Beige Book Shows Growing Coronavirus Panic Across US Economy

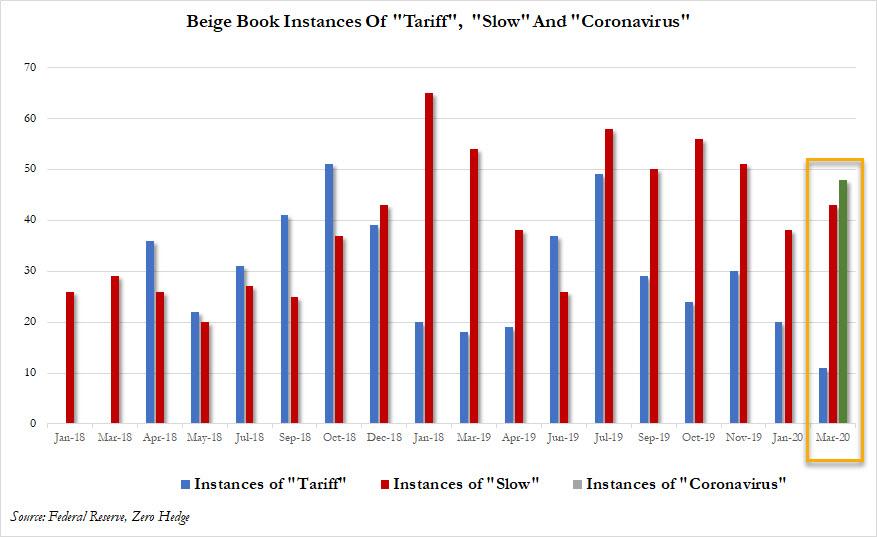

With the release of the March Beige Book, we find that as one bogeyman departs, another arrives.

Nearly two years after Beige Book respondents first mentioned tariffs as an economic concern in April 2018, the number of instances in which tariffs were discussed was just 11 in March – the lowest since the term first emerged. However, as tariffs faded from the public’s consciousness, they were replaced with fears about the coronavirus, a term which was never before used in the beige book and in March saw no less than 48 separate mentions!

Before we look at the detailed contents of the latest Beige Book, here is a quick recap of how the Fed sees the 3 key core pillar of the US economy – overall economic activity, employment and wages, and prices – at this moment.

Overall Economic Activity:

- Economic activity expanded at a modest to moderate rate over the past several weeks, according to the majority of Federal Reserve Districts. The St. Louis and Kansas City Districts, however, reported no change during this period. And while manufacturing activity expanded in most parts of the country, here is where we got the first mention of supply chain, to wit: “there were indications that the coronavirus was negatively impacting travel and tourism in the U.S. Manufacturing activity expanded in most parts of the country; however, some supply chain delays were reported as a result of the coronavirus and several Districts said that producers feared further disruptions in the coming weeks.“

- While consumer spending generally picked up (if not for long now that millions of Americans will avoid all open areas), growth was uneven across the nation, including mixed reports of auto sales. Looking ahead, the outlook for the near-term was mostly for modest growth with the coronavirus and the upcoming presidential election cited as potential risks

Employment and Wages:

- Employment increased at a slight to moderate pace, overall, with hiring constrained by a tight labor market, and “insufficient labor lowered growth for many firms and led to delays in construction projects.” Several employers changed from temporary to permanent workers in order to attract talent, and firms made efforts to retain workers such as keeping seasonal workers on staff in the off-season.

- While employment grew across most sectors, manufacturers, retailers, and transportation companies reported lower demand for labor in some Districts. That said, wages grew at a modest to moderate rate in most Districts, similar to last period, and contacts expected wage growth to continue in this range. Companies also spent more on benefits, as the cost of benefits rose and as employers expanded benefits to attract and retain workers.

Prices:

- Most Districts reported modest growth in selling prices, as well as in nonlabor input prices. Here was one of the rare mentions of the recent trade deal: “some firms, particularly manufacturers, were optimistic that the Phase One trade deal with China would reduce goods prices, but some still struggled with tariffs and were concerned about how the coronavirus might affect prices.”

- Meanwhile, oil and gas prices decreased across the country, which was largely attributed to weak demand from China because of the coronavirus. Retail prices were up in much of the country although some retailers had lower costs due to improved trade conditions, while agriculture price changes varied.

Focusing exclusively on the coronavirus case, here is how the global pandemic is impacting business, so much so apparently that the Fed decided to cut rates by an emergency 50bps yesterday to offset the aftereffects of the disease:

- Most manufacturers experienced revenue increases ranging from mid single-digit percentages to more than 20 percent, but two respondents cited revenue declines, both attributed in part to disruptions related to the coronavirus outbreak in China.

- Outlooks continued to be positive, with the coronavirus and the presidential election cited as risk factors.

- One retailer noted that their inventory levels were impacted by the coronavirus in China, which slowed production at some manufacturing plants.

- A textile manufacturer reported flat sales, and two firms, in advanced sensors and chemicals, pointed to disruptions related to uncertainty and supply chain challenges from the coronavirus as factors leading to their slower 2020 start.

- Although the retail sector is expected to see further weakness and downside macroeconomic risks were cited in relation to the coronavirus outbreak and the presidential election.

- One manufacturing contact noted problems with supply disruptions and shipment delays related to the coronavirus.

- A few New York contacts reported that the coronavirus has deterred visitors, though New York City hotels have continued to report good business.

- The share of firms reporting increased revenues and new orders rose, and the share reporting decreases in both measures fell significantly. The coronavirus has entered the list of concerns, which still includes tariffs and tight labor markets

- Most banking contacts were optimistic about the overall health of the U.S. economy going forward but expressed concerns over the potential impact of the coronavirus.

And one amusing twist: according to the Fed, in the Chicago district “contacts expressed frustration” that Chinese purchases of agricultural goods hadn’t happened after Phase One trade deal “and were concerned that the coronavirus outbreak would be used as an excuse for missing future trade targets.”

Of course, this is precisely what China is hoping to do.

That said, with the Fed having slashed rates in response to the coronavirus panic, it is only logical that Fed contacts across the nation would be freaking out about the pandemic.

Finally, looking at some choice anecdotes from the various the Fed regions, we find the following picture of the US economy:

- Boston: “Two firms, in advanced sensors and chemicals, pointed to disruptions related to uncertainty and supply chain challenges from the coronavirus as factors leading to their slower 2020 start. Seven of ten manufacturers did not mention disruptions from the virus to date.”

- New York: “Tourism activity was mixed. A few contacts reported that the coronavirus has deterred visitors, though New York City hotels have continued to report good business.”

- Philadelphia: “Inquiries and orders to source parts domestically were increasing because of tariff uncertainty and are continuing because of the coronavirus. Retailers noted no supply disruptions because of the coronavirus.”

- Cleveland: “Transportation firms expressed concern about the potential for supply-chain bottlenecks as a result of COVID-19. The virus aside, transportation firms expect conditions to improve slightly in the near future as rising consumer spending leads to increases of merchandise shipments.”

- Richmond: “Sales of both new and used autos were strong, although dealers expressed uncertainty from elections and the coronavirus. In the District of Columbia, some groups canceled travels because of the coronavirus.”

- Atlanta: “Due to the coronavirus, cancelled flights to China have reduced air cargo capacity significantly, which is expected to negatively affect first quarter revenues.”

- Chicago: “Some manufacturing contacts reported low inventories of inputs produced in China due to disruptions from the coronavirus outbreak; while most said the impact had been minimal so far, many expected a larger effect if the disruptions continued much longer.”

- St. Louis: “Contacts were uncertain about the impact of coronavirus on their business; no contacts reported a significant impact, but some have experienced travel and shipment delays.”

- Minneapolis: “Ice conditions have been less favorable this season in Minnesota and Wisconsin, cutting into spending from fishermen and snowmobilers in areas where trails cross lakes.”

- Kansas City: “After declining for several months, manufacturing activity appeared to be stabilizing with a slight uptick in activity in February, despite nearly half of firms noting some negative effect from the coronavirus spread.”

- Dallas: “Overall retail outlooks weakened slightly, with some contacts voicing concern over the coronavirus and its impact on supply chains and overall demand. A railroad contact voiced concern that the coronavirus could reduce shipments from China.”

- San Francisco: “The COVID-19 outbreak led to decreased aircraft demand from China and Southeast Asia, with one supplier reporting no orders received in January. Solar energy equipment manufacturers also experienced delayed order fulfillment due to supply chain disruptions related to the COVID-19 outbreak.”

Tyler Durden

Wed, 03/04/2020 – 14:29

via ZeroHedge News https://ift.tt/2wwHXM0 Tyler Durden