Platts: 4 Commodity Charts To Watch This Week

Via S&P Global Platts Insight blog,

From crude oil to gas to gold, commodities markets continue to be affected by the outbreak of coronavirus and the impact it has had on global economic sentiment. Read on for our pick of unfolding market trends from S&P Global Platts news editors.

1. Oil traders brace for weak demand

What’s happening? A state of contango – where prices for forward delivery are higher than those for nearer delivery dates – has spread through the Dubai crude oil market, implying traders are bracing for unusually weak demand in the second quarter and beyond. Oman crude also fell into contango at the end of last week, ending the month at parity with Dubai.

What’s next? Market conditions will increase pressure on OPEC and its non-OPEC allies to agree to extend and deepen production cuts at their meeting in Vienna from Thursday. As things stand, it is likely the Asian market will demand deep price cuts to Middle Eastern grades. Prices are expected to be issued from next week onwards.

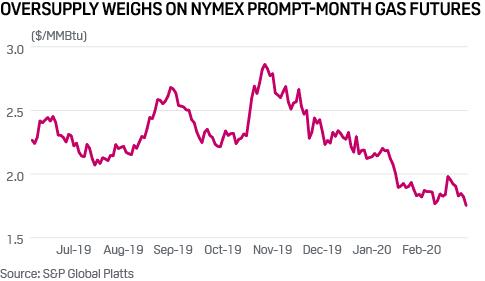

2. NYMEX natural gas futures hit 4-year low

What’s happening? The NYMEX prompt-month natural gas futures contract tumbled to its lowest level in nearly four years on February 27, settling at just $1.75/MMBtu. A steady decline in the benchmark futures price this winter comes amid sluggish residential-commercial demand and a struggle to absorb mounting US supply.

What’s next? From November 1 to date, US production has remained near record highs, averaging over 92.3 Bcf/d. This winter should see storage levels finish the current withdrawal season almost 250 Bcf above the five-year average, according to S&P Global Platts Analytics. Reduced summer-season injection demand could potentially be exacerbated by the shut-in of LNG export facilities in response to the coronavirus.

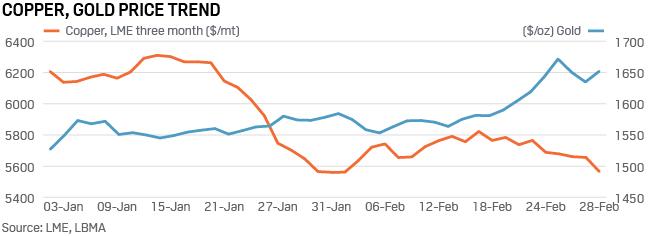

3. Copper, gold move in tandem in response to coronavirus

What’s happening? Copper, often cited as a bellwether for the global economy, has been hammered on coronavirus fears. Meanwhile, there has been a hefty inflow of capital into gold, one of the market’s favorite safe haven trades. This has seen the correlation between the two prices narrow, indicating that economic sentiment is turning increasingly sour.

What’s next? Eyes are on how quickly the virus will spread, and the lasting impact on the global economy. The London Metal Exchange three-month copper price dropped nearly 10% to $5,573/mt by February 28. Conversely, most analysts expect continued strength in the gold price, which touched a near-seven year high of $1,689/oz last week.

4. Brazilian corn farmers keep close eye on weather

What’s happening? Corn planting in Brazil’s Mato Grosso region accelerated in the week ended February 21, with sowing completed in 79.6% of the projected harvest area, above the five-year average of 72.6%, according to the Mato Grosso Institute of Agricultural Economics. The region is Brazil’s largest corn producer, accounting for over 50% of exports.

What’s next? Farmers will be watching the weather closely. Corn planting during the ideal time – by the end of February – gives a good yield if weather conditions are favorable. Pre-harvest corn sales in the state have been brisk so far and the availability of corn for exports will depend largely on domestic sales and corn prices, which continue to remain firm.

Tyler Durden

Mon, 03/02/2020 – 14:30

via ZeroHedge News https://ift.tt/3ajrpWe Tyler Durden