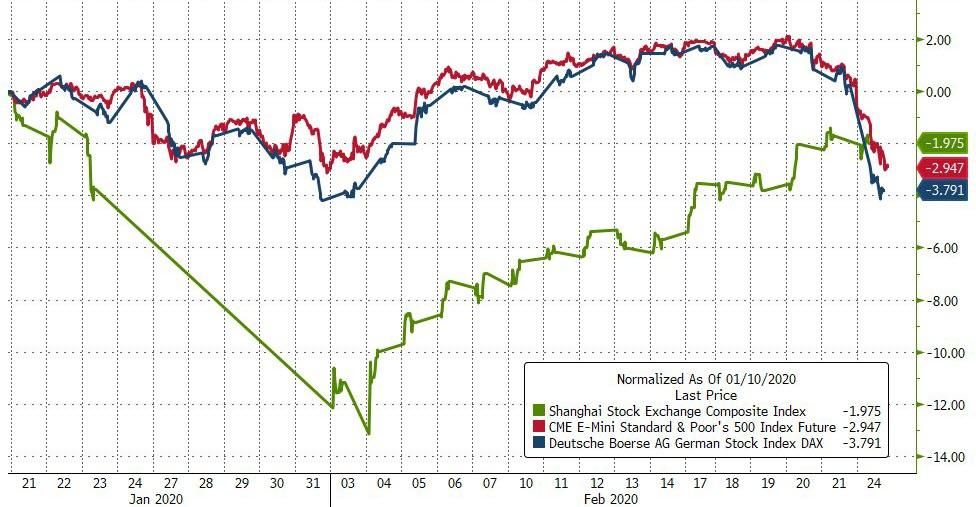

The most ironic thing about all of this utter cognitive dissonance over deadly-virus supply-chain disruptions is that China is actually outperforming US and Europe since the crisis really began…

Source: Bloomberg

High-tech, small cap Chinese stocks surged overnight as large cap stumbled…

Source: Bloomberg

South Korean stocks crashed as the virus counts exploded higher (today’s drop was biggest since Oct 2018)…

Source: Bloomberg

But as Italian news escalated, things escalated and all European equity indices fell back into the red…Italian stocks crashed over 5% – the worst day since June 2016’s Brexit vote…

Source: Bloomberg

And ugly day in US markets today as complacency finally snapped…

Nasdaq Composite saw its biggest point loss in history (bigger than during the dotcom collapse) and Dow saw its 2nd biggest point drop in history (1175pts on 2/8/18).

Technical levels saw some support with Nasdaq bouncing at its 50DMA…

S&P 500 closed red for 2020…

Dow bounced and tried hard but failed to hold 28,000 at the close…

VIX surged to its highest since Jan 2019, topping 26…

Airlines crashed to their lowest since October with the biggest daily drop since June 2016…

Source: Bloomberg

Bank stocks were battered as rates plunged, biggest daily drop since Aug 2018…

Source: Bloomberg

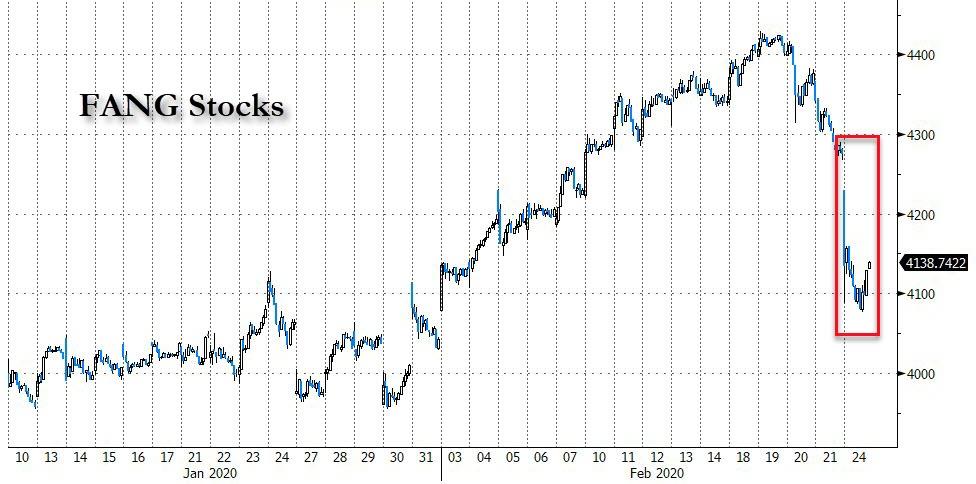

FANG stocks suffered their worst day since Dec 2018

Source: Bloomberg

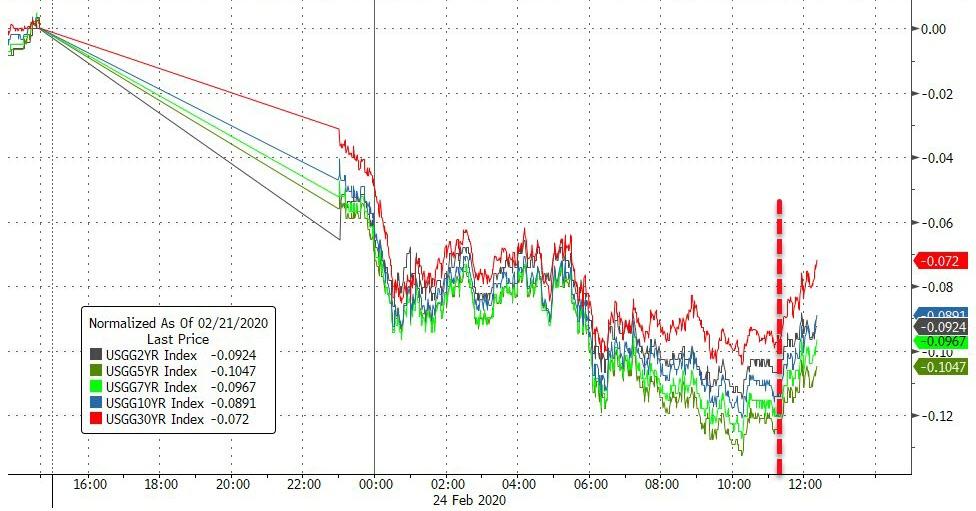

Treasury yields tumbled today but after the 1430 jerk lower in gold, bonds were sold…

Source: Bloomberg

30Y Yields crashed to record lows…

Source: Bloomberg

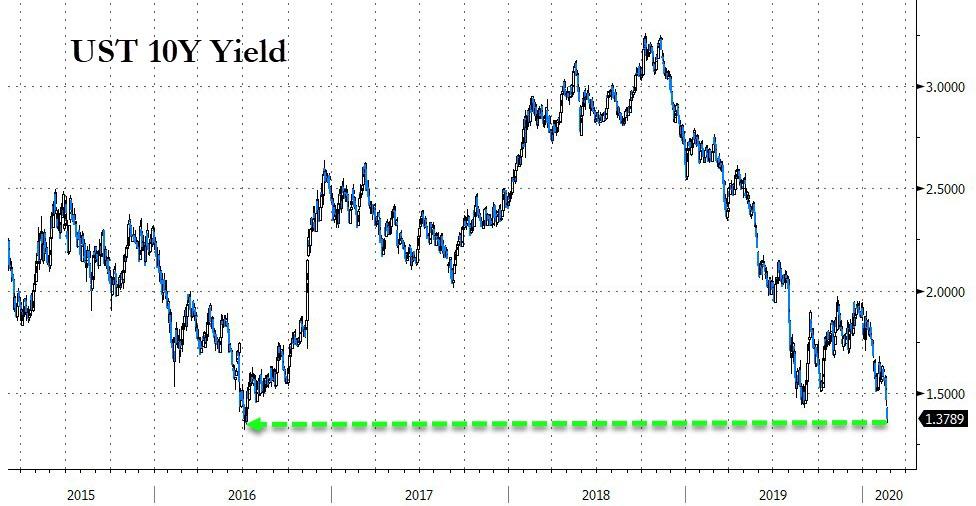

And while 10Y yields did not make a record intraday low, it got very close…

Source: Bloomberg

And the yield curve crashed to its flattest since early October…

Source: Bloomberg

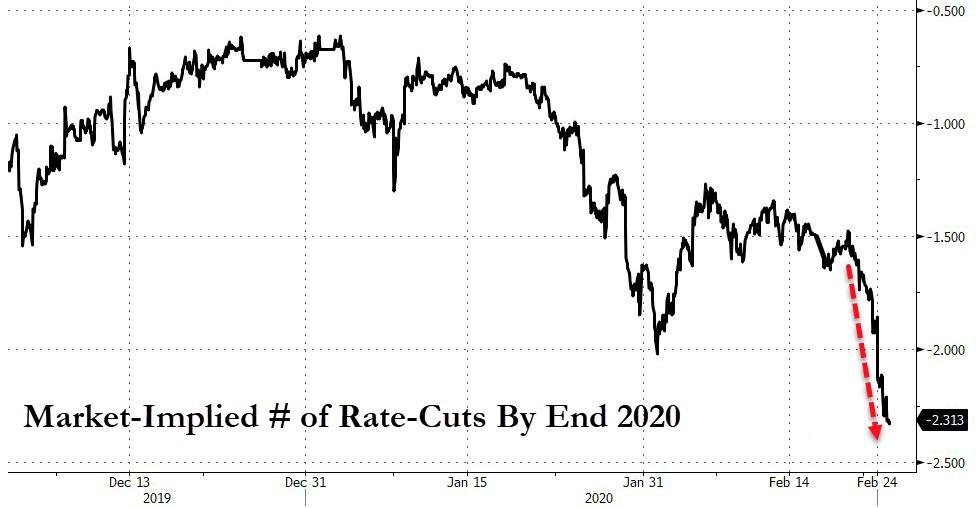

Traders are in full panic – Please Fed Save Us – mode, pushing expectations to 2.3 rate cuts now in 2020…

Source: Bloomberg

The Dollar mirrored Friday’s trading in an odd pattern…

Source: Bloomberg

Yuan has fallen to a key level…

Source: Bloomberg

Cryptos were sold overnight…

Source: Bloomberg

Bitcoin slipped back below $10k…

Source: Bloomberg

PMs were positive today and crude and copper sold hard…

Source: Bloomberg

Gold has a strong day but was clubbed like a baby seal around 1430ET margin call time

Gold and JPY fell together then tracked each other perfectly, as if The BoJ decided that record lows in JPY against gold was time to step in…

Source: Bloomberg

Additionally, gold in yuan is very close to its record highs…

Source: Bloomberg

WTI plunged to a $50 handle injtraday before being magically levitated in the afternoon…

Gold is leading year-to-date, with bonds close behind and the USD higher…but stocks ended red…

Source: Bloomberg

Finally, some might say today’s collapse came right on time…

Source: Bloomberg

Or was this crash exacerbated by the surge in Sanders over the weekend?

Source: Bloomberg

Tyler Durden

Mon, 02/24/2020 – 16:02

via ZeroHedge News https://ift.tt/2HA2iCa Tyler Durden