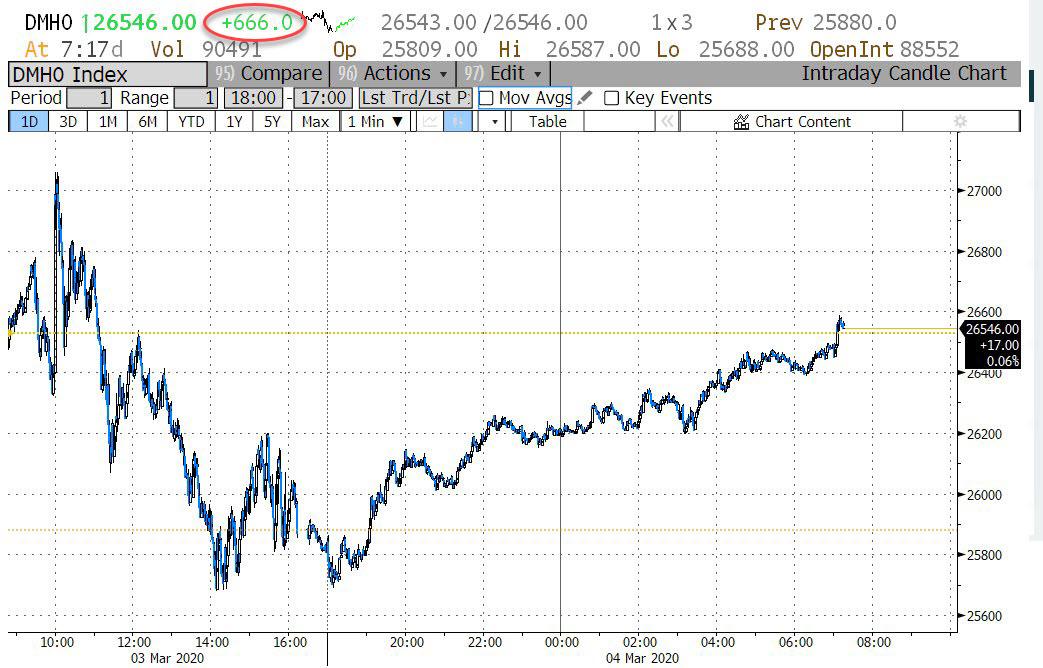

The Biden Bounce: Dow Futures Up 666 As Traders Forget About Panicking Fed

Futures have staged a miraculous recovery after yesterday’s historic drop – the biggest ever on a day when the Fed cut rates, and are up some 70 points from yesterday’s close…

… and Dow futures were up a delightfully appropriate 666 points…

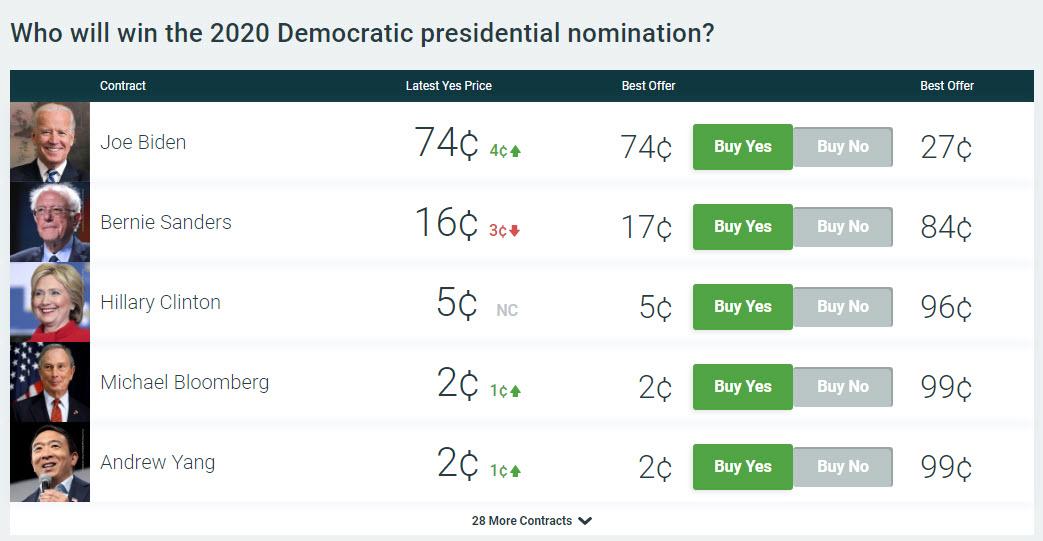

… as investors decided to forget all about the Fed’s panicked emergency rate cut and instead took solace from the surprising “Biden Bounce” during Super Tuesday which saw Bernie’s odds for re-election crash, shelving risks of a socialist America, while expectations of an even more forceful global policy responses to the coronavirus kept hopes alive that central banks are just getting started.

Biden, a non-socialist moderate seen as less likely to raise taxes and impose new financial regulations, won primaries in nine states. That set up a one-on-one battle for the Democratic presidential nomination with democratic socialist Bernie Sanders.

In Europe, the STOXX 600 gained 1.5%, on course for a third straight days of gains. Markets in Frankfurt, London .FTSE and Paris gained a similar amount. “After the action from the Fed the market is very, very watchful now for potential moves from other central banks,” said CIBC FX strategist Jeremy Stretch. On Wall Street, S&P 500 futures climbed 1.8% on Biden’s showing, after falling on Tuesday overnight despite the Fed’s rate cut.

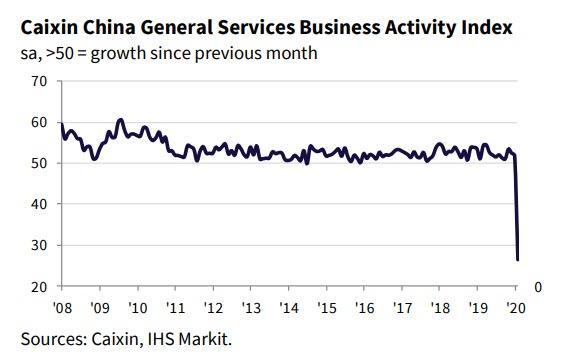

The European moves built on gains in Asia, where MSCI’s broadest index of shares ex-Japan rose 0.3%. Asian stocks had a volatile trading session, while purchasing managers’ indexes for Hong Kong and China fell to record lows as the novel coronavirus curtailed business activity.

Markets in the region were mixed, with Jakarta Composite and South Korea’s Kospi gained 2% on a $9.8 billion government stimulus package to mitigate the coronavirus impact. Australia’s S&P/ASX 200 and India’s S&P BSE Sensex Index fell. The Federal Reserve’s emergency interest-rate cut buoyed some markets. Still, the slide in Hong Kong and China PMIs to new lows last month underscored the extent that the public-health emergency may erode company earnings. The Topix declined 0.2%, with Aeon Hokkaido and Usen-Next falling the most. The Shanghai Composite Index rose 0.6%, with Nanjing Chixia Development and Baoding Tianwei Baobian Electric posting the biggest advances

The Fed’s surprise move followed a shift in money market pricing late last week. Futures swung rapidly to anticipate such a cut at the Fed’s March meeting. Now, they imply another 50 basis points of easing by April, even though investors and the Fed itself raised doubts that easing will help deal with a public health crisis.

“If you’re in China and you can direct liquidity exactly where you need to, and have rate cuts where you want them to be, monetary policy is very effective,” said Sebastien Galy, senior macro strategist at Nordea Asset Management. “In the West, in a democracy, monetary policy is less effective – you need to incentivise banks to do what is in to the benefit of the whole.”

Overall, the MSCI world equity index which tracks shares in 49 countries, gained 0.2%. It is still down around 10% falling a brutal sell-off last week as fears over economic damage from the coronavirus gripped markets.

“They’re pushing on a string,” said veteran emerging-markets investor Mark Mobius in a Bloomberg TV interview. “The problem is not so much interest rates, which are already very low globally. The problem is the supply chain coming out of China.” Markets will worsen “unless China can ramp up production,” he said.

As global markets and US rebounded, 10-year Treasury yields slipped even more after breaking below 1% for the first time in 150 years, however they have since posted a bit of a rebound and after hitting 0.93% around the European open, are back above 1.000%.

Eurozone bond yields also held near record lows on Wednesday, with Germany’s benchmark 10-year Bund yield around -0.64%, near six-month lows set on Monday. Some saw the Fed’s extraordinary move as a decision to move hard and early because it expected further economic damage from the spread of the coronavirus.

“They have signalled willingness to take further action, which is why we are seeing a further rally in bonds,” said Tim Drayson, head of economics at Legal & General Investment management. “Some argue that monetary policy can’t fight the supply shock – but it will support demand and confidence.”

Investors were also watching the Bank of England for signs it would follow the Fed. Money markets have moved to fully price in a BoE rate cut of 25 basis points at its next meeting, up from a chance of 80% before the Fed move. Sterling dipped 0.1% against the U.S. dollar and slipped 0.3% against the euro before clawing back some ground.

Elsewhere in FX, the dollar was little changed as Antipodean and Scandinavian currencies advanced as European stock markets rebound after opening lower; the euro erased losses after London came into the market and bunds gave up an early gain, underperforming bonds in the European periphery. Japan’s currency fell against all its major peers, erasing an earlier gain against the dollar, as leveraged accounts covered short positions in dollar-yen after the Nikkei 225 index reversed losses. The Australian dollar extended an advance after growth data for the fourth quarter last year beat estimates.

Looking at the day ahead now, and the data highlight will be the release of the services and composite PMIs for February from around the world. In addition, there’ll be German retail sales for January, the final reading of Italian Q4 GDP and Euro Area retail sales for January. Over in the US there’ll be the ISM non-manufacturing index for February, the ADP employment change for February, and weekly MBA mortgage applications. From central banks, the Bank of Canada will be deciding on rates and the Federal Reserve will be releasing their Beige Book. There’ll also be remarks from incoming BoE Governor Bailey, BoE Deputy Governor Broadbent, and St. Louis Fed President Bullard.

Market Snapshot

- S&P 500 futures up 1.7% to 3,049.25

- STOXX Europe 600 up 1% to 384.85

- MXAP up 0.3% to 157.58

- MXAPJ up 0.4% to 519.73

- Nikkei up 0.08% to 21,100.06

- Topix down 0.2% to 1,502.50

- Hang Seng Index down 0.2% to 26,222.07

- Shanghai Composite up 0.6% to 3,011.67

- Sensex down 0.8% to 38,307.99

- Australia S&P/ASX 200 down 1.7% to 6,325.40

- Kospi up 2.2% to 2,059.33

- German 10Y yield fell 0.3 bps to -0.628%

- Euro down 0.09% to $1.1163

- Italian 10Y yield fell 14.7 bps to 0.822%

- Spanish 10Y yield fell 2.4 bps to 0.164%

- Brent futures up 1.6% to $52.70/bbl

- Gold spot down 0.2% to $1,637.18

- U.S. Dollar Index up 0.1% to 97.26

Top Overnight Headlines from Bloomberg

- The European Central Bank said it would restrict all non- essential travel until April 20, Japan’s Olympics minister said it would be possible to delay the summer games to later in the year

- Joe Biden cemented a remarkable comeback on the biggest primary night of the Democratic presidential campaign with victories in nine states across the country, including upsets in Texas and Massachusetts, even as Bernie Sanders took the biggest prize of the night, California

- China’s car sales fell 80% in February, according to preliminary numbers from the China Passenger Car Association released Wednesday, the biggest monthly plunge on record. Average daily sales improved toward the end of the month compared with the first three weeks, PCA said

- The European Union imposed five-year tariffs on steel road wheels from China in a dispute that will ease concerns by manufacturers in Europe about whether revamped EU trade- protection rules are strong enough

- Expectations for rate cuts have climbed in Japan and New Zealand in the wake of Federal Reserve’s emergency interest-rate cut, and in Australia there are now signs that traders are starting to prepare for quantitative easing

- At Sweden’s central bank the newest policy maker said monetary easing is the wrong way to fight the fallout of the coronavirus while the governor of Norway’s central bank said a “significant” slump in trade triggered by the coronavirus might force him to reassess the outlook for interest rates

Asian bourses traded somewhat mixed following from the weak rollover from Wall St. where all major indices slumped around 3% despite the Fed delivering an emergency rate cut of 50bps, as this failed to alleviate the slowdown concerns from the coronavirus outbreak and the G7 statement on coordinated policy action also provided little in terms of details in which it did not commit to any monetary or fiscal action. Nonetheless, US equity futures partially nursed losses overnight as focus turned to Super Tuesday Democrat Primary results which showed former VP Biden performed well although there was still far to go with the biggest states California and Texas still up for grabs. ASX 200 (-1.7%) and Nikkei 225 (U/C) were lacklustre with Australia pressured by underperformance in tech and the top-weighted financials sector due to virus fallout concerns and the lower interest rate environment, while the Japanese benchmark was indecisive amid a choppy currency and uncertainty regarding the Tokyo Olympics after a minister suggested the event could be held back although Chief Cabinet Secretary Suga later reiterated they will continue to move ahead with preparations. Elsewhere, Hang Seng (-0.2%) and Shanghai Comp. (+0.6%) were temperamental despite speculation the PBoC could lower rates this month and after the HKMA moved in lockstep with the Fed through a 50bps rate cut, as participants also digested further weak data in which Chinese Caixin Services and Composite PMIs printed record lows. Finally, 10yr JGBs surged above the 154.00 level as they tracked the upside in T-notes following the Fed’s emergency rate cut and with the BoJ also in the market for over JPY 800bln in up to 5yr JGBs.

Top Asian News

- Netanyahu Camp’s Lead Narrows, Encumbering Coalition Building

- Desperate for Debt Relief, Lebanon Hatches Plan to Avoid Default

- Rare Default on Green Bond in India Flags Broader Credit Strains

- India’s Sensex Extends Decline on Reports of New Virus Cases

European equities saw a relatively shaky start to the session before eventually moving back into positive territory (Eurostoxx 50 +0.5%) as markets attempt to gauge the efficacy of recent and potential upcoming stimulus efforts from global authorities. Stateside, futures markets are indicating the likelihood of a positive open on Wall St., however, it remains to be seen whether this is a result of genuine optimism over recent policy responses or merely a fleeting paring back of some of yesterday’s declines. Furthermore, attention in the US will also partially be placed on the fallout from the Democratic “Super Tuesday” which saw a stellar performance for former VP Biden who now holds a total of 320 delegates (at the latest count) vs. 252 for Sanders. In terms of how this will effect the broader performance for stocks going forward, analysis is mixed. Some argue that Biden is more market-friendly than Sanders and thus his success should be seen as a positive, whereas others argue that even though Sanders would be detrimental for markets (should he enter the White House), Trump would be more likely to beat him, with Trump viewed by most as the overall most market-positive candidate. Sectoral performance in Europe is higher across the board with outperformance for material, healthcare and consumer staples. Individual movers include Eurofins Scientific (+7.8%) at the top of the Stoxx 600 post-earnings, Dialog Semiconductor (+3.6%) shares have been supported after posting favourable revenue guidance, whilst Rio Tinto (+3.6%) trade higher after a broker upgrade at SocGen. To the downside, the clear outlier is Intu Properties (-20%) after abandoning its equity placement, whilst Metro AG (-4.2%) are lower following reports of a potential tie-up with Sysco; reports that were later rebuffed.

Top European News

- Virus Takes Aim at $1.7 Trillion Industry as Tourists Stay Home

- Day of Reckoning Nears for Intu After It Pulls Share Sale

- Coronavirus Disrupts Johnson’s Bounce as U.K. Services Slow

- Billionaire Agnellis Sells PartnerRe to Covea for $9 Billion

In FX, the index and Greenback in general have regained some composure after Tuesday’s slide in wake of the Fed’s early or emergency March policy easing, with the former back above the 97.000 handle within a 97.423-104 range vs yesterday’s 96.926 base. However, Usd/major and EM pairs are mostly softer after FOMC Chairman Powell refrained from signalling that the 50 bp inter-meeting rate cut would likely suffice to protect the US economy from nCoV contagion, leaving the door ajar for more stimulus if necessary.

- AUD/NZD/CAD/CHF/SEK/NOK – The Aussie appears to be building a firmer base on the 0.6600 handle vs its US peer on the back of firmer than forecast Q4 GDP data that will feed the notion of no back-to-back or follow up action from the RBA after its ¼ point reduction even though Deputy Governor Debelle warns that the bushfires and coronavirus will have more of an adverse impact on the economy in Q1. This has also lifted Aud/Nzd back above 1.0500 as the Kiwi continues to trail behind awaiting the RBNZ’s response to the COVID-19 outbreak later this month, with Nzd/Usd still struggling to advance beyond 0.6300. On that note, the Loonie is deriving some traction from another rebound in crude prices ahead of the BoC, albeit not as much as the Norwegian Crown given Eur/Nok rooted towards the base of a 10.3045-3730 band, as Usd/Cad pivots 1.3350. In terms of market pricing, -25 bp is baked in, but the probability of a like-for-like Fed move is also high at around 80%, hence options assigning a wide 75 pip break-even for the event. Elsewhere, while the SNB sits tight pending its quarterly review next week, Usd/Chf is holding circa 0.9550 and hardly acknowledging Swiss CPI slipping below zero y/y again, but the Swedish Krona has gleaned support from another upbeat PMI to straddle 10.5500 vs the Euro.

- GBP/EUR/JPY – All on the back foot as the Buck regroups, with Cable still unable to sustain gains above 1.2800 and respecting the 200 DMA (1.2830) amidst heightened BoE policy stimulus calls, while Eur/Usd has faded ahead of 1.1200 and hefty option expiries between 1.1200-05 in 1.6 bn as the coronavirus spreads and especially in Italy. Lastly, the Yen has pared gains around 107.00 following comments from BoJ Governor Kuroda indicating a higher level of vigilance for Chinese epidemic effects and a potentially lower bar for a policy response.

- EM – Broad recoveries across the region, and with the Lira also acknowledging positive comments from Turkish President Erdogan contending that a ceasefire can be forged at Thursday’s meeting with Russia to try and resolve the ongoing stand-off in Syria.

In commodities, WTI and Brent prices are firmer this morning, following yesterday’s emergency stimulus action by the Fed as markets are firmly on the look-out for action elsewhere, but more pertinently for the complex itself is reports pertaining to OPEC, as the JMMC meeting gets underway today. Comments this morning point towards Russia and Saudi holding bilateral discussions but reports note that Russia are likely to make their decision on cuts at the last moment. In terms of the magnitude of cuts sources point towards a cut around the 1mln mark, but that any figure above the 600k BPD initial JTC recommendation must be considered. These reports have coincided with upside in the crude complex, which saw WTI briefly surpass the USD 48/bbl mark; however, this upside has occurred alongside a general grinding higher in risk sentiment so its unclear how much of the move can be directly attributed to the OPEC commentary. Indicative scheduling for this week’s OPEC events saw the JMMC commence from around 11:00GMT today, with OPEC set to meet tomorrow before the entire OPEC+ committee convenes on Friday. As well as a decision on any additional cuts, focus will be placed on remarks around compliance as countries such as Russia are still not meeting their quota. Looking ahead, today sees the EIA weekly release, which is expected to see a build of 3.333mln barrels which, if correct, is just shy of double yesterday’s API crude build at 1.7mln. In terms of metals, it has been a relatively steady day for spot gold that is currently just shy of the USD 1650/oz mark, which appears to be capping price action and is in proximity to yesterday’s high; after the metal was supported on the emergency FOMC cut.

US Event Calendar

- 7am: MBA Mortgage Applications, prior 1.5%

- 8:15am: ADP Employment Change, est. 170,000, prior 291,000

- 9:45am: Markit US Services PMI, est. 49.4, prior 49.4

- 9:45am: Markit US Composite PMI, prior 49.6

- 10am: ISM Non-Manufacturing Index, est. 54.9, prior 55.5

- 2pm: U.S. Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

From my calculation that’s the 8th emergency inter-meeting Fed cut in my 24.5 years of working in financial markets so it feels like a landmark event especially as the other six have occurred in three clusters (98, 01, and 07/08). Yesterday afternoon we looked at what happened to the S&P 500 in the week, six months, and one year after these last 7 emergency cuts. The medium price move after these cuts were +2.8% (1w), -4.3% (6m) and -9.2% (1yr). When you consider the average 1yr price return (excluding dividends) for the S&P 500 is around 6% then that is a considerable 6 months and one year under-performance when the Fed deems it necessary to do an emergency cut. We’ve put the table in the pdf if you click the full link. 1998 was the big positive outlier as you didn’t see a subsequent recession and we moved into maximum bubble phase with the extra stimulus. That would be the bull hope. However for now the market will debate whether they have fired too much of their armoury too early. With Fed Funds now in the 1-1.25% range it feels a little like the flood defences to zero have seen a big erosion over the last 24 hours. Long-term readers will know that I think the Fed balance sheet will explode in the years ahead with the forward debt profile of the US (and other countries to be fair). I suspect this accelerates that move. To be fair to the Fed they were probably damned if they did and damned if they didn’t.

After the 50bp cut around at 10am EST the Fed said the move was unanimous and mentioned in their statement afterwards that “the coronavirus poses evolving risks to economic activity.” In his press conference, Chair Powell acknowledged the economic implications, saying that “the virus, and the measures that are being taken to contain it, will surely weigh on economic activity, both here and abroad for some time.” He also left open the prospect of further easing, saying that “we will use our tools and act as appropriate to support the economy”. This is the first 50bps move in either direction since the GFC and the market closed pricing in 3.01 25bp cuts, to lower rates a further 75.2bps by the January 2021 meeting, relative to yesterday’s 2.98 cuts and 74.6bps. So the 50bps cut has just led to the market pricing an extra 50bps anyway over the last 24 hours. In response, our US Economics team have accelerated this timeline and now expect another 50bp cut at the March meeting, a move that would be consistent with the historical experience of inter-meeting actions. The situation remains highly fluid, however, and positive developments related to financial markets or the coronavirus spread could justify a delay in any further easing. They will reassess this call ahead of the March meeting. See more at the link here.

Looking at the market reaction, it wasn’t encouraging that the S&P 500 fell sharply after the move. To be fair we went from -1% to just shy of +1.5% in the three minutes after the move, before fading for the rest of the session to be down -3.68% at one point and then settling to -2.81% at the close. We still closed +4.26% above levels before the Fed statement on Friday night for reference. With S&P futures up +1.27% this morning on a stunningly good night for Biden (more below), that gap from the lows has edged a bit wider for now.

10yr Treasuries surged following the decision, with yields falling -16.4bps on the day to another record low of 0.999% yesterday, while the 2s10s curve steepened for a 7th consecutive session, ending up a further +3.8bps. Treasuries are at 0.972% as we type. With US rates hitting new lows across the curve bank stocks led losses yesterday followed by technology stocks. Gold was the major beneficiary following the decision though, ending the session up +3.24%, its largest daily advance since the day after the Brexit referendum. The VIX climbed 3.40 points to finish at 36.82, its 4th close in a row over 30 – the first time that’s happened since November 2011 on the US credit downgrade. US HY spreads widened +8.7bps, at their widest closing levels since 2016.

Overnight in Asia markets are trading mixed with continued high volatility. The Kospi (+2.20%) is leading the gains on the back of the announcement of KRW 11.7tn stimulus by the government and expectations of a rate cut from the BoK at its unscheduled emergency meeting today which is currently underway. Meanwhile, the Nikkei (+0.08%) is trading flat but the Hang Seng (-0.11%) and Shanghai Comp (-0.39%) are down. The Japanese yen is down -0.24% this morning after being up by +1.12% yesterday.

As for overnight data releases, China’s February Caixin services PMI came in at a shocking 26.5 against expectation of 48 (which may not have fully adjusted after the weekend’s numbers), marking the lowest reading (by a very long way) since the series began and in turn bringing the composite PMI to 27.5 (vs. 51.9 last month) also the lowest since the series began. Japan’s final February services PMI came in one tenth higher than flash read at 46.8 while composite PMI was in line with flash read at 47.0. We also have the Bank of Canada rate decision today and markets are now pricing in a 66% chance of a 50bps cut which is substantially up from the start of trading yesterday when markets were expecting just a 25bps cut.

In other news, Bloomberg is reporting overnight that the BoJ is likely to consider downgrading its economic assessment this month due to the expected impact from the coronavirus outbreak. The BoJ meeting is due on March 18-19th. Elsewhere, the latest on the virus is that the WHO head has said that the coronavirus doesn’t transmit as efficiently as influenza but the fatality rate is higher at 3.4%, based on reported cases. Earlier, the fatality rate was assumed to be around 2%.

Turning to super Tuesday, Former Vice President Joe Biden solidified the idea that this might rapidly become a two person race now and he may well be the clear frontrunner again after turning party endorsements and a big South Carolina outperformance into a successful Super Tuesday. It continues to be likely that no one will win a majority of pledged delegates according to fivethirtyeight.com’s model, but now Joe Biden looks to have path to a plurality of delegates. This could lead to the nomination, especially because he would likely get a majority of super delegates on the second ballot. The concern for Biden coming into the night was that Sanders would build too large of a lead in states like California and Texas, the biggest and third-biggest delegate prizes of the night. However while Biden may still end the night with less overall delegates than Sanders – based on what the California and Texas vote counts ends up as – there is now a clear path forward for Biden that may not have existed a week ago in a field with a divided moderate vote. There is now renewed pressure on Joe Biden to continue performing both electorally and on the debate stage (next one is 15-Mar) as we move forward, because he was in the presumptive winner position before and then fell off that perch.

Joe Biden started the night well by building on his strength in South Carolina over the weekend into winning more Southeastern states, picking up Virginia, North Carolina, Alabama, Oklahoma, Arkansas, and Tennessee. Overall Biden has now officially won 8 states. Biden won Minnesota, a state Sanders won 4 year ago. Until recently Minnesota was expected to vote for their home Senator Klobuchar and Biden was not particularly close, but following her dropping out and endorsing of Biden, he was able to win it. This shows just how important the last few days were as the moderate wing came together behind Biden. Biden showed strength in the northeast where he won Massachusetts, Senator Warren’s home state – who has indicated she will not drop out yet, but that is a very disappointing result for her and she may still yet in coming days. He is currently leading in Maine, which would be an upset considering Sanders is the neighboring Senator. Biden is slightly up in Texas and gaining, which would be a major upset as Sanders was banking on running up the vote there.

Senator Sanders has officially won 3 states and will likely win in California which is the biggest prize of the night. At first glance it doesn’t look promising for Michael Bloomberg. Anyway overall Super Tuesday has been a big win for Biden with Sanders being dealt a notable blow. He is still in the race but is now having to catch up against the moderates rallying behind Biden.

Before all this and completing the picture from yesterday, European equities closed half way between the 3 minute Fed rally and the bulk of the US declines and so held on to gains with the STOXX 600 up +1.37%, its strongest day in a month. European sovereign debt also seemed to benefit from the Fed’s surprise move, with the spread of Italian 10yr-bunds falling by -14.6bps yesterday, in its largest move tighter in nearly six months. That came in spite of the fact that the number of Italian cases of the coronavirus has risen to more than 2,000. 10yr bunds yields were relatively unchanged on the day themselves, down -0.1bps. EURUSD strengthened beyond 1.12 for the first time since early January, before paring back some gains to close at 1.118. Even as risk assets were selling off hard, Oil stayed fairly unchanged (Brent -0.08%) and is up c.+1.40% this morning on news that an OPEC+ committee is recommending virus-related cuts of their own ahead of the meeting tomorrow/Friday to try and boost slumping oil prices.

The decision from the Fed came after the conference call earlier in the day between G7 finance ministers and central bank governors. In their subsequent statement, it said that “we reaffirm our commitment to use all appropriate policy tools to achieve strong, sustainable growth and safeguard against downside risks.” On the fiscal side, it also said that “G7 finance ministers are ready to take actions, including fiscal measures where appropriate, to aid in the response to the virus and support the economy during this phase.” However, the policymakers didn’t lay out any specific moves for what they’d do next.

Economic data releases have understandably taken a back seat over the last 24 hours, but we did get some key Euro Area data, with the flash CPI reading falling to 1.2% as expected, while the core CPI reading rose to 1.2%, also in line with expectations. The releases coincided with inflation expectations for the Euro Area coming off their record lows, with five-year forward five-year inflation swaps moving up +4.42bps to 1.152%. Meanwhile the Euro Area unemployment rate remained at 7.4% as expected, remaining at its joint lowest since April 2008. Finally, the UK construction PMI surprisingly rose to 52.6 (vs. 49.0 expected), its highest level since December 2018.

To the day ahead now, and the data highlight will be the release of the services and composite PMIs for February from around the world. In addition, there’ll be German retail sales for January, the final reading of Italian Q4 GDP and Euro Area retail sales for January. Over in the US there’ll be the ISM non-manufacturing index for February, the ADP employment change for February, and weekly MBA mortgage applications. From central banks, the Bank of Canada will be deciding on rates and the Federal Reserve will be releasing their Beige Book. There’ll also be remarks from incoming BoE Governor Bailey, BoE Deputy Governor Broadbent, and St. Louis Fed President Bullard.

Tyler Durden

Wed, 03/04/2020 – 07:45

via ZeroHedge News https://ift.tt/3asJkdi Tyler Durden