BMO: Negative Rates Are Coming To The US

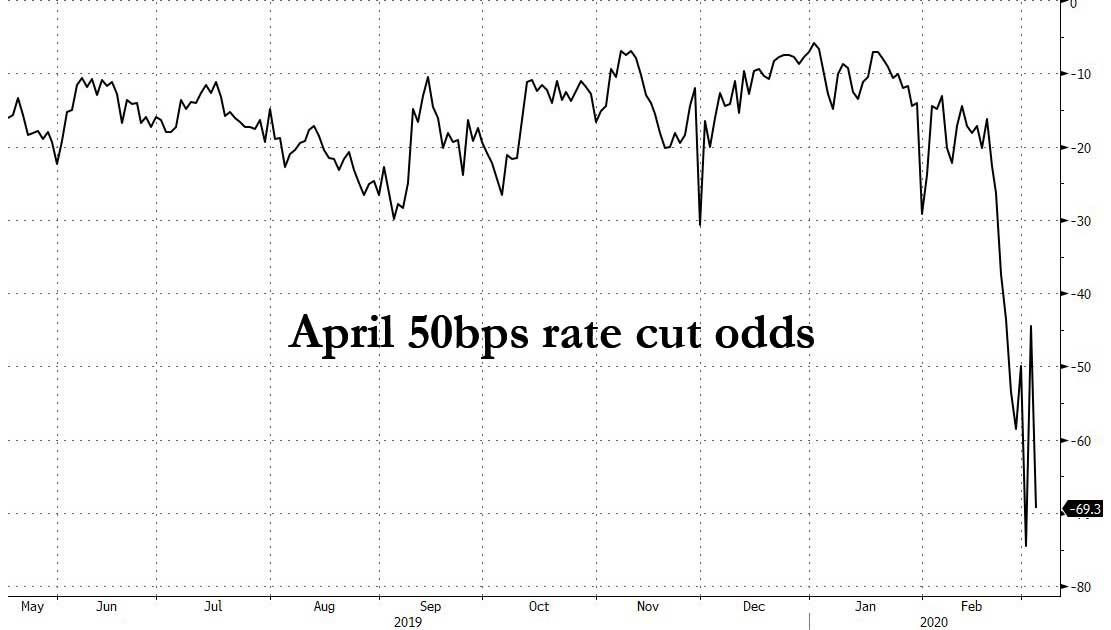

Commenting on the market’s reaction to the Fed’s “panic” rate cut, BMO’s rates strategist Ian Lyngen put it best: “the situation didn’t play out exactly as Powell might have envisioned.” While that was a clear understatement, as Lyngen explained further, there was a simple reason for the market’s shocking response: nothing Powell did would have been seen as enough by a market, which has grown habituated to generous Fed bailouts and which as of this morning is pricing 69% odds for an additional half-point move in April.

Two things follow as a result of the Fed being trapped again: i) any attempt by the Committee to walk back those expectations will need to occur in short order given the looming pre-FOMC radio-silence period, and ii) any “walk back” would lead to a market crash with traders now expecting rates to hit 0% in just a few weeks. As Lyngen puts it, Powell’s biggest risk in going the emergency route was always that investors would respond “fifty’s fine, but a hundred’s divine.”

Which begs the question: did the Fed jump the shark by slashing rates, or is the Fed’s target rate far lower?

As BMO explains, “given the backdrop of a ‘relatively’ strong domestic economic profile coming into 2020, the rapidly deteriorating outlook is remarkable insofar as it hints of underlying vulnerabilities in sentiment even before Covid-19 hit. Recall 10-year yields were unable to sustainably trade above 1.95% in light of the trade war (remember that?), geopolitical tensions, Brexit, Europe’s flagging economy, and stubbornly low inflation. Adding a pandemic to the mix was undoubtedly going to be worth a significant rally in Treasuries.”

This leave the bank to contemplate whether 100 bps in 10s isover extended or just a reminder that are still 93 bp to go before the zero-bound comes into focus. Here as a reminder, all of Germany and Switzerland’s sovereign debt now trades in negative yield territory. The same is true for France out to the 15-year sector and Japan out to 10s.

And so, according to Lyngen, while this doesn’t suggest that US rates are poised to dip below the zero-bound (particularly not in 10s and 30s), “negative yields in the 2- and 3-year sector of the US Treasury curve have a much higher chance of coming to fruition” an admission the rates strategist says is as disturbing to write as it surely is to read, and explains:

- We very much doubt the Fed will ever take policy rates below zero – if for no other reason than Europe’s experience with the failed experiment,

- once the FOMC lowers rates to the 0.00-0.25% range, QE quickly comes into play, and

- unlike the EGB market, there is more than ample Treasury supply to satisfy SOMA’s balance sheet expanding ambitions.

Why then does Lyngen think that negative front-end yields are a possibility? The answer is simple: investors’ perception that once policy rates are near zero, there’s a chance (no matter how remote) that the currently unthinkable is the only course of action. At that point it becomes a self-fulfilling prophecy, and as we have observed so often, whatever the market demands the Fed does, the Fed ends up doing. Even if it means NIRP.

That said, NIRP in the US won’t come tomorrow: first we need to retest the recent record low in the 10Y yield:

As a point of clarity, the transition from rate cuts, to framework-shift, to bond-buying isn’t one that we’re anticipating to playout immediately – or even this rates cycle. Nonetheless, given the global rates backdrop it is well within the realm of conceivable outcomes to have negative front-end yields. For the time being, we’ll content ourselves with the prospects of 10-year yields retesting the 89.1 bp lows from yesterday; a breach of which would negate the ‘it was just a panic safe-haven move’ argument.

The technicals are also set for NIRP: “Monday’s rally established a 10-year yield outside-day lower which has historically been a bullish continuation pattern. The accompanying extensions of overbought stochastics and MACD are, of course, troubling even if the repricing warrants an elevated degree of skepticism on the traditional momentum measures.”

As such, a period of consolidation at or near the yield lows “would be sufficient to work off the extremes and clear the path for another leg lower in US rates.”

Meanwhile, as Lyngen concludes, “the number of incoming inquiries on what 50 bp on Tuesday implies for the March meeting speaks to the demand for even greater accommodation as the rising probability of another cut begs the question if even that will be enough. If the ‘shock factor’ played a role in the Committee’s decision to lower rates this week, the same logic would apply to a growing chance of an additional 50 bp adjustment on the 18th. While it is still too soon to call this a base case, it is a risk which will only grow more likely in the event further downside in equities is realized.“

In short, while negative yields are virtually assured, the question of when they happen will depend on stocks: another crash, in a day or two and we may wake up in late March or early April in a whole new monetary twilight zone, one which in turn will set the stage for the monetary endgame, one heralded by the Magic Money Tree, or MMT, which will be the beginning of the end.

Tyler Durden

Wed, 03/04/2020 – 13:25

via ZeroHedge News https://ift.tt/38mxG1W Tyler Durden