This Wasn’t Supposed To Happen: One Day After Fed Rate Cut, Repos Signal Record Liquidity Shortage

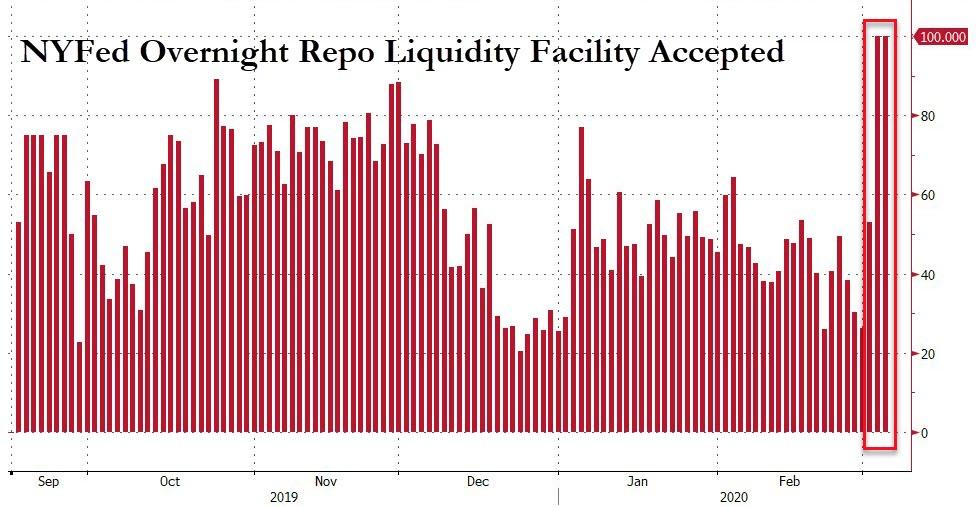

Yesterday morning, when we discussed the sudden spike in liquidity shortage that resulted in both a (record) oversubscribed term repo and the first oversubscribed overnight repo since the start of the repo crisis last September that spawned QE4 and helped its culprit, JPMorgan report record annual revenues, we said that “if going solely by the amount of securities submitted between the term and overnight repo, the overall liquidity shortage today was nearly $180BN, the highest since the start of the repo crisis, and a clear signal to the Fed that it needs to do something to further ease interbank lending conditions.“

Less than an hour later the Fed cut rates by 50bps in its first emergency intermeeting action since the financial crisis.

So with its emergency action now in the rearview mirror, did the Fed manage to stem the funding panic that has gripped repo markets following last week’s market bloodbath? The answer, if based on the latest overnight repo results, is a resounding no.

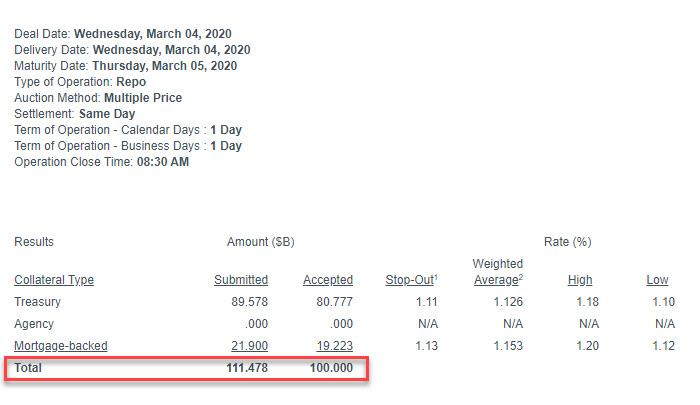

Moments ago, the Fed announced that its latest repo operation was once again oversubscribed, with the full $100 million amount of repo accepted.

In other words, for the second day in a row the overnight funding repo operation was oversubscribed (and it is virtually certain that tomorrow’s downsized term-repo will be oversubscribed as well).

What is perhaps more notable is that the amount of securities submitted into today’s repo op was a whopping $111.478 billion, which was not only higher than yesterday’s $108.6 billion, but it was an all time high amount of overnight funding needs expressed by dealers.

Which, stated simply, is rather bizarre as it means that not only did the rate cut not unlock additional funding, it actually made the problem worse, and now banks and dealers are telegraphing that they need not only more repo buffer but likely an expansion of QE… which will come soon enough, once the Fed hits 0% rates in 2 months and restart bond buying.

Will that be enough to stabilize the market? We don’t know, but in light of the imminent corona-recession, overnight Credit Suisse’s Zoltan Pozsar repo guru published a lengthy piece (which we will discuss more in depth later), and whose conclusion – at least on the liquidity front – is that the Fed should “combine rate cuts with open liquidity lines that include a pledge to use the swap lines, an uncapped repo facility and QE if necessary.“

In short, a liquidity avalanche is coming to prevent a market crash. It’s only a matter of time.

Tyler Durden

Wed, 03/04/2020 – 08:51

via ZeroHedge News https://ift.tt/39tLTM8 Tyler Durden