Morgan Stanley: “We Believe That We Are Still Heading Towards Scenario 2”

Authored by Chetan Ahya, chief economist at Morgan Stanley

Disruption, Dislocations and Delayed Recovery

With economic activity disrupted and capital markets dislocated, investors are debating if Covid-19 will derail the global cycle. In times of sharp drops in asset markets, pessimistic prognoses are easy to make, but it is at times like this when some perspective is warranted.

Coming into the year, we had a growing body of evidence that, after a tough 18 months, the global economy was on the mend. PMIs new orders were improving from October and headline PMIs troughed then too. Global trade was growing again in December after contracting for six months. While there was still skepticism then, we thought these data points were lending support to our thesis of a global recovery taking hold from 1Q20.

The outbreak of Covid-19 has certainly changed the near-term narrative. It is an untimely shock, considering that the starting point of global growth was weak, and the recovery was very nascent. The disruptions to economic activity will create a pronounced impact on global growth in 1Q20.

The question is whether this is an exogenous, transitory shock or one that fundamentally challenges the cycle. We are in the former camp. Indeed, throughout this expansion cycle, we have had a series of shocks to the global economy, which have led to a number of mini-cycles in global growth, but have actually helped to extend the cycle as we did not have the runway to go into a traditional overheating situation.

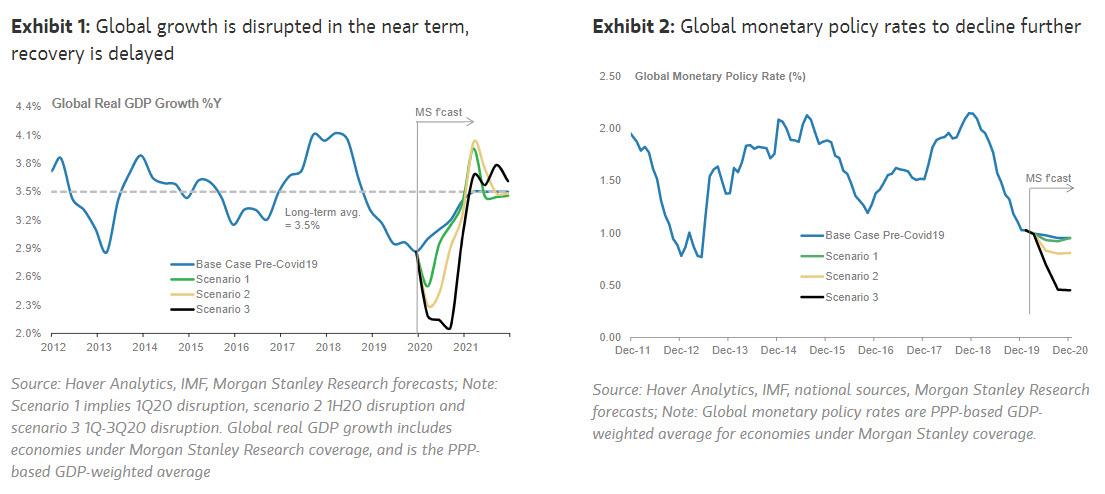

Given the uncertainty over the virus outbreak, we see three possible scenarios for the road ahead:

- Scenario #1 – containment by March: The virus outbreak is contained by end-March and production disruption is limited to 1Q20. Policy-makers in China and Asia will provide meaningful policy support, with China expanding its fiscal deficit by 120bp, keeping it high for the second year running. Global growth dips to 2.5%Y in 1Q20 (from 2.9%Y in 4Q19), but recovers meaningfully from 2Q20.

- Scenario #2 – escalation in new geographies, disruption extends into 2Q20: New cases continue to rise in other parts of the world, before peaking by end-May. The disruption extends into 2Q20, affecting corporate profitability in select sectors, risking the emergence of corporate credit risks. If the dislocations in asset markets also persist into 2Q20, the sharp tightening in financial conditions may well become the overwhelming factor and exacerbate the impact on growth via weaker corporate confidence and capex and cutbacks in hiring activity.

In response, policy-makers around the world will step up easing measures – with fiscal policy in Asia and Europe and monetary policy in the US doing the heavy lifting. Indeed, our chief US economist Ellen Zentner expects the Fed to cut rates by 25bp in March and to maintain an explicit promise to continue if growth damage extends. Global growth averages just 2.4%Y in 1H20, but picks up from 3Q20.

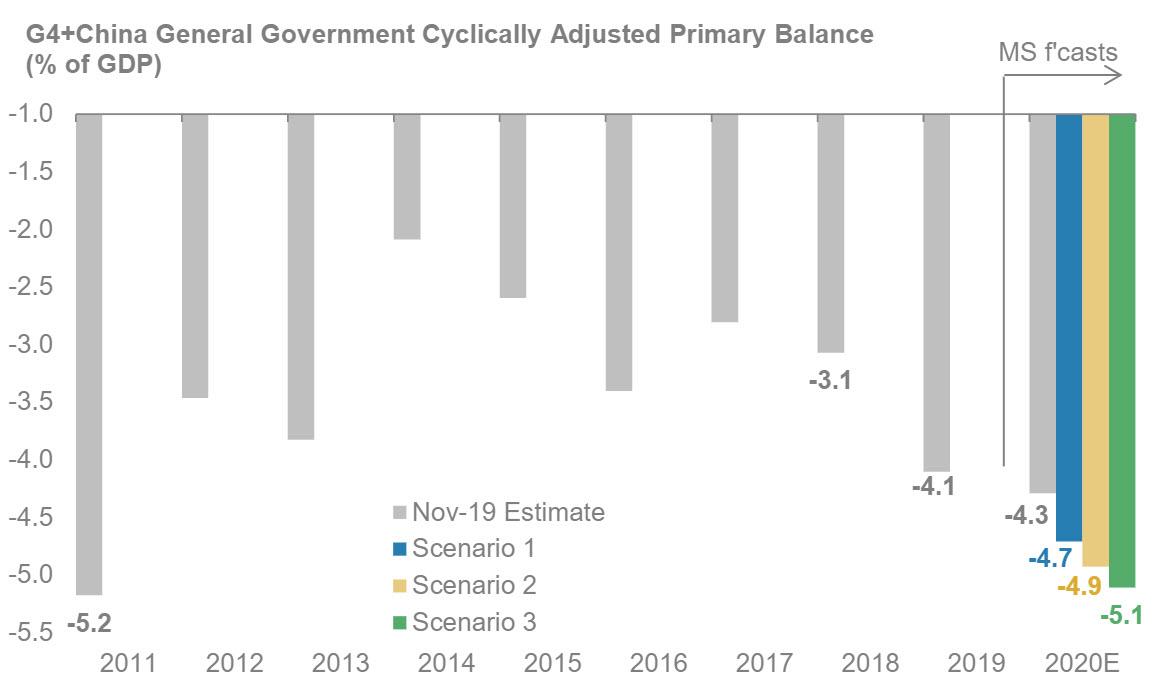

- Scenario #3 – persisting into 3Q, escalating recession risks: The virus continues to spread into 3Q, encompassing all the large economies. China faces a renewed rise in new cases as it restarts production. Disruption continues into 3Q. The extended disruption to economic activity damages corporate profitability and brings about a rise in corporate credit risks and significant tightening in financial conditions, which exacerbate the slowdown in global growth.

- Central banks will embark on a renewed easing cycle, with the potential for a coordinated response. We expect the global weighted average monetary policy rate to dip to its lowest level since 2012. The Fed extends the cuts from March-June and becomes more aggressive in 50bp increments to take rates to close to the lower bound by 3Q20. The fiscal response across key DM and EM economies also becomes more aggressive, with China taking up 200bp of fiscal expansion. The cyclically adjusted primary fiscal deficit for G4 and China widens to 5.1% of GDP in 2020, from 4.1% in 2019. Global growth stays weak (i.e., below 2.5%Y) between 1Q20-3Q20.

At the current juncture, we believe that we are heading towards scenario 2. Our strategists believe that more liquid markets, such as equities and UST yields, may well see a bounce from oversold levels soon, but credit has not cheapened enough given the greater return asymmetry. Developments related to the outbreak of the virus remain key to watch, and we are monitoring the following signposts:

- The ability to bring the outbreaks under control in affected areas and the scope of the spread across Europe and into the US;

- Whether China faces a rise in new cases as it continues to restart production; and

- Updated data from the therapeutics in development.

Tyler Durden

Sun, 03/01/2020 – 17:25

via ZeroHedge News https://ift.tt/2Top7yg Tyler Durden