'Joementum' Sparks Stock Buying-Panic, Rate-Cut Hopes Soar

Some success, after weeks of doldrums, for Joe Biden’s campaign sparked a massive surge in prediction markets’ view of his likelihood of getting the Democratic nomination surged to record highs (as Bernie and Bloomberg crashed)…

Source: Bloomberg

And it is this phoenix-like rise that is being proposed as driving today’s surge in stocks…

Source: Bloomberg

And intraday, as various results came in with Biden winning, the market legged ever higher…

Source: Bloomberg

Do traders really believe this guy can win?

THIS is not “normal.”

The Biden family needs to end this disgusting charade. pic.twitter.com/2NJbCgy1qy

— thebradfordfile™ (@thebradfordfile) March 4, 2020

Prediction markets disagree, and Trump’s odds of victory actually improved overnight

Source: Bloomberg

So maybe, just maybe, Biden’s gains mean Trump more likely to win… and that’s what sent stocks higher?

But, there is another factor – the market is now demanding almost 2 more rate-cuts in March…

Source: Bloomberg

And an increasing number of traders are betting on The Fed going ZIRP/NIRP soon!

Source: Bloomberg

So maybe – as usual – it’s just the market demanding more liquidity, knowing The Fed will never let it down?

US markets erased yesterday’s losses and gamma lifted them after that…

S&P Futures moved above a key level of support (as Nomura’s Charlie McElligott warned, a close above 3079 today would see the signal go from current “+16%” (long) back to “+100%” signal, leading to further aggressive buying and more shorts squeezed), and that sparked the gamma flip melting futures up towards yesterday’s rate-cut highs…

Dow Desperately wanted 27k…

Another 1000-plus-point range day in the Dow has sent realized vol to its highest since mid-2011 – the heart of the European Financial Crisis…

Source: Bloomberg

Stocks desperately didn’t want to be outdone by gold post-Powell…

Value was monkey-hammered as the equity momentum factor had its best 3-day surge since June 2016 (Brexit vote)…

Source: Bloomberg

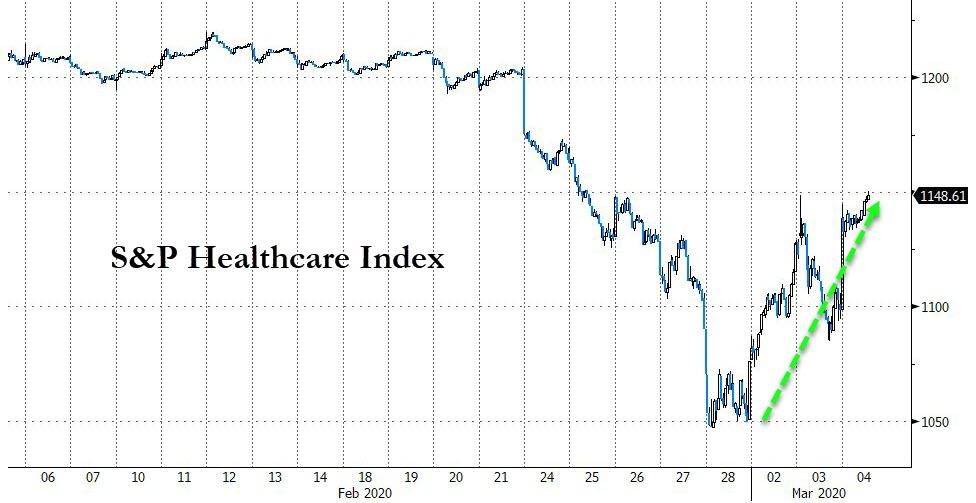

Biden’s victory over Bernie did spark a very real resurgence in healthcare stocks however…the biggest daily jump since Nov 2008…

Source: Bloomberg

FANG Stocks managed gains today but only marginal…

Source: Bloomberg

And bank stocks managed gains – after 10 days of carnage…

Source: Bloomberg

VIX tumbled 5 vols today after spiking down yesterday on the rate-cut and then surging higher…

Bonds and stocks continue to decouple… again…

Source: Bloomberg

Treasury yields were very mixed today with the short-end tumbling as the long-end chopper around, ending flat…

Source: Bloomberg

The 2Y Yield plunged again…

Source: Bloomberg

The yield curve steepened significantly – to its steepest since June 2018…

Source: Bloomberg

But, don’t get all excited – Indeed, the last time the curve rose so fast from such a low base was in 1990, 2001, and 2008, months before the U.S. economy entered recession each time…

Source: Bloomberg

And before we leave bond-land, we note that the spread between ‘cheap’ China bonds and ‘expensive’ US bonds is at its highest in 5 years…

Source: Bloomberg

And on the other side, US yields have collapsed relative to German yields…

Source: Bloomberg

The Dollar rallied today, desperately trying to erase the rate-cut crash from yesterday…

Source: Bloomberg

Cryptos legged lower today…

Source: Bloomberg

Commodities were generally unchanged today, but PMs held their post-rate-cut gains…

Source: Bloomberg

Oil surged overnight on OPEC+ hopes, and inventory data, but Russia’s lack of cooperation appeared to spook investors…

Gold future hovered around $1640, holding on to the post-Powell spike…

Gold’s historical vol has exploded to 4 year highs…

Source: Bloomberg

And gold continues to track the global volume of negative yielding debt extremely closely…

Source: Bloomberg

Finally, this could be a problem for the bears… Bloomberg notes that as of March 2, short sellers had increased outstanding contracts to the highest level since June 2014, according to IHS Markit data.

Source: Bloomberg

Which might fit with the bounce we saw in 2000, after The Fed’s Y2K liquidity program ended…

Source: Bloomberg

Tyler Durden

Wed, 03/04/2020 – 16:01

via ZeroHedge News https://ift.tt/2wpw3Dr Tyler Durden